Nitheesh NH

[caption id="attachment_75288" align="aligncenter" width="580"] Source: Company reports/Coresight Research.[/caption]

4Q18 Results

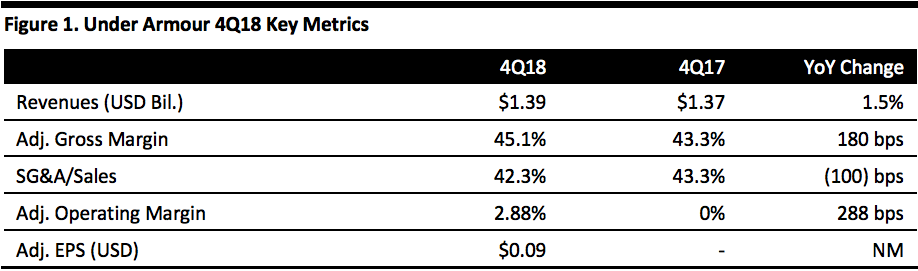

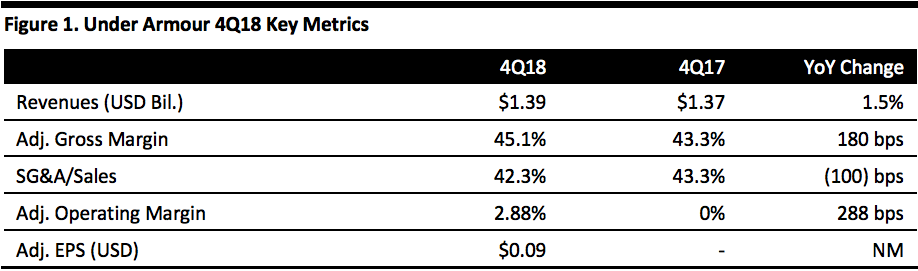

Under Armour reported adjusted EPS of $0.09 for 4Q 2018, beating the consensus estimate of $0.04.

Total revenue for the quarter was up 1.5% to $1.39 billion, a 2.5% increase at constant exchange rates, beating the consensus estimate of $1.38 billion. Revenue increased 31.7% (35.2% currency neutral) to $178.2 million in EMEA and up 35.2% (38.8% currency neutral) to $49.2 million in Asia Pacific. Sales declined 5.8% (5.6% currency neutral) to $964.8 million in North America and 15.1% (10.8% currency neutral) to $49.2 million in Latin America.

Sales from apparel gained 2% to $970.4 million, largely driven by the training category but missing the consensus estimate of $972.0 million. Footwear revenue decreased 4.5% to $235.2 million, missing the consensus estimate of $238.8 million. Despite softer demand in accessories, continued efforts to optimize logistics supported $108.2 million in accessory sales, beating the consensus estimate of $106.1 million but down 2.2% year over year. Revenues from licensing increased 39.4% to $45.9 million, beating the consensus estimate of $32.6 million. Connected fitness also generated $30.3 million in sales, up 9.1% year over year, beating the consensus estimate of $28.1 million.

Adjusted gross margin expanded to 45.1%, up 180 basis points year over year, beating the consensus estimate of 44.8%. The improved result was driven by the regional and channel mix, product cost improvements, lower promotional and air freight costs, which partially offset the negative impact from foreign exchange rates.

SG&A represented 42.3% of revenue (down 100 bps year over year), down 1% to $587.4 million.

The company had $48.2 million cost related to restructuring and impairment charges.

Adjusted operating income was $40 million, adjusted net income $42 million and inventory declined 12% to $1.1 billion.

Outlook

The company reiterated its 2019 outlook:

Source: Company reports/Coresight Research.[/caption]

4Q18 Results

Under Armour reported adjusted EPS of $0.09 for 4Q 2018, beating the consensus estimate of $0.04.

Total revenue for the quarter was up 1.5% to $1.39 billion, a 2.5% increase at constant exchange rates, beating the consensus estimate of $1.38 billion. Revenue increased 31.7% (35.2% currency neutral) to $178.2 million in EMEA and up 35.2% (38.8% currency neutral) to $49.2 million in Asia Pacific. Sales declined 5.8% (5.6% currency neutral) to $964.8 million in North America and 15.1% (10.8% currency neutral) to $49.2 million in Latin America.

Sales from apparel gained 2% to $970.4 million, largely driven by the training category but missing the consensus estimate of $972.0 million. Footwear revenue decreased 4.5% to $235.2 million, missing the consensus estimate of $238.8 million. Despite softer demand in accessories, continued efforts to optimize logistics supported $108.2 million in accessory sales, beating the consensus estimate of $106.1 million but down 2.2% year over year. Revenues from licensing increased 39.4% to $45.9 million, beating the consensus estimate of $32.6 million. Connected fitness also generated $30.3 million in sales, up 9.1% year over year, beating the consensus estimate of $28.1 million.

