albert Chan

In this report, we review the performance of U.K. retail over the 2018 holiday season, looking at newly released December retail sales data from the ONS and holiday trading figures from major U.K. retailers that have reported so far.

Data in this report are not seasonally adjusted.

Data in this report are not seasonally adjusted.

Source: ONS/Coresight Research[/caption] [caption id="attachment_66184" align="aligncenter" width="624"] Source: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

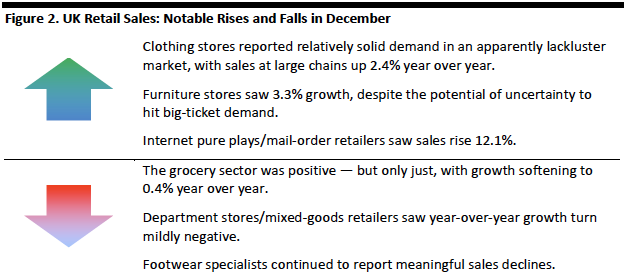

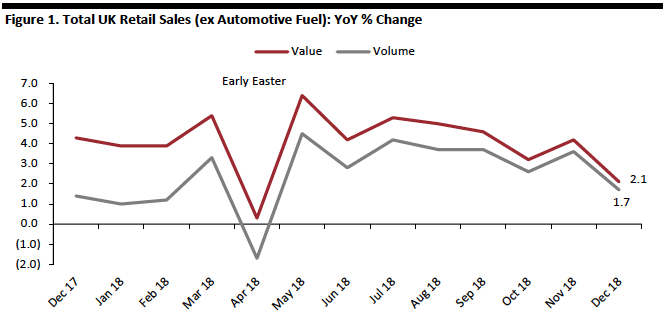

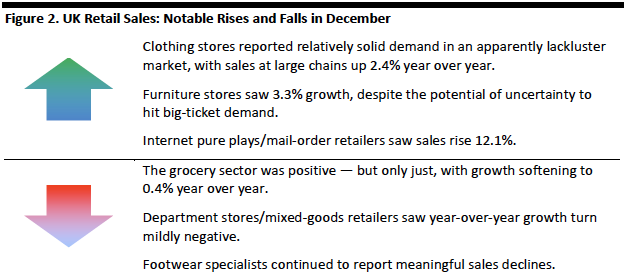

December was an unusually weak month for total retail sales, and major sectors such as grocery and department stores/mixed goods were weaker still. Overall growth was supported by a double-digit rise in sales through small retailers (defined as those with fewer than 100 employees or with revenues of £60 million or less per year) and, partly as a result, we continued to see highly volatile figures for some fragmented sectors. In December, the ONS reported a surprisingly large rise in sales at specialist food stores and DIY retailers. It continued to report deep declines at floorcovering retailers, as well as computer and telecoms stores.

Despite the uncertainty in the U.K. over Brexit, the big-ticket furniture sector reported positive year-over-year growth, though electrical goods retailers turned negative after Black Friday delivered a strong November. The ONS reported solid demand at clothing specialists in a market that other data points suggest is proving tough.

[caption id="attachment_66185" align="aligncenter" width="648"]

Source: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

December was an unusually weak month for total retail sales, and major sectors such as grocery and department stores/mixed goods were weaker still. Overall growth was supported by a double-digit rise in sales through small retailers (defined as those with fewer than 100 employees or with revenues of £60 million or less per year) and, partly as a result, we continued to see highly volatile figures for some fragmented sectors. In December, the ONS reported a surprisingly large rise in sales at specialist food stores and DIY retailers. It continued to report deep declines at floorcovering retailers, as well as computer and telecoms stores.

Despite the uncertainty in the U.K. over Brexit, the big-ticket furniture sector reported positive year-over-year growth, though electrical goods retailers turned negative after Black Friday delivered a strong November. The ONS reported solid demand at clothing specialists in a market that other data points suggest is proving tough.

