albert Chan

[caption id="attachment_80442" align="aligncenter" width="670"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

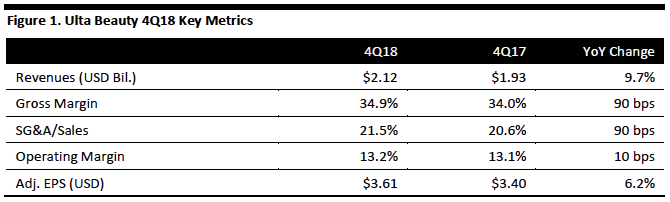

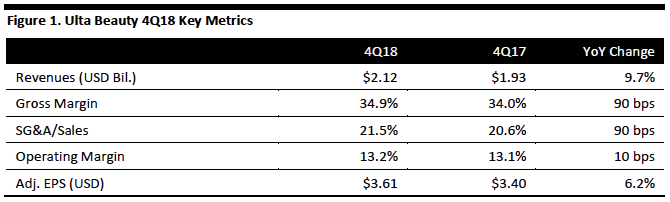

Ulta Beauty reported EPS of $3.61 for fiscal 4Q 2018, up 6.2% year over year and beating the consensus estimate of $3.56.

Net sales for the quarter rose 9.7% to $2.12 billion, ahead of the $2.11 billion consensus estimate. Excluding the 53rd week in the year ago quarter, sales increased 16.2%. E-commerce sales increased 25.1% as total site traffic rose 33%, mobile site traffic rose 31% and mobile app traffic was up 49%. Salon sales increased 4.7% to $73.7 million (including the extra week in the year ago quarter).

Comparable sales rose 9.4%, lapping an 8.8% comp gain in the year ago quarter, driven by a 7.1% increase in transactions and a 2.3% gain in the average ticket. Newness drove traffic and share gains across all merchandise categories, with products new to the assortment driving approximately 4 points of the total company comp. Mass cosmetics was the best performing category in the quarter, with Morphy, Revolution Beauty and E.L.F. leading the way and fragrance ended the year with a double digit 4Q comp.

The gross margin was 34.9%, up 90 bps year over year. Gross profit increased $82.6 million to $740.9 million, driven by new revenue recognition accounting (60 bps), leveraging fixed store costs and improved merchandise margins.

The SG&A expense ratio increased 90 bps due to new revenue recognition accounting. Operating income increased 10.5% to $281.2 million, and the operating income margin increased 10 bps to 13.2% of sales.

During 4Q18, Ulta opened 12 new stores and ended the fiscal year with 1,174 stores and total square footage of 12.3 million, a 9.2% year over year increase.

The ULTAmate Rewards loyalty program achieved 14.4% active member growth during FY18, reaching 31.8 million active members at year end. Omni-channel customers with loyalty membership shopping both retail stores and on Ulta.com increased to 12.1% of guests for 2018 compared to 10.4% in 2017

Ulta’s credit card achieved double digit sales penetration during 2018 and sales of gift cards increased 24% in 4Q18, with 3rd party distribution driving much of the gift card growth as the total 3rd party store count exceeds 50,000 distribution points.

Outlook

The company offered the following for its FY19 outlook:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Ulta Beauty reported EPS of $3.61 for fiscal 4Q 2018, up 6.2% year over year and beating the consensus estimate of $3.56.

Net sales for the quarter rose 9.7% to $2.12 billion, ahead of the $2.11 billion consensus estimate. Excluding the 53rd week in the year ago quarter, sales increased 16.2%. E-commerce sales increased 25.1% as total site traffic rose 33%, mobile site traffic rose 31% and mobile app traffic was up 49%. Salon sales increased 4.7% to $73.7 million (including the extra week in the year ago quarter).

Comparable sales rose 9.4%, lapping an 8.8% comp gain in the year ago quarter, driven by a 7.1% increase in transactions and a 2.3% gain in the average ticket. Newness drove traffic and share gains across all merchandise categories, with products new to the assortment driving approximately 4 points of the total company comp. Mass cosmetics was the best performing category in the quarter, with Morphy, Revolution Beauty and E.L.F. leading the way and fragrance ended the year with a double digit 4Q comp.

The gross margin was 34.9%, up 90 bps year over year. Gross profit increased $82.6 million to $740.9 million, driven by new revenue recognition accounting (60 bps), leveraging fixed store costs and improved merchandise margins.

The SG&A expense ratio increased 90 bps due to new revenue recognition accounting. Operating income increased 10.5% to $281.2 million, and the operating income margin increased 10 bps to 13.2% of sales.

During 4Q18, Ulta opened 12 new stores and ended the fiscal year with 1,174 stores and total square footage of 12.3 million, a 9.2% year over year increase.

