Nitheesh NH

Introduction

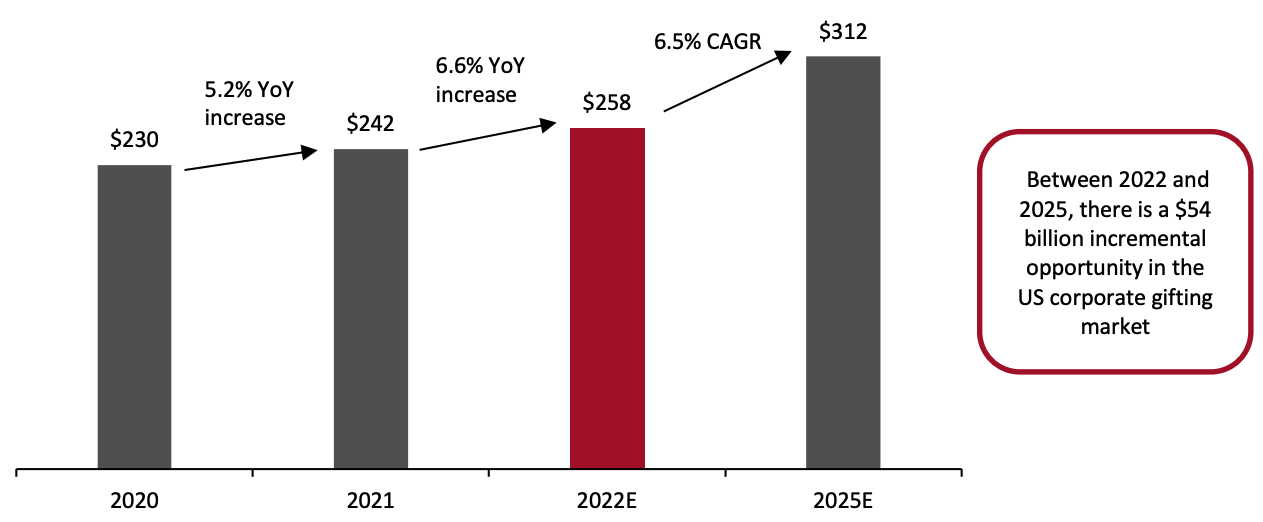

What’s the Story? Trust and appreciation are the essence of nurturing long-term relationships, including in business. Corporate gifting plays a pivotal role in improving professional relationships and is an indispensable tool for staying connected with clients/partners and employees. We are seeing external factors impact the corporate gifting market—in terms of gifting frequency, budget and occasions— such as improved adaptability of organizations to changed working models, the emergence of new ways to stay connected with employees or clients, and the altered nature of corporate events, most of which have now started making their in-person comeback. We believe that the supply side of corporate gifting is undergoing a transition across most geographies, including the US. Gift givers are starting to have a better understanding of the underlying value in corporate gifting and are taking it up more seriously, planning better and focusing on personalization. In this report, sponsored by gifting solution GiftNow, we explore the flurry of opportunities in the US corporate gifting market, assess changes in the market over the past year (including the impacts of the pandemic) and evaluate its future outlook. We analyze the findings of an April 2022 Coresight Research survey of corporate gift givers in the US; respondents were from across industries such as retail, real estate, manufacturing, travel, hospitality and health services, among others. We asked respondents about their corporate gifting frequency, key occasions they leverage for giving out corporate gifts and perceived benefits from gifting. Also informing the trends we discuss in this report are findings from our May 2021 survey of US corporate gift givers. For more analysis of data from that survey, read Coresight Research and GiftNow’s report, titled Unwrapping the American Corporate Gifting Opportunity. Why It Matters Corporate gifting is a large and growing opportunity for brands and retailers:- We estimate that the corporate gifting market will total $258 billion in the US in 2022, growing 6.6% year over year—surpassing 2021’s growth of 5.2%.

- We estimate that the corporate gifting market will total $312 billion in 2025, representing a CAGR of 6.5% between 2022 and 2025.

Figure 1. US Corporate Gifting Market (USD Bil.) [caption id="attachment_149106" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

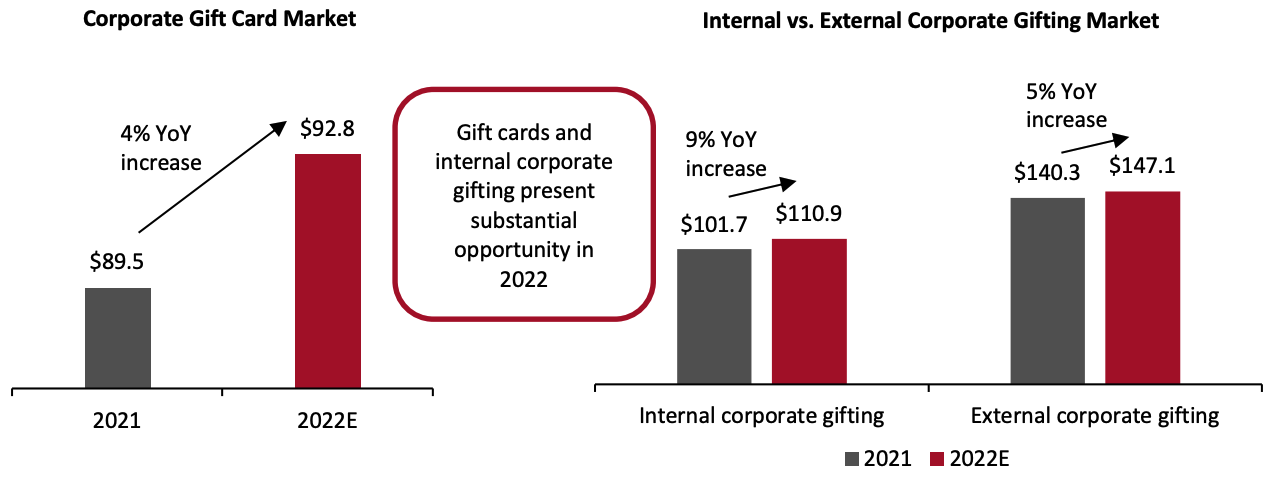

Our survey findings reveal that gift cards are set to be the most-purchased gift category in the coming 12 months. Although gift cards may lack the emotional aspect of gifting, if retailers can leverage innovative technologies to make gift cards more personalized, it can translate to a big, untapped opportunity as corporate gift givers look for more meaningful gifts. We estimate that gift cards will account for around 36% of the overall corporate gifting market in 2022—totaling $92.8 billion.

We expect internal corporate gifting (employer to employee) to grab a marginally higher share (43%) of the overall corporate gifting market this year versus 2021 (42%), totaling $110.9 billion.