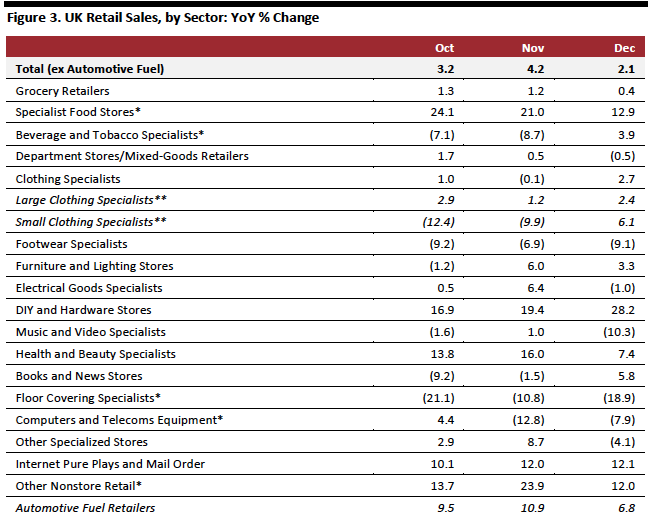

[caption id="attachment_66185" align="aligncenter" width="648"] *A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

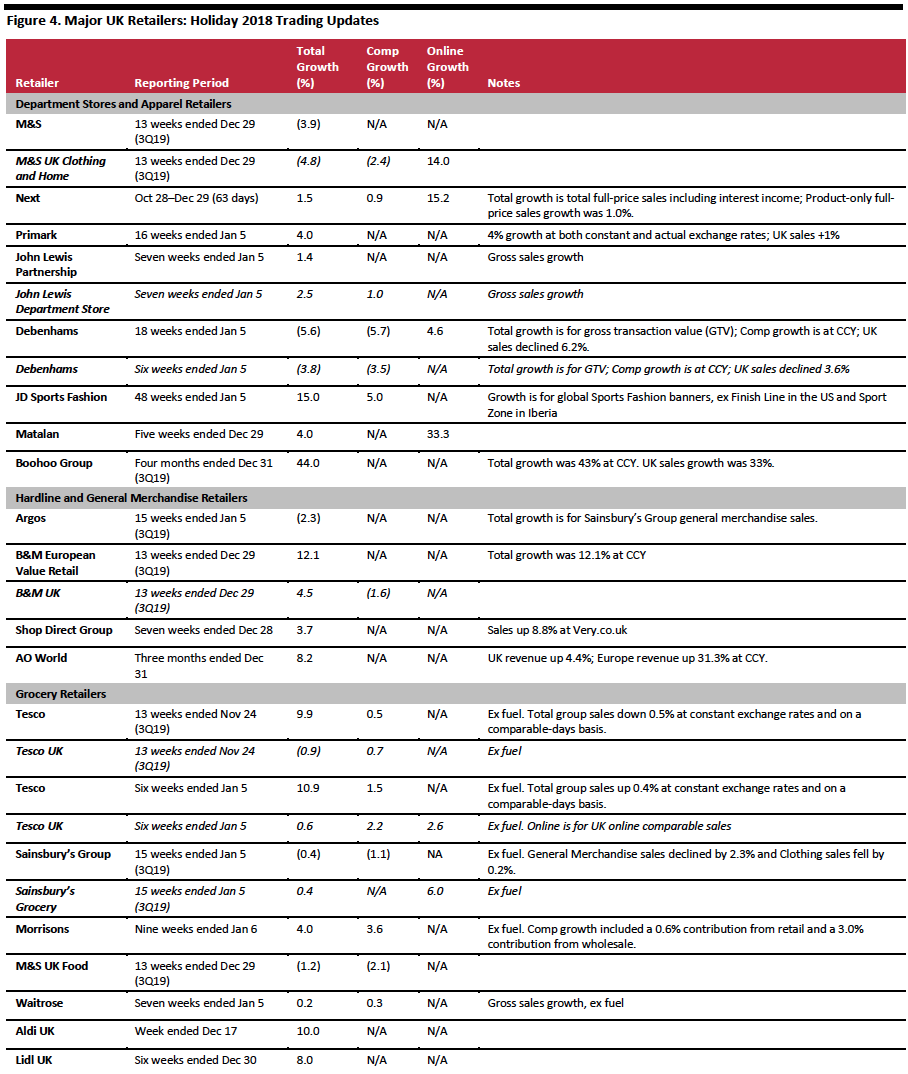

Source: ONS.[/caption] Online Retail Sales Total internet retail sales were up 13.9% year over year in December, versus 12.9% growth in November. In December, internet sales increased 3.7% at food retailers and 10.6% at nonfood retailers. Online sales were up a very strong 19.1% at nonstore retailers (predominantly internet pure plays). Across November and December in total, online retail sales accounted for 20.6% of all U.K. retail sales, and 30.0% of all nonfood retail sales, both in line with our forecast. Major Retailers’ Trading Updates In a relatively soft holiday season, those retailers that focused on value tended to outperform: Source: Company reports[/caption]

