Source: Company reports/Fung Global Retail & Technology

1Q17 Results

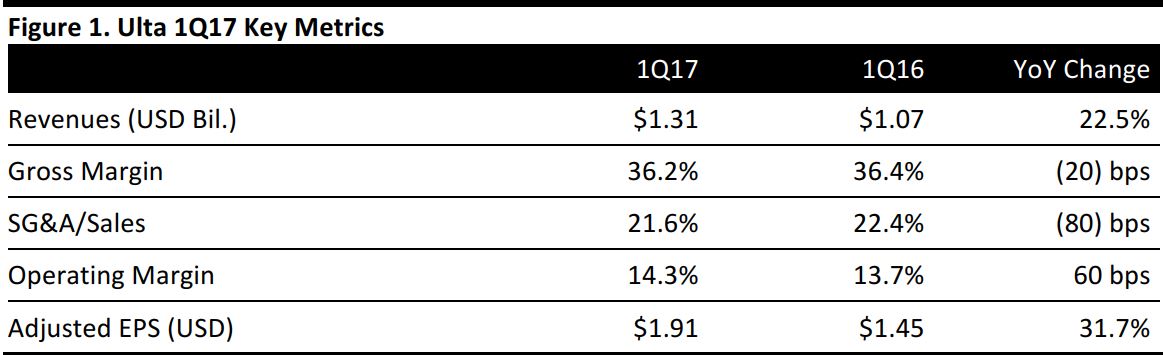

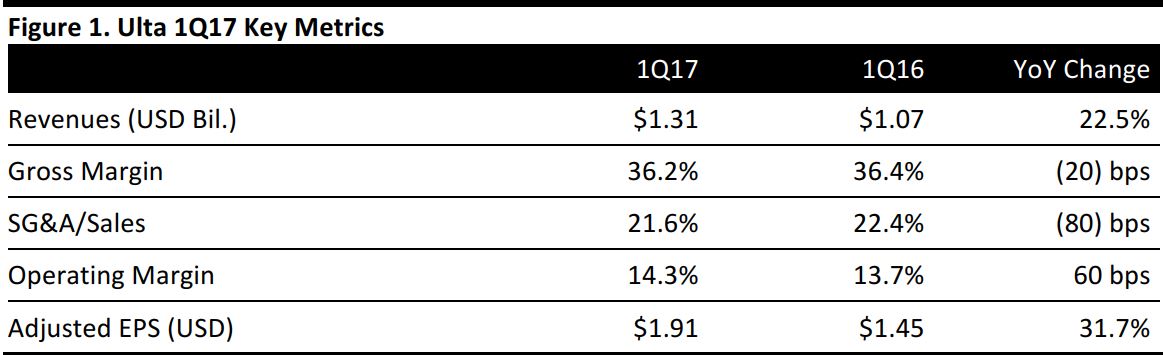

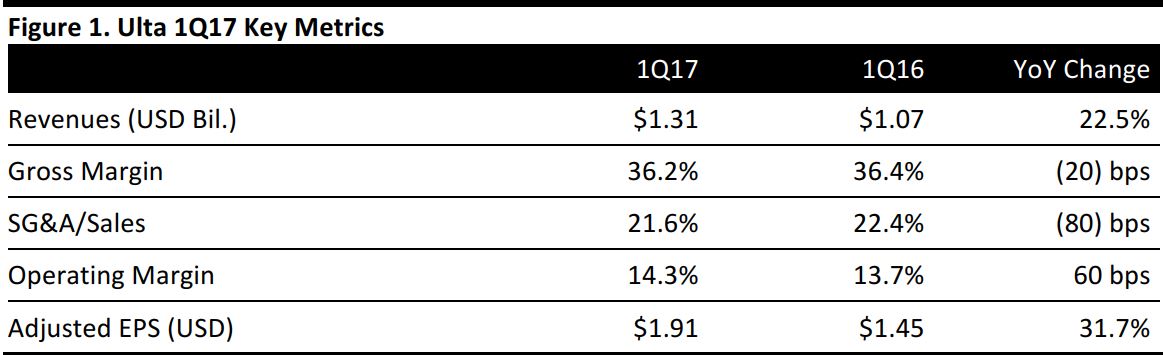

Ulta reported 1Q17 adjusted EPS of $1.91, up 31.7% from the year-ago quarter and above the $1.80 consensus estimate. The company reported total revenue of $1.31 billion, above the $1.27 billion consensus estimate and up 22.5% from the year-ago quarter.

Management was pleased with the strong results, which reflected strong merchandising and marketing programs as well as steady growth in the company’s salon services and e-commerce businesses.

Comparable sales increased by 14.3% year over year, driven by an 8.7% increase in transactions and a 5.6% increase in average ticket. By business segment, retail comps increased by 10.9% and salon comps increased by 9.9%. Ulta’s e-commerce business contributed 340 basis points to total comps.

The company opened 18 stores in the first quarter. Inventory at the end of the quarter was $1,048 million, compared with $843.5 million at the end of 1Q16. Average inventory per store increased by 11.2% year over year, driven by 104 net new stores.

Outlook

The company expects 2Q17 EPS of $1.72–$1.77 and total revenues of $1.26–$1.28 billion. Comps for the quarter are expected to increase by 10%–12% versus 14.4% in 2Q16.

The company also raised its FY17 guidance. Ulta now expects EPS percentage growth in the mid-twenties range, up from a low-twenties range previously. This guidance excludes the impact of the 53rd week. The company now expects comps for the year to increase by 9%–11% versus 8%–10% previously. E-commerce is expected to grow approximately 50%, versus 40% previously.

The company plans to open 100 net new stores during the year. Planned capital expenditure is estimated at around $460 million for FY17, $80 million of which will be used to fund prestige brand expansion; capital expenditure in FY16 was $374 million.