What’s the Story?

Ulta Beauty hosted its virtual Analyst Day on October 19, 2021. The day featured many management presentations, including by David Kimbell, CEO; Shelley Haus, Chief Marketing Officer; Monica Arnaudo, Chief Merchandising Officer; Kecia Steelman, Chief Operating Officer; Prama Bhatt, Chief Digital Officer; and Scott Settersten, CFO.

In this report, we present insights from the event, covering the company’s growth strategies and its dedication to innovation.

Ulta Beauty Analyst Day 2021: Key Insights

Ulta Beauty outlined its three-year plan to grow revenues to $10 billion by fiscal 2024, from $7.4 billion in fiscal 2019 (ended February 1, 2020)—representing a CAGR of 5%–7%. In that timeframe, the company is planning to open 50 new stores per year and increase same-store sales by 3%–5% annually. Other financial targets include an operating profit margin of 13%–14% of sales and low double-digit growth in diluted earnings per share.

Ulta Beauty reported that in 2020, it had a 7% share of the $91 billion US beauty market and has multiple growth levers to pull moving forward.

Membership Growth Among Beauty Enthusiasts

Ulta Beauty

had 34.6 million

loyalty members in its Ultamates Rewards program at the end of its July quarter (the second quarter of fiscal 2021), whose annual spend for the trailing 12 months ended July 2021 rose 2% from the comparable period in July 2019 (pre-pandemic).

To continue to grow its membership base, Ulta Beauty is focused on three key groups of “Beauty Enthusiasts”: Gen Z, Hispanic and Black. The company describes enthusiasts as consumers that “live, love and breathe beauty,” see beauty as more than routine, lean on beauty for self-care and self-expression, and find joy, wellness and excitement in beauty. Ulta Beauty revealed that it is working to evolve from a product focus to a community and cultural focus, to reflect beauty’s changing role in consumers’ lives to one of wellness: According to the company, 65% of consumers believe that the beauty category is significantly connected to wellness.

Maximizing Growth from Core Categories

Ulta Beauty defined its merchandising vision as follows: “To engage and continuously delight Beauty Enthusiasts with a curated and differentiated assortment focused on inclusivity and leading trends.” As part of this vision, the company is focused on four strategic pillars:

- Maximize growth from core categories

- Fuel high-growth, cross-category strategic platforms and adjacencies

- Differentiate through exclusive brands, products and our private-label business

