Uberification and its Implications for the Retail Industry

“Uber is evolving the way the world moves. By seamlessly connecting riders to drivers through our apps, we make cities more accessible, opening up more possibilities for riders and more business for drivers. From our founding in 2009 to our launches in over 200 cities today, Uber’s rapidly expanding global presence continues to bring people and their cities closer.”

— Uber.com

- Uber is the most visible player (and driver) of the “sharing economy.” Behind Uber’s success is the growing trend of the “sharing economy” and on-demand services.

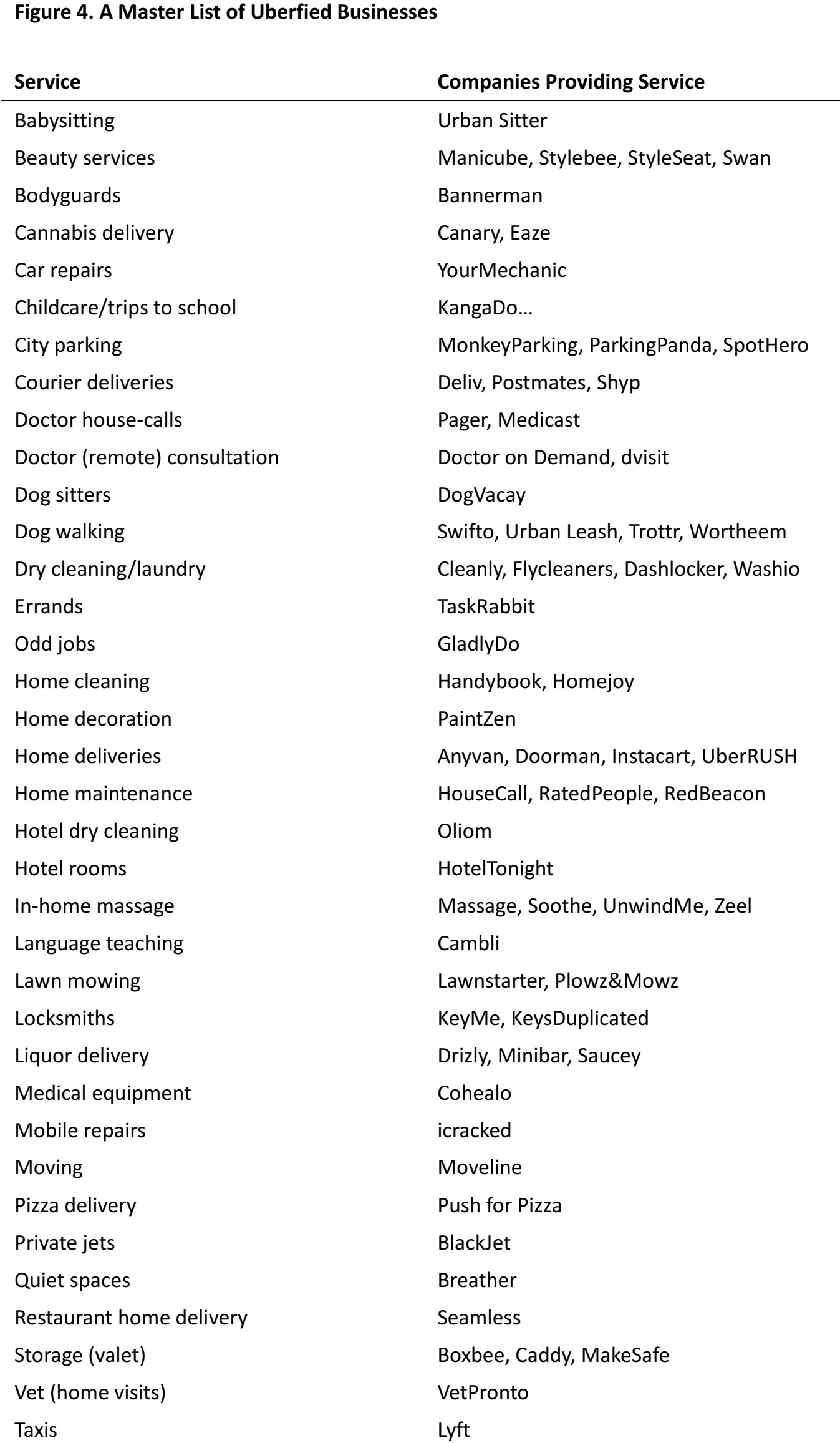

- Uberification: New startups are adopting the model. Inspired by Uber’s business model and the concept of sharing and an on-demand economy, start-ups are increasingly seeking to “uberfy” the world with convenient mobile services that match demand with supply conveniently via software. From laundry and medical marijuana to in-home massage and the outsourcing of errands, there is an app that will get it for you with just one click.