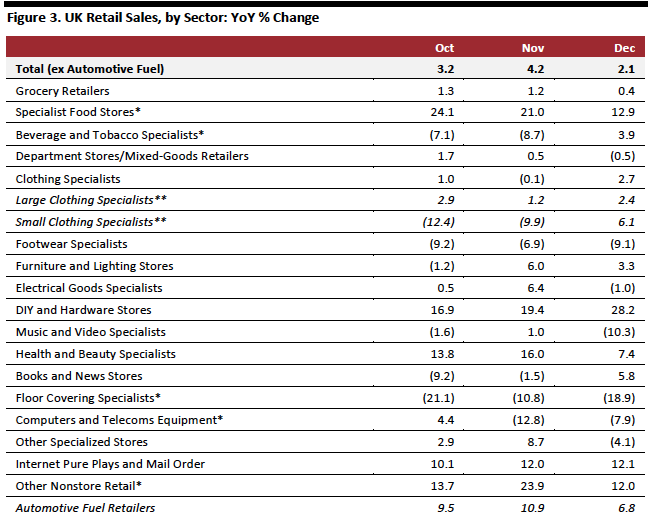

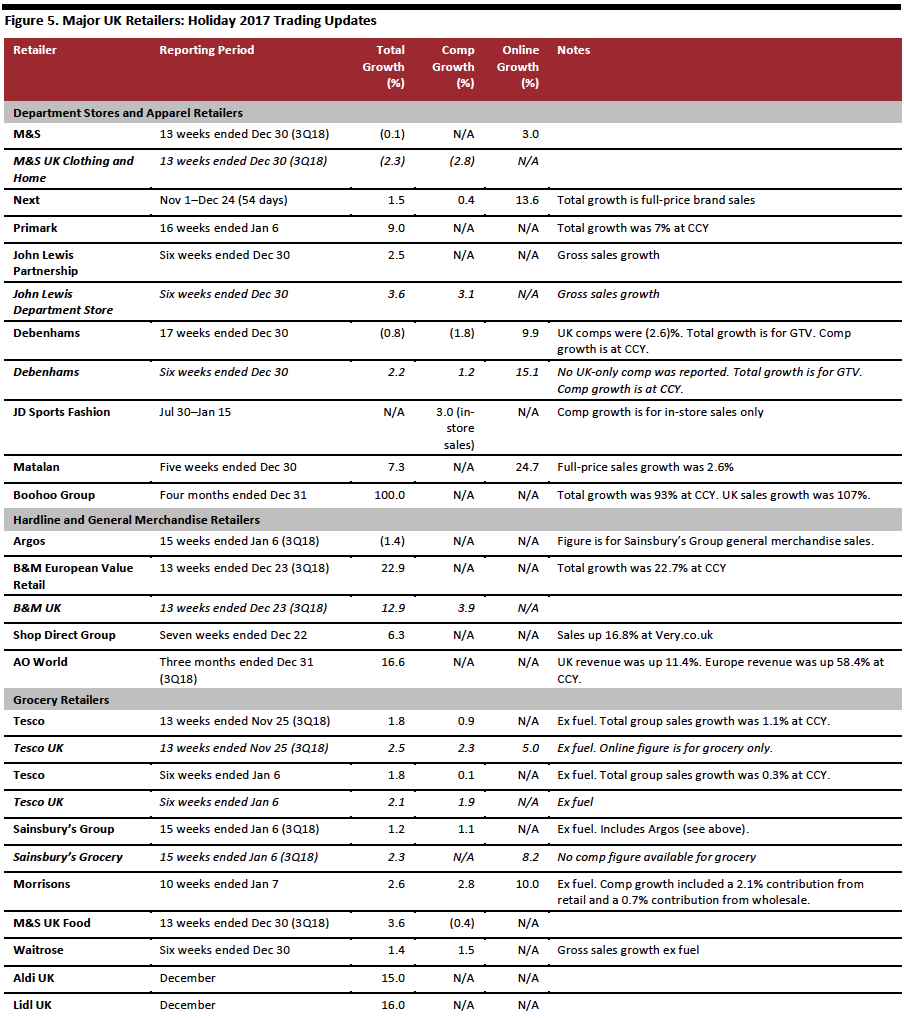

The table below provides figures from the 2017 holiday season for the same companies.

[caption id="attachment_66187" align="aligncenter" width="720"]

Source: Company reports[/caption]

The table below provides figures from the 2017 holiday season for the same companies.

[caption id="attachment_66187" align="aligncenter" width="720"] Source: Company reports[/caption]

Source: Company reports[/caption]

