DIpil Das

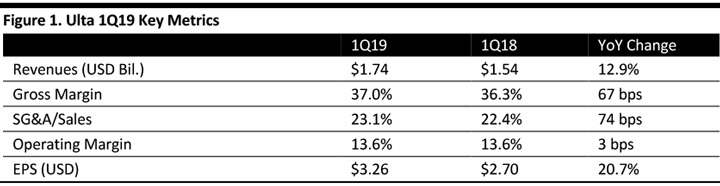

[caption id="attachment_89559" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ulta reported fiscal 1Q19 revenues of $1.74 billion, up 12.9% year over year and below the consensus estimate of $1.75 billion. Earnings per share (EPS) was $3.26, up 20.7% from the year-ago period. The company’s EPS included a $0.18 benefit due to income tax accounting for share-based compensation.

The company saw comparable store sales growth of 7.0% compared to the consensus estimate of 7.1% and compared to an increase of 8.1% in same period last year. Management reported double-digit comparable sales growth in mass cosmetics, skin care and fragrance, tempered by mixed performance in prestige cosmetics. Specifically, management reported it is seeing growth of its extension brands including Clinic, Mac, Estée Lauder and NARS, but not sufficient to offset the softness in several large established prestige cosmetic brands.

Kylie cosmetics is driving traffic in incremental sales with new products, including eyeshadow pallet and the Kris Jenner palette. Ulta plans to add blushes, highlighters, bronzers and the birthday pallet, which will be in the stores in a few weeks. Ulta also launched Omar beauty, an exclusive makeup line inspired by African beauty with a focus on diversity, offering vivid colors and a foundation with six formulas offered in many shades.

The Ultimate rewards loyalty program grew to 32.6 million active members, up 14% on a rolling 12-month basis. The company is seeing an increase in diamond and platinum members, and its credit card growth was above plan. Ulta sees nearly a 50% increase in incremental spend once customers become cardholders. Gift card sales increased 32% in the first quarter.

Stores

During the first quarter of fiscal 2019, the company opened 22 stores, ending the first quarter with 1,196 stores. This is an 8.0% increase in square footage compared to the first quarter of fiscal 2018. For the full fiscal year, Ulta plans to open approximately 80 new stores, remodel or relocate 20 and complete approximately 270 store refreshes.

The company announced it will expand internationally with a launch in Canada.

Outlook

For the full fiscal year, the company expects to deliver diluted earnings per share in the range of $12.83 to $13.03 compared to the $12.90 consensus. The company expects comparable sales growth of 6-7%, compared to the consensus estimate of 6.6%. The company projects e-commerce growth of 20-30%. The company will no longer provide quarterly guidance but will update annual guidance on a quarterly basis.

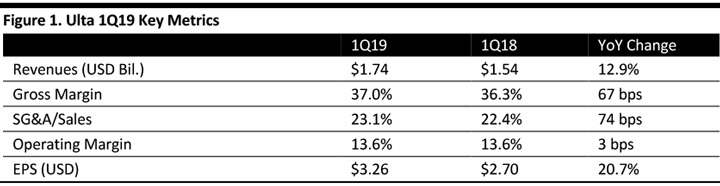

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ulta reported fiscal 1Q19 revenues of $1.74 billion, up 12.9% year over year and below the consensus estimate of $1.75 billion. Earnings per share (EPS) was $3.26, up 20.7% from the year-ago period. The company’s EPS included a $0.18 benefit due to income tax accounting for share-based compensation.

The company saw comparable store sales growth of 7.0% compared to the consensus estimate of 7.1% and compared to an increase of 8.1% in same period last year. Management reported double-digit comparable sales growth in mass cosmetics, skin care and fragrance, tempered by mixed performance in prestige cosmetics. Specifically, management reported it is seeing growth of its extension brands including Clinic, Mac, Estée Lauder and NARS, but not sufficient to offset the softness in several large established prestige cosmetic brands.

Kylie cosmetics is driving traffic in incremental sales with new products, including eyeshadow pallet and the Kris Jenner palette. Ulta plans to add blushes, highlighters, bronzers and the birthday pallet, which will be in the stores in a few weeks. Ulta also launched Omar beauty, an exclusive makeup line inspired by African beauty with a focus on diversity, offering vivid colors and a foundation with six formulas offered in many shades.

The Ultimate rewards loyalty program grew to 32.6 million active members, up 14% on a rolling 12-month basis. The company is seeing an increase in diamond and platinum members, and its credit card growth was above plan. Ulta sees nearly a 50% increase in incremental spend once customers become cardholders. Gift card sales increased 32% in the first quarter.

Stores

During the first quarter of fiscal 2019, the company opened 22 stores, ending the first quarter with 1,196 stores. This is an 8.0% increase in square footage compared to the first quarter of fiscal 2018. For the full fiscal year, Ulta plans to open approximately 80 new stores, remodel or relocate 20 and complete approximately 270 store refreshes.

