Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

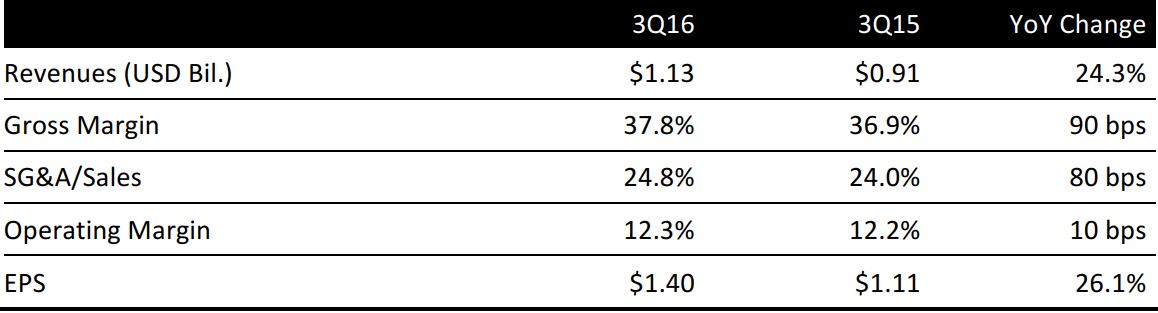

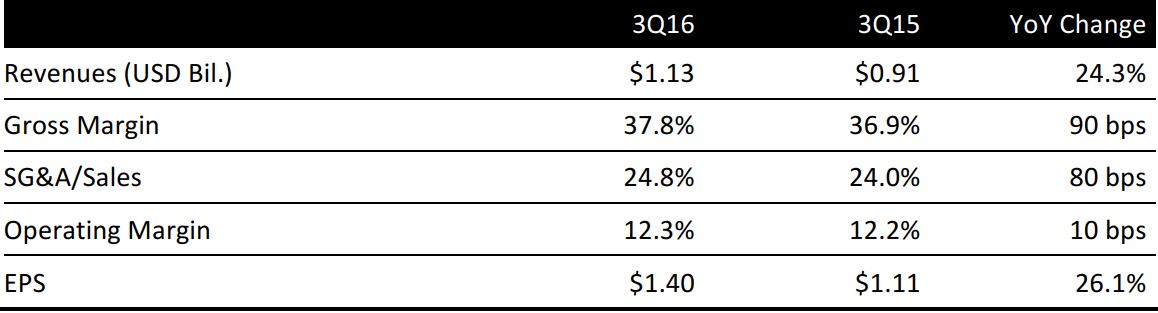

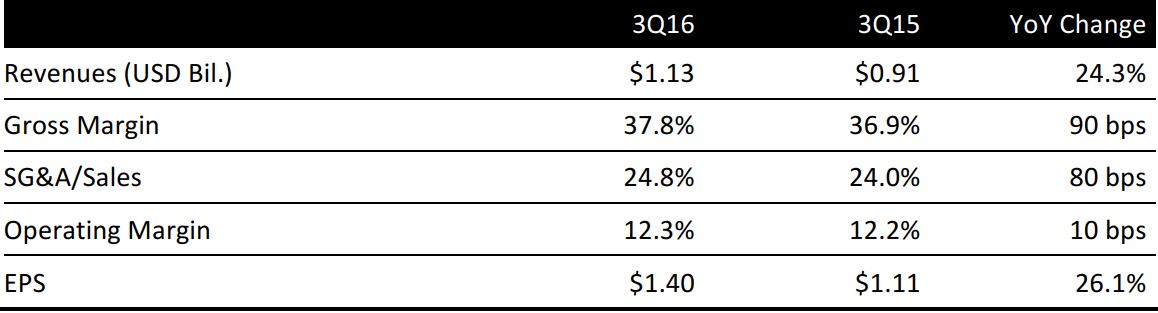

ULTA Beauty reported 3Q16 revenues of $1.13 billion, up 24.3% year over year, and above the $1.11 billion consensus estimate.

Comps (including the impact of ecommerce sales) were up 16.7% year over year in the quarter, ahead of the 14.8% consensus estimate. The comp increase was driven by 11.1% growth in transaction volume and 5.6% growth in average ticket sale.

Retail comparable sales increased 14.3%, including salon comparable growth of 10.3%. Salon sales increased 16.7% year over year to $60.4 million. Ecommerce increased 59.1% year over year to $73.6 million, which represents 240 bps of the total company comp sales increase of 16.7%.

Gross profit increased 90 bps to 37.8%, from 36.9% in the year-ago quarter. The increase was due to product margin expansion and leverage in fixed store costs.

SG&A as a percentage of sales increased 80 bps to 24.8%, primarily driven by investments to support growth initiatives and deleverage corporate overhead costs.

EPS was $1.40, ahead of the $1.37 consensus estimate, and up 26.1% year over year.

OUTLOOK

The company raised its FY16 guidance, and now expects EPS growth in the high 20% range versus previous guidance of mid-twenties percentage, which includes the impact of the new Dallas distribution center, the accelerated rollout of prestige brand boutiques, the accelerated share repurchase program and continued open market share repurchases. The consensus calls for EPS of $6.31, an increase of 26% from last year’s total of $4.98.

ULTA Beauty expects full-year comps of 13%–15% (including the impact of the ecommerce business), versus previous guidance of 12%–14% and the 13.8% consensus estimate.

Full-year revenue is projected to increase in the low 20% range versus previous guidance of high-teens percentage. The consensus estimate expects revenues of $4.76 billion, representing a 21.4% year-over-year increase from last year’s total of $3.92 billion.

The company plans to expand store square footage by 11%, opening 100 net new stores and remodeling 12 locations.