Nitheesh NH

Ulta Beauty and Sephora: An Overview

Ulta Beauty and Sephora are two dominant retail chains that are competing against each other in an estimated $56 billion US beauty retail market.

Ulta Beauty was founded in 1990 and operates 1,213 stores across all 50 US states, as of August 2019. The company remains on track to open 80 stores in 2019. Most Ulta stores are about 10,000 square feet in size, each with nearly 950 square feet dedicated to a full-service salon. As nearly 90% of Ulta’s stores are located in suburban strip malls instead of enclosed shopping malls, the company is less affected by declining mall traffic. Ulta also sells its products online, and its websites offers beauty tutorials, tips and social content. The company’s portfolio comprises over 25,000 products from nearly 500 established and emerging beauty brands across various categories, including the company’s private label, the Ulta Beauty Collection. Ulta provides an omnichannel shopping experience to its customers. In the second quarter of fiscal 2019, the company rolled out a “buy online, pick up in store” (BOPIS) offering.

Sephora was founded in 1969 and acquired by LVMH in 1997. The company operates more than 1,120 stores across the US, including 460 full stores and 660 JCPenney shop-in-shops. According to Sephora, its website is its “largest North American store” and offers visitors the opportunity to engage with its beauty community and other brands’ happenings. The company sells more than 17,000 products from over 300 brands, including the Sephora Collection in-house brand. The company aims to open 35 new stores in 2019. Unlike Ulta, Sephora has more locations inside shopping malls. However, it is taking initiatives to move out of malls by experimenting with a boutique format. In 2017, Sephora opened Sephora Studio in Boston, a 2,000-square-foot experiential retail concept store that is less than half the size of a typical 5,500-square-foot Sephora store. The company opened its second Studio location in May 2018, which measures 3,580 square feet.. Each Sephora Studio store incorporates innovative technology and provides customized experiences with beauty experts. Although Sephora is investing in its omnichannel strategy, the company does not currently provide a BOPIS offering, unlike Ulta.

Ulta and Sephora provide similar product offerings, although Sephora stocks more high-end brands, while Ulta stocks more mass-market options. For example, Sephora’s relatively affordable in-house brand—which features a line of $8 lipsticks—is pricier than some of the mass-market brands offered by Ulta, such as NYX and Milani. As we have identified, Ulta has an overall beauty portfolio that is 7,000 products larger that Sephora’s, thus offering more choice for its customers, particularly for those on a budget.