Source: Coresight Research[/caption]

Our survey findings reveal that gift cards are set to be the most-purchased gift category in the coming 12 months. Although gift cards may lack the emotional aspect of gifting, if retailers can leverage innovative technologies to make gift cards more personalized, it can translate to a big, untapped opportunity as corporate gift givers look for more meaningful gifts. We estimate that gift cards will account for around 36% of the overall corporate gifting market in 2022—totaling $92.8 billion.

We expect internal corporate gifting (employer to employee) to grab a marginally higher share (43%) of the overall corporate gifting market this year versus 2021 (42%), totaling $110.9 billion.

Figure 2. US Corporate Gifting: Selected Market Sizes (USD Bil.) [caption id="attachment_149107" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

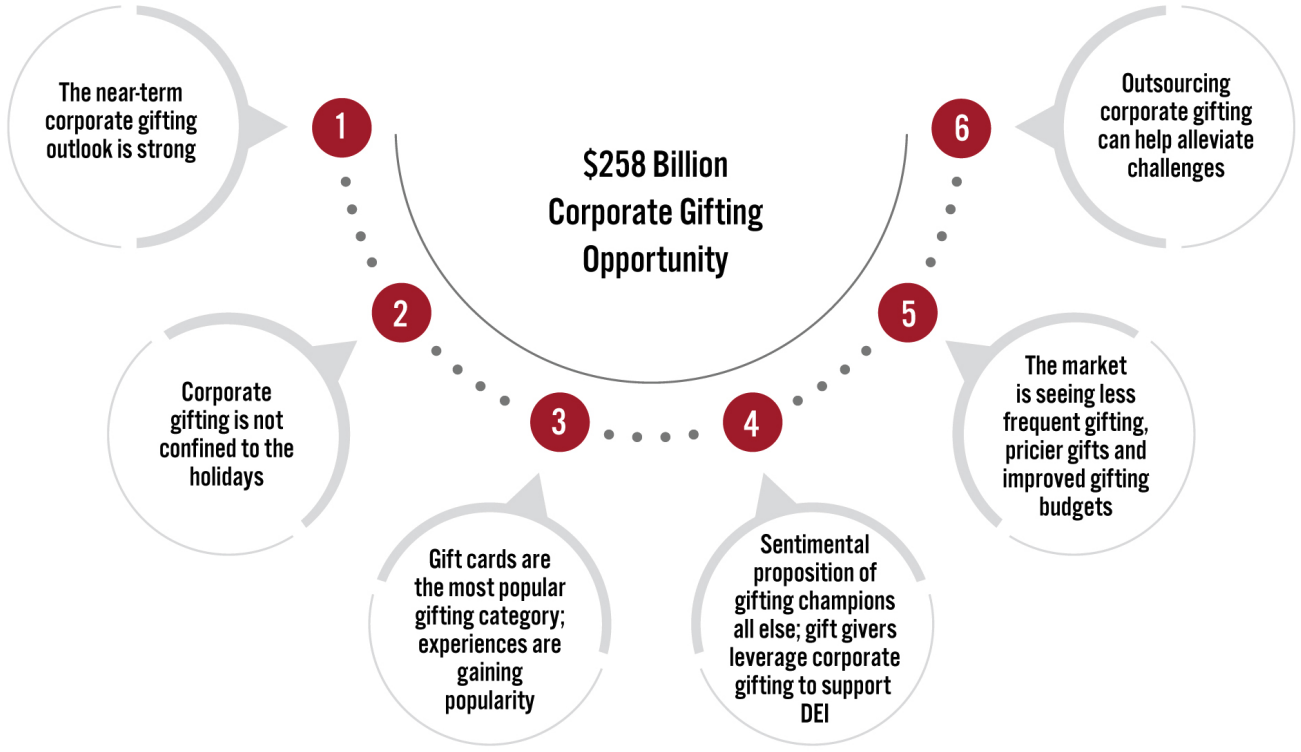

Unboxed: The $258 Billion US Corporate Gifting Opportunity—Coresight Research x GiftNow Analysis

Based on the analysis of our survey findings, we present six key things that retailers and solution providers should know about the US corporate gifting market. We summarize these in Figure 3 and explore each in detail below.Figure 3. US Corporate Gifting 2022: Six Things To Know [caption id="attachment_149108" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. The Near-Term Corporate Gifting Outlook Is Strong

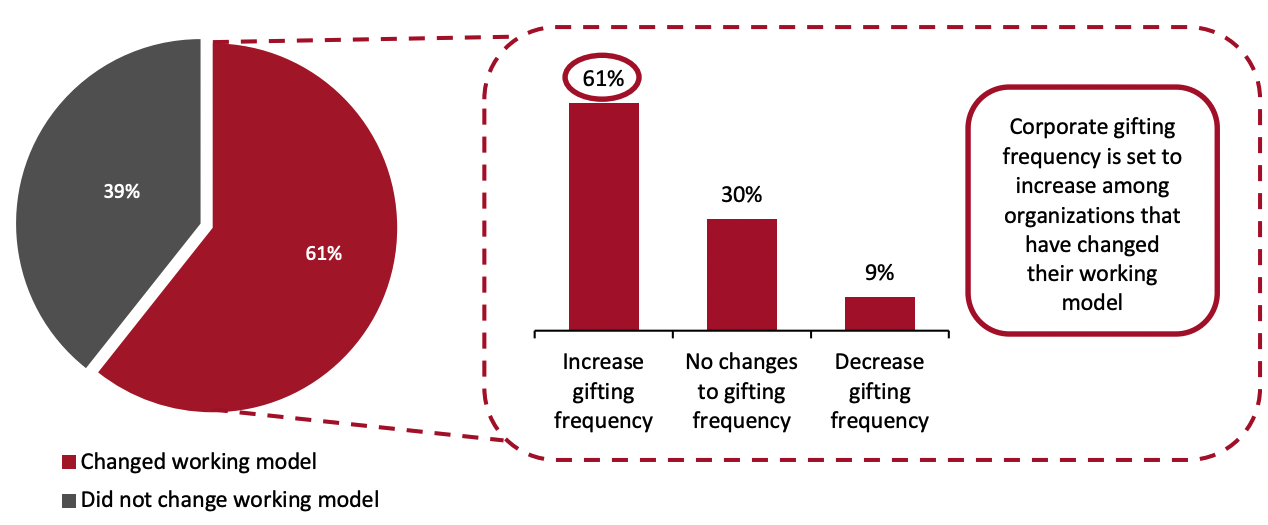

The Covid-19 pandemic had a substantial impact on working models, with many organizations implementing work-from-home or hybrid working practices. Our survey found that 61% of organizations have changed how their employees work due to Covid-19—and this shift correlates strongly with an expected increase in the amount of corporate gifting that organizations will do over the next year:

The overwhelming majority (91%) of organizations that changed their working model due to Covid-19 expect to maintain or increase the frequency of corporate gifting over the next 12 months.

