Nitheesh NH

What’s the Story?

The UK department store sector continues to undergo huge transformation due to changes in consumer shopping behavior, which have been driven in the past 18 months by the Covid-19 pandemic. Even prior to the pandemic, the department store sector was beginning to restructure and reorganize amid two major bankruptcies—House of Fraser in 2018 and Debenhams in 2019—and their subsequent acquisitions, leading to store closures. In this report, we analyze the recent performance of the UK department store sector and explore how change presents opportunities for future growth. We discuss the competitive landscape and three trends that we expect to shape the sector moving forward.Why It Matters

The UK department store sector is polarized between a few luxury department stores that have consistently performed well and mass department stores that have, in aggregate, seen declining sales since 2016. The sector, which has traditionally relied heavily on the brick-and-mortar channel, has proven vulnerable to the gradual consumer shift to e-commerce, which accelerated dramatically in pandemic-impacted 2020 and 2021. Major department store retailers are therefore making efforts to optimize their store fleets and turn to online channels for future growth. As the sector looks to recover from the pandemic, department store retailers will need to innovate to stay relevant—such as by launching new services, products, categories and store formats.UK Department Stores: Coresight Research Analysis

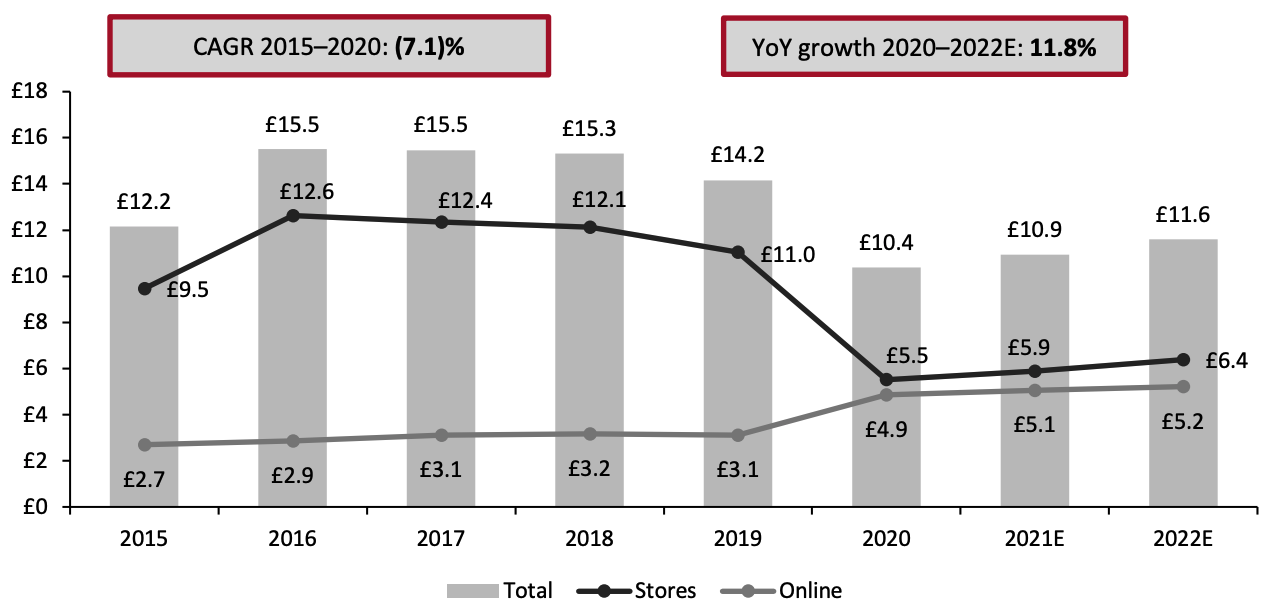

Market Size Coresight Research estimates that the UK department store sector will achieve total revenue of £10.9 billion ($15.1) billion in 2021. This will be the first year of positive year-over-year revenue growth (of 5.4%) for the sector since 2016 but follows the pandemic-driven lows of 2020; we do not expect revenue to reach pre-pandemic levels (see Figure 1). This estimated sector growth underpaces our estimate for total UK apparel and footwear sales in the UK, which we expect to grow by 8.1% in 2021.Figure 1. UK Department Store Sector: Revenue, in Total and by Channel (GBP Bil.) [caption id="attachment_137353" align="aligncenter" width="700"]

Totals may not sum due to rounding

Totals may not sum due to roundingSource: Company reports/Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption] The recent performance of the UK department store sector has been impacted by three key, interrelated factors, which also influence our estimates for physical and online sales growth in 2021 and 2022:

- The Covid-19 pandemic—The UK experienced nationwide lockdowns for the first three months of 2021, which impacted physical store sales. Online, department stores continue to face fierce competition—including from multichannel rivals such as Next and multibrand platforms such as ASOS and Zalando.