Adjusted gross margin expanded to 45.1%, up 180 basis points year over year, beating the consensus estimate of 44.8%. The improved result was driven by the regional and channel mix, product cost improvements, lower promotional and air freight costs, which partially offset the negative impact from foreign exchange rates.

SG&A represented 42.3% of revenue (down 100 bps year over year), down 1% to $587.4 million.

The company had $48.2 million cost related to restructuring and impairment charges.

Adjusted operating income was $40 million, adjusted net income $42 million and inventory declined 12% to $1.1 billion.

Outlook

The company reiterated its 2019 outlook:

Source: Company reports/Coresight Research.[/caption]

4Q18 Results

Under Armour reported adjusted EPS of $0.09 for 4Q 2018, beating the consensus estimate of $0.04.

Total revenue for the quarter was up 1.5% to $1.39 billion, a 2.5% increase at constant exchange rates, beating the consensus estimate of $1.38 billion. Revenue increased 31.7% (35.2% currency neutral) to $178.2 million in EMEA and up 35.2% (38.8% currency neutral) to $49.2 million in Asia Pacific. Sales declined 5.8% (5.6% currency neutral) to $964.8 million in North America and 15.1% (10.8% currency neutral) to $49.2 million in Latin America.

Sales from apparel gained 2% to $970.4 million, largely driven by the training category but missing the consensus estimate of $972.0 million. Footwear revenue decreased 4.5% to $235.2 million, missing the consensus estimate of $238.8 million. Despite softer demand in accessories, continued efforts to optimize logistics supported $108.2 million in accessory sales, beating the consensus estimate of $106.1 million but down 2.2% year over year. Revenues from licensing increased 39.4% to $45.9 million, beating the consensus estimate of $32.6 million. Connected fitness also generated $30.3 million in sales, up 9.1% year over year, beating the consensus estimate of $28.1 million.

Adjusted gross margin expanded to 45.1%, up 180 basis points year over year, beating the consensus estimate of 44.8%. The improved result was driven by the regional and channel mix, product cost improvements, lower promotional and air freight costs, which partially offset the negative impact from foreign exchange rates.

SG&A represented 42.3% of revenue (down 100 bps year over year), down 1% to $587.4 million.

The company had $48.2 million cost related to restructuring and impairment charges.

Adjusted operating income was $40 million, adjusted net income $42 million and inventory declined 12% to $1.1 billion.

Outlook

The company reiterated its 2019 outlook:

Source: Company reports/Coresight Research.[/caption]

4Q18 Results

Under Armour reported adjusted EPS of $0.09 for 4Q 2018, beating the consensus estimate of $0.04.

Total revenue for the quarter was up 1.5% to $1.39 billion, a 2.5% increase at constant exchange rates, beating the consensus estimate of $1.38 billion. Revenue increased 31.7% (35.2% currency neutral) to $178.2 million in EMEA and up 35.2% (38.8% currency neutral) to $49.2 million in Asia Pacific. Sales declined 5.8% (5.6% currency neutral) to $964.8 million in North America and 15.1% (10.8% currency neutral) to $49.2 million in Latin America.

Sales from apparel gained 2% to $970.4 million, largely driven by the training category but missing the consensus estimate of $972.0 million. Footwear revenue decreased 4.5% to $235.2 million, missing the consensus estimate of $238.8 million. Despite softer demand in accessories, continued efforts to optimize logistics supported $108.2 million in accessory sales, beating the consensus estimate of $106.1 million but down 2.2% year over year. Revenues from licensing increased 39.4% to $45.9 million, beating the consensus estimate of $32.6 million. Connected fitness also generated $30.3 million in sales, up 9.1% year over year, beating the consensus estimate of $28.1 million.

Adjusted gross margin expanded to 45.1%, up 180 basis points year over year, beating the consensus estimate of 44.8%. The improved result was driven by the regional and channel mix, product cost improvements, lower promotional and air freight costs, which partially offset the negative impact from foreign exchange rates.

SG&A represented 42.3% of revenue (down 100 bps year over year), down 1% to $587.4 million.

The company had $48.2 million cost related to restructuring and impairment charges.

Adjusted operating income was $40 million, adjusted net income $42 million and inventory declined 12% to $1.1 billion.

Outlook

The company reiterated its 2019 outlook:

- Revenue target of 3-4% growth, reflecting a low double-digit percentage rate increase in international business, offset by relatively flat results for North America.

- Gross margin is projected to expand 60-80 bps as Under Armour reduces sales to the off-price channel, benefits from supply chain initiatives and direct-to-consumer grows its proportion of total sales.

- Operating income of $210-230 million.

- EPS of $0.31-0.33.

- Capital expenditures of around $210 million.