Source: Coresight Research[/caption]

1. The Near-Term Corporate Gifting Outlook Is Strong

The Covid-19 pandemic had a substantial impact on working models, with many organizations implementing work-from-home or hybrid working practices. Our survey found that 61% of organizations have changed how their employees work due to Covid-19—and this shift correlates strongly with an expected increase in the amount of corporate gifting that organizations will do over the next year:

The overwhelming majority (91%) of organizations that changed their working model due to Covid-19 expect to maintain or increase the frequency of corporate gifting over the next 12 months.

Figure 4. Whether Companies Changed Their Working Model Due to Covid-19 (Left); Expected Changes in Corporate Gifting Frequency over the Next 12 Months Due to Changed Working Models (Right) (% of Respondents) [caption id="attachment_149123" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US (left), 182 (61%) of whose organizations changed their working model due to the Covid-19 pandemic (right)

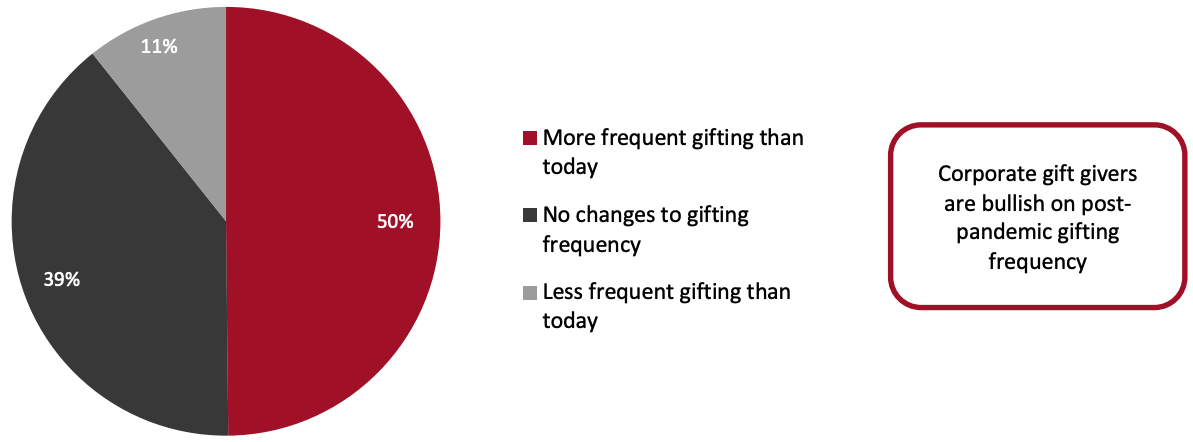

Base: 300 corporate gift givers in the US (left), 182 (61%) of whose organizations changed their working model due to the Covid-19 pandemic (right)Source: Coresight Research[/caption] Further exploring expectations around future gifting frequency, we found that 89% of corporate gift givers won’t change their gifting frequency or will gift more frequently “once the pandemic ceases” compared to today. We believe that this underlines the value that organizations now place on corporate gifting—they see that value extending to the future beyond the pandemic.

Figure 5. Expected Corporate Gifting Frequency Once the Pandemic Ceases (% of Respondents) [caption id="attachment_149110" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US

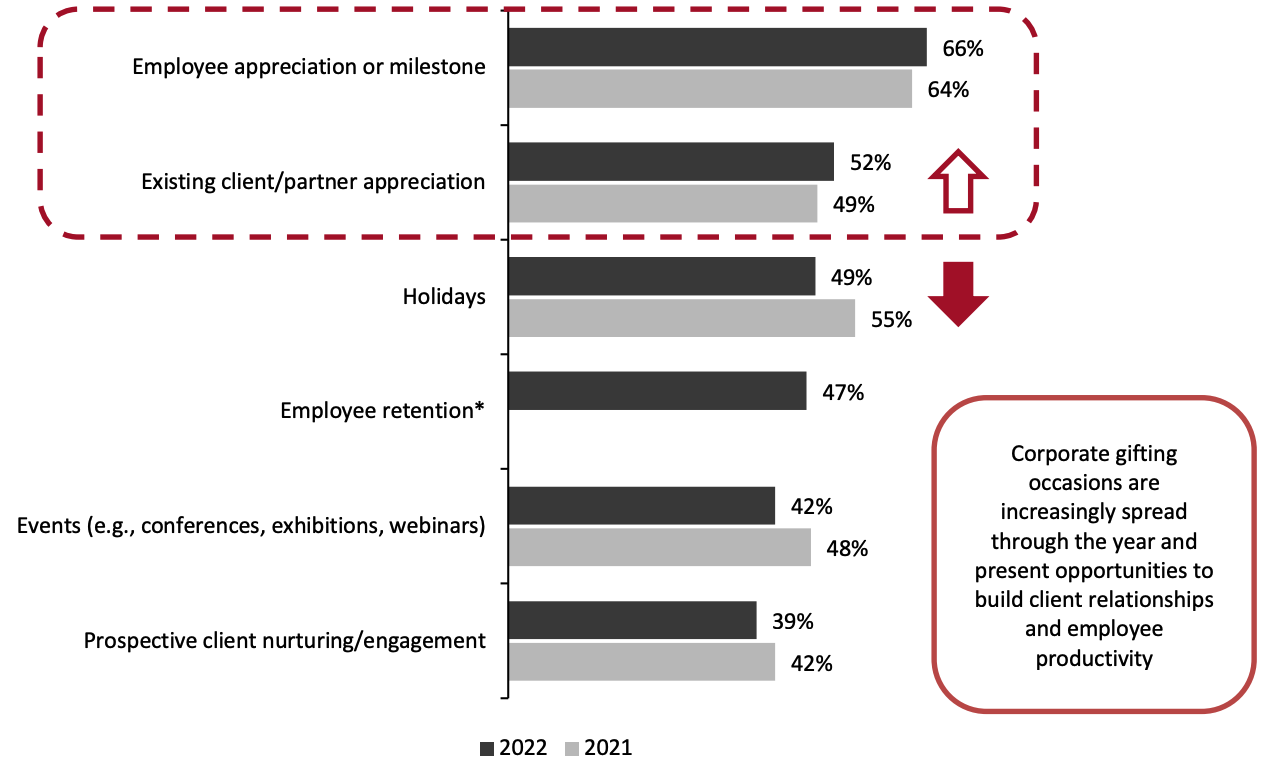

Base: 300 corporate gift givers in the USSource: Coresight Research[/caption] 2. Corporate Gifting Is Not Confined To the Holidays Corporate gifting is not limited to the holidays. Employers want to show appreciation to their employees through the year, and gifting also acts as a strong medium for staying connected with clients and prospects. Showing appreciation plays a pivotal role in building trust and creates an environment of mutual respect. On receiving gifts, the recipient feels valued, which can be a catalyst in forging long-term professional relationships. Reflecting this, the responses from our survey indicate the year-round nature of corporate gifting:

- Two-thirds (66%) of respondents reported that their organizations give gifts to show appreciation to an employee or to acknowledge a milestone, such as a work anniversary—topping the list of corporate gifting occasions, as it did in our 2021 survey.