- Changing consumer mind-set will challenge retailers: Those who have experienced these services are going to demand faster turnaround times on everything at the convenience levels they have become accustomed to. This new consumer mind-set challenges retailers to be more responsive.

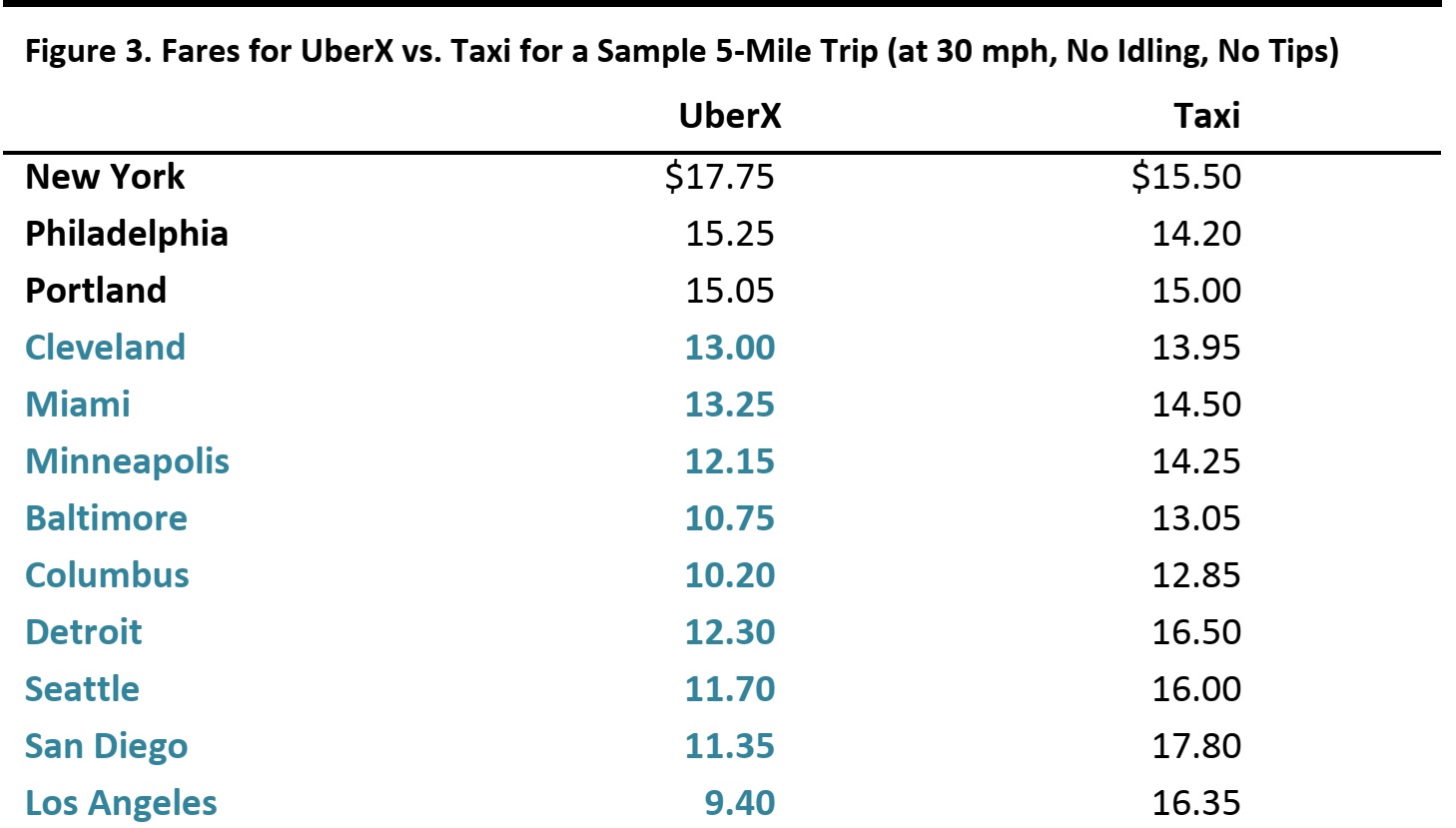

- Opportunities for retailers: How much is convenience worth? An Uber ride is not always cheaper than a taxi ride, which means that consumers are willing to pay a premium for on-demand services. Retailers should not focus too much on price – they can also identify areas where customers are willing to pay more for convenience.