- Drive profitability and productivity

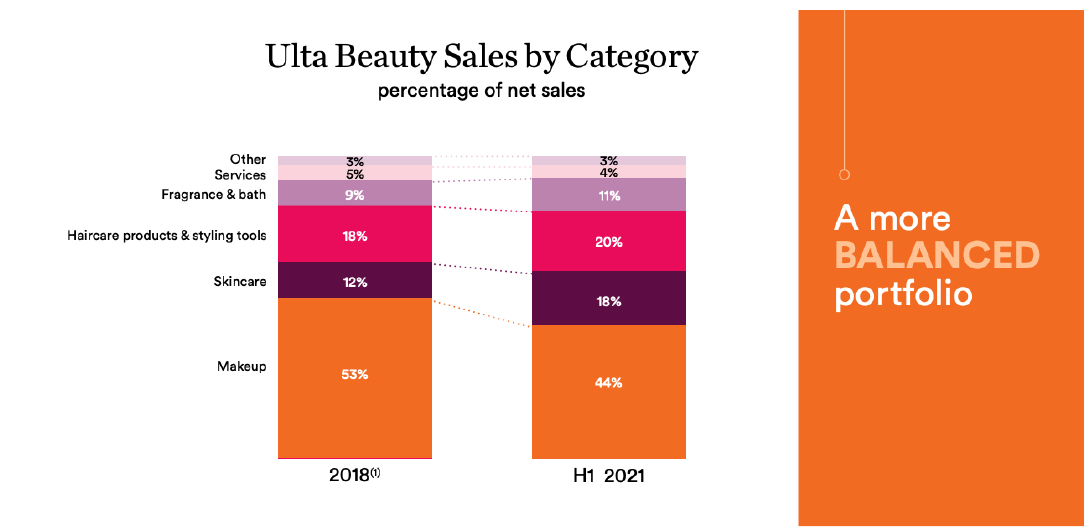

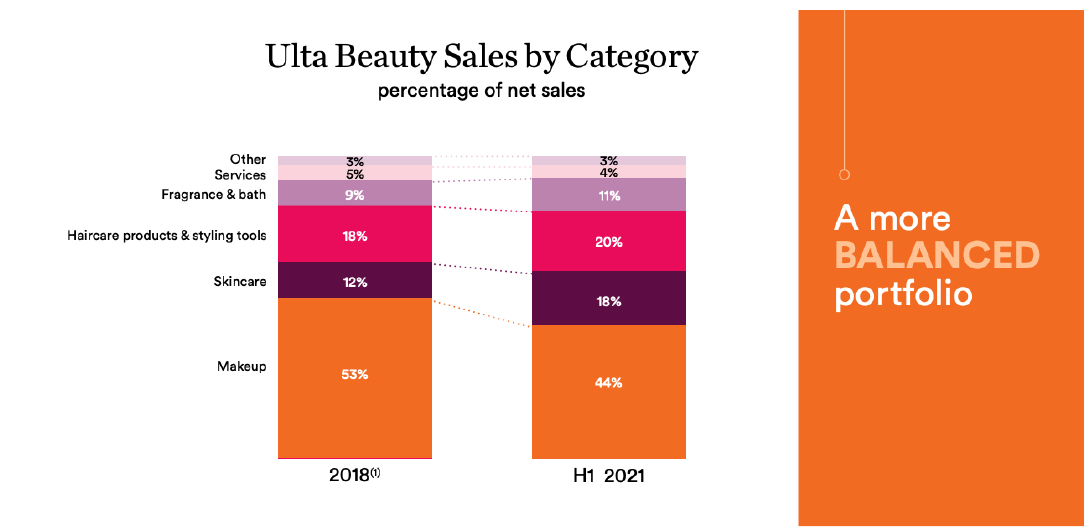

Focusing on the first pillar, there are four core product categories in the company’s portfolio, for which Ulta Beauty has varied growth outlooks, which we discuss below.

- Makeup: Return to growth. The US makeup category, Ulta Beauty’s largest category, saw net sales growth decline by 26% in pandemic-impacted 2020. In 2021, year-to-date makeup sales are up 51% year over year, reflecting new brand launches—including Bobbi Brown, Hourglass, Jaclyn Hill, KVD Vegan Beauty, Laura Mercier, Mented and many more. In addition, Arnaudo said, “A desire for self-expression and engaging platforms like TikTok have reignited the category engagement through generational belonging, new beauty influencers and new content forms, all with the ability to generate high viral activity.”

- Skincare: Sustained growth. Skincare has grown significantly as a proportion of Ulta Beauty’s total sales in the past three years (see the image below)—in part, propelled by the pandemic and deeper consumer interest in skincare and wellness. Sales in the skincare category are up by 66% year over year in year-to-date 2021 (46% growth from pre-pandemic 2019 levels). Ulta Beauty expects interest in skincare to remain high in the wake of the pandemic and is focused on honing its “authority and credibility” through editorial content, digital exposure, increased associate training and its skincare app.

- Haircare: Segment acceleration. Ulta Beauty sees the haircare category as part of the self-care wellness movement, with new rituals and products providing ample opportunities for shoppers to trade up. Today, clean, vegan and cruelty-free are table stakes for new brands, Ulta Beauty emphasized. The company plans to leverage its assortment and salon expertise to focus on education—to inspire, educate and empower through service experiences, expert voices and educational content.

- Fragrance & bath: Continued growth. The fragrance & bath category fared well during the pandemic and is continuing its strong growth trajectory. Sales in the category are up 129% year over year in year-to-date 2021 and up 87% versus 2019. Ulta Beauty reported that growth is being fueled by luxury and celebrity fragrances, as well as the wellness focus. The company has recently launched new fragrance brands including Ariana Grande, JLo, Tiffany & Co., Tom Ford and Valentino.