- Change in consumer category demand—The shift in consumer demand toward more casual apparel and changing lifestyles, including working from home and fewer occasions, has impacted apparel choices for some department stores. Marks & Spencer, one of the sector’s largest department stores, reported at its Investor Day in October 2021 that the pandemic further amplified several trends: Consumers are spending less overall on apparel; they are spending more on casual apparel and less on formal wear; and they are spending more on home. For example, the company reported that its skirts, trouser, footwear, dresses, swimwear, and men’s formal footwear were all down by over 50% in fiscal year 2021 compared to fiscal year 2020.

- Industry consolidation—In May 2021, major department store Debenhams liquidated its remaining 124 stores, representing a major contraction in the sector. Boohoo acquired Debenhams and the retailer now operates online only (and, so, can no longer be considered a department store).

- M&S

- John Lewis

- Debenhams

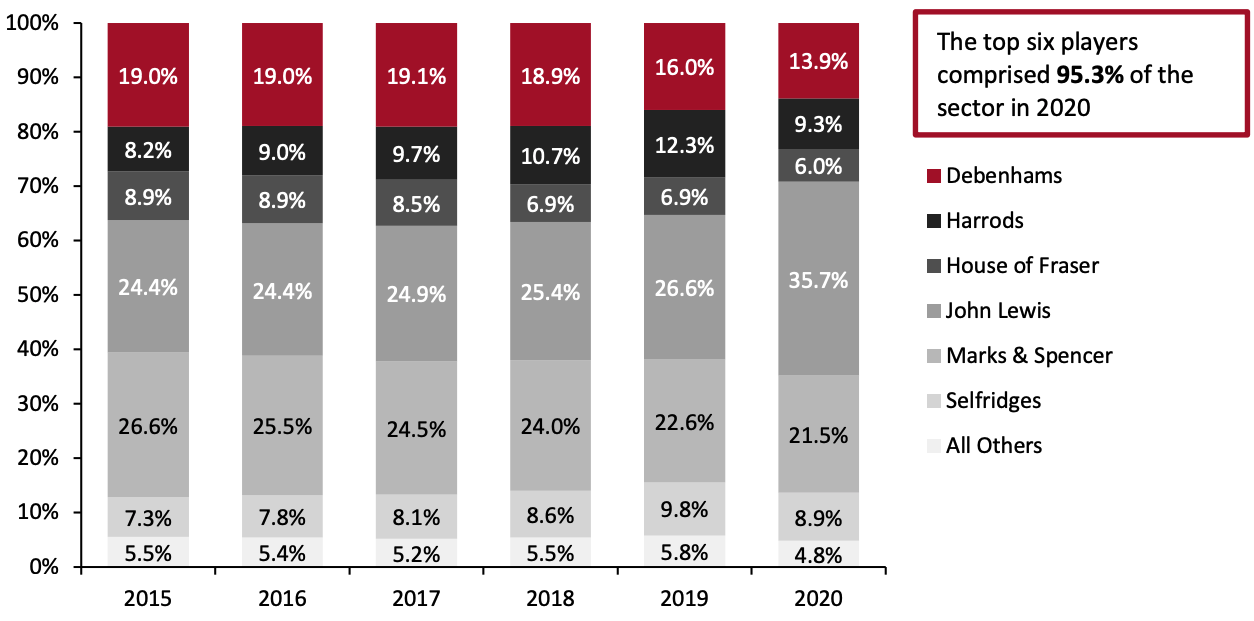

Figure 2. UK Department Store Sector: Market Share by Major Players (%) [caption id="attachment_137354" align="aligncenter" width="700"]

