Source: Company reports/FGRT

2Q17 Results

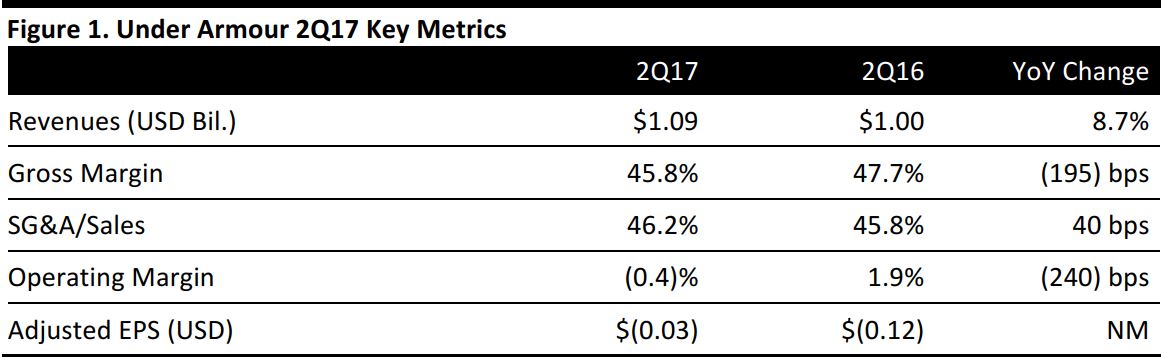

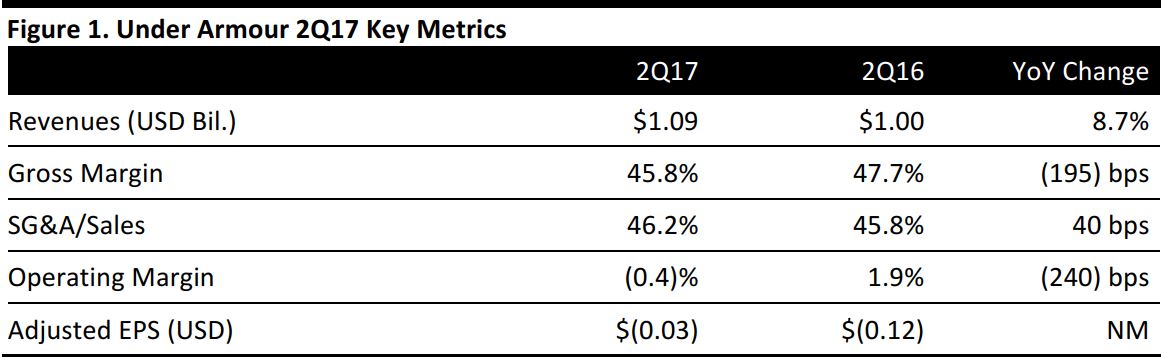

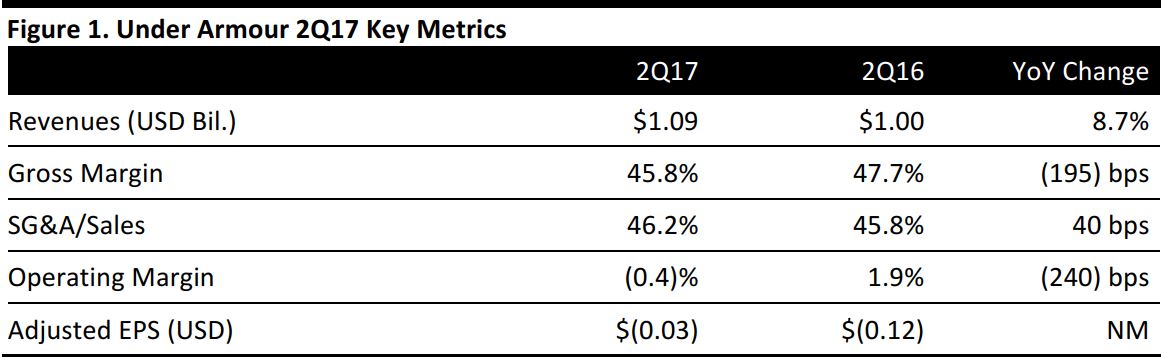

Under Armour reported 2Q17 adjusted EPS of $(0.03), versus consensus expectations of $(0.06). Total revenues were $1.09 billion, ahead of the $1.08 billion consensus estimate, and were up 8.7% year over year. Revenue growth was driven by a 3% increase in wholesale revenues (to $655 million) and a 20% increase in direct-to-consumer revenues (to $386 million).

By product type, apparel revenues increased by 11%, to $681 million, driven by strength in the training and golf subcategories. Footwear revenues were down 2%, to $237 million, against a tough comparative (footwear revenues were up 58% in the year-ago quarter, driven by basketball shoe sales). Accessories revenues were up 22%, to $123 million, with strength seen in the men’s and women’s training and youth subcategories.

North American revenues were down 0.3%, as a promotional retail environment continued to temper results. International revenues reflected continued strong momentum and were up 57%, representing 22% of total revenues in the quarter. Within the International business, revenues were up 57% in the EMEA region, 89% in the Asia-Pacific region and 10% in Latin America.

Restructuring Plan

Under Armour said it plans to close stores and cut jobs as it looks to revitalize its business amid tough competition in the North American athletic apparel market. Management plans to increase its speed in getting products to market and expand the company’s digital capabilities. Under Armour said its five fastest-growing category opportunities are men’s training, women’s, running, basketball and lifestyle. The company said it closed 33 factory outlets and 23 Under Armour branded stores in the 12 months ended June 30.

FY17 Outlook

The company lowered its FY17 revenue guidance to 9%–11% from 11%–12% previously. It now expects full-year revenues to reach $5.25–$5.36 billion, versus consensus of $5.34 billion. Under Armour expects FY17 EPS of $0.37–$0.40, excluding any impacts from restructuring, compared with the $0.42 consensus estimate. The company expects pretax charges of up to $130 million for FY17 related to store closures and severance costs.