Source: Company reports/Fung Global Retail & Technology

1Q17 Results

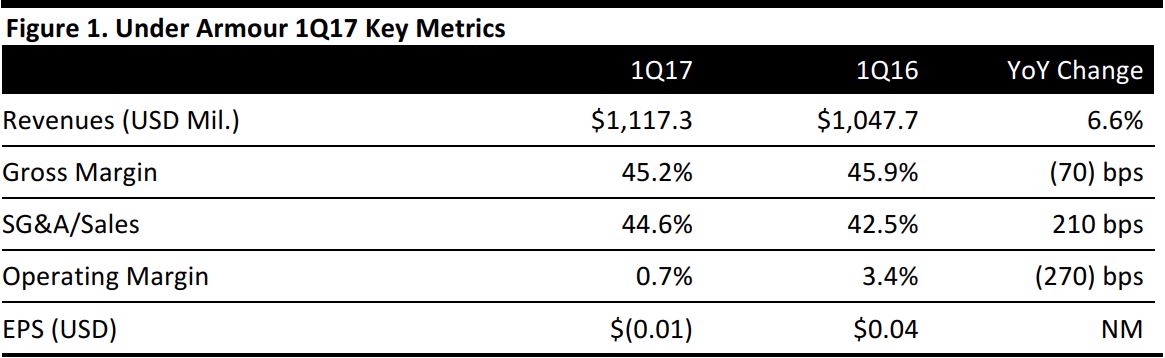

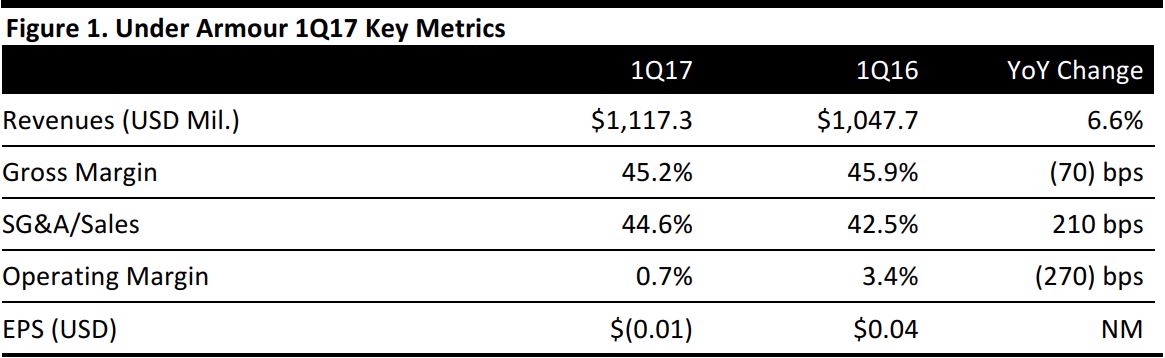

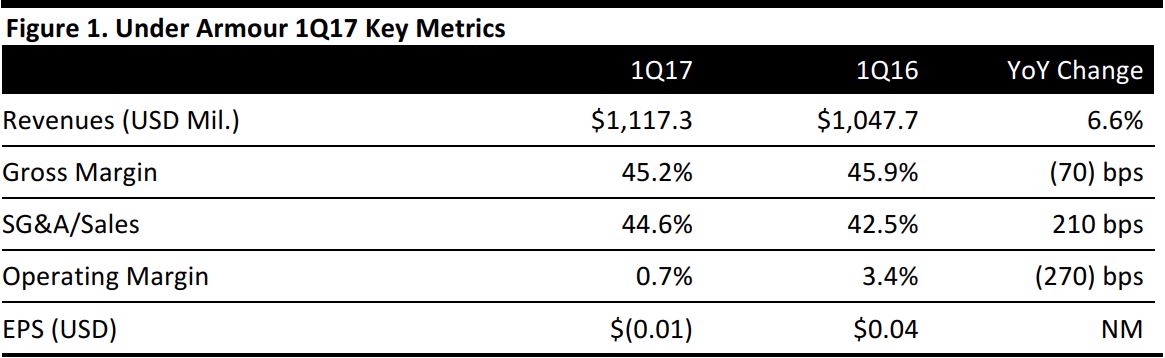

Under Armour reported 1Q17 EPS of $(0.01), which was ahead of expectations of $(0.04).

Total revenues were $1.12 billion versus expectations of $1.11 billion, and were up 6.6% year over year, driven by a 4% increase in wholesale revenues and a 13% increase in direct-to-consumer revenues. Apparel revenues increased by 7%, driven by strength in the training, golf and team sports subcategories. Footwear revenues were up 2% against a tough comparative and accessories revenues were up 12%, with strength seen in the men’s training, running, youth and global football subcategories.

North American revenues were down 1%, as new distribution was more than offset by a lack of business related to bankruptcies in 2016. International revenues were up 52% and represented 20% of total revenue in the quarter.

2017 Outlook

Management reiterated its guidance for net revenues to increase by 11%–12% for the year, to reach nearly $5.4 billion; consensus calls for full-year revenues of $5.36 billion. The company’s gross margin is expected to be down slightly from the 46.4% rate in 2016. Benefits in product costs are projected to be offset by changes in foreign currency and shifts in sales mix, as growth in the footwear and international businesses continues to outpace that of the higher-margin apparel and North American businesses. Operating income is expected to reach $320 million.