Totals may not sum due to rounding

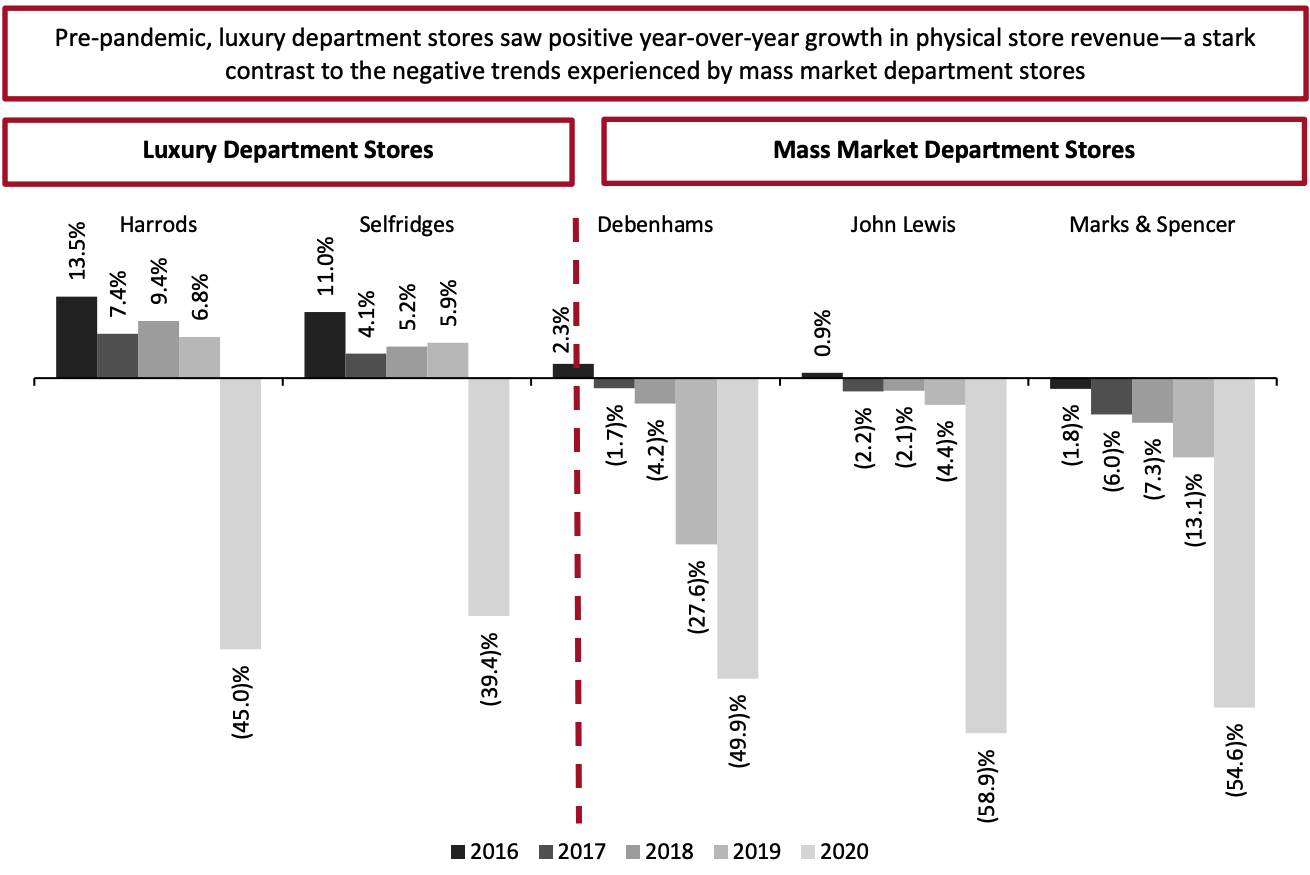

Totals may not sum due to roundingSource: Company reports/Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption] In-Store Revenue Trends, by Retailer In terms of brick-and-mortar revenue, the sector has seen contrasts in the performance of mass market versus luxury department stores. The two leading UK department stores (as discussed in the previous section) are both positioned as mass-market retailers, with John Lewis positioned as more premium than M&S, alongside Debenhams. These three companies were experiencing negative in-store revenue growth even before the pandemic, with declines then seeing drastic acceleration in 2020.

- Following revenue declines in recent years—with particular struggles in its apparel segment—M&S announced in May 2021 that it will close 30 stores following a decline in in-store clothing and home sales of over 50% year over year.