- Over half (52%) of respondents give gifts for appreciating an existing client or partner—up 3.0 percentage points versus 2021 and surpassing holidays, which were the second most common gifting occasion in 2021.

Figure 6. Key Corporate Gifting Occasions, 2022 Versus 2021 (% of Respondents) [caption id="attachment_149111" align="aligncenter" width="700"]

*“Employee retention” not included as an option in 2021 survey

*“Employee retention” not included as an option in 2021 surveyBase: 300 corporate gift givers in the US, surveyed in April 2022 and May 2021

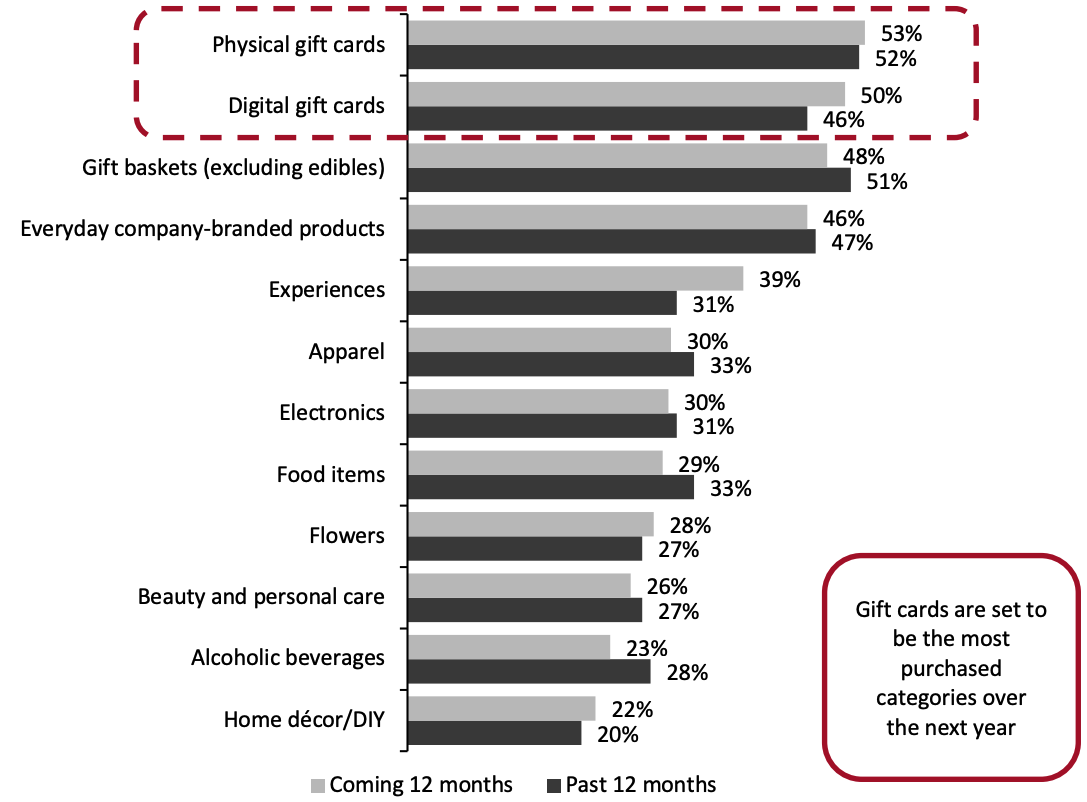

Source: Coresight Research[/caption] We believe that the findings discussed above signal the maturing nature of the market and corporate gift givers having a better understanding of important underlying benefits of corporate gifting. Gifting for appreciating clients and employees can play a pivotal role in generating repeat business and in fostering trust amongst employees, which translates to them putting in best efforts in their work. 3. Gift Cards Are the Most Popular Gifting Category; Experiences Are Gaining Popularity Gift cards are an easy and convenient solution to overcome challenges associated with gifting. This is particularly true in corporate gifting, where gift givers have limited information around a recipient’s preferences. In addition, gift givers can send gift cards digitally, so they do not have to know the recipient’s address or factor in shipping when making a purchase. Our survey data reveal that gift cards—both physical and digital—are the most anticipated purchase on shoppers’ wish lists. Around 53% of corporate gift givers expect to purchase physical gift cards in the coming 12 months, while 50% expect to purchase digital gift cards. Experiences such as tickets to a movie or an adventure (such as a hot air balloon ride) are gaining popularity: 39% of corporate gift givers plan to gift experiences to recipients over the coming year—improving by 8 percentage points versus past 12 months.

Figure 7. Gift Categories That Corporate Gift Buyers Have Purchased in the Last 12 Months and What They Expect To Purchase in the Coming 12 Months (% of Respondents) [caption id="attachment_149112" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US

