Nitheesh NH

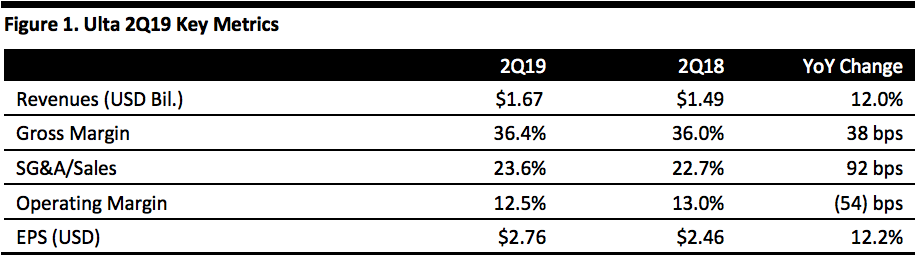

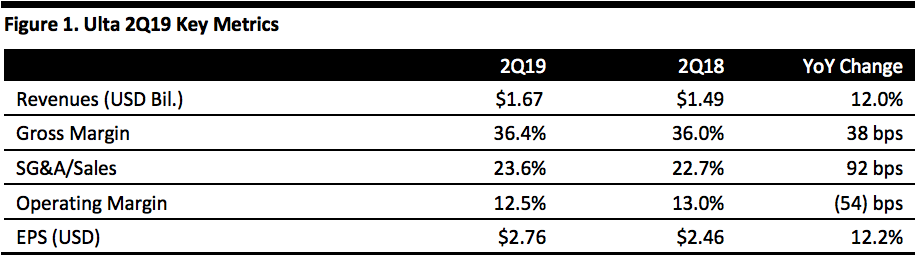

[caption id="attachment_95524" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ulta reported 2Q19 revenues of $1.67 billion, up 12.0% year over year but below the consensus estimate of $1.68 billion. Earnings per share (EPS) were $2.76, up 12.2% from the year-agoperiod and below the consensus estimate of $2.80.

The company saw comparable store sales growth of 6.2% compared to an increase of 6.5% in the year-agoperiod, lower than the consensus estimate of 6.6%.

Management said the company adjusted its outlook for the second half of the year due to headwinds and volatility in US cosmetics. Specifically, the cosmetics category at Ulta (which comprises approximately 50% of the business) saw low-single-digit growth year to date. CEO Mary Dillon explained that after several years of very strong performance, growth in the makeup category has been decelerating over the past two years, and recently turned negative, adding that the US cosmetics market has experienced mid-single-digit declines through the first six months of 2019 and has been more volatile in recent weeks. Management said it expects softness within the cosmetic category trend to continue through the remainder of the year.

Ulta reported the main issue driving softness in cosmetics has been a lack of innovation and newness that previously drove incremental growth, such as contouring or brow styling, innovative product formats such as liquid lips, palettes and minis. Ulta said the most recent innovations have not driven this type of growth.

Outside of cosmetics, Ulta saw strong sales growth in skincare, haircare and personal care appliances. Skincare continues to be one of its strongest growth categories, with prestige, mask and sun care all delivering double-digit comps in the quarter. Category strength is being driven by strong innovation, supported by new ingredients such as moisturizers with SPF, tanners and new skincare rituals such as serums and masks. Sales in suncare were robust, driven by an expanded selection of self-tanning products and sun protection options.

The company reported it has an exclusive prestige brand launch next quarter by KTW Beauty Kim Kardashian West. The collection will launch with 67 SKUs and include contouring and highlight kits, new lip and versatile eye looks. For the holidays, Ulta will offer guests two exclusive holiday kits available only at Ulta Beauty.

Ulta will launch Florence by Mills, a collection created by Millie Bobby Brown, star of the Netflix series Stranger Things. Exclusive to Ulta Beauty, Florence by Mills offers a fresh, fun approach to clean beauty with a universalrange of skincare and make-up products expected to have wide appeal, especially Gen Zers.

Ulta created a dedicated team within its merchandising organization to identify smaller and emerging brands across all beauty categories and then working with them closely to ensure they succeed. Year-to-date, this team has launched more than 30 unique new brands.

“Spark at Ulta Beauty” is a new platform designed to feature a curated, ever-evolving selection of emerging brands across all categories, in select stores and on ulta.com. The company debuted Spark Ulta Beauty at Beauty Con to showcase these brands and give guests the opportunity to discover, explore and play with new emerging brands.

