Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

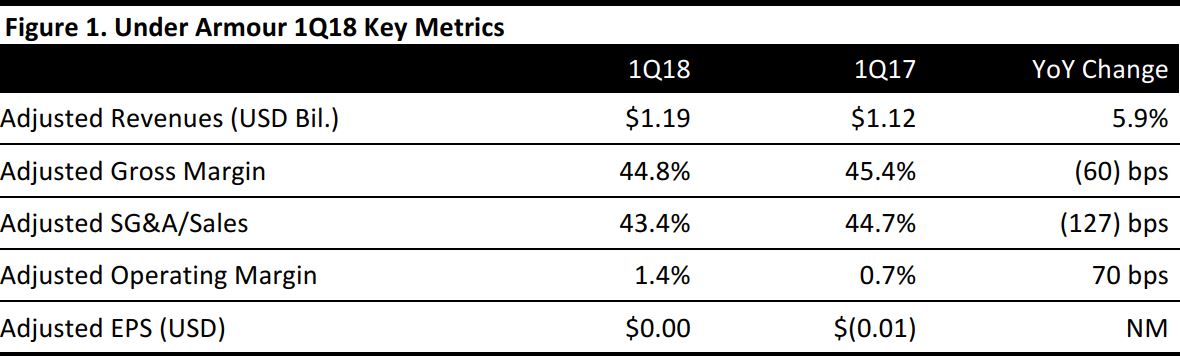

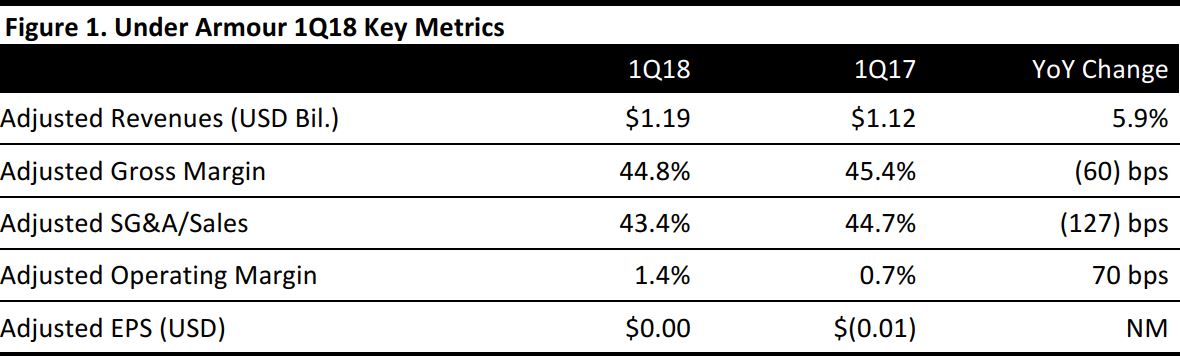

1Q18 Results

Under Armour reported 1Q18 adjusted EPS of $0.00, ahead of the $(0.05) consensus estimate and up from $(0.01) in the year-ago quarter. Total revenues were $1.19 billion, beating the $1.12 billion consensus estimate and up 5.9% year over year.

Wholesale revenues increased by 1%, to $779 million, and direct-to-consumer revenues were up 17%, to $352 million. The direct-to-consumer business represented 30% of total revenues.

North America revenues, which make up about 76% of overall revenues, were down 0.4% in the quarter. International revenues reflected continued strong momentum and were up 27% from the year-ago quarter, representing 24% of total revenues. Within the international business, revenues were up 23% in the Europe, Middle East and Africa region; up 35% in the Asia-Pacific region; and up 21% in Latin America.

By product type, apparel revenues increased by 7%, to $766 million, driven by strength in men’s training. Footwear revenues were up 1%, to $272 million, driven by strength in running that was partially offset by team sports and global football. Accessories revenues were up 3%, to $92 million, with strength seen in men’s training.

The company’s adjusted gross margin was 44.8%, versus the 45.2% consensus estimate, while inventory increased by 27%, to $1.1 billion, driven by accelerated inventory management initiatives and lower promotional activity. Under Armour has eliminated about 40% of its products in order to focus on its best-performing lines. The company will continue to execute this strategy and it expects to carry less inventory into 2019 as it narrows its SKU count.

New store openings continued to drive revenue growth. Total new store revenue growth was up 21% year over year, versus 17% direct-to-consumer revenue growth and 5.9% total company revenue growth. In the international business, new store revenues were up 55%, versus total international revenue growth of 27%.

Outlook

Management provided the following guidance:

- The company reaffirmed its FY18 adjusted EPS guidance of $0.14–$0.19, versus the consensus estimate of $0.18.

- The company expects revenues to increase by low single digits, reflecting a mid-single-digit decline in the North America business and international growth of more than 25%. The consensus estimate calls for revenues of $5.11 billion, reflecting 2.8% growth.

- Under Armour expects its gross margin to increase by 50 basis points, to 45.5%, due to benefits from lower planned promotional activity, product costs, channel mix and changes in foreign currency.

- The company expects adjusted operating income of $130–$160 million.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research