albert Chan

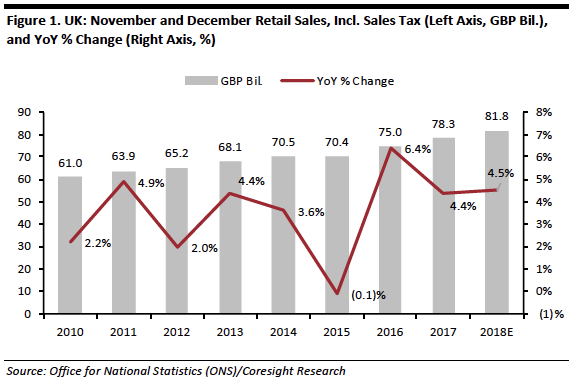

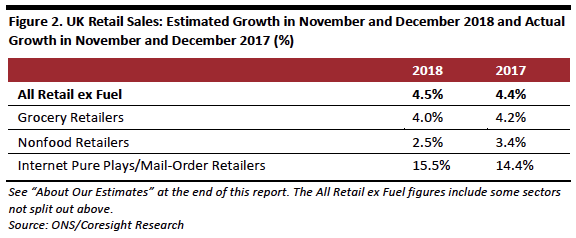

Despite negative headlines, total UK retail sales look set to grow solidly over the festive peak. We are penciling in 4.5% year-over-year growth in UK retail sales this November and December, which would take total holiday retail sales to £81.8 billion. Recent indicators suggest that grocery retailers are likely to see a good season, but we expect a slight sequential slowing in nonfood retailers’ sales growth and note that discretionary demand could soften further if recent Brexit uncertainty turns into political chaos.

So far, all indicators suggest that we will see solid total demand this Christmas.

In spite of decent underlying growth, structural shifts and rising costs will continue to pinch legacy brick-and-mortar retailers. This has been a prominent trend so far this year and we discuss it in more detail later in this report.

E-Commerce Expected to Capture 20%+ of All Retail Sales and 30% of Nonfood Retail Sales

The migration of sales—and especially of nonfood sales—online is one major structural shift. E-commerce typically grows its share of retail sales over the holiday season, and we estimate the following based on ONS data:- Some 20.6% of all UK retail sales will be made online this November and December, up from 18.7% in the same period last year.

- This means that 2018 will be the first year in which e-commerce captures more than one-fifth of all holiday retail sales.

- We estimate that e-commerce will capture around £16.9 billion of retail sales this November and December, an increase of approximately 15% year over year.

- We expect nonfood e-commerce sales to reach a threshold, too, increasing to 30% of total holiday nonfood retail sales for the first time. This compares with 27.1% across November and December in 2017.

- In recent months, grocery retailers have seen strong sales growth driven by sustained volume growth and moderate inflation of around 2%. In the four months from May through August, grocery retailers’ sales rose by 4.5% according to the ONS. Market-meaurement firm Kantar Worldpanel has also recorded solid growth in grocery sales.

- Year to date through August, sales at store-based nonfood retailers were up 2.8% year over year. For the final two months of the year, we factor in a slight slowdown, as we anticipate that political uncertainties and dwindling shop-price inflation will hinder nonfood sales growth. We also note that a tepid housing market is likely to compound this unwinding of growth.

- We expect the structural shift to e-commerce to continue unabated, driving a mid-teen increase in sales at Internet pure plays (a sector that, per the ONS, includes the residual catalog retailers). As the table below indicates, Internet pure plays will likely take up the slack as year-over-year growth in other sectors slows.

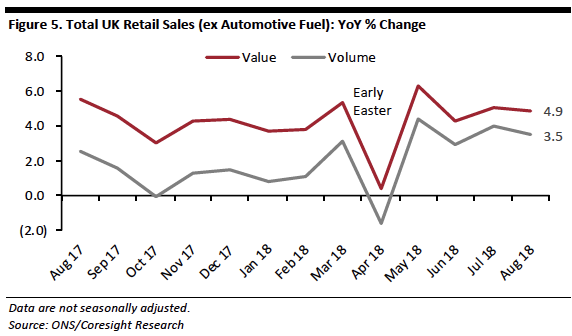

Year to date through August, total UK retail sales were up 4.2% year over year, although April was a weak month. For the four most recent months, May through August, retail sales were up 5.2% year over year, with sales growing by 4.9% in August (latest).