During the second quarter, Ulta updated GLAM LAB, its virtual try-on experience, to include live try on for Android devices. The company also began testing its skincare virtual beauty adviser online, powered by AI and AR, and gives guests easy ways to get skincare advice.

The Ultimate rewards loyalty program grew to 33.2 million active members, an increase of about 13% over the second quarter last year. Loyalty members account for more than 95% of sales, and Ulta uses insights gleaned from member data to create more personalized recommendations, replenishment reminders and unique offers to drive engagement and increase spend per member.

Stores

During the second quarter of fiscal 2019, the company opened 17 net new stores, relocated four stores and remodeled eight stores, compared to 19 net new stores, one relocation and seven remodels in the second quarter of last year, ending the quarter with 1,213 stores. The company reported it remains on track to open 80 stores this year.

Outlook

The company updated its full fiscal year guidance to reflect industry-wide headwinds in cosmetics. The company lowered EPS guidance to $11.86-12.06 from $12.83-13.03, versus the consensus of $12.97. Ulta expects revenue growth of 9-12% versus prior guidance of up low double-digits compared to the consensus of 12.3%. Ulta reduced compguidance to 4-6% from 6-7% andcompared to the consensus estimate of 6.7%.

Ulta plans to open approximately 80 new stores, remodel or relocate 20, and complete approximately 270 store refreshes.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ulta reported 2Q19 revenues of $1.67 billion, up 12.0% year over year but below the consensus estimate of $1.68 billion. Earnings per share (EPS) were $2.76, up 12.2% from the year-agoperiod and below the consensus estimate of $2.80.

The company saw comparable store sales growth of 6.2% compared to an increase of 6.5% in the year-agoperiod, lower than the consensus estimate of 6.6%.

Management said the company adjusted its outlook for the second half of the year due to headwinds and volatility in US cosmetics. Specifically, the cosmetics category at Ulta (which comprises approximately 50% of the business) saw low-single-digit growth year to date. CEO Mary Dillon explained that after several years of very strong performance, growth in the makeup category has been decelerating over the past two years, and recently turned negative, adding that the US cosmetics market has experienced mid-single-digit declines through the first six months of 2019 and has been more volatile in recent weeks. Management said it expects softness within the cosmetic category trend to continue through the remainder of the year.

Ulta reported the main issue driving softness in cosmetics has been a lack of innovation and newness that previously drove incremental growth, such as contouring or brow styling, innovative product formats such as liquid lips, palettes and minis. Ulta said the most recent innovations have not driven this type of growth.

Outside of cosmetics, Ulta saw strong sales growth in skincare, haircare and personal care appliances. Skincare continues to be one of its strongest growth categories, with prestige, mask and sun care all delivering double-digit comps in the quarter. Category strength is being driven by strong innovation, supported by new ingredients such as moisturizers with SPF, tanners and new skincare rituals such as serums and masks. Sales in suncare were robust, driven by an expanded selection of self-tanning products and sun protection options.

The company reported it has an exclusive prestige brand launch next quarter by KTW Beauty Kim Kardashian West. The collection will launch with 67 SKUs and include contouring and highlight kits, new lip and versatile eye looks. For the holidays, Ulta will offer guests two exclusive holiday kits available only at Ulta Beauty.

Ulta will launch Florence by Mills, a collection created by Millie Bobby Brown, star of the Netflix series Stranger Things. Exclusive to Ulta Beauty, Florence by Mills offers a fresh, fun approach to clean beauty with a universalrange of skincare and make-up products expected to have wide appeal, especially Gen Zers.

Ulta created a dedicated team within its merchandising organization to identify smaller and emerging brands across all beauty categories and then working with them closely to ensure they succeed. Year-to-date, this team has launched more than 30 unique new brands.

“Spark at Ulta Beauty” is a new platform designed to feature a curated, ever-evolving selection of emerging brands across all categories, in select stores and on ulta.com. The company debuted Spark Ulta Beauty at Beauty Con to showcase these brands and give guests the opportunity to discover, explore and play with new emerging brands.

During the second quarter, Ulta updated GLAM LAB, its virtual try-on experience, to include live try on for Android devices. The company also began testing its skincare virtual beauty adviser online, powered by AI and AR, and gives guests easy ways to get skincare advice.

The Ultimate rewards loyalty program grew to 33.2 million active members, an increase of about 13% over the second quarter last year. Loyalty members account for more than 95% of sales, and Ulta uses insights gleaned from member data to create more personalized recommendations, replenishment reminders and unique offers to drive engagement and increase spend per member.