The ULTAmate Rewards loyalty program achieved 14.4% active member growth during FY18, reaching 31.8 million active members at year end. Omni-channel customers with loyalty membership shopping both retail stores and on Ulta.com increased to 12.1% of guests for 2018 compared to 10.4% in 2017

Ulta’s credit card achieved double digit sales penetration during 2018 and sales of gift cards increased 24% in 4Q18, with 3rd party distribution driving much of the gift card growth as the total 3rd party store count exceeds 50,000 distribution points.

Outlook

The company offered the following for its FY19 outlook:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Ulta Beauty reported EPS of $3.61 for fiscal 4Q 2018, up 6.2% year over year and beating the consensus estimate of $3.56.

Net sales for the quarter rose 9.7% to $2.12 billion, ahead of the $2.11 billion consensus estimate. Excluding the 53rd week in the year ago quarter, sales increased 16.2%. E-commerce sales increased 25.1% as total site traffic rose 33%, mobile site traffic rose 31% and mobile app traffic was up 49%. Salon sales increased 4.7% to $73.7 million (including the extra week in the year ago quarter).

Comparable sales rose 9.4%, lapping an 8.8% comp gain in the year ago quarter, driven by a 7.1% increase in transactions and a 2.3% gain in the average ticket. Newness drove traffic and share gains across all merchandise categories, with products new to the assortment driving approximately 4 points of the total company comp. Mass cosmetics was the best performing category in the quarter, with Morphy, Revolution Beauty and E.L.F. leading the way and fragrance ended the year with a double digit 4Q comp.

The gross margin was 34.9%, up 90 bps year over year. Gross profit increased $82.6 million to $740.9 million, driven by new revenue recognition accounting (60 bps), leveraging fixed store costs and improved merchandise margins.

The SG&A expense ratio increased 90 bps due to new revenue recognition accounting. Operating income increased 10.5% to $281.2 million, and the operating income margin increased 10 bps to 13.2% of sales.

During 4Q18, Ulta opened 12 new stores and ended the fiscal year with 1,174 stores and total square footage of 12.3 million, a 9.2% year over year increase.

The ULTAmate Rewards loyalty program achieved 14.4% active member growth during FY18, reaching 31.8 million active members at year end. Omni-channel customers with loyalty membership shopping both retail stores and on Ulta.com increased to 12.1% of guests for 2018 compared to 10.4% in 2017

Ulta’s credit card achieved double digit sales penetration during 2018 and sales of gift cards increased 24% in 4Q18, with 3rd party distribution driving much of the gift card growth as the total 3rd party store count exceeds 50,000 distribution points.

Outlook

The company offered the following for its FY19 outlook:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Ulta Beauty reported EPS of $3.61 for fiscal 4Q 2018, up 6.2% year over year and beating the consensus estimate of $3.56.

Net sales for the quarter rose 9.7% to $2.12 billion, ahead of the $2.11 billion consensus estimate. Excluding the 53rd week in the year ago quarter, sales increased 16.2%. E-commerce sales increased 25.1% as total site traffic rose 33%, mobile site traffic rose 31% and mobile app traffic was up 49%. Salon sales increased 4.7% to $73.7 million (including the extra week in the year ago quarter).

Comparable sales rose 9.4%, lapping an 8.8% comp gain in the year ago quarter, driven by a 7.1% increase in transactions and a 2.3% gain in the average ticket. Newness drove traffic and share gains across all merchandise categories, with products new to the assortment driving approximately 4 points of the total company comp. Mass cosmetics was the best performing category in the quarter, with Morphy, Revolution Beauty and E.L.F. leading the way and fragrance ended the year with a double digit 4Q comp.

The gross margin was 34.9%, up 90 bps year over year. Gross profit increased $82.6 million to $740.9 million, driven by new revenue recognition accounting (60 bps), leveraging fixed store costs and improved merchandise margins.

The SG&A expense ratio increased 90 bps due to new revenue recognition accounting. Operating income increased 10.5% to $281.2 million, and the operating income margin increased 10 bps to 13.2% of sales.

During 4Q18, Ulta opened 12 new stores and ended the fiscal year with 1,174 stores and total square footage of 12.3 million, a 9.2% year over year increase.

The ULTAmate Rewards loyalty program achieved 14.4% active member growth during FY18, reaching 31.8 million active members at year end. Omni-channel customers with loyalty membership shopping both retail stores and on Ulta.com increased to 12.1% of guests for 2018 compared to 10.4% in 2017

Ulta’s credit card achieved double digit sales penetration during 2018 and sales of gift cards increased 24% in 4Q18, with 3rd party distribution driving much of the gift card growth as the total 3rd party store count exceeds 50,000 distribution points.

Outlook

The company offered the following for its FY19 outlook:

- Open approximately 80 new stores, carry out approximately 20 remodel or relocation projects and complete approximately 270 store refreshes.

- Total revenue growth to be in the low-double-digit percentage range.

- Comp growth to achieve 6-7%, including 20-30% e-commerce growth.

- Operating profit margin rate will leverage from 10 to 20 bps.

- CapEX will incur between $380-400 million.

- Adjusted EPS will be in the range of $12.65-12.85.