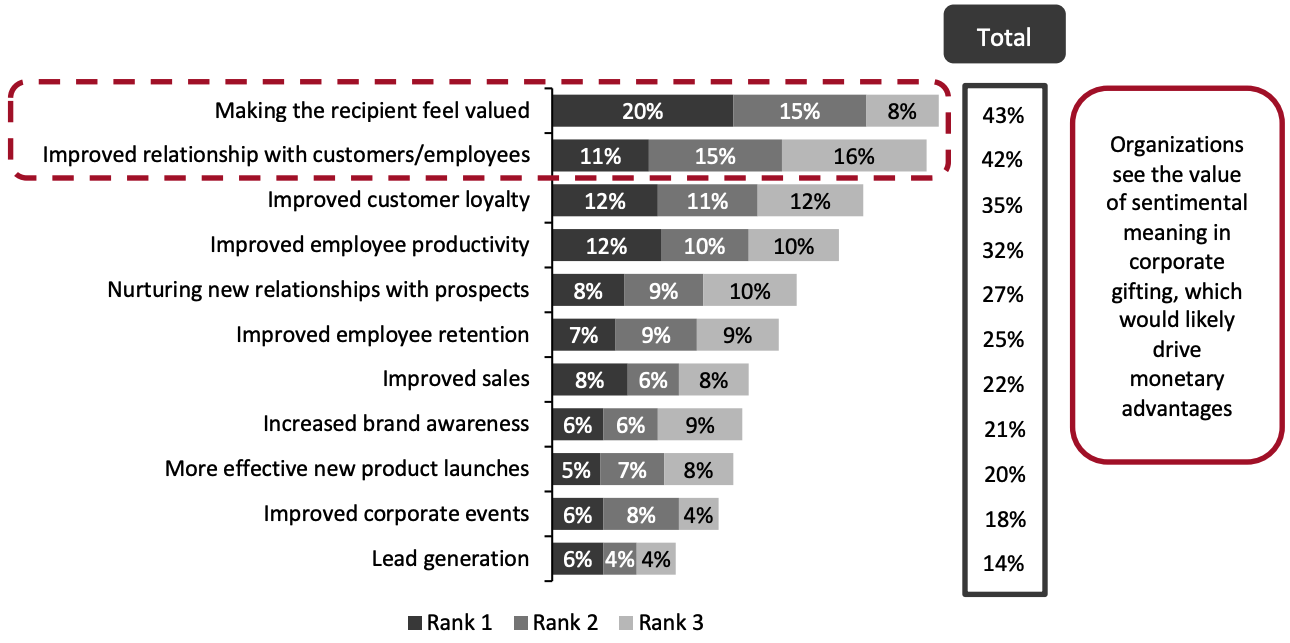

Base: 300 corporate gift givers in the USSource: Coresight Research[/caption] We believe that innovation in gift cards—such as adding a more personalized touch through a video message—can open up new opportunities for companies to connect with recipients of corporate gifts in a more meaningful way, which is important in an environment where relationship building and personal connections have become more important than ever before. 4. The Sentimental Proposition of Gifting Champions All Else; Gift Givers Leverage Corporate Gifting To Support DEI The essence of corporate gifting will continue to lie in sentimental meaning and recipient gratification, which have important underlying benefits for the gift giver: we believe that a focus on relationship building and creating a sense of value is a robust pathway to improved employee performance, sales and lead conversion. Our survey emphasized the value that corporate gift givers place on establishing personal connections through corporate gifting:

- Just over four in 10 (43%) of respondents cited making the recipient feel valued as one of the top three advantages of corporate gifting, and 20% of those respondents ranked it as the topmost advantage of corporate gifting.

- Some 42% of respondents cited improved relationship with customers and employees as among the top three advantages of corporate gifting.

Figure 8. Key Advantages of Corporate Gifting (% of Respondents) [caption id="attachment_149113" align="aligncenter" width="700"]

Respondents were asked to select and rank up to three criteria, with “Rank 1” signifying the biggest advantage; criteria are ordered based on a weighted average of responses, where “Rank 1” carries the highest weight

Respondents were asked to select and rank up to three criteria, with “Rank 1” signifying the biggest advantage; criteria are ordered based on a weighted average of responses, where “Rank 1” carries the highest weightBase: 300 corporate gift givers in the US

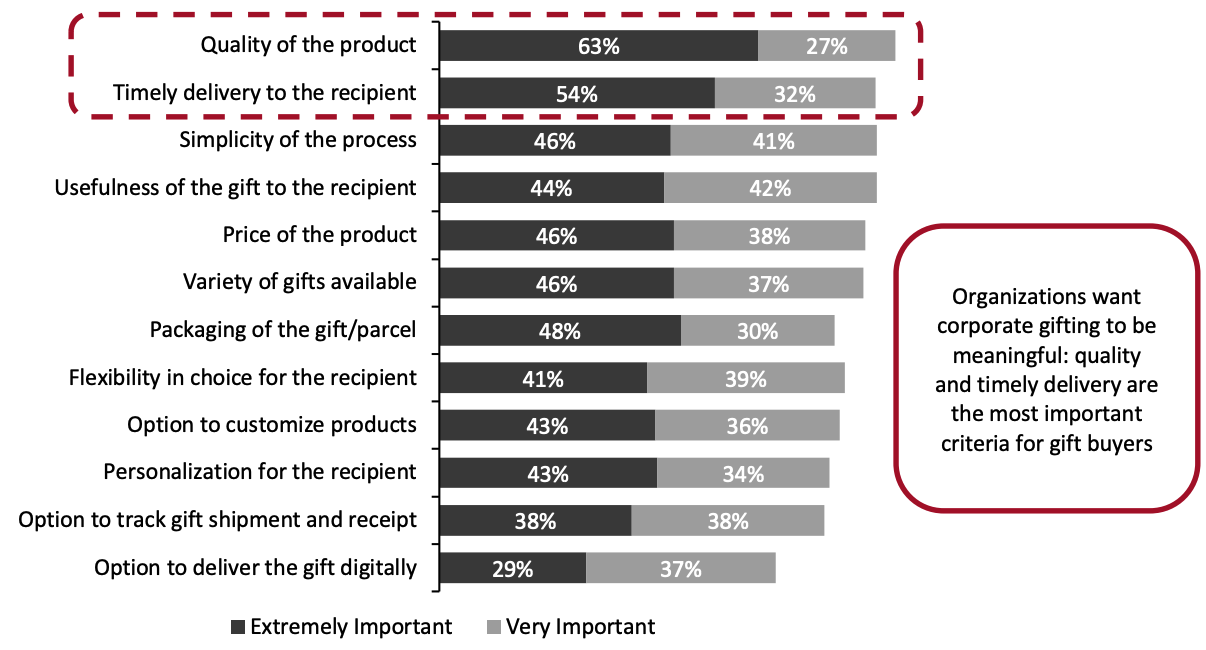

Source: Coresight Research[/caption] Reinforcing the view that meaningful gifting is important to corporate gift givers, organizations consider the quality of the product and the speed of delivery to be key criteria before purchasing gifts: high-quality gifts can ensure recipients feel valued and missing an important milestone can substantially undermine the positive impact of gifting.

- Quality is the most important criteria for gift buyers—nine in 10 (90%) respondents cited quality of the product as “very” or “extremely” important.

- Ensuring that the gift is delivered in a timely manner to the recipient emerged as the second-most-important criteria; cited as “very” or “extremely” important by 86% of respondents.