- John Lewis saw low-single-digit revenue declines in the few years prior to the pandemic, we estimate from company data on online sales. In 2020, the company closed eight stores, and it announced the closure of another eight stores in March 2021 due to continued sluggish in-store sales.

- Debenhams has now closed all brick-and-mortar stores following its acquisition.

- Harrods’ flagship is a 1.1 million-square-foot luxury department store that offers over 330 services, from beauty suites to lighting installation services.

- At Selfridges, the company’s take on luxury is accessible, innovative and popular with younger shoppers. The retailer hosts in-store events with fashion and art, such as the “Prada on Ice at the Selfridges Corner Shop” event, which exhibits the luxury brand’s winter-themed products, from snowboards to cozy logo knits, personalized bottles and Re-Nylon ski jackets. Another Selfridges event invites consumers to view William Darrell kinetic sculptures, crafted from plant-based plastic, at The Selfridges Art Block (the retailer’s permanent exhibition space in its London store).

Figure 3. Major Players in the UK Department Store Sector: Estimated Physical Store Revenue Growth (YoY %) [caption id="attachment_137355" align="aligncenter" width="700"]

Store sales (and, so, growth) inferred from online sales, which are estimated in some instances. House of Fraser is not included as an in-store/online revenue split is not available for all years.

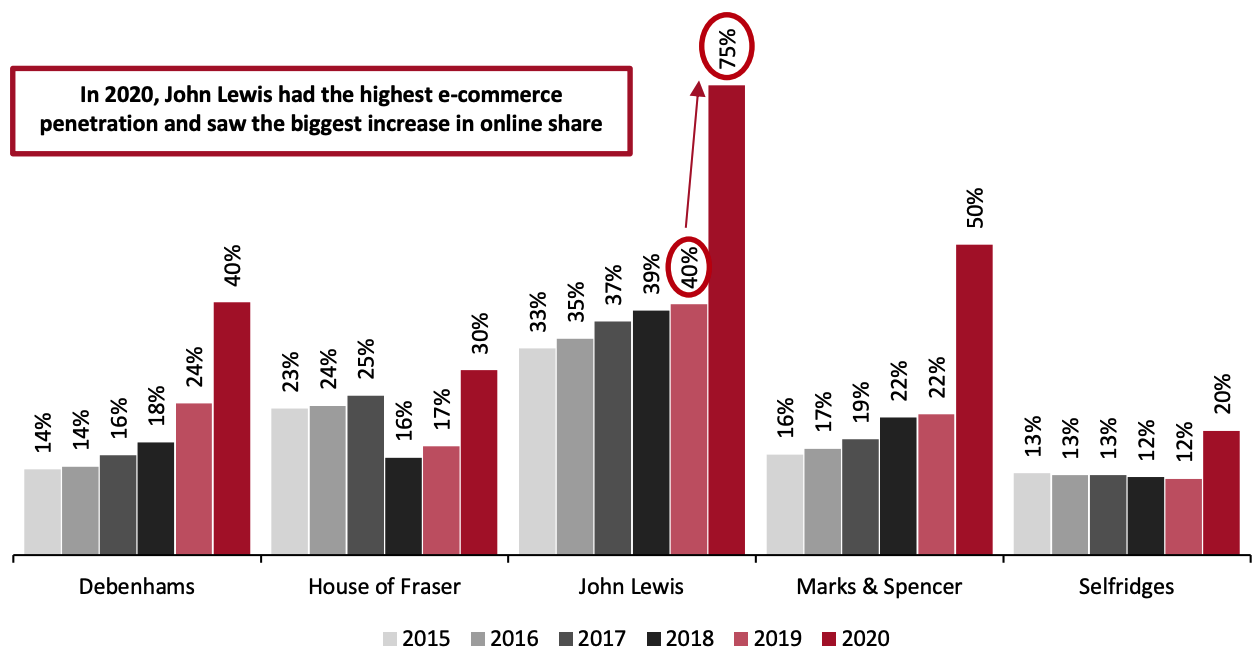

Store sales (and, so, growth) inferred from online sales, which are estimated in some instances. House of Fraser is not included as an in-store/online revenue split is not available for all years. Source: Company reports/Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption] E-Commerce Growth, by Retailer E-commerce penetration has grown in the UK department store sector in recent years—unsurprisingly, the major players saw e-commerce penetration accelerate amid the widespread consumer shift to online in pandemic-impacted 2020 (see Figure 4).