The company announced it will expand internationally with a launch in Canada.

Outlook

For the full fiscal year, the company expects to deliver diluted earnings per share in the range of $12.83 to $13.03 compared to the $12.90 consensus. The company expects comparable sales growth of 6-7%, compared to the consensus estimate of 6.6%. The company projects e-commerce growth of 20-30%. The company will no longer provide quarterly guidance but will update annual guidance on a quarterly basis.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ulta reported fiscal 1Q19 revenues of $1.74 billion, up 12.9% year over year and below the consensus estimate of $1.75 billion. Earnings per share (EPS) was $3.26, up 20.7% from the year-ago period. The company’s EPS included a $0.18 benefit due to income tax accounting for share-based compensation.

The company saw comparable store sales growth of 7.0% compared to the consensus estimate of 7.1% and compared to an increase of 8.1% in same period last year. Management reported double-digit comparable sales growth in mass cosmetics, skin care and fragrance, tempered by mixed performance in prestige cosmetics. Specifically, management reported it is seeing growth of its extension brands including Clinic, Mac, Estée Lauder and NARS, but not sufficient to offset the softness in several large established prestige cosmetic brands.

Kylie cosmetics is driving traffic in incremental sales with new products, including eyeshadow pallet and the Kris Jenner palette. Ulta plans to add blushes, highlighters, bronzers and the birthday pallet, which will be in the stores in a few weeks. Ulta also launched Omar beauty, an exclusive makeup line inspired by African beauty with a focus on diversity, offering vivid colors and a foundation with six formulas offered in many shades.

The Ultimate rewards loyalty program grew to 32.6 million active members, up 14% on a rolling 12-month basis. The company is seeing an increase in diamond and platinum members, and its credit card growth was above plan. Ulta sees nearly a 50% increase in incremental spend once customers become cardholders. Gift card sales increased 32% in the first quarter.

Stores

During the first quarter of fiscal 2019, the company opened 22 stores, ending the first quarter with 1,196 stores. This is an 8.0% increase in square footage compared to the first quarter of fiscal 2018. For the full fiscal year, Ulta plans to open approximately 80 new stores, remodel or relocate 20 and complete approximately 270 store refreshes.

The company announced it will expand internationally with a launch in Canada.

Outlook

For the full fiscal year, the company expects to deliver diluted earnings per share in the range of $12.83 to $13.03 compared to the $12.90 consensus. The company expects comparable sales growth of 6-7%, compared to the consensus estimate of 6.6%. The company projects e-commerce growth of 20-30%. The company will no longer provide quarterly guidance but will update annual guidance on a quarterly basis.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ulta reported fiscal 1Q19 revenues of $1.74 billion, up 12.9% year over year and below the consensus estimate of $1.75 billion. Earnings per share (EPS) was $3.26, up 20.7% from the year-ago period. The company’s EPS included a $0.18 benefit due to income tax accounting for share-based compensation.

The company saw comparable store sales growth of 7.0% compared to the consensus estimate of 7.1% and compared to an increase of 8.1% in same period last year. Management reported double-digit comparable sales growth in mass cosmetics, skin care and fragrance, tempered by mixed performance in prestige cosmetics. Specifically, management reported it is seeing growth of its extension brands including Clinic, Mac, Estée Lauder and NARS, but not sufficient to offset the softness in several large established prestige cosmetic brands.

Kylie cosmetics is driving traffic in incremental sales with new products, including eyeshadow pallet and the Kris Jenner palette. Ulta plans to add blushes, highlighters, bronzers and the birthday pallet, which will be in the stores in a few weeks. Ulta also launched Omar beauty, an exclusive makeup line inspired by African beauty with a focus on diversity, offering vivid colors and a foundation with six formulas offered in many shades.

The Ultimate rewards loyalty program grew to 32.6 million active members, up 14% on a rolling 12-month basis. The company is seeing an increase in diamond and platinum members, and its credit card growth was above plan. Ulta sees nearly a 50% increase in incremental spend once customers become cardholders. Gift card sales increased 32% in the first quarter.

Stores

During the first quarter of fiscal 2019, the company opened 22 stores, ending the first quarter with 1,196 stores. This is an 8.0% increase in square footage compared to the first quarter of fiscal 2018. For the full fiscal year, Ulta plans to open approximately 80 new stores, remodel or relocate 20 and complete approximately 270 store refreshes.

The company announced it will expand internationally with a launch in Canada.

Outlook

For the full fiscal year, the company expects to deliver diluted earnings per share in the range of $12.83 to $13.03 compared to the $12.90 consensus. The company expects comparable sales growth of 6-7%, compared to the consensus estimate of 6.6%. The company projects e-commerce growth of 20-30%. The company will no longer provide quarterly guidance but will update annual guidance on a quarterly basis.