Source: Company reports

4Q15 RESULTS

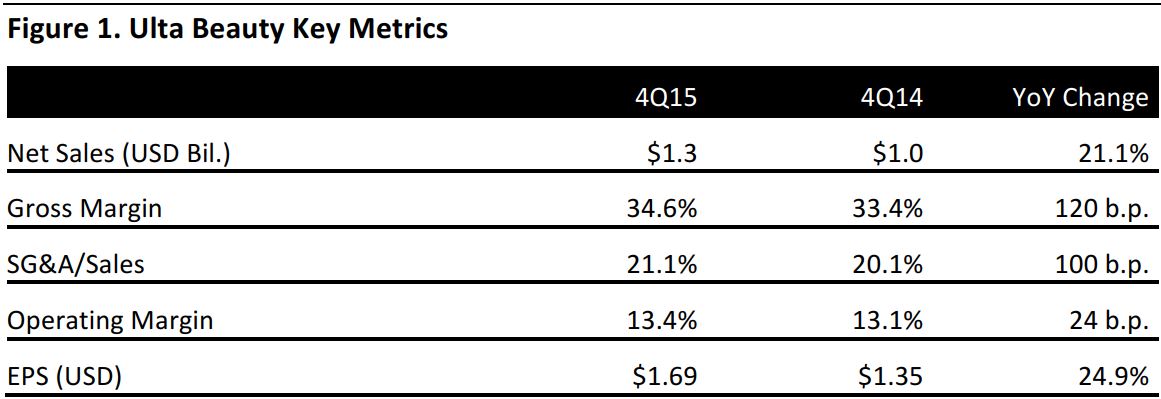

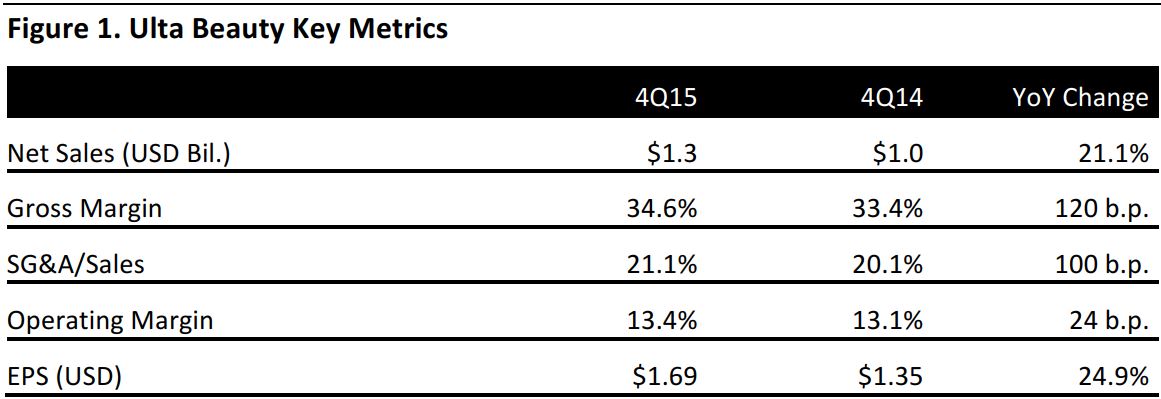

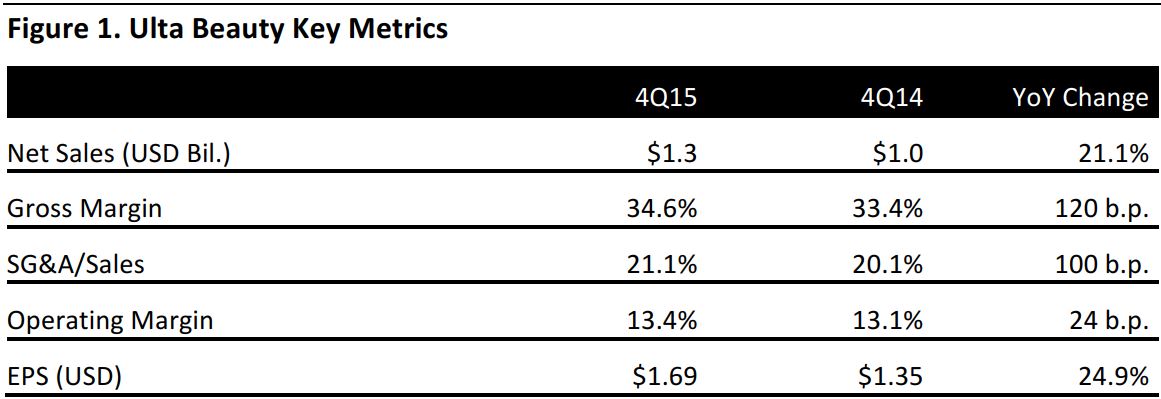

Ulta Beauty’s 4Q15 net sales were $1.3 billion, beating the consensus estimate by $33 million.

Retail comps increased by 10.4%, including salon comp growth of 9.2%. Salon sales grew by 16.7% year over year, to $54.6 million, and e-commerce sales grew by 44.2% year over year, to $94.8 million, adding 210 basis points to the total comparable sales.

The gross margin increased by 120 basis points year over year, to 34.6%, owing to higher merchandise margins, an improvement in e-commerce profit contribution and leverage in fixed store costs, which were offset by supply chain investments. The SG&A-to-sales ratio increased by 100 basis points, to 21.1%, due to investments in marketing, in-store payroll hours and higher incentive compensation.

EPS was $1.69, compared to the consensus estimate of $1.54.

During the fourth quarter, the company opened a total of 14 stores and ended the quarter with 874 stores representing 9.2 million square feet, a 13% increase year over year.

2015 RESULTS

Net sales in 2015 increased by 21.1%, to $3.9 billion.

Comps increased by 11.8%, following an increase of 9.9% in 2014. The same-store sales increase was driven by 8.4% transaction growth and 3.4% growth in average ticket size.

Retail comps increased by 10.0%, including salon comp growth of 10.1%. Salon sales increased by 19.2% year over year, to $209.2 million. E-commerce sales grew by 47.5% year over year, to $221.1 million, adding 180 basis points to the total same-store sales increase.

EPS was $4.98 compared to $3.98 in 2014.

GUIDANCE

For 2016, the company expects sales growth in the mid-to-high teens based on 8%–10% comp growth, or revenue of $4.5–$4.7 billion, compared to the consensus estimate of $4.5 billion.

The company also expects 18%–20% EPS growth, which would result in EPS of $5.87–$5.97, ahead of the consensus estimate of $5.71.

Capital expenditures are expected to be about $390 million in 2016, compared to $299 million in 2015. Of the total, $80 million is earmarked to fund an accelerated rollout of prestige brand boutiques, enhancements to the Ulta Beauty Collection and fragrance fixtures in hundreds of stores.

For the first quarter, the company expects net sales of $1.016–$1.033 billion, ahead of the consensus estimate of $1.0 billion, based on a 9%–11% increase in comps.

First-quarter EPS is expected to be $1.25–$1.30, ahead of the consensus estimate of $1.22.