- John Lewis

- M&S

Figure 4. Major Players in the UK Department Store Sector: E-Commerce Penetration (Online Sales as a % of Total Sales) [caption id="attachment_137356" align="aligncenter" width="700"]

Note: Harrods does not report e-commerce results

Note: Harrods does not report e-commerce resultsSource: Company reports/Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption] Three Trends in the UK Department Store Sector We present three key trends in the UK department store sector in Figure 5 and explore each in detail below.

Figure 5. Three Trends in the UK Department Store Sector [caption id="attachment_137357" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

1. Sector Consolidation and Store Optimization

Over the past five years, the UK department store sector has become more consolidated through company ownership changes and a smaller UK physical sector store fleet. In Figure 6, we summarize the major events that have contributed to this consolidation.

Source: Coresight Research[/caption]

1. Sector Consolidation and Store Optimization

Over the past five years, the UK department store sector has become more consolidated through company ownership changes and a smaller UK physical sector store fleet. In Figure 6, we summarize the major events that have contributed to this consolidation.

Figure 6. UK Department Store Sector Consolidation: Recent Major Events [wpdatatable id=1515]

Source: Company reports/Coresight Research

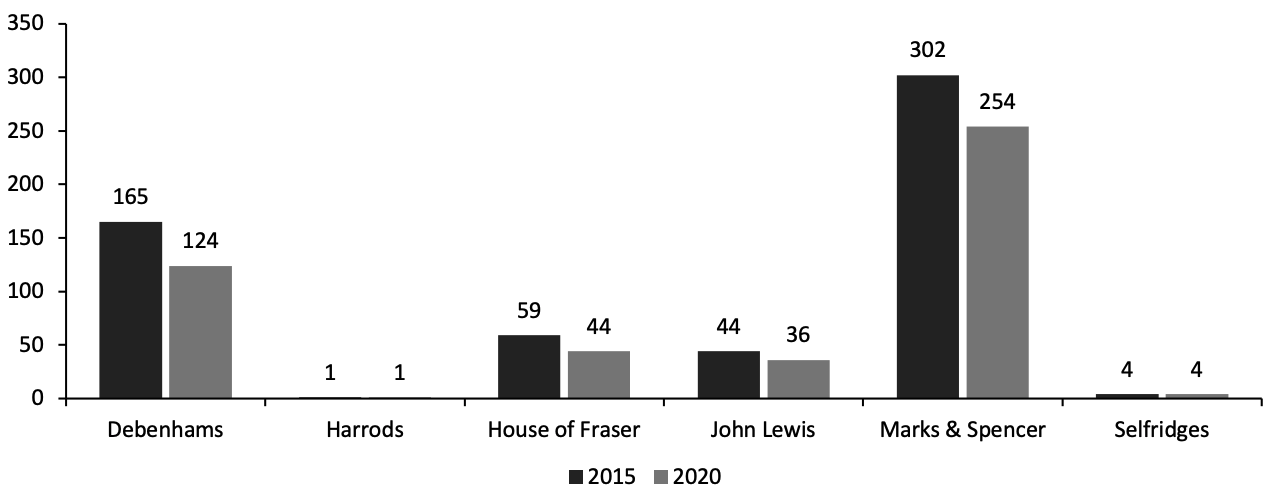

The UK department store is not very large, totaling 575 stores across six major retailers in 2015. The sector has seen considerable contraction and reduction over the past five years. The acquisition of two major retailers from administration (Debenhams and House of Fraser) has resulted in the closure of nearly 139 department stores across these two banners. In addition, M&S and John Lewis have both announced department store optimization over the past few years, involving the closure of a high number of stores. Across the major department store retailers, the landscape of full-line stores declined by 19.5% between 2015 and 2020, from 575 stores to 463—a reduction of 112 stores. In addition, Debenhams’ total estate of 124 stores closed in 2021.Figure 7. UK Department Store Sector: Physical Store Portfolios of the Major Players (Number of Stores) [caption id="attachment_137358" align="aligncenter" width="700"]

Source: Company reports[/caption]

Although the major department store retailers are reducing their portfolio of full-line stores, some are introducing smaller store formats to defray some real estate expense while retaining brick-and-mortar touchpoints with consumers. The small-format store is a trend that is taking hold across the US retail industry too, with many retailers opting for smaller stores and even showrooms that do not hold inventory (such as Nordstrom).