Ulta’s and Sephora’s Loyalty Programs

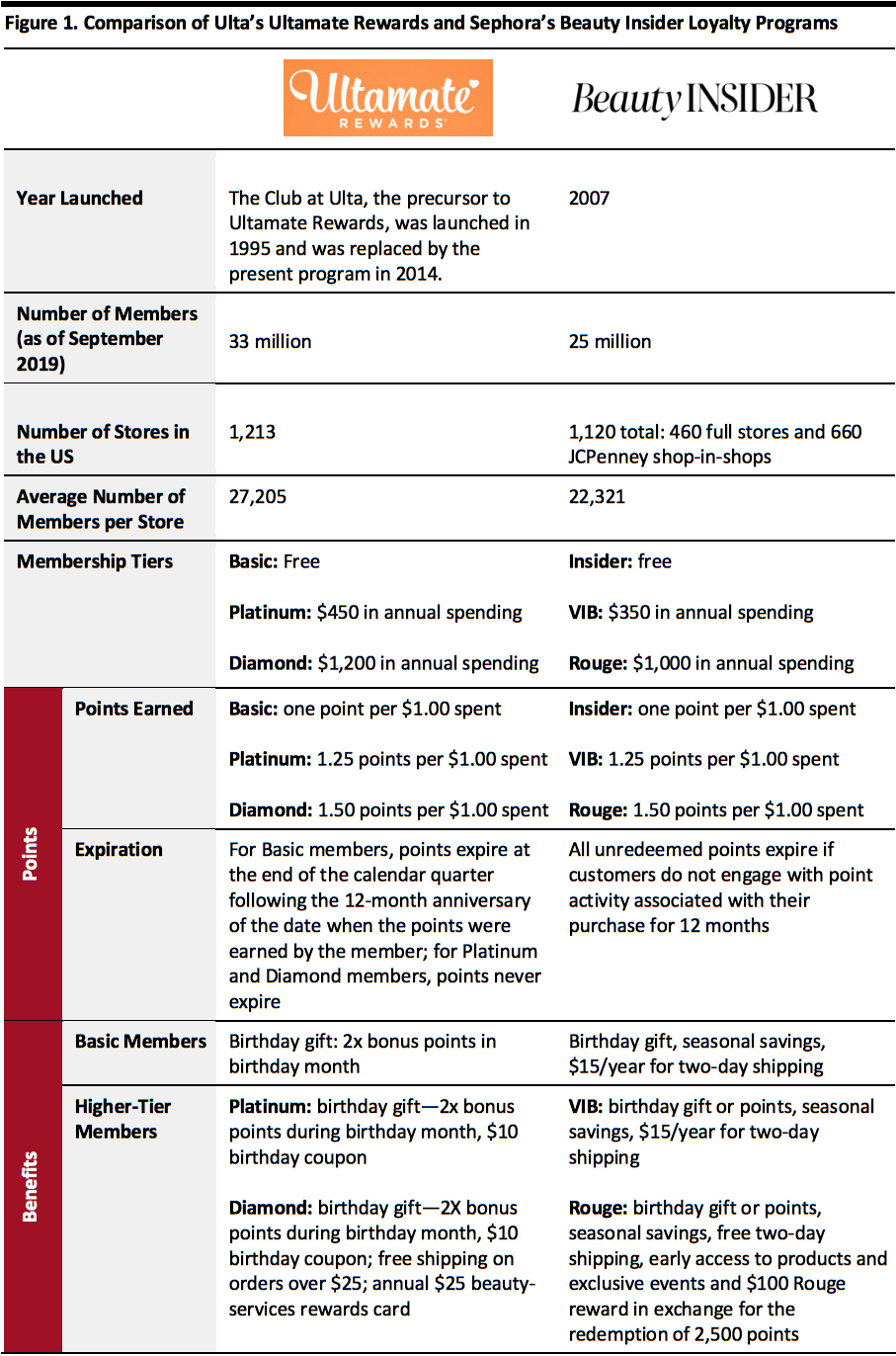

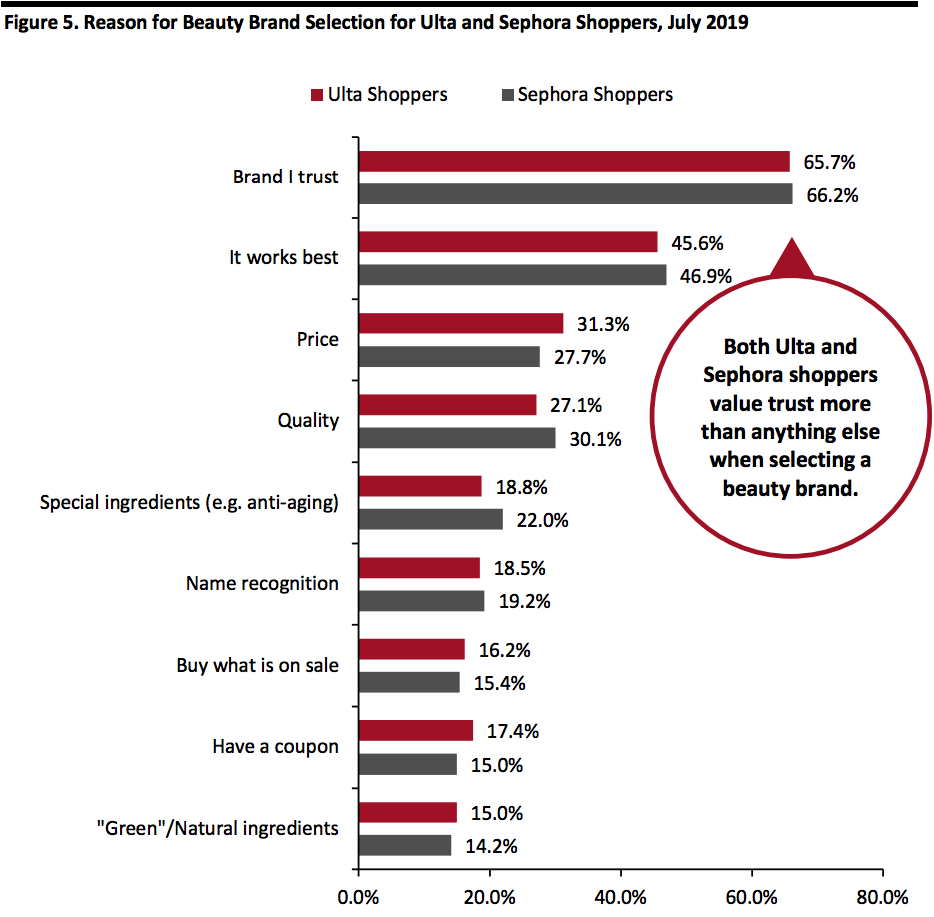

For any company, a loyalty program helps drive sales and customer engagement and is therefore a core component of the business. Sephora’s Beauty Insider loyalty program and Ulta’s Ultamate Rewards program allow members to accumulate points and use them to pay for selected items and services, and both are available in stores across the US and through the retailers’ websites. Loyalty program tiers enable different levels of access, providing benefits to higher-spending customers in addition to the exclusive services available to members at all levels, such as early access to events and new products.

Source: Company reports/WARC[/caption]

Source: Company reports/WARC[/caption]

*As of September 2019

*As of September 2019

Source: Company reports/WARC[/caption] Base: 1,276 US shoppers

Base: 1,276 US shoppers

Source: Cowen[/caption] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

Base: 461 Ulta shoppers and 285 Sephora shoppers, aged 18+

Base: 461 Ulta shoppers and 285 Sephora shoppers, aged 18+

Source: Prosper Insights & Analytics[/caption] Key Insights Both Ulta and Sephora are thriving in the beauty market. With 33 million members as of September 2019, Ulta’s Ultamate Rewards program is bigger than Sephora’s Beauty Insider program and has also grown faster since 2014. Although Sephora has fewer members than Ulta, its shoppers’ monthly average expenditure on skin care and cosmetics across all retailers is higher, according to Prosper’s recent consumer survey. As the beauty market continues to grow, each retailer’s loyalty programs will remain a useful tool for Ulta and Sephora to engage with and retain customers. These programs should have a clear value proposition and align with the strategic positioning of the retailer. Both Ulta and Sephora are using AI and AR tools to analyze their loyalty program data to enhance personalization for their customers and drive incremental sales.

- Sephora’s Beauty Insider turns customers’ spending into points that can be redeemed at the company’s Rewards Baazar in exchange for products. Sephora’s loyalty program rarely offers cash discounts or sales to its members and is instead centered around free gifts and exclusive services; free beauty classes and custom makeovers are offered to higher-tier Beauty Insider members, along with early access to, and special offers at, events such as Sephoria House of Beauty. Beauty Insider program members account for nearly 80% of Sephora’s total sales.

- Ulta’s Ultamate Rewards program focuses on value, in alignment with the company’s strategic positioning. Unlike Sephora, Ulta points are redeemed as cash discounts on future purchases, driving members to increase their spending. The Ultamate Rewards program represented over 95% of Ulta’s total sales in 2018.

Source: Company reports/WARC[/caption]

Source: Company reports/WARC[/caption]