Figure 9. Importance of Key Criteria Before Purchasing Corporate Gifts (% of Respondents) [caption id="attachment_149114" align="aligncenter" width="700"]

Respondents were asked to rate each option in terms of importance, from “not at all important” to “extremely important”; criteria are ordered in the chart based on the weighted average of responses, where “extremely important” carries the highest weight

Respondents were asked to rate each option in terms of importance, from “not at all important” to “extremely important”; criteria are ordered in the chart based on the weighted average of responses, where “extremely important” carries the highest weightBase: 300 corporate gift givers in the US

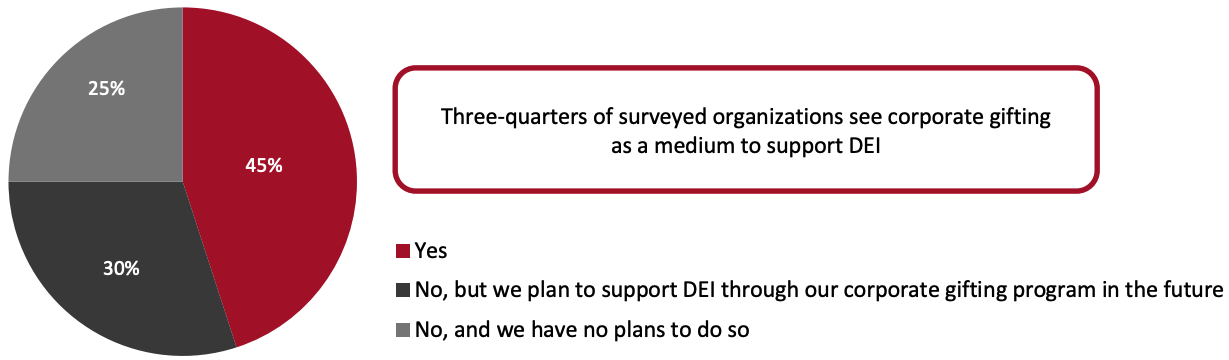

Source: Coresight Research[/caption] Furthermore, corporate gifting can also be used as a medium to support diversity, equity and inclusion (DEI) initiatives. We have identified inclusivity as one of our key retail trends to watch, and this spans inclusion in the workforce. Marking days dedicated to DEI, such as in Pride Month, through corporate gifting is one means of actioning inclusivity. Our survey respondents agree—we asked gift givers whether they leverage gifting to support DEI and found that:

- Almost half (45%) of corporate gift givers are currently supporting DEI through the medium of corporate gifting.

- Some 30% of corporate gift givers are not currently supporting DEI through corporate gifting but plan to do so in the future.

Figure 10. Whether Corporate Gift Givers Currently Leverage, or Will Leverage, Corporate Gifting To Support DEI (% of Respondents) [caption id="attachment_149115" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US

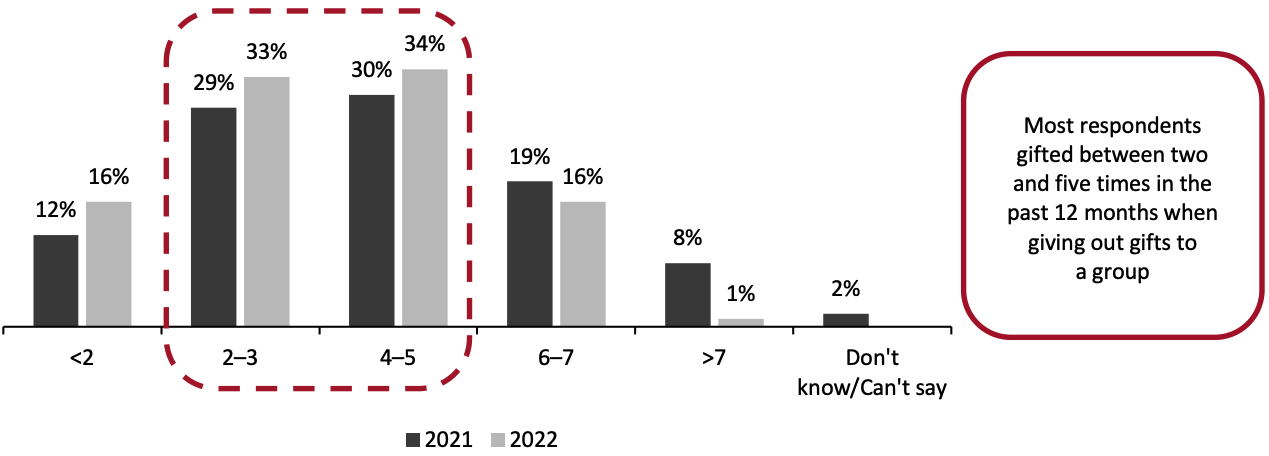

Base: 300 corporate gift givers in the USSource: Coresight Research[/caption] 5. The Market Is Seeing Less Frequent Gifting, Pricier Gifts and Improved Gifting Budgets We define two ways in which corporate gifting is carried out: one-to-one gifting, in which the gift giver purchases the gift for an individual client or an employee; and one-to-many gifting, in which gifts are distributed to a small group or an entire organization. One-to-many gifting can be more cumbersome and has a higher chance of being ineffective, as buyers tend to follow a one-size-fits-all approach: only a few recipients may find gifts such as company-branded “swag” to be useful in their day-to-day life. Furthermore, ensuring that recipients do not view corporate gifts as a marketing collateral can be highly challenging for corporate gift givers. Our 2022 survey findings reveal that organizations are conducting more mindful one-to-many corporate gifting than was reported in last year’s survey. Between our 2021 and 2022 surveys, we saw a total 8.0-percentage-point gain in the proportion of organizations participating in one-to-many gifting two to five times in the 12 months prior to the surveys—at the expense of a gifting frequency of six and above. These findings suggest that corporate gift givers may be turning toward more meaningful gifting, especially when viewed in combination with amount that gift buyers are spending (see analysis below).

Figure 11. Number of One-to-Many Corporate Gifting Occasions in the Past 12 Months (% of Respondents) [caption id="attachment_149116" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US