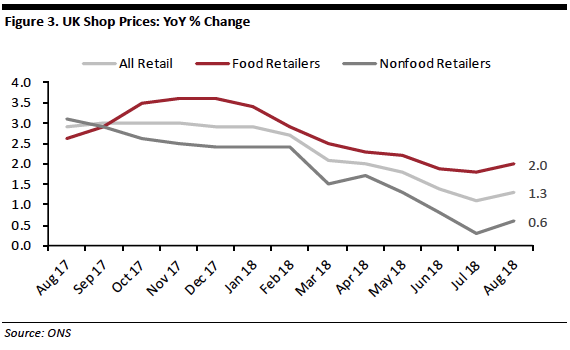

Shop-price inflation is likely to be considerably lower this Christmas than it was during the same period last year, and we expect this to contribute to the slowing trend at nonfood retailers.

Year to date through August, total UK retail sales were up 4.2% year over year, although April was a weak month. For the four most recent months, May through August, retail sales were up 5.2% year over year, with sales growing by 4.9% in August (latest).

Shop-price inflation is likely to be considerably lower this Christmas than it was during the same period last year, and we expect this to contribute to the slowing trend at nonfood retailers.

Squaring Solid Retail Sales with “the Death of the High Street”

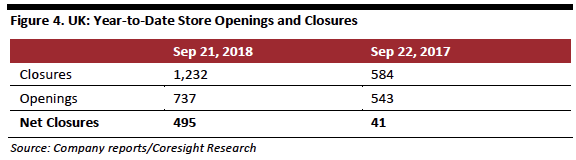

Store closures have dominated UK business headlines this year, fueling a “death of the high street” narrative. Major names such as House of Fraser, Carpetright, New Look and Mothercare have opted for company voluntary arrangements that allow them to close stores and reduce rents on remaining leases, and our week-by-week tracking of store openings and closures by major US and UK retailers has reflected the raft of closings this year. As we show below, the number of UK closures announced through the third week of September has increased substantially year over year.

Squaring Solid Retail Sales with “the Death of the High Street”

Store closures have dominated UK business headlines this year, fueling a “death of the high street” narrative. Major names such as House of Fraser, Carpetright, New Look and Mothercare have opted for company voluntary arrangements that allow them to close stores and reduce rents on remaining leases, and our week-by-week tracking of store openings and closures by major US and UK retailers has reflected the raft of closings this year. As we show below, the number of UK closures announced through the third week of September has increased substantially year over year.

Some struggling retailers have cited softening consumer demand, but we think that such softness is due in many cases to consumers opting to shop at rivals rather than to them cutting their spending altogether because, as the graph below shows, total retail demand has continued to grow. In our view, two specific challenges have driven store closures among undifferentiated midmarket retailers:

Some struggling retailers have cited softening consumer demand, but we think that such softness is due in many cases to consumers opting to shop at rivals rather than to them cutting their spending altogether because, as the graph below shows, total retail demand has continued to grow. In our view, two specific challenges have driven store closures among undifferentiated midmarket retailers:

- First, all retailers have seen labor costs rise due to the tight labor market, changes to the national living wage and new pension obligations. Coupled with high business rates, these have piled on costs even as sales move online, deleveraging the fixed costs of brick-and-mortar stores and eroding store-level profitability.

- Second, price-aggressive competitors continue to steal share from legacy retailers in the midmarket, while limiting those retailers’ ability to pass on higher costs to shoppers. Consumer migration to e-commerce is one such shift, but the rise of discount retailers in grocery and adjacent categories (such as beauty) has had similar effects. Fierce competition has forced long-standing midmarket retailers to absorb cost pressures even as many of them have faced losing share in their market.

We note that some other sources, notably the British Retail Consortium (BRC), typically report softer retail growth and lower shop-price inflation than the ONS does. However, BRC figures are based on a smaller sample of retailers and the ONS’s Retail Sales Index claims to represent between 93% and 95% of all UK retail sales.

Solid Macroeconomic Backdrop, but Political Uncertainty

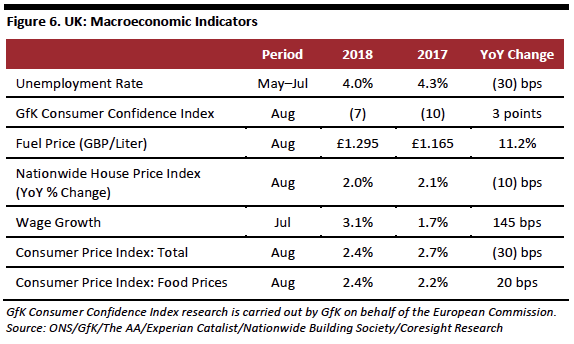

The macroeconomic picture provides a supportive backdrop for Christmas shopping this year. Year over year, unemployment is down, consumer confidence is up, wage growth is stronger and inflation has moderated.