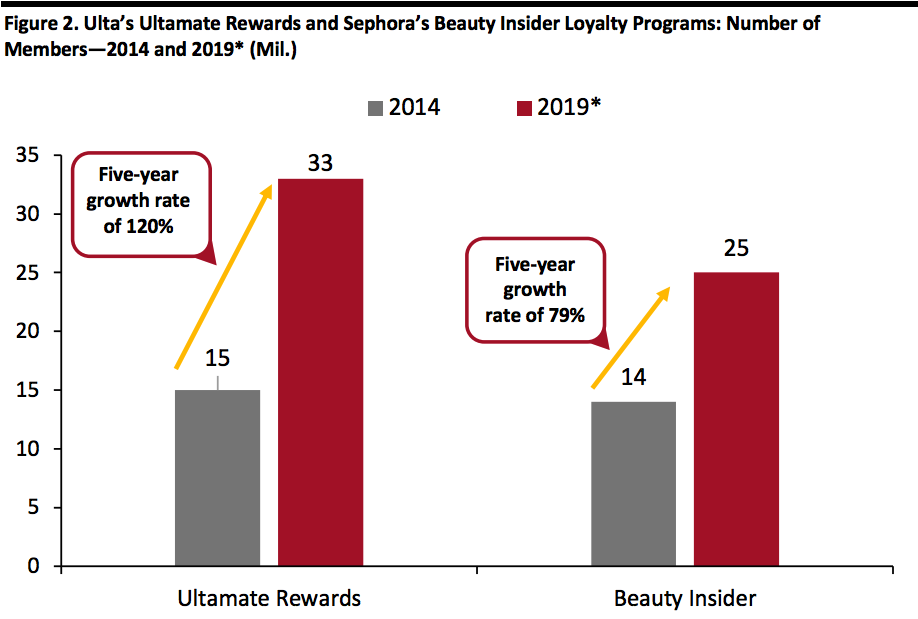

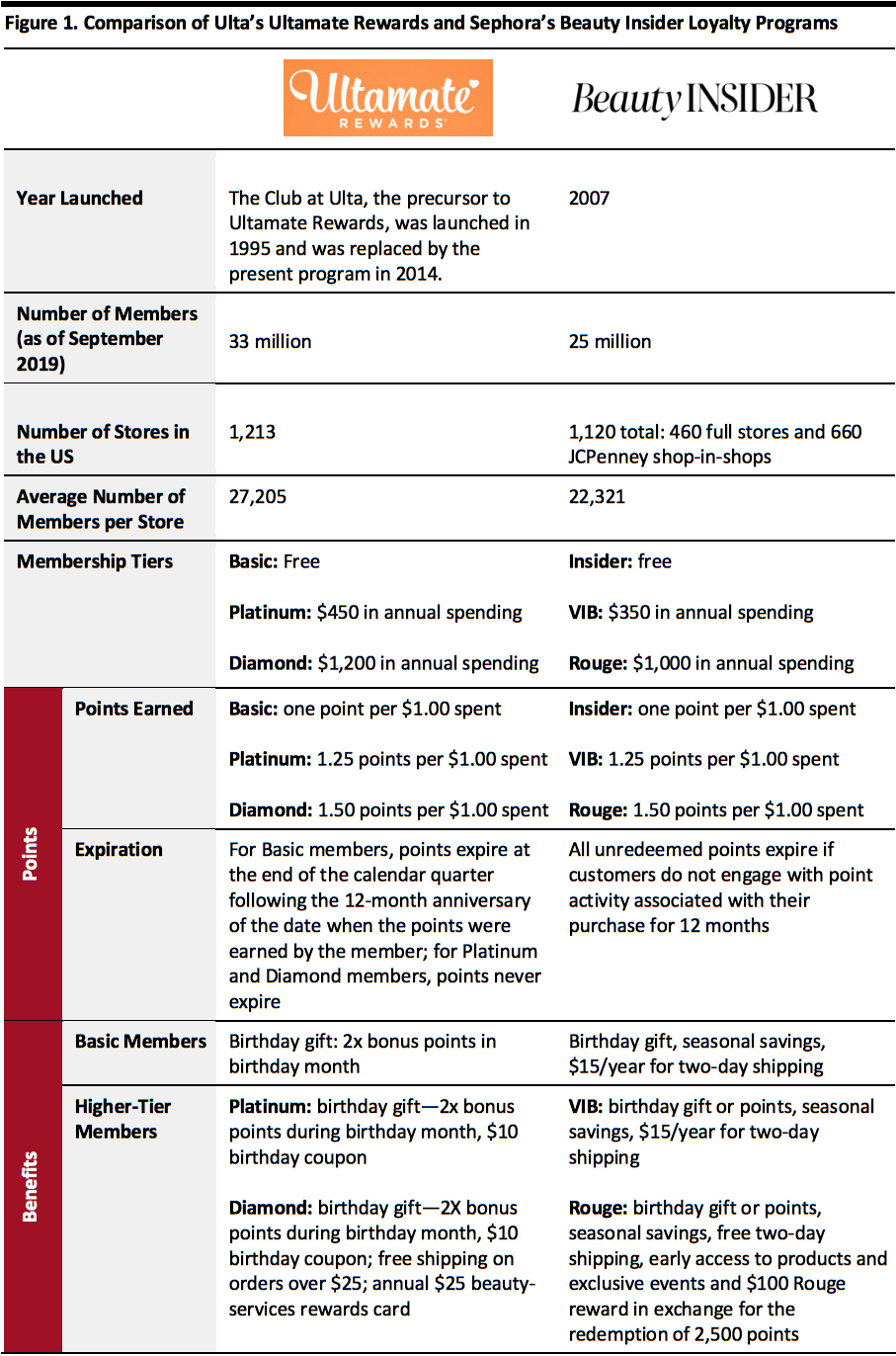

Ulta’s Loyalty Program Is Growing Faster than Sephora’s

Over the past five years, membership of Ulta’s Ultamate Rewards loyalty program has grown by 120%. Sephora’s Beauty Insider membership base has grown by a comparatively slower rate of 79% since 2014, according to market intelligence firm WARC. [caption id="attachment_100248" align="aligncenter" width="700"] *As of September 2019

*As of September 2019Source: Company reports/WARC[/caption]

Sephora and Ulta Are Using Customer Loyalty Data To Curate Personalized Experiences

Both Ulta and Sephora generate customer data through sales, product reviews and social media engagement. These data provide insights into consumer preferences and loyalty, and help the retailers to make informed decisions about marketing and promotional strategies across different touchpoints. Sephora gathers customer data across channels and platforms, and analyses it using artificial intelligence (AI) and augmented reality (AR) tools. For example, the company’s Color IQ shade-matching skincare technology scans shoppers’ skin via a handheld device to capture their skin tone and match it to results from an existing “shade library” in order to offer personalized online and in-store beauty product assortments. Sephora’s Virtual Artist, which was launched in May 2017, allows shoppers to virtually try on beauty products from multiple categories from their mobile devices. Virtual Artist quickly gained strong traction among shoppers, witnessing over 8.5 million visits to the feature online and through the app in less than a year. Sephora’s Beauty Insider rewards program collects data—such as hair color, eye color and skin tone—to generate an individual profile for each member and offer personalized recommendations. Furthermore, customers are able to sort product reviews by shoppers who have similar profile characteristics, helping them to make more informed decisions. By employing a targeted email strategy based on this data, Sephora increases the probability of customers opening each email, clicking through the product links and making a purchase. Owing to its revamped loyalty program and personalization-driven approach to communication, the company ranked first in