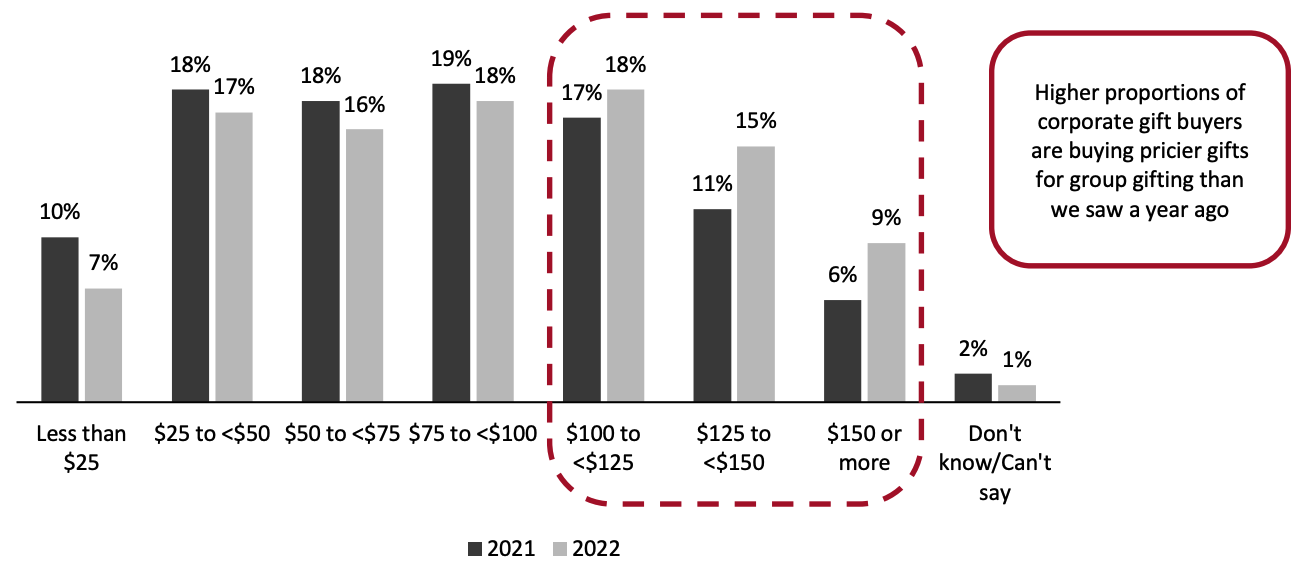

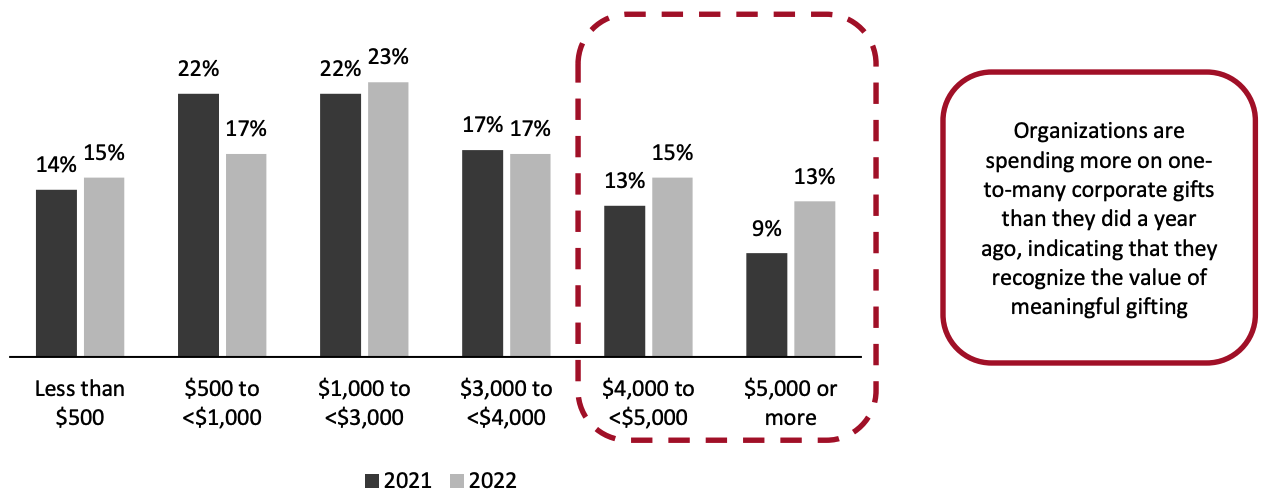

Base: 300 corporate gift givers in the USSource: Coresight Research[/caption] In tandem with reducing the number of one-to-many gifting occasions, organizations are spending more on one-to-many gifts, implying that they are gifting higher-quality products: our 2022 found an increase of 8.0 percentage points in the proportion of respondents spending $100 or more on one-to-many corporate gifts, compared to the 2021 survey.

Figure 12. Amount Spent on a Per-Unit Basis on One-to-Many Corporate Gifts (% of Respondents) [caption id="attachment_149117" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US

Base: 300 corporate gift givers in the USSource: Coresight Research[/caption] The average amounts spent by respondents on one-to-many corporate gifting line up with the per-unit findings and strengthens the finding of increased mindfulness in one-to-many corporate gifting: organizations are spending more for each gifting occasion than they did a year ago, indicating that they recognize the value of meaningful gifting.

- A slightly higher proportion (28%) of corporate gift givers in our 2022 survey reported that they spend in the upper end of the order value spectrum—$4,000 and above—compared to the 2022 survey (22%).

Figure 13. Average Order Amount for One-To-Many Corporate Gifting (% of Respondents) [caption id="attachment_149118" align="aligncenter" width="700"]

Base: 300 corporate gift givers surveyed in April 2022 and in May 2021

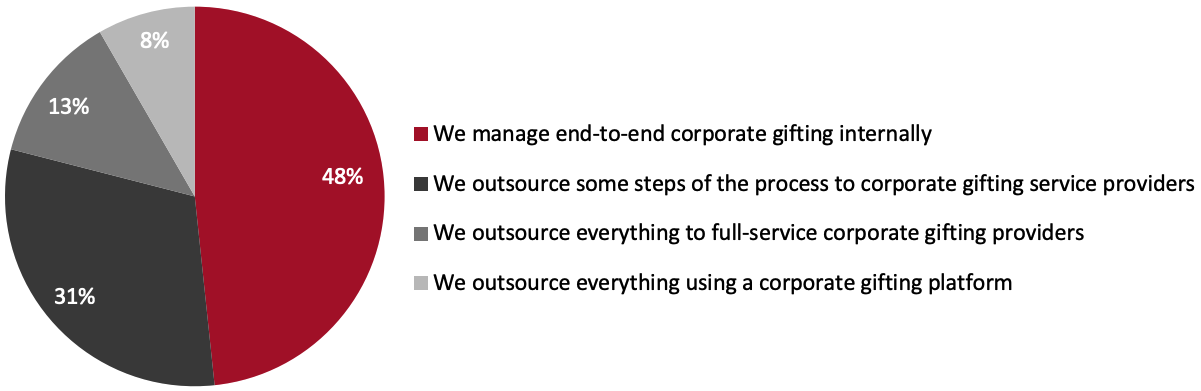

Base: 300 corporate gift givers surveyed in April 2022 and in May 2021Source: Coresight Research[/caption] 6. Outsourcing Corporate Gifting Can Help Alleviate Challenges Organizations face multiple challenges in corporate gifting, including limited information on buyer preferences and little control of the budget, primarily because there is often a limited product assortment to choose from. Outsourcing corporate gifting processes either fully or partially can help organizations simplify the overall gifting process by overseeing stages in the purchasing journey, such as packaging and shipping. Our survey data suggest a substantial market gap and an untapped opportunity for gifting platforms and service providers. We asked respondents about how they manage and execute corporate gifting within their organization and found that:

- Nearly half (48%) of all respondents do not outsource any elements of corporate gifting.

- Only 13% of corporate gift givers outsource entirely to corporate gifting service providers.

- An underwhelming proportion—8% of corporate gift givers—cited using an end-to-end corporate gifting platform for managing and executing corporate gifting.