[caption id="attachment_135234" align="aligncenter" width="726"]

Source: Company reports

Source: Company reports [/caption]

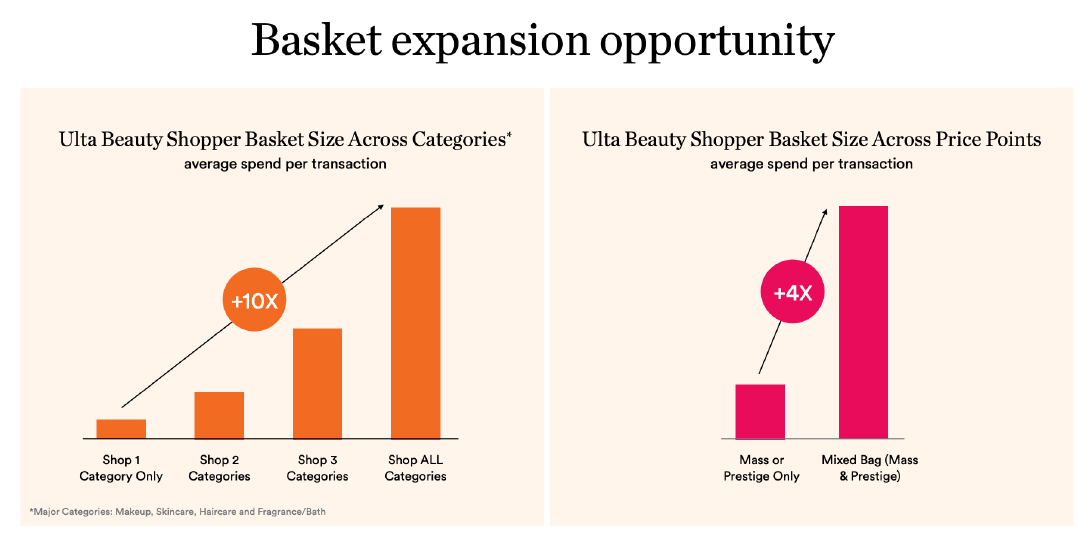

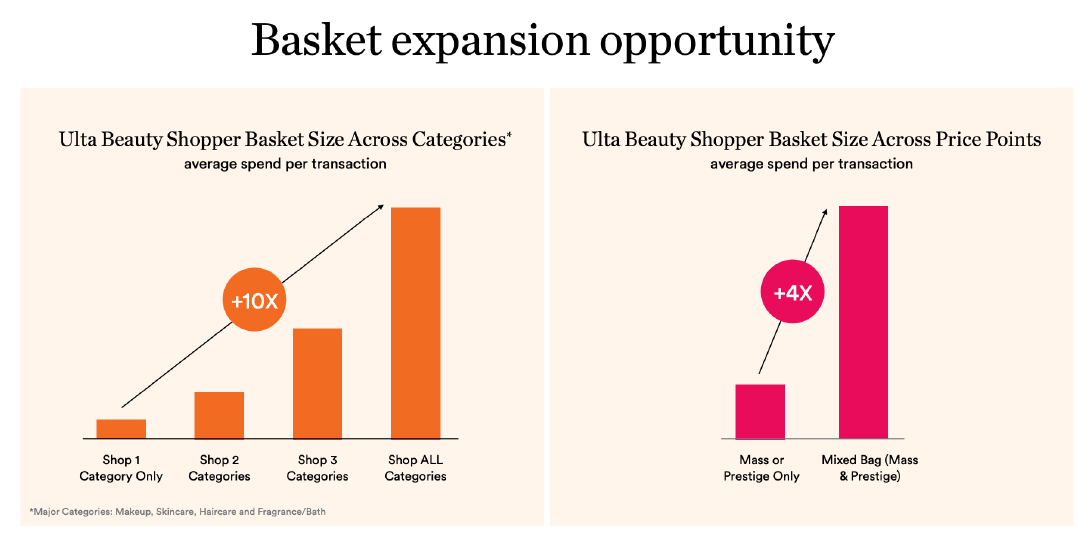

According to Ulta Beauty, cross-pollinating shoppers across its four core categories increases the average spend by up to 10X, while customers that shop multiple price points increase spend by 4X (see the image below).

[caption id="attachment_135235" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports [/caption]

Other Growth Drivers

In addition to category growth, Ulta Beauty believes it is positioned well to meet and potentially beat its financial targets and increase market share due to increased e-commerce penetration, ongoing store expansion and its

partnership with Target (through shop-in-shop locations).

Ulta Beauty is reimagining its brick-and-mortar presence through the “digital store of the future,” which merges content with commerce to provide more connected, seamless, frictionless, omnichannel experiences. The shopping journey in the digital store includes advanced personalization, through the company’s “Quazi” product recommendation and replenishment engine, as well as its recent partnership with Adeptmind (which we discuss further in a later section of this report).