Sailthru’s Retail Personalization Index in 2018, for the third year in a row. Ulta also uses loyalty program data to provide a personalized experience to its customers, recommending beauty products based on members’ skin and hair type, interests and other information. The company’s mobile app features several quizzes for users to discover products, as well as enabling shoppers to set detailed preferences and virtually try on the products—data which helps the app provide customized recommendations. In 2018, Ulta enhanced its personalization strategy through the acquisition of AR beauty technology company GlamST and QM Scientific, an AI start-up. Using the AI tool, Ulta is able to identify members’ responses to different offers and incorporates those insights to customize future offerings and therefore drive incremental sales. To drive deeper engagement and spend per member, Ulta is creating unique offers, more personalized recommendations and replenishment reminders, said the company’s CEO Mary N. Dillon when discussing the second quarter fiscal 2019 earnings. Dillon explained that Ulta is making progress on this effort, as the number of members receiving these recommendations and reminders is continuing to rise, which is also boosting the company’s in-store sales growth. In early 2019, Ulta partnered with Google Cloud to analyze and transform its customer loyalty data into valuable insights. Under the alliance, Ulta deployed Google Cloud tools, such as BigQuery and Anthos, to analyze data and generate content, such as personalized product recommendations and event-based messages. The partnership has helped the retailer to increase customer engagement both in store and online, according to Michelle Pacynski, Vice President of Digital Innovation at Ulta Beauty. Through the partnership, Ulta has also developed new tools, such as a virtual beauty advisor tool that provides a platform for customer conversations and delivers tailored recommendations to shoppers. In June, Ulta expanded its existing partnership with Google Cloud. The Shopping Habits and Behaviors of Ulta’s and Sephora’s Customers In this section, we use consumer survey data to explore the beauty buying habits of Ulta’s and Sephora’s shoppers in the US.Beauty Shoppers Are More Likely To Prefer Ulta than Sephora

