Source: Company reports/Fung Global Retail & Technology

4Q16 Results

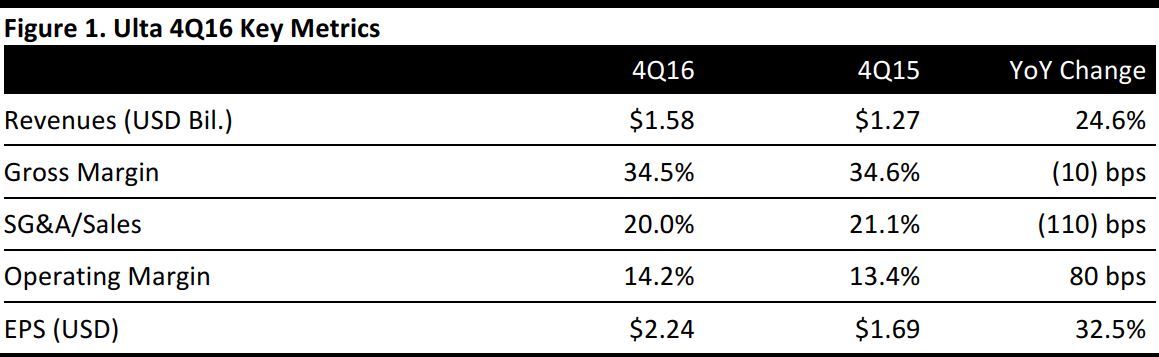

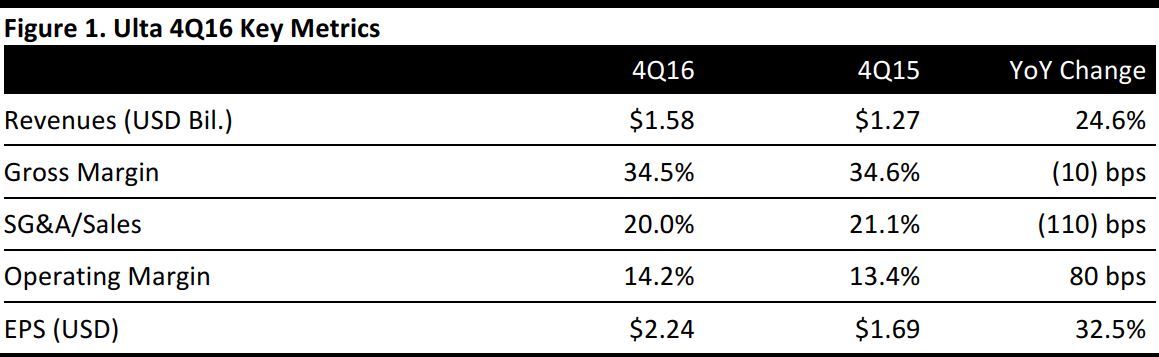

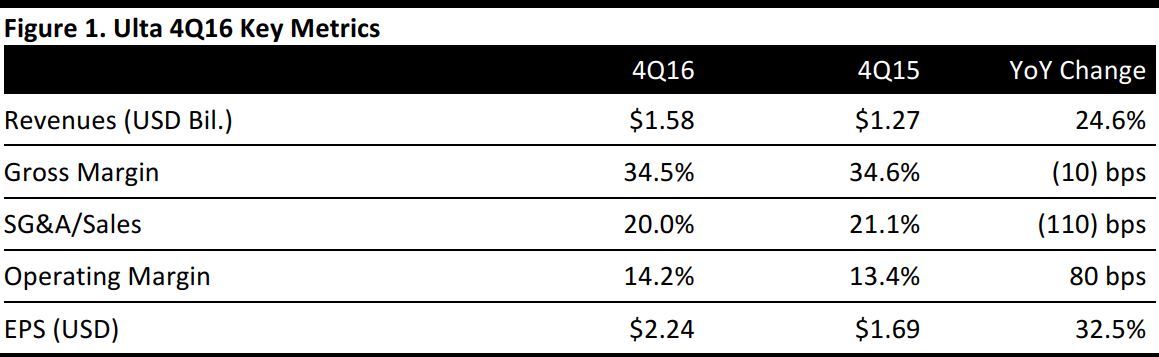

Ulta Beauty reported total revenues of $1.58 billion for 4Q16, up 24.6% from the year-ago quarter and above the $1.54 billion consensus estimate. Comp sales (including the impact of e-commerce sales) were up 16.6% year over year, ahead of the 13.8% consensus estimate. That growth was driven by a 10.9% gain in transaction volume and a 5.7% higher average ticket sale.

Retail comparable sales increased by 12.8%, including salon comparable growth of 8.8%. Total salon sales for the quarter increased 15.2%, to $62.9 million, with strength in hair color and makeup services.

E-commerce sales increased 63.4% year over year to $62.9 million, which represents 380 basis points of the total company comp sales increase of 16.6%. Traffic growth was up almost 63%, with mobile traffic up more than 90%.

The company saw strength across all major categories, with cosmetics leading overall comp growth. Top performing brands included: Urban Decay, IT Cosmetics, NYX, Redken, Too Faced, Tarte, Anastasia, Clinique, Lancôme, Benefit, Ardell, Real Techniques and the Ulta Beauty Collection. Skincare, both mass and prestige, accelerated in the quarter, with mass outperforming.

Gross profit decreased 10 bps to 34.5%, primarily driven by supply-chain investments and a higher mix of e-commerce sales.

SG&A as a percentage of sales decreased 110 bps to 20.0%, primarily due to leverage of advertising, and corporate overhead expenses attributed to higher sales volume.

Ulta reported 4Q16 EPS of $2.24, up 32.5% from the year-ago quarter and above the $2.14 consensus estimate.

The company saw merchandise inventories increase $182.2 million, with average inventory per store up 11.2% compared to 4Q15. The increase was primarily driven by 100 net new stores, investments in inventory to ensure high in-stock levels to support sales growth and incremental inventory for new brands.

Management noted that active membership in its loyalty program, ULTAmate Rewards, grew by 1.7 million members during the quarter, driven by compelling marketing communication and conversion in-store.

FY16 Results

For FY16, Ulta reported revenue of $4.85 billion, up 23.7% from FY15, and comp sales up 15.8%. Comp sales growth was driven by a 10.7% increase in transaction volume and a 5.1% increase in average ticket growth. Retail comparable sales increased 13.4%, including salon comp sales growth of 8.7%.

Total salon sales increased 15.2% from the year-ago period to $241.1 million. Total e-commerce sales grew 56.2% to $345.3 million, which represents 240 bps to the total company comp sales increase of 15.8%.

The retailer reported full-year EPS of $6.52, up 30.9% from $4.98 the previous year.

Management commented that active membership in its loyalty program grew by 5.2 million members to 23.4 active members, an increase of 28%. The company also said positive growth was aided by the more than 500 prestige brand expansions and 69 new brands.

FY17 Outlook

For FY17, Ulta projects EPS growth in the low 20% range, compared with the 25% consensus estimate, or EPS of $8.03. The company noted that the additional week in 2017 has been factored into its annual guidance.

Comparable sales for the full year are expected to be up 8%–10%, (including the e-commerce business) versus the 10% consensus estimate.

The retailer expects to open 100 net new stores and a total of 1,074 stores by FY17 year-end.