An Expanded Definition of “All Things Beauty”

To be fully immersed in an always-on relationship with the Beauty Enthusiast, Ulta Beauty is expanding its definition of “All Things Beauty” in its strategic framework to meet shoppers wherever they are, conversationally and personally. The company is looking to engage in “deep relationships marked by advocacy, content, conversation and curation.”

Haus explained that, while products and experiences matter, “beauty is more meaningful than ever. Beauty is intersecting with culture and wellness, and the place where beauty lives is really not a place at all; it is within each person and within each community.”

“All Things Beauty” goals extend beyond business to culture and community. Ulta Beauty is working to position itself at the heart of the beauty community and expand what beauty means—“truly unlocking beauty’s superpowers of self-care, self-expression, togetherness and shaping the world as a cultural force for good.”

The company is dedicated to driving positive impacts through ESG (environmental, social and corporate governance). Ulta Beauty is also committed to diversity, equity and inclusive strategies: The company joined the 15 Percent Pledge—pledging 15% of shelf space to Black-owned businesses—in June 2021, and its MUSE 100 media platform celebrates Black voices in beauty.

Innovation at Ulta Beauty

On the innovation front, Ulta Beauty is very active. Its strategic investment/partnership with Adeptmind, a leading AI (artificial intelligence) retail technology company that, in combination with Quazi, will power Ulta Beauty’s new personalized search engine for its digital store of the future.

To strengthen its partner ecosystem and further establish Ulta Beauty as a leader in innovation, the company announced a $20 million Digital Innovation Fund, which is dedicated to transforming the future of beauty, retail and commerce. The company intends to partner with innovative entrepreneurs, early-stage investors and other agents of change to drive innovation and co-develop differentiated and disruptive experiences.

The launch of UB Media, designed to harness Ulta Beauty’s first-party data to transform how brand partners can connect with beauty lovers, is a new business model and revenue stream for the company. UB Media is a media platform through which Ulta Beauty’s brand partners are able to reach unique audiences across many advertising channels, including Ulta Beauty’s website and app as well as external channels such as Facebook and Instagram. UB Media builds on the company’s existing Digital Marketing Partner Program, which has around 100 brands actively participating in placing digital campaigns, many in digital displays and paid social media.

Source: Company reports [/caption]

According to Ulta Beauty, cross-pollinating shoppers across its four core categories increases the average spend by up to 10X, while customers that shop multiple price points increase spend by 4X (see the image below).

[caption id="attachment_135235" align="aligncenter" width="725"]

Source: Company reports [/caption]

According to Ulta Beauty, cross-pollinating shoppers across its four core categories increases the average spend by up to 10X, while customers that shop multiple price points increase spend by 4X (see the image below).

[caption id="attachment_135235" align="aligncenter" width="725"] Source: Company reports [/caption]

Other Growth Drivers

In addition to category growth, Ulta Beauty believes it is positioned well to meet and potentially beat its financial targets and increase market share due to increased e-commerce penetration, ongoing store expansion and its partnership with Target (through shop-in-shop locations).

Ulta Beauty is reimagining its brick-and-mortar presence through the “digital store of the future,” which merges content with commerce to provide more connected, seamless, frictionless, omnichannel experiences. The shopping journey in the digital store includes advanced personalization, through the company’s “Quazi” product recommendation and replenishment engine, as well as its recent partnership with Adeptmind (which we discuss further in a later section of this report).

An Expanded Definition of “All Things Beauty”

To be fully immersed in an always-on relationship with the Beauty Enthusiast, Ulta Beauty is expanding its definition of “All Things Beauty” in its strategic framework to meet shoppers wherever they are, conversationally and personally. The company is looking to engage in “deep relationships marked by advocacy, content, conversation and curation.”

Haus explained that, while products and experiences matter, “beauty is more meaningful than ever. Beauty is intersecting with culture and wellness, and the place where beauty lives is really not a place at all; it is within each person and within each community.”

“All Things Beauty” goals extend beyond business to culture and community. Ulta Beauty is working to position itself at the heart of the beauty community and expand what beauty means—“truly unlocking beauty’s superpowers of self-care, self-expression, togetherness and shaping the world as a cultural force for good.”