We have moved out of a period of raised inflation, as higher input costs have generally annualized. Food-price inflation peaked at 4.2% in November 2017 and remained high in December last year before moderating across the first half of this year (although we have recently seen a slight uptick in food inflation).

We note three possible drags on discretionary purchases this festive season:

We note that some other sources, notably the British Retail Consortium (BRC), typically report softer retail growth and lower shop-price inflation than the ONS does. However, BRC figures are based on a smaller sample of retailers and the ONS’s Retail Sales Index claims to represent between 93% and 95% of all UK retail sales.

Solid Macroeconomic Backdrop, but Political Uncertainty

The macroeconomic picture provides a supportive backdrop for Christmas shopping this year. Year over year, unemployment is down, consumer confidence is up, wage growth is stronger and inflation has moderated.

We have moved out of a period of raised inflation, as higher input costs have generally annualized. Food-price inflation peaked at 4.2% in November 2017 and remained high in December last year before moderating across the first half of this year (although we have recently seen a slight uptick in food inflation).

We note three possible drags on discretionary purchases this festive season:

- The housing market has weakened, and this is impacting purchases of some big-ticket home products. In August, the Nationwide Building Society recorded the biggest month-over-month house-price fall since July 2012.

- Automotive fuel prices have been rising by double digits year over year, although it looks like the rate of inflation peaked in July, given a moderation in August.

- For the last two years, many commentators have warned about the possibility of Brexit hitting consumers’ willingness to spend. Our general skepticism of such doom-and-gloom predictions has proven well founded, as consumers have been willing to spend on goods and services. However, at the time of writing, the UK-EU negotiations have reached an impasse at a critical stage, and should the situation escalate into a crisis, it could slow growth in discretionary spending this holiday season.

An Early Black Friday Could Boost Top-Up Gift Purchasing

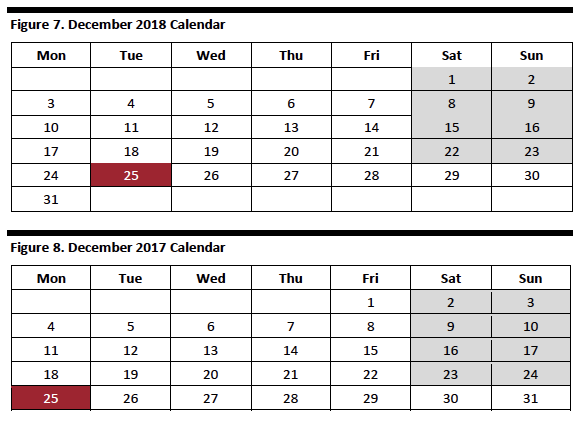

Calendar impacts are likely to have a limited effect on year-over-year sales growth, as December has four weekends before Christmas this year, just as it did last year.

However, Black Friday falls on November 23 this year, which is the earliest that it can fall (Black Friday is the day after Thanksgiving in the US and Thanksgiving falls on the fourth Thursday in November every year). This early timing suggests greater potential for retailers to win unplanned, incremental spending from shoppers making top-up purchases later in the season after making planned gift purchases on Black Friday.

An Early Black Friday Could Boost Top-Up Gift Purchasing

Calendar impacts are likely to have a limited effect on year-over-year sales growth, as December has four weekends before Christmas this year, just as it did last year.

However, Black Friday falls on November 23 this year, which is the earliest that it can fall (Black Friday is the day after Thanksgiving in the US and Thanksgiving falls on the fourth Thursday in November every year). This early timing suggests greater potential for retailers to win unplanned, incremental spending from shoppers making top-up purchases later in the season after making planned gift purchases on Black Friday.

Coresight Research’s Forecasting Record

We began publishing our UK holiday forecast in 2015, and our record is one of being directionally accurate. In 2017, for instance, holiday season sales growth was in line with our forecast.

About Our Estimates

Our estimates are rounded, weighted averages for November and December, which comprise a total of nine weeks in the ONS Retail Sales Index. We benchmark our sales estimates to the ONS’s unadjusted sales data, which include value-added tax.

Coresight Research’s Forecasting Record

We began publishing our UK holiday forecast in 2015, and our record is one of being directionally accurate. In 2017, for instance, holiday season sales growth was in line with our forecast.

About Our Estimates

Our estimates are rounded, weighted averages for November and December, which comprise a total of nine weeks in the ONS Retail Sales Index. We benchmark our sales estimates to the ONS’s unadjusted sales data, which include value-added tax.