Stores

During the second quarter of fiscal 2019, the company opened 17 net new stores, relocated four stores and remodeled eight stores, compared to 19 net new stores, one relocation and seven remodels in the second quarter of last year, ending the quarter with 1,213 stores. The company reported it remains on track to open 80 stores this year.

Outlook

The company updated its full fiscal year guidance to reflect industry-wide headwinds in cosmetics. The company lowered EPS guidance to $11.86-12.06 from $12.83-13.03, versus the consensus of $12.97. Ulta expects revenue growth of 9-12% versus prior guidance of up low double-digits compared to the consensus of 12.3%. Ulta reduced compguidance to 4-6% from 6-7% andcompared to the consensus estimate of 6.7%.

Ulta plans to open approximately 80 new stores, remodel or relocate 20, and complete approximately 270 store refreshes.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ulta reported 2Q19 revenues of $1.67 billion, up 12.0% year over year but below the consensus estimate of $1.68 billion. Earnings per share (EPS) were $2.76, up 12.2% from the year-agoperiod and below the consensus estimate of $2.80.

The company saw comparable store sales growth of 6.2% compared to an increase of 6.5% in the year-agoperiod, lower than the consensus estimate of 6.6%.

Management said the company adjusted its outlook for the second half of the year due to headwinds and volatility in US cosmetics. Specifically, the cosmetics category at Ulta (which comprises approximately 50% of the business) saw low-single-digit growth year to date. CEO Mary Dillon explained that after several years of very strong performance, growth in the makeup category has been decelerating over the past two years, and recently turned negative, adding that the US cosmetics market has experienced mid-single-digit declines through the first six months of 2019 and has been more volatile in recent weeks. Management said it expects softness within the cosmetic category trend to continue through the remainder of the year.

Ulta reported the main issue driving softness in cosmetics has been a lack of innovation and newness that previously drove incremental growth, such as contouring or brow styling, innovative product formats such as liquid lips, palettes and minis. Ulta said the most recent innovations have not driven this type of growth.

Outside of cosmetics, Ulta saw strong sales growth in skincare, haircare and personal care appliances. Skincare continues to be one of its strongest growth categories, with prestige, mask and sun care all delivering double-digit comps in the quarter. Category strength is being driven by strong innovation, supported by new ingredients such as moisturizers with SPF, tanners and new skincare rituals such as serums and masks. Sales in suncare were robust, driven by an expanded selection of self-tanning products and sun protection options.

The company reported it has an exclusive prestige brand launch next quarter by KTW Beauty Kim Kardashian West. The collection will launch with 67 SKUs and include contouring and highlight kits, new lip and versatile eye looks. For the holidays, Ulta will offer guests two exclusive holiday kits available only at Ulta Beauty.

Ulta will launch Florence by Mills, a collection created by Millie Bobby Brown, star of the Netflix series Stranger Things. Exclusive to Ulta Beauty, Florence by Mills offers a fresh, fun approach to clean beauty with a universalrange of skincare and make-up products expected to have wide appeal, especially Gen Zers.

Ulta created a dedicated team within its merchandising organization to identify smaller and emerging brands across all beauty categories and then working with them closely to ensure they succeed. Year-to-date, this team has launched more than 30 unique new brands.

“Spark at Ulta Beauty” is a new platform designed to feature a curated, ever-evolving selection of emerging brands across all categories, in select stores and on ulta.com. The company debuted Spark Ulta Beauty at Beauty Con to showcase these brands and give guests the opportunity to discover, explore and play with new emerging brands.

During the second quarter, Ulta updated GLAM LAB, its virtual try-on experience, to include live try on for Android devices. The company also began testing its skincare virtual beauty adviser online, powered by AI and AR, and gives guests easy ways to get skincare advice.

The Ultimate rewards loyalty program grew to 33.2 million active members, an increase of about 13% over the second quarter last year. Loyalty members account for more than 95% of sales, and Ulta uses insights gleaned from member data to create more personalized recommendations, replenishment reminders and unique offers to drive engagement and increase spend per member.

Stores

During the second quarter of fiscal 2019, the company opened 17 net new stores, relocated four stores and remodeled eight stores, compared to 19 net new stores, one relocation and seven remodels in the second quarter of last year, ending the quarter with 1,213 stores. The company reported it remains on track to open 80 stores this year.