The company is dedicated to driving positive impacts through ESG (environmental, social and corporate governance). Ulta Beauty is also committed to diversity, equity and inclusive strategies: The company joined the 15 Percent Pledge—pledging 15% of shelf space to Black-owned businesses—in June 2021, and its MUSE 100 media platform celebrates Black voices in beauty.

Innovation at Ulta Beauty

On the innovation front, Ulta Beauty is very active. Its strategic investment/partnership with Adeptmind, a leading AI (artificial intelligence) retail technology company that, in combination with Quazi, will power Ulta Beauty’s new personalized search engine for its digital store of the future.

To strengthen its partner ecosystem and further establish Ulta Beauty as a leader in innovation, the company announced a $20 million Digital Innovation Fund, which is dedicated to transforming the future of beauty, retail and commerce. The company intends to partner with innovative entrepreneurs, early-stage investors and other agents of change to drive innovation and co-develop differentiated and disruptive experiences.

The launch of UB Media, designed to harness Ulta Beauty’s first-party data to transform how brand partners can connect with beauty lovers, is a new business model and revenue stream for the company. UB Media is a media platform through which Ulta Beauty’s brand partners are able to reach unique audiences across many advertising channels, including Ulta Beauty’s website and app as well as external channels such as Facebook and Instagram. UB Media builds on the company’s existing Digital Marketing Partner Program, which has around 100 brands actively participating in placing digital campaigns, many in digital displays and paid social media.

Source: Company reports [/caption]

Other Growth Drivers

In addition to category growth, Ulta Beauty believes it is positioned well to meet and potentially beat its financial targets and increase market share due to increased e-commerce penetration, ongoing store expansion and its partnership with Target (through shop-in-shop locations).

Ulta Beauty is reimagining its brick-and-mortar presence through the “digital store of the future,” which merges content with commerce to provide more connected, seamless, frictionless, omnichannel experiences. The shopping journey in the digital store includes advanced personalization, through the company’s “Quazi” product recommendation and replenishment engine, as well as its recent partnership with Adeptmind (which we discuss further in a later section of this report).

An Expanded Definition of “All Things Beauty”

To be fully immersed in an always-on relationship with the Beauty Enthusiast, Ulta Beauty is expanding its definition of “All Things Beauty” in its strategic framework to meet shoppers wherever they are, conversationally and personally. The company is looking to engage in “deep relationships marked by advocacy, content, conversation and curation.”

Haus explained that, while products and experiences matter, “beauty is more meaningful than ever. Beauty is intersecting with culture and wellness, and the place where beauty lives is really not a place at all; it is within each person and within each community.”

“All Things Beauty” goals extend beyond business to culture and community. Ulta Beauty is working to position itself at the heart of the beauty community and expand what beauty means—“truly unlocking beauty’s superpowers of self-care, self-expression, togetherness and shaping the world as a cultural force for good.”

The company is dedicated to driving positive impacts through ESG (environmental, social and corporate governance). Ulta Beauty is also committed to diversity, equity and inclusive strategies: The company joined the 15 Percent Pledge—pledging 15% of shelf space to Black-owned businesses—in June 2021, and its MUSE 100 media platform celebrates Black voices in beauty.

Innovation at Ulta Beauty

On the innovation front, Ulta Beauty is very active. Its strategic investment/partnership with Adeptmind, a leading AI (artificial intelligence) retail technology company that, in combination with Quazi, will power Ulta Beauty’s new personalized search engine for its digital store of the future.

To strengthen its partner ecosystem and further establish Ulta Beauty as a leader in innovation, the company announced a $20 million Digital Innovation Fund, which is dedicated to transforming the future of beauty, retail and commerce. The company intends to partner with innovative entrepreneurs, early-stage investors and other agents of change to drive innovation and co-develop differentiated and disruptive experiences.

The launch of UB Media, designed to harness Ulta Beauty’s first-party data to transform how brand partners can connect with beauty lovers, is a new business model and revenue stream for the company. UB Media is a media platform through which Ulta Beauty’s brand partners are able to reach unique audiences across many advertising channels, including Ulta Beauty’s website and app as well as external channels such as Facebook and Instagram. UB Media builds on the company’s existing Digital Marketing Partner Program, which has around 100 brands actively participating in placing digital campaigns, many in digital displays and paid social media.