Source: Company reports[/caption]

Although the major department store retailers are reducing their portfolio of full-line stores, some are introducing smaller store formats to defray some real estate expense while retaining brick-and-mortar touchpoints with consumers. The small-format store is a trend that is taking hold across the US retail industry too, with many retailers opting for smaller stores and even showrooms that do not hold inventory (such as Nordstrom).

- John Lewis announced in its “2021 Annual Report” that it plans to open “smaller service stores” that are new formats of smaller, more local shops with “the very best of John Lewis.” The company did not detail specific numbers but said that it has undertaken consumer research to determine what the consumer is seeking, and it will reshape its portfolio over the next five years to include destination stores and smaller service stores, and to provide greater convenience for consumers.

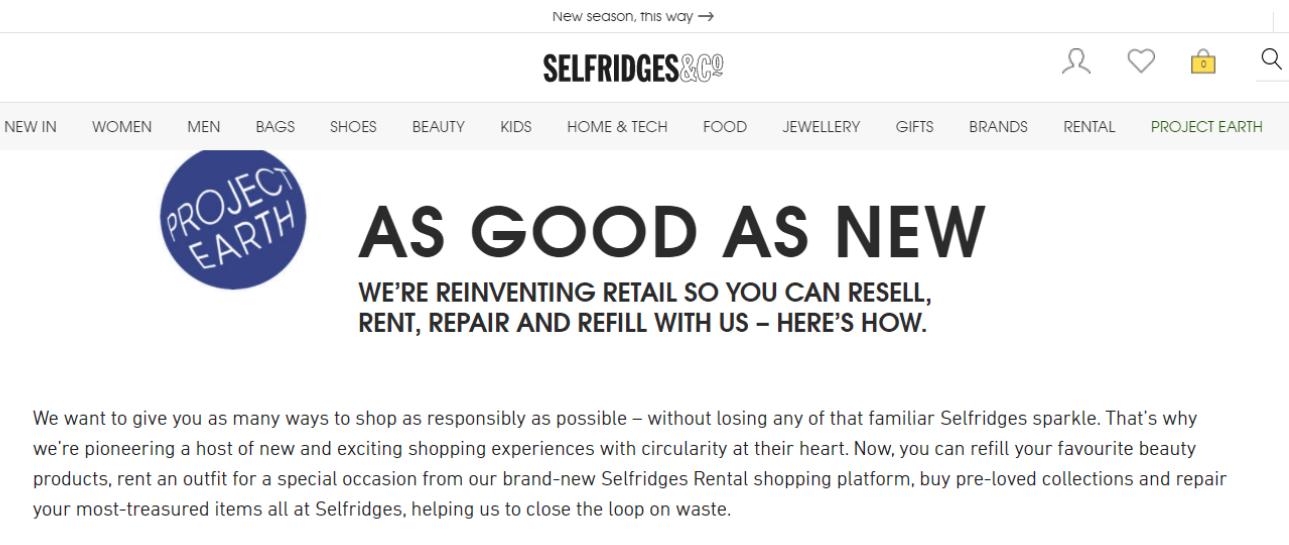

- Selfridges launched Project Earth in August 2020, a sustainability initiative that includes rental, resale, repair and refill services. Consumers can rent clothing items through the Selfridges rental platform; buy and sell pre-loved items via the “resellfridges” service; repair shoes, jewelry and accessories in the repair shop; source archive wedding and archive fashion pieces; give garments a new life through upcycling; and refill beauty products.

Selfridges’ Project Earth services include resale, rental, repair and refill solutions

Selfridges’ Project Earth services include resale, rental, repair and refill solutionsSource: Company website[/caption]

- John Lewis provides a furniture rental service in partnership with rental company Fat Llama. The offering enables customers to rent John Lewis products including desks, chairs, dining tables and sofas for three, six or 12 months, and they have the option to buy the rented product at any time. John Lewis reported in its “2021 Annual Report” that it plans to expand the rental offering: “Attitudes towards renting items and the sharing economy have dramatically shifted in recent years, and we know that renting and reselling items and recycling them is a growing priority for our customers. Renting furniture will give more customers access to high-quality furniture, as well as the latest designs.” John Lewis is a first mover in the furniture rental category, which should help to drive traffic to the John Lewis website. The service will also provide personalization and consumer engagement opportunities, as the department store can collect and analyze data on customer shopping preferences to offer targeted offers based on past rentals and purchases