What is Uber? It Rationalizes Markets by Connecting Drivers to Riders

Uber is essentially an app that connects drivers directly with passengers, rather than through a centralized booking service or just by hailing a taxi on the street. The app—which is available on both Android and iOS—pitches itself as a safe and reliable way to get on-demand rides in most of the world’s major cities.

The Uber app allows users to request a ride and track when it will arrive along with its progress in real time. Both the rider and driver can see each other’s picture and profile on the app, which requires both parties to accept one another before a ride is arranged. The app then provides navigation information to the driver using the Global Positioning System (GPS), to both the customer’s location and destination.

The Uber app also facilitates direct payment. It calculates the estimated fare ahead of time and transfers the money electronically, so no money need change hands, and Uber takes its cut from the fare.

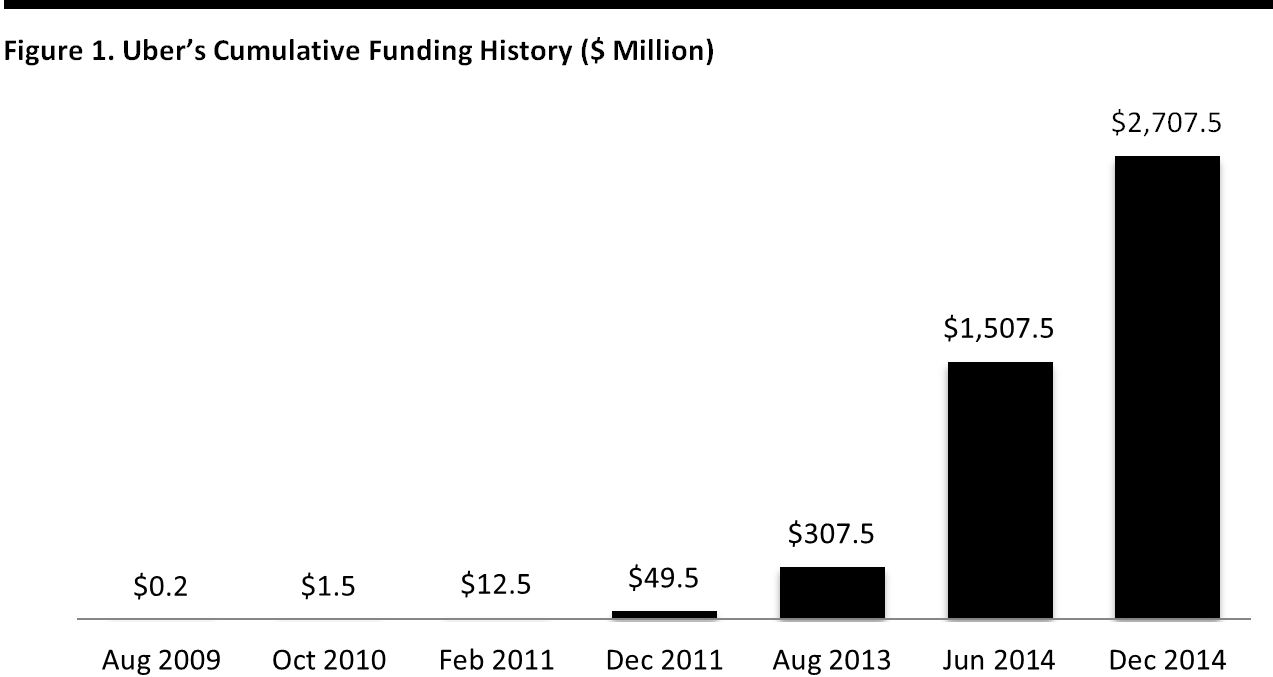

Uber’s Phenomenal Growth Has Catapulted its Valuation to $40 billion

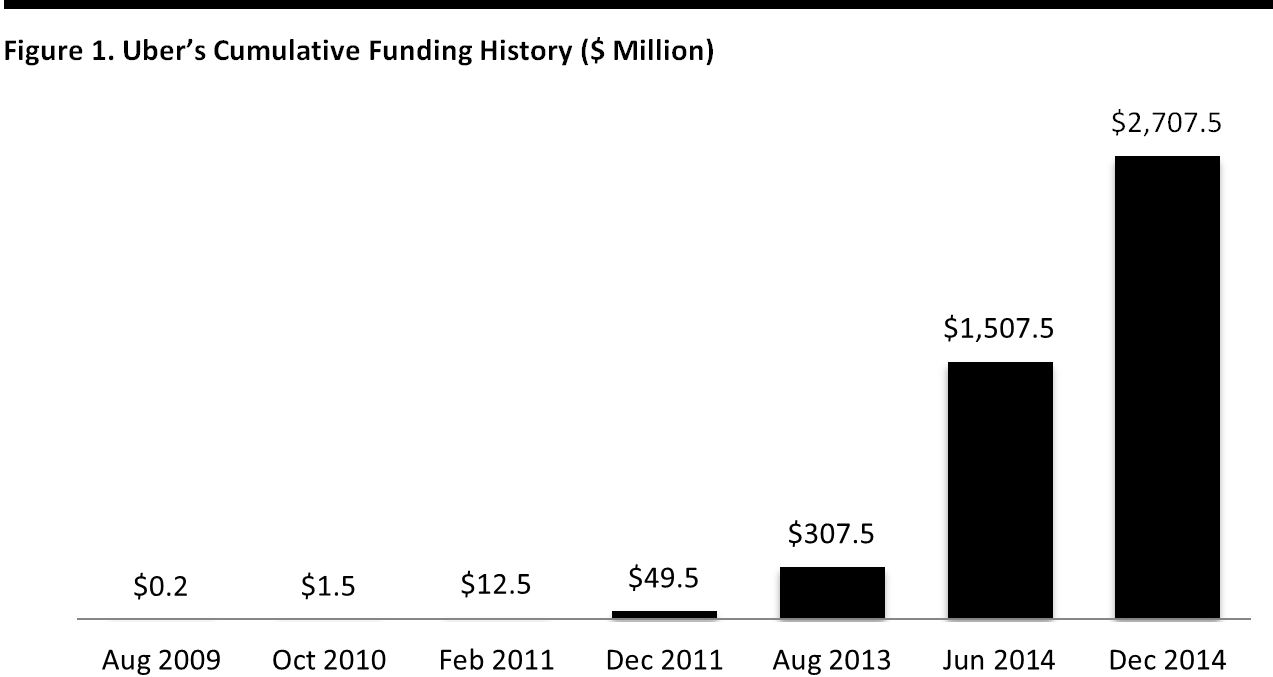

In August 2013, Google Ventures officially cast its vote of confidence in Uber with a $258 million investment—a full 86% of Uber’s then-$300 million annual budget.

After raising money in June of this year at an $18 billion valuation, Uber raised an additional $1.2 billion in its latest funding round this December, putting its valuation at a whopping $40 billion. In other words, Uber’s valuation more than doubled in just six months.