Retail Sales

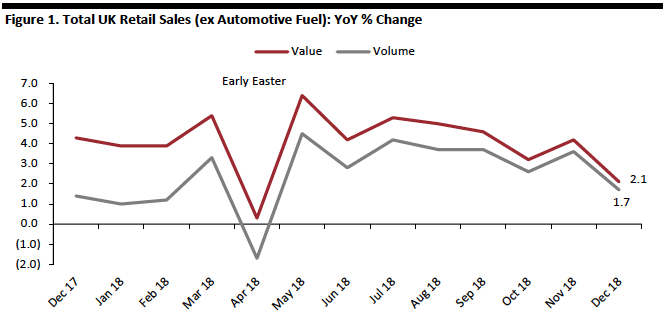

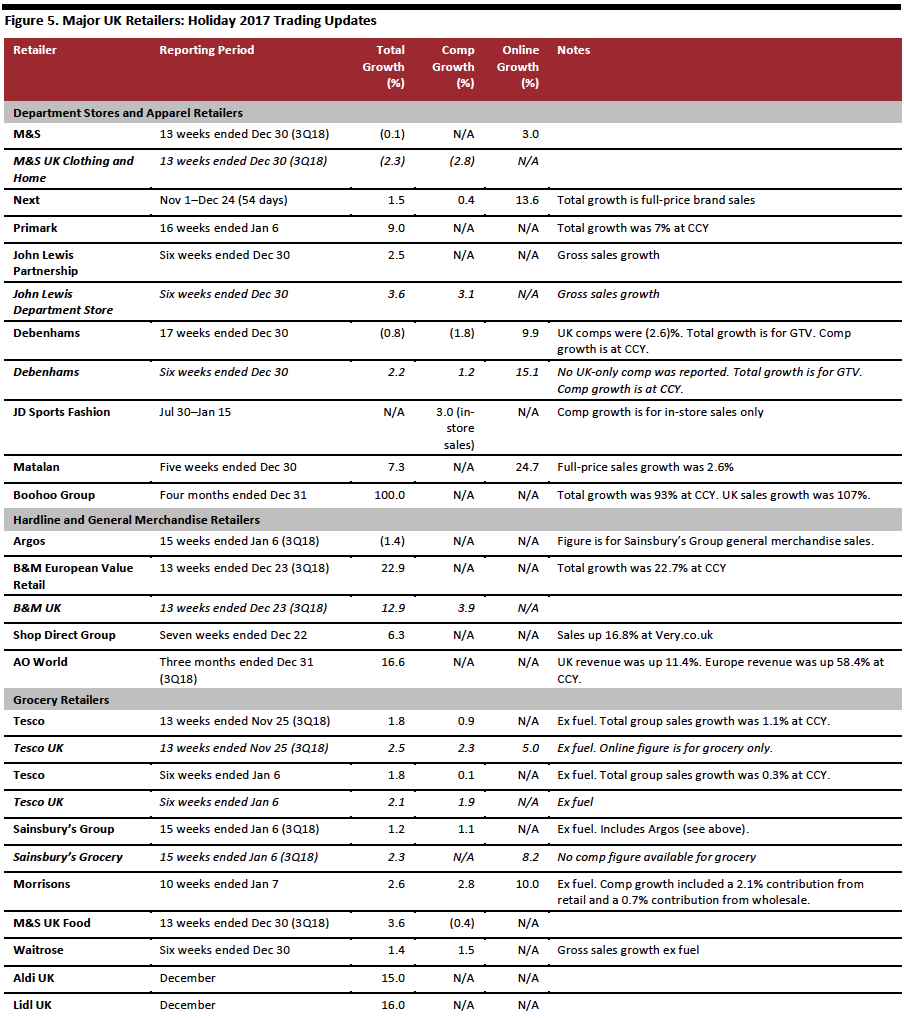

Retail Sales Slow in December Momentum in the retail sector decelerated meaningfully in December, as measured by both value and volume (real terms). Value sales growth slowed from 4.2% in November to 2.1% in December. This was despite a number of retailers reporting a better month in December following an unusually tough November. Across November and December in aggregative (our definition of the holiday period), sales were up 3.0% year over year. [caption id="attachment_66182" align="aligncenter" width="666"] Data in this report are not seasonally adjusted.

Data in this report are not seasonally adjusted.Source: ONS/Coresight Research[/caption] [caption id="attachment_66184" align="aligncenter" width="624"]

Source: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

December was an unusually weak month for total retail sales, and major sectors such as grocery and department stores/mixed goods were weaker still. Overall growth was supported by a double-digit rise in sales through small retailers (defined as those with fewer than 100 employees or with revenues of £60 million or less per year) and, partly as a result, we continued to see highly volatile figures for some fragmented sectors. In December, the ONS reported a surprisingly large rise in sales at specialist food stores and DIY retailers. It continued to report deep declines at floorcovering retailers, as well as computer and telecoms stores.

Despite the uncertainty in the U.K. over Brexit, the big-ticket furniture sector reported positive year-over-year growth, though electrical goods retailers turned negative after Black Friday delivered a strong November. The ONS reported solid demand at clothing specialists in a market that other data points suggest is proving tough.

[caption id="attachment_66185" align="aligncenter" width="648"]

Source: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

December was an unusually weak month for total retail sales, and major sectors such as grocery and department stores/mixed goods were weaker still. Overall growth was supported by a double-digit rise in sales through small retailers (defined as those with fewer than 100 employees or with revenues of £60 million or less per year) and, partly as a result, we continued to see highly volatile figures for some fragmented sectors. In December, the ONS reported a surprisingly large rise in sales at specialist food stores and DIY retailers. It continued to report deep declines at floorcovering retailers, as well as computer and telecoms stores.

Despite the uncertainty in the U.K. over Brexit, the big-ticket furniture sector reported positive year-over-year growth, though electrical goods retailers turned negative after Black Friday delivered a strong November. The ONS reported solid demand at clothing specialists in a market that other data points suggest is proving tough.

[caption id="attachment_66185" align="aligncenter" width="648"] *A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

