DIpil Das

- Sainsbury’s has been the weakest performing of the UK’s “Big Four” grocery retailers.

- The company has been stripping out costs by cutting in-store staff but the impact appears to be risking its longstanding differentiated position in the grocery market.

UK shoppers and motorists would be worse off if Sainsbury’s and Asda…were to merge. This is due to expected price rises, reductions in the quality and range of products available, or a poorer overall shopping experience.

The CMA’s investigation found that, as well as affecting in-store customers, the merger would result in increased prices and reduced quality of service, such as fewer delivery options, when shopping online. Furthermore, it would lead to motorists paying more at over 125 locations where Sainsbury’s and Asda petrol stations are located close together.

Referring to a pledge by the companies to lower prices by £1 billion per year by the third year after the merger, Sainsbury's CEO Mike Coupe said:The CMA's conclusion that we would increase prices post-merger ignores the dynamic and highly competitive nature of the UK grocery market. The CMA is today effectively taking £1 billion out of customers' pockets.

Sainsbury's is a great business and I am confident in our strategy. We are focused on offering our customers great quality, value and service and making shopping with us as convenient as possible.

Judith McKenna, CEO of Walmart International, said:While we’re disappointed by the CMA’s final report and conclusions, our focus now is continuing to position Asda as a strong UK retailer delivering for customers. Walmart will ensure Asda has the resources it needs to achieve that.

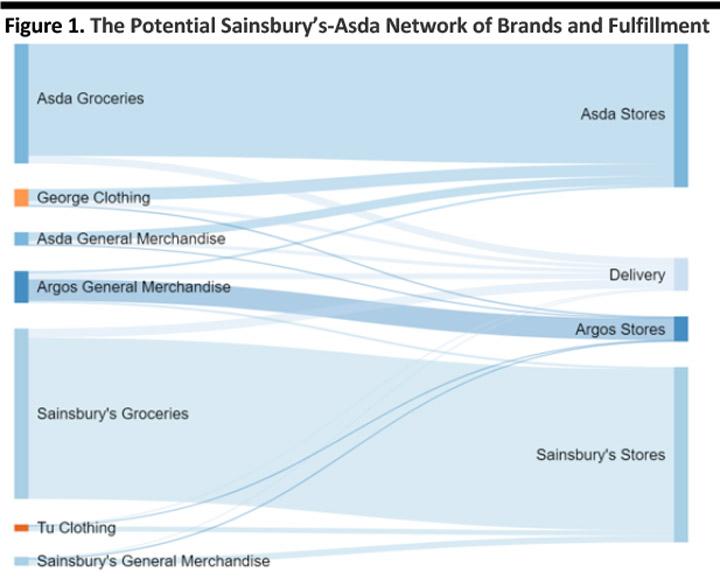

Sainsbury’s-Asda Would Have Become a Major Nongrocery Retailer The merger would have made Sainsbury’s-Asda the UK’s biggest retailer, its biggest grocery retailer, and, by our estimates, probably its second-largest retailer of nongrocery products, behind Amazon. We estimate the new combined entity would have seen total sales of around £9-10 billion across apparel and general merchandise. In nonfood categories, the Sainsbury’s-Asda combination would have brought together the variety store Argos, which was acquired by Sainsbury’s in 2016; Asda’s highly successful George apparel brand; Sainsbury’s newer but high-growth Tu clothing brand; and, Asda’s and Sainsbury’s own general merchandise sales. It would have allowed the company to sell those products through thousands of stores across multiple formats. [caption id="attachment_85344" align="aligncenter" width="720"] Scales are indicative only.

Scales are indicative only. Source: Coresight Research [/caption] Appendix: What the CMA Said Below, we include extracts from the CMA’s final report. Supermarkets:

Where the merger lessens competition in local areas representing a significant proportion of the Parties’ overall supermarkets, the merger may result in price rises (and/or a worsening of other aspects) across all the parties’ stores. The effect could be a worse deal for customers in each local area where one or more of the parties is present (that is, including areas where they do not overlap).

Convenience Stores:For Sainsbury’s, we found that the merger would not give rise to an incentive for it to raise prices across all of its convenience stores, which charge different prices to Sainsbury’s supermarkets. This is because the local areas where we have found competition concerns regarding Sainsbury’s convenience stores represent a small part of Sainsbury’s overall convenience store estate.

For Asda, the situation is different because its convenience stores charge the same prices as its supermarkets. Our finding that the merger would result in an SLC [substantial lessening of competition] in each local area where Asda’s supermarkets are present through a degradation of PQRS [price, quality, range and service] which could include a national price rise, would also mean that the Merger would result in an SLC in each local area where Asda’s convenience stores are present.

Online Groceries:Only three online delivered groceries retailers (Tesco, Sainsbury’s, Asda) have a near-national presence and many online delivered groceries customers would have a restricted choice following the merger: sometimes limited to only the parties and Tesco.

We have found that the merger would give rise to an incentive to degrade PQRS [price, quality, range and service] across Asda’s online delivered groceries offer, resulting in an SLC [substantial lessening of competition] in each local area across the country where Asda is present.