DIpil Das

Source: Company reports/Coresight Research.[/caption]

Source: Company reports/Coresight Research.[/caption]

2Q19 Results

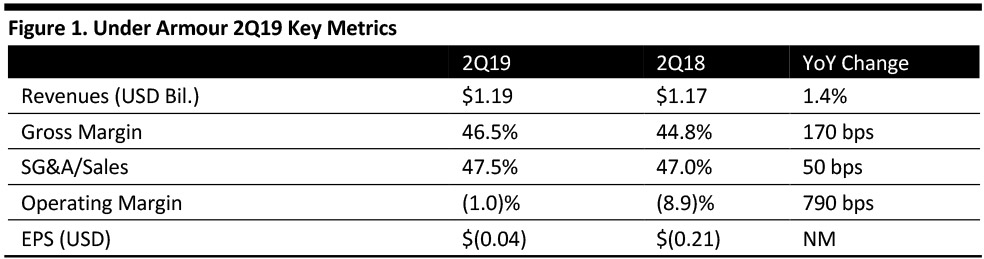

Under Armour reported EPS of $(0.04) for 2Q19, ahead of the consensus estimate of $(0.05).

Total revenue for the quarter was up 1.4% to $1.19 billion, a 3% increase at constant exchange rates, missing the consensus estimate of $1.20 billion. The company continued to reset toward more premium price points, hurting North America’s revenue growth. Wholesale business declined 1% to $707 million but the company saw a better-than-expected trend in North America’s premium wholesale business. Direct-to-consumer revenue grew 2% to $423 million, lower than expected due to traffic and conversion challenges.

Sales declined 3% to $816 million in North America. The company’s international business increased 12% to $339 million, up 17% currency neutral and representing 28% of total revenue. Revenue increased 6% (11% currency neutral) to $145 million in EMEA, up 23% (29% currency neutral) to $154 million in Asia Pacific and up 3% (2% currency neutral) to $40 million in Latin America.

Sales from apparel declined 1% to $740 million. Footwear revenue grew 5% to $284 million. Sales from accessories were unchanged at $106 million. Revenues from licensing increased 19.5% to $25 million. Connected fitness generated $32 million in sales, up 9.7% year over year.

Gross margin expanded to 46.5%, up 170 basis points (bps) year over year. The improved result was driven by supply chain initiatives, regional mix and prior period restructuring charges, hurt by foreign exchange rates.

SG&A represented 47.5% of revenue (up 50 bps year over year) and increased 2% to $566 million.

At the end of the quarter, inventory declined 26% to $966 million.

The operating loss was $11 million and net loss was $17 million.

Outlook

The company updated its 2019 outlook as follows:

- Revenue target of 3-4% growth, reflecting a low to mid-teen percentage rate increase in international business, offset by slightly lower results for North America.

- Adjusted gross margin steady with the previous guidance of a 70-90 bps expansion.

- Operating income of $230-235 million versus the previous expectation of $220-230 million.

- EPS of $0.33 to $0.34, unchanged from the previous guidance.

- Capital expenditures of around $210 million, unchanged from the previous guidance.