- M&S announced on October 2, 2021, that it is launching M&S Opticians services in 55 stores over the next 18 months, by April 2023. M&S has opened 12 M&S Opticians in its stores to date. Each of the branches will be operated by opticians and hearing care provider Owl Optical, part of the Scrivens Group of Companies. Customers will have the choice of M&S branded optical frames as well as third-party frames. M&S reported that the rollout follows a successful trial where the service received a customer satisfaction rate of 96% and a customer recommendation rate of 96%. As part of the company’s omnichannel services, M&S is also offering customers the ability to book appointments online and virtually try on and purchase glasses via its digital tool.

M&S Opticians is set to open in 55 store locations by April 2023

M&S Opticians is set to open in 55 store locations by April 2023Source: Company reports[/caption] 3. Apparel Brand Launches and Collaborations Department stores are collaborating with outside designers and brands, acquiring brands, and launching new products to drive consumer traffic. Staying on trend is a challenge for all apparel retailers; the challenge is even steeper for department stores, which have a broader consumer base of men, women and children, as well as a portfolio that spans multiple categories, from casual to tailored. Department stores are taking steps to strengthen their apparel offerings and cater to consumer trends such as casual, active and sustainability. Key apparel strategies by major department store retailers include brand collaborations, brand acquisitions and new product launches.

- At M&S, the apparel assortment has traditionally been focused on private labels, emphasizing quality and tailored clothing. Due to the department store’s declining apparel sales, the company has taken steps to broaden its apparel assortment to reach a younger consumer. As part of its “Never the Same Again” program to “accelerate its transformation and turbocharge online growth,” M&S has made investments in the apparel category through the following ways:

- Brand collaborations—M&S is collaborating with other brands outside of its traditional private-label brands. This effort began in 2020 through a collaboration with sustainable brand Nobody’s Child. Marks & Spencer then launched a joint collection with fashion label Ghost, with which it released the M&S X Ghost autumn/winter range in early September 2021—the fourth collection under the collaboration.

- Acquisition—In January 2021, M&S acquired fashion brand Jaeger from administration. The brand includes casualwear and modern tailored looks for men and women.

- Brand partnerships—In March 2021, M&S launched “Brands at M&S” with 11 clothing partner brands, spanning menswear, womenswear and kids, to be sold online alongside selected core M&S in-house brands.

- Brand launches/category repositioning—M&S has been transitioning its kidswear category from “special occasion” to “everyday style” in an aim to gain market share. The retailer has recently launched three casual clothing lines for kids—Hype, Little Joule and Somebody’s Child. It also launched a “more sustainable than ever” back-to-school uniform collection in July 2021 using sustainable cotton.

- John Lewis offers mid- to high-end fashion and beauty offerings across designer brands. The department store continues to broaden its assortment to stay current with trends and relevant with consumers.

- Brand launches in apparel and beauty—The company reported in its Annual Report in April 2021 that it launched 30 new fashion and beauty brands in stores and online over the past year, with a further 50 to be introduced, with many of the brands being independent and British. In apparel, the retailer has added Mango and Banana Republic, among others. In beauty, the company has launched Olaplex, luxury beauty technology from MZ Skin, Foreo, Dermaflash and BeGlow.

What We Think

The Debenhams store closures in May 2021 have created a huge opportunity for competitors to capture share of shoppers, particularly in multibranded apparel and beauty; consumers that regularly shopped Debenhams will be seeking out new retailers to shop their favorite brands and styles. We see this as one of the biggest opportunities for legacy department stores in the UK department store sector. We expect UK department stores to continue to innovate with new services to bring consumers into stores, including rental and resale, and use these services to drive personalized offers for consumers. As online services are growing, we expect that department stores will take a more active role with livestreaming, virtual selling and social commerce—with one-to-one styling and beauty consultations as well as mini events providing further opportunity for retailers to integrate personalization into the consumer experience. We expect that UK department stores will pilot to showroom and small-format stores to replace closed legacy stores, as these formats are trending globally—providing a physical consumer touchpoint without the real estate burden of a full-line store. We see an increased focus on the in-store consumer experience to attract shoppers and create cultural destinations, such as the Selfridges Art Block.Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved