Source: Company reports/Coresight Research

2Q18 Results

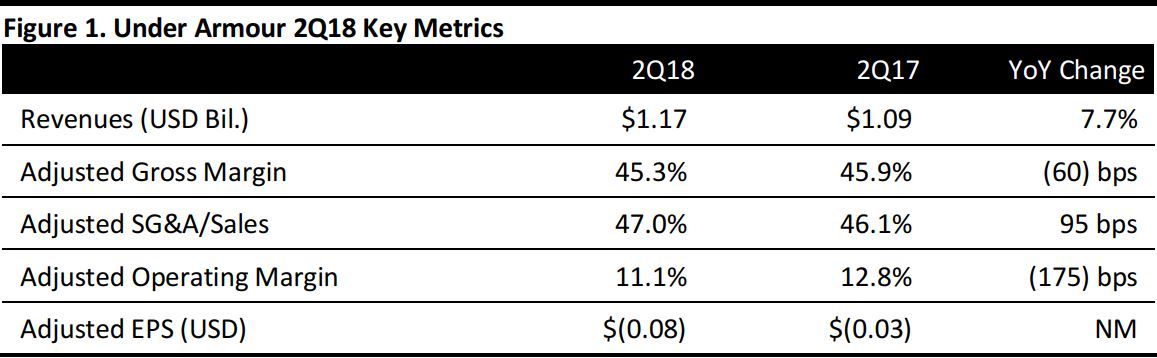

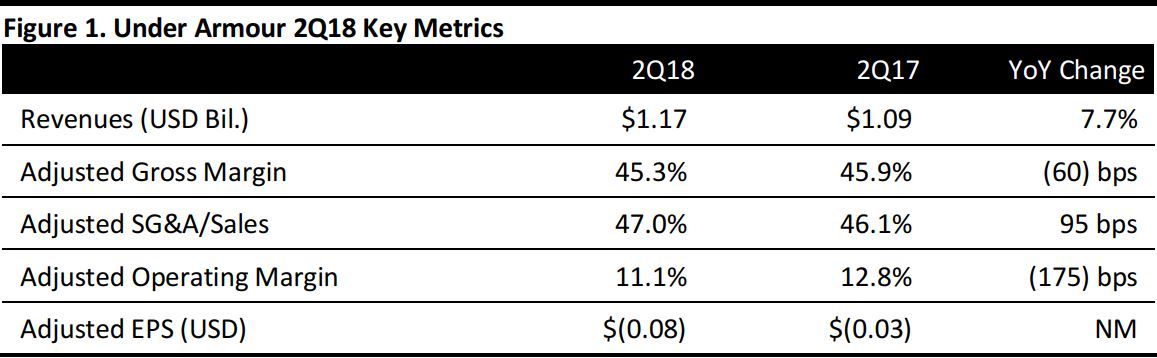

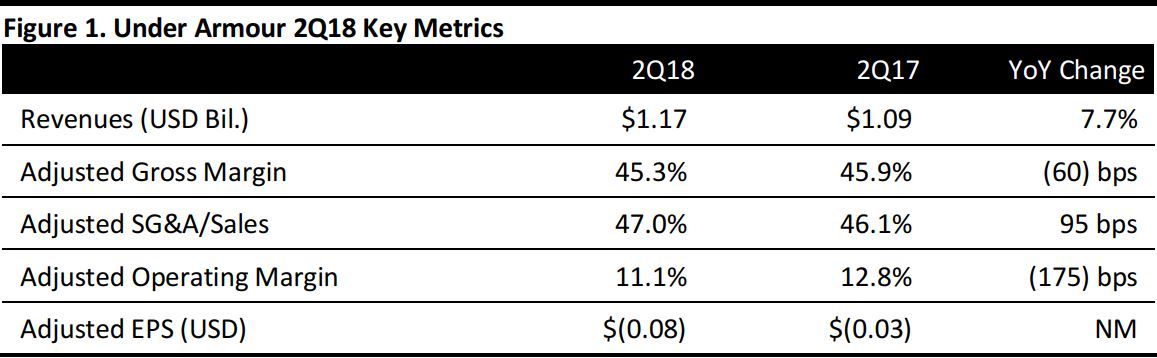

Under Armour reported 2Q18 adjusted EPS of $(0.08), in line with the consensus estimate. Total revenues were $1.17 billion, beating the $1.15 billion consensus estimate and up 7.7% year over year.

Wholesale revenues increased by 9%, to $710 million, and direct-to-consumer revenues were up 7%, to $414 million. The direct-to-consumer business represented 35% of total revenues, up from 30% in the first quarter.

North America revenues increased by 2%, to $843 million. International revenues continued their strong momentum and were up 28%, to $302 million, representing 26% of total revenues. Within the international business, revenues were up 31% in the Europe, Middle East and Africa region; up 34% in the Asia-Pacific region; and up 7% in Latin America.

Apparel revenues rose by 10%, to $747 million, driven by strength in the training and running categories. Footwear revenues were up 15%, to $271 million, led by strength in the running and team sports categories. Accessories revenues decreased by 14%, to $106 million, due to weaker demand.

The company’s gross margin was 44.8%, down 110 basis point from the year-ago quarter, while inventory increased by 11%, to $1.3 billion (although the increase was significantly lower than the previous quarter’s 27% increase). Accelerated inventory management initiatives and a $6 million impact related to restructuring efforts affected inventory growth. The company’s adjusted gross margin decreased by 60 basis points, to 45.3%.

Under Armour will continue its SKU rationalization initiative, eliminating products in order to focus on its best-performing lines. The company expects to carry less inventory into 2019 as it narrows its SKU count.

New store openings continued to drive revenue growth. Under Armour ended the quarter with 302 stores, up from 268 in the year-ago period.

Outlook

The company reaffirmed its FY18 adjusted EPS guidance of $0.14–$0.19, versus the consensus estimate of $0.18. The company expects FY18 to be challenging, with cash flow and profit margins negatively impacted by inventory management initiatives and continued investment in key areas such as the international and direct-to-consumer businesses.

The company guided for revenues to increase by 3%–4%, reflecting expectations of a low- to mid-single-digit decline in North America and international growth of greater than 25%. The company’s prior outlook called for a low-single-digit revenue increase. The consensus estimate calls for revenues of $5.16 billion, reflecting 3.7% growth.

The company expects footwear revenues to increase by low single digits and apparel revenues to increase by mid-single digits, reflecting additional inventory management actions.

The company expects a slightly improved adjusted gross margin compared with FY17, as it predicts that benefits from product costs and lower planned promotional activity will be offset by increased inventory management actions. SG&A is still expected to grow at a mid-single-digit rate.

The company expects 3Q18 adjusted EPS of $0.11–$0.12.