A February 2019 survey by Cowen, a financial services firm, asked respondents which retailer they prefer when buying beauty products such as skin care, cosmetics, hair products and fragrances—Ulta came out on top. Compared to data from the same survey last year, both Ulta and Sephora have seen a rise in the proportion of consumers preferring to purchase beauty products from them, while Amazon witnessed a decline. That said, Amazon remains more a popular choice than Sephora. [caption id="attachment_100249" align="aligncenter" width="700"] Base: 1,276 US shoppers

Base: 1,276 US shoppersSource: Cowen[/caption]

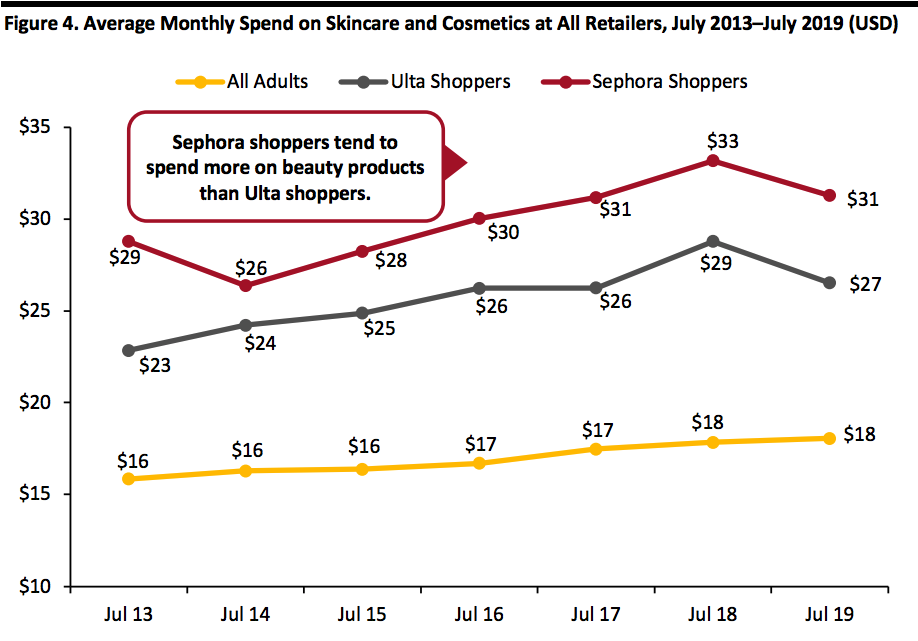

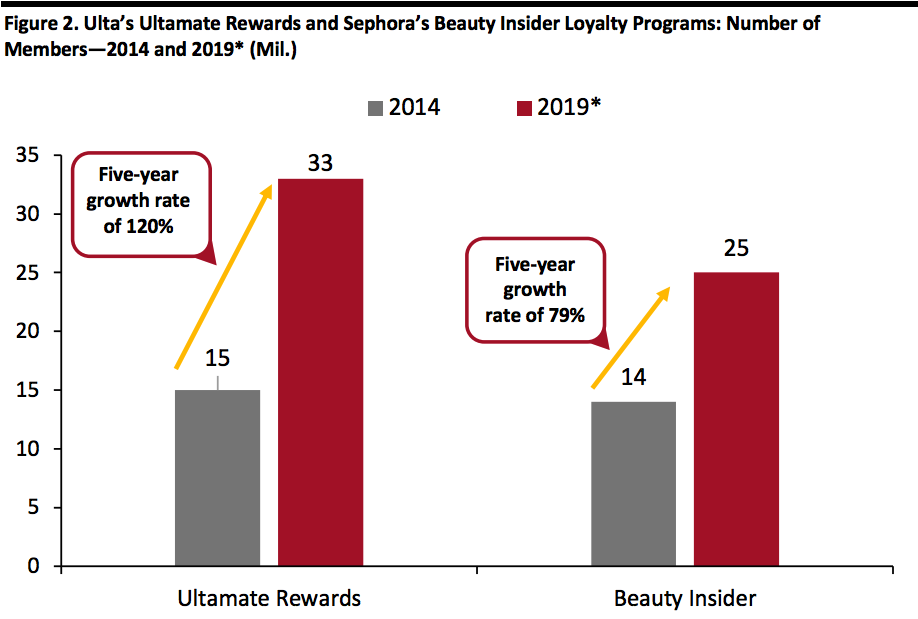

Sephora Shoppers Spend More per Month than Ulta Shoppers

According to the latest survey from Prosper Insights & Analytics, Sephora shoppers tend to spend more on beauty products than do Ulta shoppers. Sephora customers spend an average of about $31 per month on skin care and cosmetics across all retailers, which is $4 more than the corresponding figure for Ulta shoppers. Among all the retailers surveyed, Sephora and Ulta have the highest spending averages. The average monthly expenditure on skin care and cosmetics among all survey respondents is about $18. From 2014 to 2018, the average monthly skincare and cosmetics spending of both Sephora and Ulta shoppers steadily increased. However, in 2019, average monthly spending saw a decline in the case of both Sephora and Ulta shoppers. [caption id="attachment_100250" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