Uber has raised $4.5 billion in funding since 2013 alone

Source: CrunchBase

What began in 2009 as a luxury car service in San Francisco now operates in more than 200 cities worldwide. “It’s probably the fastest international expansion that I’ve ever seen from a venture-backed company,” noted Bill Gurley, a venture capitalist at Benchmark, which invested in Uber in 2011.

Uber Wants to Be Your “Delivery Guy” Too

Leveraging its network of drivers, Uber is also experimenting with different delivery service options in a widespread effort to find new avenues to expand its business. If it can move people, it certainly can move things too.

This August, Uber began testing uberFRESH, a service that provides lunch between 11:30 a.m. and 2:30 p.m. to customers in a Santa Monica, CA trial area. It first offered a prix-fixe menu with a different selection every day, with a new selection every week, for $12 per meal. In November, uberFRESH expanded into Beverly Hills and West Hollywood.

Other similar experiments include the Uber Corner Store in the Washington, DC area, which offers on-demand delivery of corner-store staple items.

Rapid Expansion Has Created Regulatory Hurdles and Safety Concerns

In the course of its rapid global expansion, Uber often encounters regulatory issues as it attempts to enter new markets. Uber has been banned nationwide in Germany, Spain, the Netherlands and Thailand, and regionally in India, Korea and Belgium. In other parts of Europe and Asia, regulators and industry organizations alike are trying to pressure Uber to follow the same rules as local taxi services.

