Web Developers

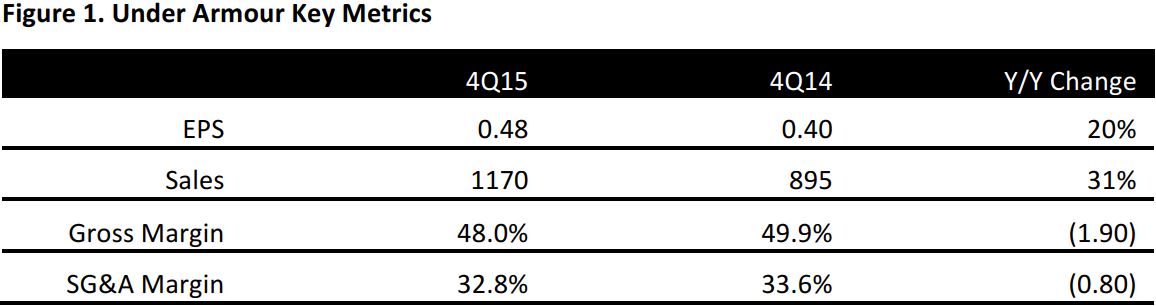

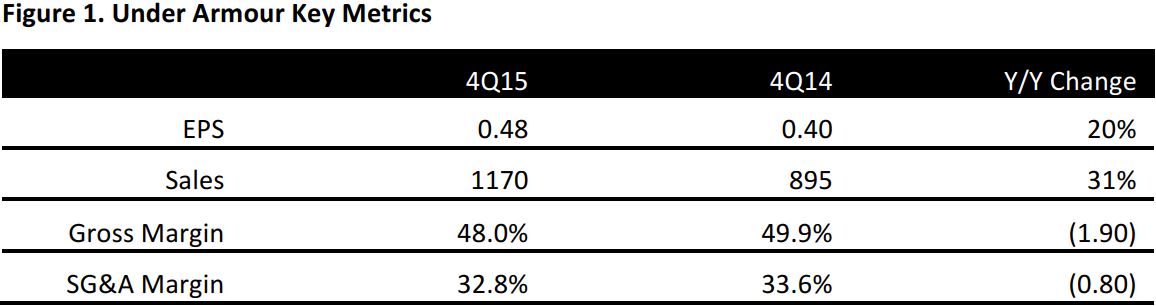

Under Armour reported fourth-quarter EPS of $0.48 versus the consensus estimate of $0.46. Total revenue was up 31% year over year, to $1.17 billion, versus expectations of $1.12 billion. Excluding currency effects, sales were up 33%.

By category, apparel sales were up 22%, to $864.8 million, versus consensus of $847.1 million, and were led by growth in training, running, golf and basketball. While apparel continues to be the company’s largest category, it has been able to diversify the business and add other categories. Ten years ago, apparel represented 93% of revenues and compression was 64% of the entire business. Today, apparel represents 71% of sales and compression is less than 10%.

Footwear sales were up 95%, to $166.9 million, versus consensus of $135.7 million, driven by the success of the Stephen Curry signature basketball line.

Accessories sales were up 23%, to $97.1 million, versus consensus of $97.5 million, driven by new introductions in the bag category.

Connected Fitness sales were $17.0 million versus consensus of $14.6 million. Under Armour reported that it had almost 160 million unique registered users on its Connected Fitness platform as of the end of 2015.

Direct-to-consumer sales, comprising 25 websites and 400 retail stores globally, have grown to 30% of total sales. E-commerce continues to outperform other channels. As an example, on Singles’ Day in China in November, the company had its first $1 million day online.

International sales increased by 70% in the fourth quarter (up 85% excluding foreign exchange) and represented 12% of total sales.

Full-year guidance calls for total revenue of $4.95 billion versus consensus of $4.91 billion and operating income of $503 million. That represents sales growth of 25% over the prior year and 23% growth in operating income, in line with the company’s financial targets.