Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

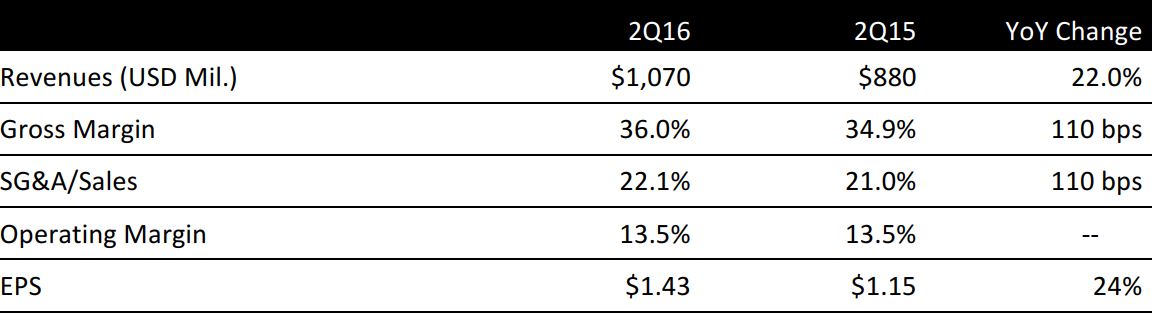

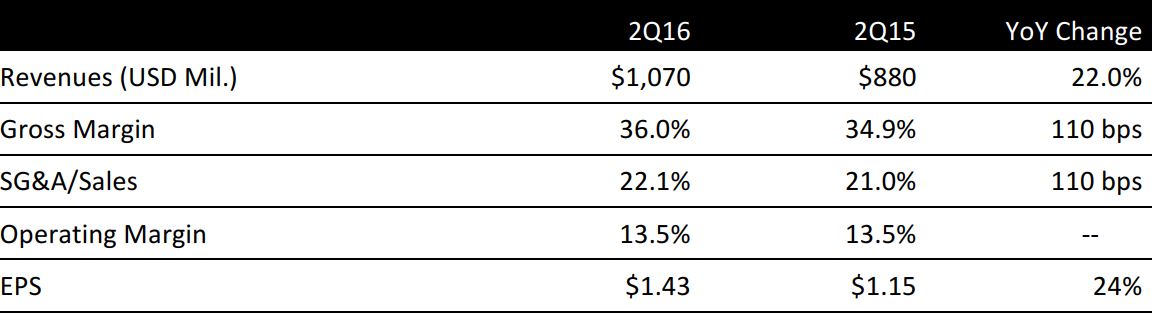

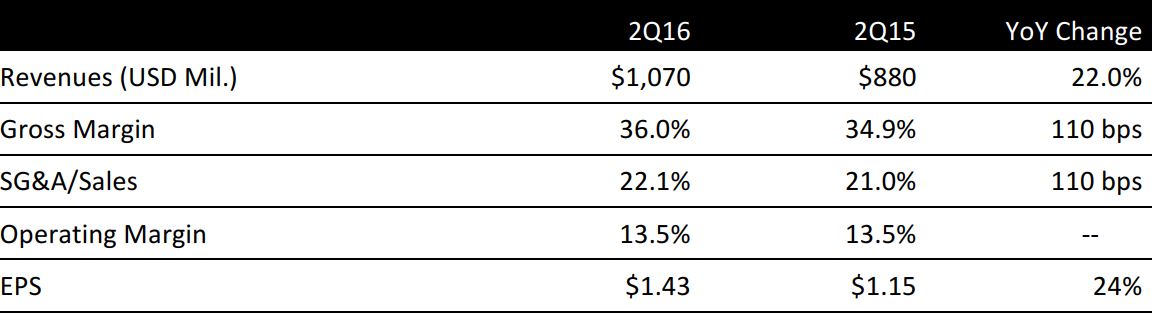

Ulta Beauty reported 2Q16 revenues of $1,070 million, up 21.9% from last year’s $887 million and slightly above the consensus estimate of $1,060 million. Comps were 14.4% and exceeded expectations of 12.9%. Reported EPS was $1.43, ahead of the $1.40 consensus estimate and up 24% year over year.

Total comps were up 14.4%, driven by a 9.7% increase in the number of transactions and a 4.7% increase in the average ticket value. E-commerce was another bright spot; sales grew 54.6% to $59 million in the quarter and contributed 180 basis points to the overall comp growth.

The company acquired new customers in the quarter. Its loyalty program surpassed the 20-million-member milestone in the quarter, and now has 20.6 million active members, up 27% from last year. Management discovered store associates are very successful at signing up new customers for the ULTAmate Rewards loyalty program. On the digital front, its multimedia advertising strategy raised brand awareness which also helped acquire new customers. Finally, the newly launched credit card program is designed to provide a better customer experience both in-store and online.

Cosmetics products, both mass and prestige brands, were top performers. Product innovation continues to drive Ulta’s business. Management said they continue to see impressive performance in brands such as Urban Decay, Too Faced and the ULTA Beauty Collection. In particular, ULTA Beauty’s professional hair care products are very successful.

The company’s average inventory per store increased 18.7%, a result of its investment in in-stock levels, additional new brands and increased in-store prestige boutiques. Excluding the 90 net store openings and two new distribution centers in Indiana and Dallas, average inventory per store increased 14.5%.

2016 Outlook

The company guided for net sales to be $1,070 million to $1,090 million for 3Q16, in line with the consensus of $1,080 million and compared to last year’s $910.7 million. Total comps are expected to increase 11%–13%, versus last year’s 12.8%. Management expects the EPS to be $1.25–1.30, below consensus of $1.30 and up from last year’s reported $1.11. Its e-commerce sales are projected to grow in the 40% range.

Ulta also raised guidance for fiscal year 2016. The company now plans to achieve 11%–13% comps versus the previously guided 10%–12%. The guided EPS for the year is now in the low- to mid-20% range, compared to the previous guidance of low twenties. Management maintained its guidance for total sales growth in the high teens range.

Ulta Beauty plans to grow its total store square footage by 11% with 100 net new stores, and plans to remodel 12 stores. About $80 million out of $390 million capital expenditures will be dedicated to funding an accelerated rollout of prestige brand boutiques and enhancing in-store fixtures.