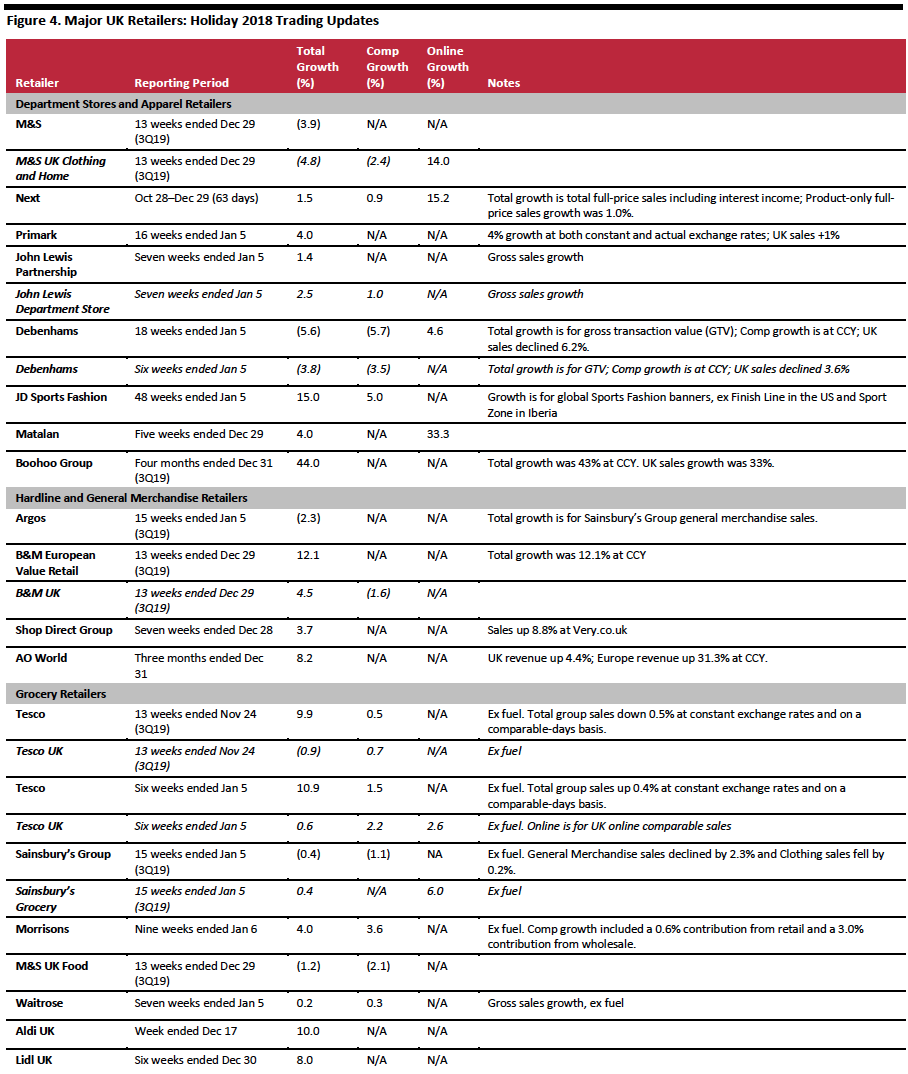

Source: ONS.[/caption] Online Retail Sales Total internet retail sales were up 13.9% year over year in December, versus 12.9% growth in November. In December, internet sales increased 3.7% at food retailers and 10.6% at nonfood retailers. Online sales were up a very strong 19.1% at nonstore retailers (predominantly internet pure plays). Across November and December in total, online retail sales accounted for 20.6% of all U.K. retail sales, and 30.0% of all nonfood retail sales, both in line with our forecast. Major Retailers’ Trading Updates In a relatively soft holiday season, those retailers that focused on value tended to outperform:

- Tesco reported its strongest U.K. comparable sales for nearly a decade, with comp growth of 2.2% for the six-week period ended January 5. This was above the consensus estimate of 1.4%. Management pointed to the rollout of its low-price “Exclusively at Tesco” brands as supporting growth.

- Primark grew U.K. sales 1% year over year in the 16 weeks ended January 5, 2019. The company claimed it was ahead of the overall U.K. apparel market, and pointed to positive U.K. comparable sales in September and October, a weak November and a December that exceeded its expectations.

- Boohoo Group grew revenues by 44% year over year to £328 million in the four months ended December 31, beating the consensus estimate of £323 million. At constant currency (CCY), the company grew revenues 43%.

- Privately owned Aldi and Lidl both pointed to strong growth, but both chose to focus on unusually specific trading periods (a single week at Aldi and six weeks at Lidl), compared to the one-month December figures they reported in past years.

Source: Company reports[/caption]

The table below provides figures from the 2017 holiday season for the same companies.

[caption id="attachment_66187" align="aligncenter" width="720"]

Source: Company reports[/caption]

The table below provides figures from the 2017 holiday season for the same companies.

[caption id="attachment_66187" align="aligncenter" width="720"] Source: Company reports[/caption]

Source: Company reports[/caption]