Figure 14. Criteria Best Describing How Gift Givers Manage and Execute Corporate Gifting (% of Respondents) [caption id="attachment_149119" align="aligncenter" width="700"]

Base: 300 corporate gift givers in the US

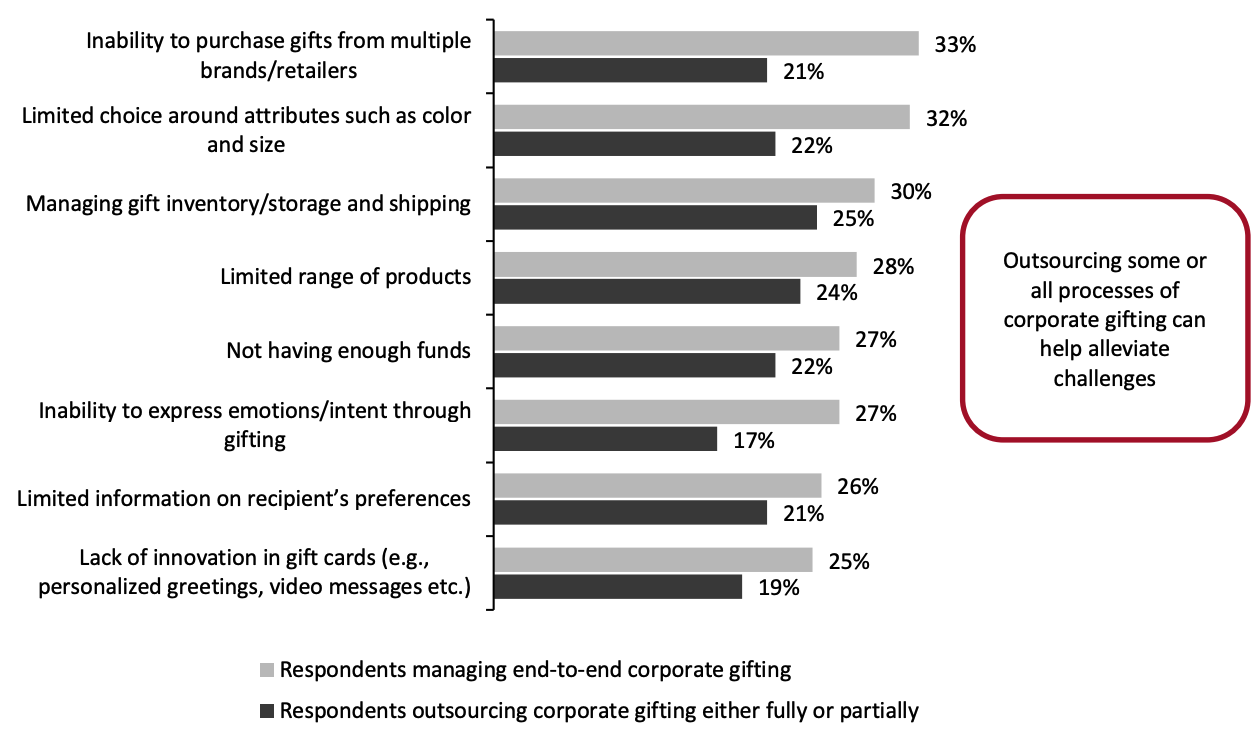

Base: 300 corporate gift givers in the USSource: Coresight Research[/caption] Our analysis reveals that the organizations that manage end-to-end corporate gifting internally face a higher degree of challenges versus respondents who either partially or fully outsource corporate gifting. For example, 33% of corporate gift givers managing end-to-end corporate gifting reported that purchasing gifts from multiple brands and retailers is “very challenging”, compared to just 21% of organizations that outsource corporate gifting reported the same.

Figure 15. Key Challenges in Corporate Gifting: Those Ranked as “Very Challenging” by Corporate Gift Givers (% of Respondents) [caption id="attachment_149120" align="aligncenter" width="700"]

Respondents were asked to rate each option from “not challenging” to “very challenging”; charted are the proportions of respondents that ranked each challenge as “very challenging”

Respondents were asked to rate each option from “not challenging” to “very challenging”; charted are the proportions of respondents that ranked each challenge as “very challenging”Base: 145 corporate gift givers in the US that manage end-to-end corporate gifting and 155 corporate gift givers in the US that outsource some or all corporate gifting processes to service providers or gifting platforms

Source: Coresight Research[/caption] Outsourcing to full-service corporate gifting providers or to corporate gifting platforms can substantially improve the overall gift-giving experience. Gifting platforms that are integrated with company software, such as HR management systems, and oversee end-to-end corporate gifting can help organizations focus on the important aspects of gifting—what to gift and the assortment of gifts in a selected campaign—rather than concern themselves with aspects such as packaging, shipping and ensuring timely delivery to the recipient.

What We Think

Our survey findings inform three key recommendations for retailers, corporate gifting platforms and corporate gifting service providers to better capitalize on opportunities in the corporate gifting market.- Outsource/automate gifting processes: There are multiple processes such as shipping, timely delivery and managing inventory associated with gifting. Overseeing these processes may not be the best utilization of time or resources for most organizations, which may benefit from outsourcing these tasks either fully or partially. In order to gain a larger share of the fast-growing and evolving corporate gifting market, gifting platforms and service providers must work toward strengthening end-to-end gifting management capabilities, including storage and shipping.

- Improve the quality of corporate gifts: Retailers and corporate gifting service providers must focus on improving the assortment for corporate gifting, as quality is the most important factor for corporate gift buyers. Additionally, gestures as small as not printing the company logo on everyday products but sending along a sticker or a badge can signal a positive message and ensure that recipients do not view products as marketing collateral.

- Innovate in the gift card space: Our survey data reveal gift cards top the list of expected gift category purchases in the coming 12 months. Gifting platforms and service providers should work toward adding personalization features to gift cards such as video greetings or ability for the recipient to revert using text or video. We believe this can improve retailers’ and gifting platforms/service providers’ ability to grab a larger share of the gift card market.

Methodology

This study is based on the analysis of data from two online surveys of 300 corporate gift buyers in the US, conducted by Coresight Research on April 7–15, 2022, and in May 2021. Respondents in the survey satisfied the following criteria:- Company annual revenues of any size (from companies with revenue of under $100 million to those with revenue of over $30 billion)

- Employee count of any number (from companies with under 100 employees to those with over 3,000 employees)

- Industries such as retail, real estate, manufacturing, travel and hospitality and health services among others

- Departments such as administration, operations management, sales and events management, among others

GiftNow shares this information solely for your convenience. All statements are the sole opinions of Coresight Research. Synchrony and its affiliates, including GiftNow, make no representations or warranties regarding the content.