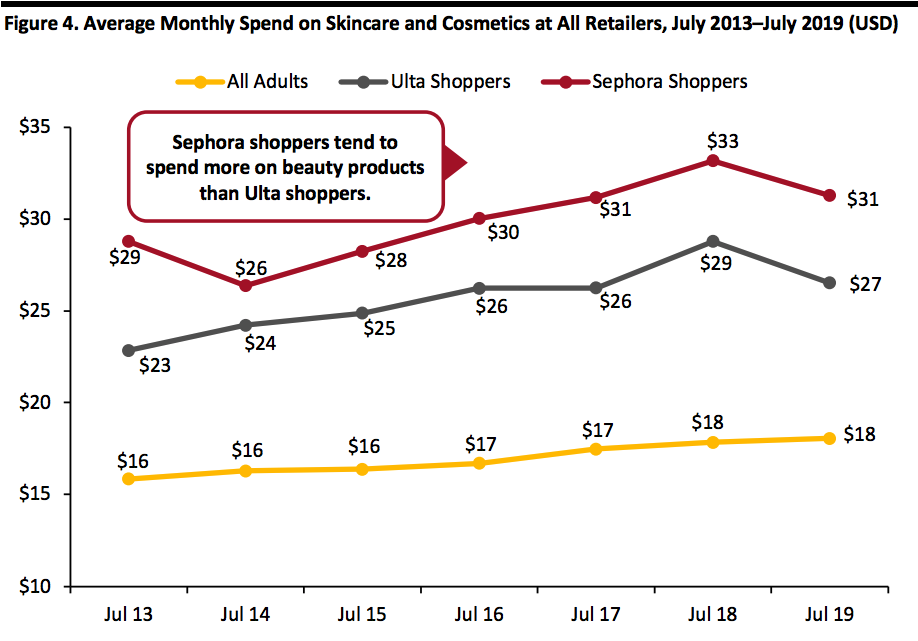

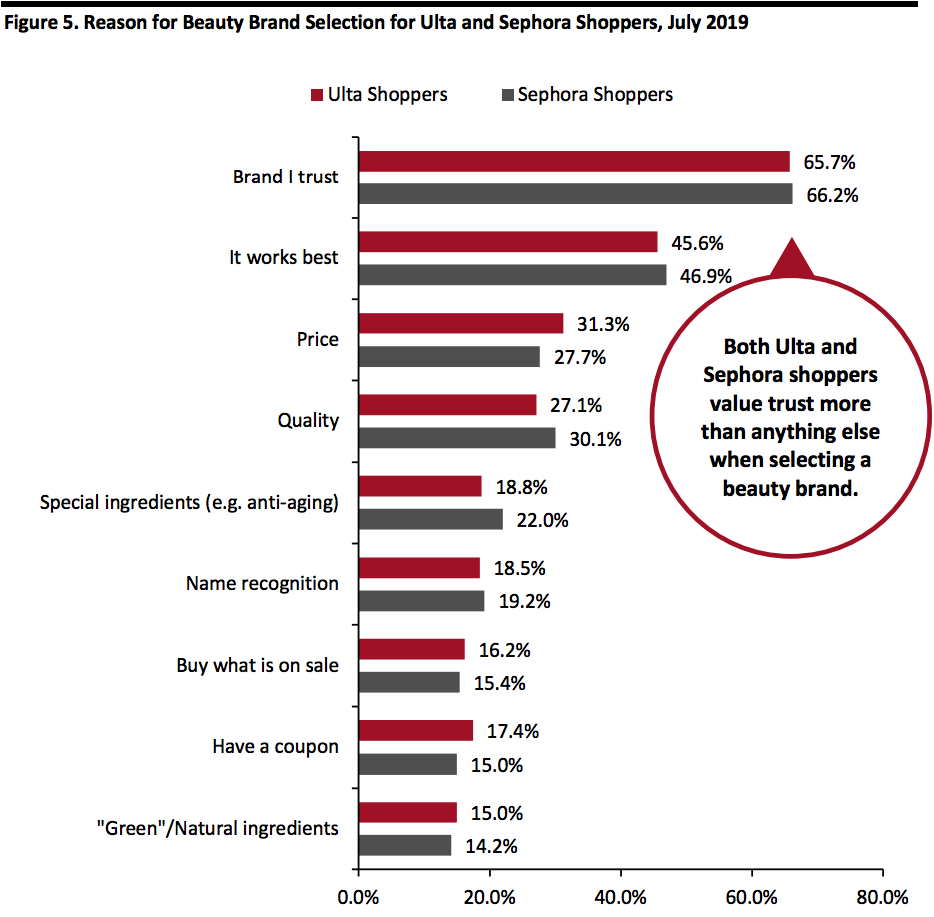

Purchase Drivers for Ulta and Sephora Shoppers

Both Ulta and Sephora shoppers value trust over anything else when selecting a beauty brand; according to a Prosper survey in July 2019, about 66% of Ulta and Sephora shoppers said they would select a beauty product based on trust. The second-most important criterion is the effectiveness of beauty products—roughly 47% and 46% of Sephora and Ulta shoppers respectively would select a beauty product based on how it works for them. Although price is a significant influencer for the customers of both retailers, Ulta shoppers are more likely than Sephora shoppers to look out for the best deals and to use coupon codes when buying a beauty product. On the other hand, Sephora shoppers are more likely than Ulta shoppers to value quality and select a cosmetics brand based on this factor. [caption id="attachment_100251" align="aligncenter" width="700"] Base: 461 Ulta shoppers and 285 Sephora shoppers, aged 18+

Base: 461 Ulta shoppers and 285 Sephora shoppers, aged 18+Source: Prosper Insights & Analytics[/caption] Key Insights Both Ulta and Sephora are thriving in the beauty market. With 33 million members as of September 2019, Ulta’s Ultamate Rewards program is bigger than Sephora’s Beauty Insider program and has also grown faster since 2014. Although Sephora has fewer members than Ulta, its shoppers’ monthly average expenditure on skin care and cosmetics across all retailers is higher, according to Prosper’s recent consumer survey. As the beauty market continues to grow, each retailer’s loyalty programs will remain a useful tool for Ulta and Sephora to engage with and retain customers. These programs should have a clear value proposition and align with the strategic positioning of the retailer. Both Ulta and Sephora are using AI and AR tools to analyze their loyalty program data to enhance personalization for their customers and drive incremental sales.