Outlook

The company updated its full fiscal year guidance to reflect industry-wide headwinds in cosmetics. The company lowered EPS guidance to $11.86-12.06 from $12.83-13.03, versus the consensus of $12.97. Ulta expects revenue growth of 9-12% versus prior guidance of up low double-digits compared to the consensus of 12.3%. Ulta reduced compguidance to 4-6% from 6-7% andcompared to the consensus estimate of 6.7%.

Ulta plans to open approximately 80 new stores, remodel or relocate 20, and complete approximately 270 store refreshes.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ulta reported 2Q19 revenues of $1.67 billion, up 12.0% year over year but below the consensus estimate of $1.68 billion. Earnings per share (EPS) were $2.76, up 12.2% from the year-agoperiod and below the consensus estimate of $2.80.

The company saw comparable store sales growth of 6.2% compared to an increase of 6.5% in the year-agoperiod, lower than the consensus estimate of 6.6%.

Management said the company adjusted its outlook for the second half of the year due to headwinds and volatility in US cosmetics. Specifically, the cosmetics category at Ulta (which comprises approximately 50% of the business) saw low-single-digit growth year to date. CEO Mary Dillon explained that after several years of very strong performance, growth in the makeup category has been decelerating over the past two years, and recently turned negative, adding that the US cosmetics market has experienced mid-single-digit declines through the first six months of 2019 and has been more volatile in recent weeks. Management said it expects softness within the cosmetic category trend to continue through the remainder of the year.

Ulta reported the main issue driving softness in cosmetics has been a lack of innovation and newness that previously drove incremental growth, such as contouring or brow styling, innovative product formats such as liquid lips, palettes and minis. Ulta said the most recent innovations have not driven this type of growth.

Outside of cosmetics, Ulta saw strong sales growth in skincare, haircare and personal care appliances. Skincare continues to be one of its strongest growth categories, with prestige, mask and sun care all delivering double-digit comps in the quarter. Category strength is being driven by strong innovation, supported by new ingredients such as moisturizers with SPF, tanners and new skincare rituals such as serums and masks. Sales in suncare were robust, driven by an expanded selection of self-tanning products and sun protection options.

The company reported it has an exclusive prestige brand launch next quarter by KTW Beauty Kim Kardashian West. The collection will launch with 67 SKUs and include contouring and highlight kits, new lip and versatile eye looks. For the holidays, Ulta will offer guests two exclusive holiday kits available only at Ulta Beauty.

Ulta will launch Florence by Mills, a collection created by Millie Bobby Brown, star of the Netflix series Stranger Things. Exclusive to Ulta Beauty, Florence by Mills offers a fresh, fun approach to clean beauty with a universalrange of skincare and make-up products expected to have wide appeal, especially Gen Zers.

Ulta created a dedicated team within its merchandising organization to identify smaller and emerging brands across all beauty categories and then working with them closely to ensure they succeed. Year-to-date, this team has launched more than 30 unique new brands.

“Spark at Ulta Beauty” is a new platform designed to feature a curated, ever-evolving selection of emerging brands across all categories, in select stores and on ulta.com. The company debuted Spark Ulta Beauty at Beauty Con to showcase these brands and give guests the opportunity to discover, explore and play with new emerging brands.

During the second quarter, Ulta updated GLAM LAB, its virtual try-on experience, to include live try on for Android devices. The company also began testing its skincare virtual beauty adviser online, powered by AI and AR, and gives guests easy ways to get skincare advice.

The Ultimate rewards loyalty program grew to 33.2 million active members, an increase of about 13% over the second quarter last year. Loyalty members account for more than 95% of sales, and Ulta uses insights gleaned from member data to create more personalized recommendations, replenishment reminders and unique offers to drive engagement and increase spend per member.

Stores

During the second quarter of fiscal 2019, the company opened 17 net new stores, relocated four stores and remodeled eight stores, compared to 19 net new stores, one relocation and seven remodels in the second quarter of last year, ending the quarter with 1,213 stores. The company reported it remains on track to open 80 stores this year.

Outlook

The company updated its full fiscal year guidance to reflect industry-wide headwinds in cosmetics. The company lowered EPS guidance to $11.86-12.06 from $12.83-13.03, versus the consensus of $12.97. Ulta expects revenue growth of 9-12% versus prior guidance of up low double-digits compared to the consensus of 12.3%. Ulta reduced compguidance to 4-6% from 6-7% andcompared to the consensus estimate of 6.7%.

Ulta plans to open approximately 80 new stores, remodel or relocate 20, and complete approximately 270 store refreshes.