Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

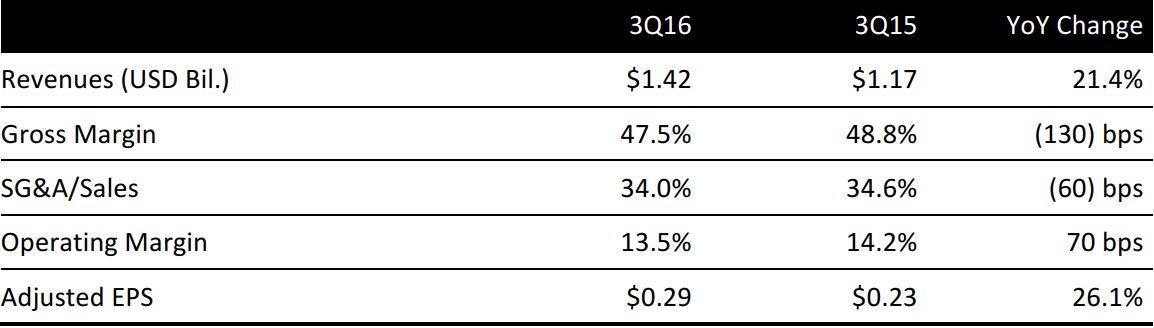

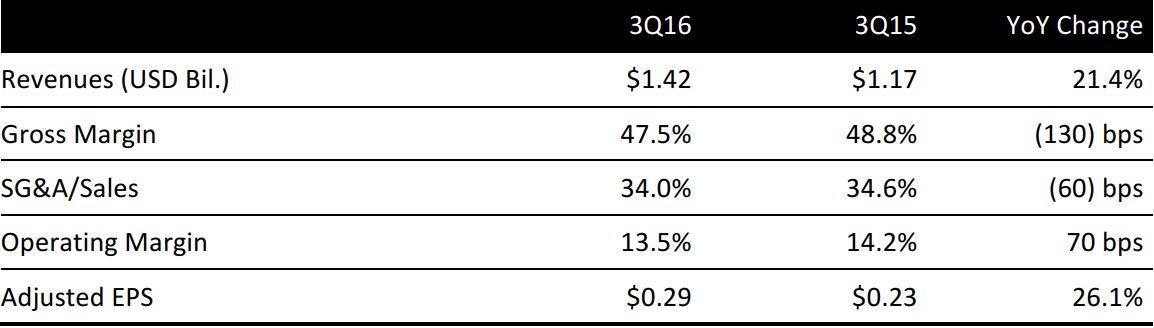

Under Armour reported 3Q16 revenues of $1.42 billion, up 21.4% year over year and above the consensus estimate. Revenues increased by 23.0% excluding currency effects. Sales increased in all regions and across all product categories.

Adjusted EPS was $0.29, ahead of the $0.25 consensus estimate and up 26.1% year over year.

BY PRODUCT CATEGORY

Footwear sales increased by 42.1% year over year in the quarter. Sales of apparel, the company’s largest segment, increased by 18%. Accessories sales increased by 17.6%.

- Footwear—Under Armour’s footwear revenue increased by 42.1% in the quarter. The company’s footwear business has grown from $239 million in 2012 to nearly $1 billion in 2016. Today, the company released the Steph Curry 3 sneaker model, which is expected to be highly popular. Within running, the company saw strong growth driven by the Bandit 2 and the Slingride, both of which are priced over $100.

- Apparel—Sales increased by 18.0%, to $1.02 billion, up from $866 million in the year-ago quarter. Growth was led by the company’s sport categories, including men’s training, women’s training, golf and team sports.

- Accessories—Sales increased by 17.6%, to $122 million from $104 million in the year-ago quarter, primarily driven by bags and headwear.

BY GEOGRAPHIC REGION

In the quarter, revenues increased by 16% in North America and by 74% internationally.

- North America—Sales increased by 16%, to $1.23 billion, up from $1.06 billion during the same period last year. The North American store count at the end of the quarter included 162 company-owned stores.

- International—International revenues increased by 74%, to $226 million, and accounted for 15% of total revenues. On a currency-neutral basis, international revenues increased by 80%.

OUTLOOK

Under Armour maintained its revenue guidance of approximately $4.9 billion for 2016, representing growth of 24% over 2015. This would be the slowest pace of revenue growth since 2009, according to Bloomberg

. The company expects operating income to grow 8%–9% over 2015’s figure.

Despite holding guidance flat, the company noted that North American apparel growth is slowing across the industry. Accordingly, Under Armour expects that its apparel business’s growth rate will be lower than what was expected at the company’s Investor Day in 2015.