Another major challenge facing Uber is the increasingly frequent reports of alleged sexual harassment by (often non-professional UberX) drivers. The latest hit against the rideshare app involves an alleged rape by a driver in New Delhi.

The Rise of the Sharing Economy

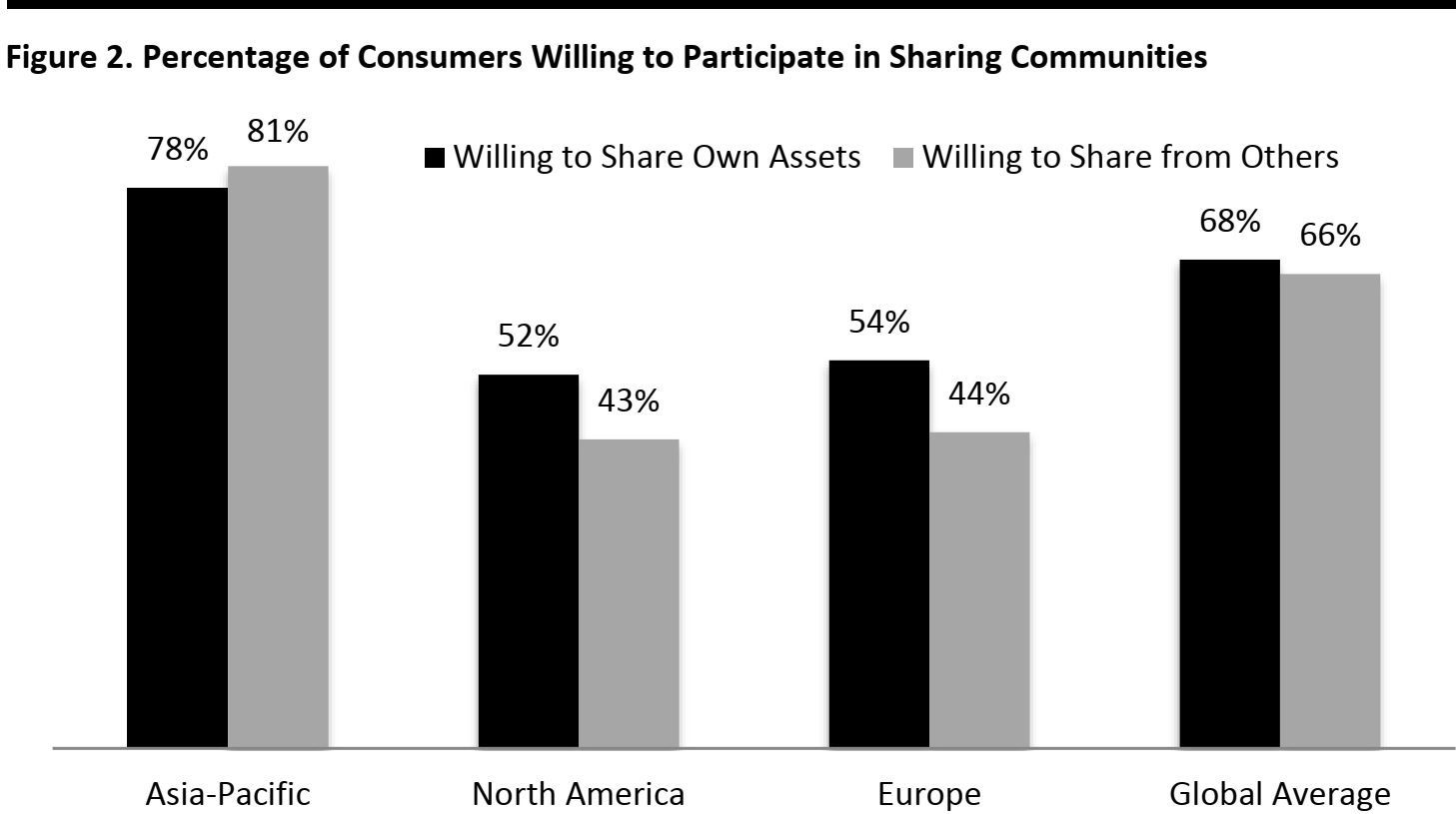

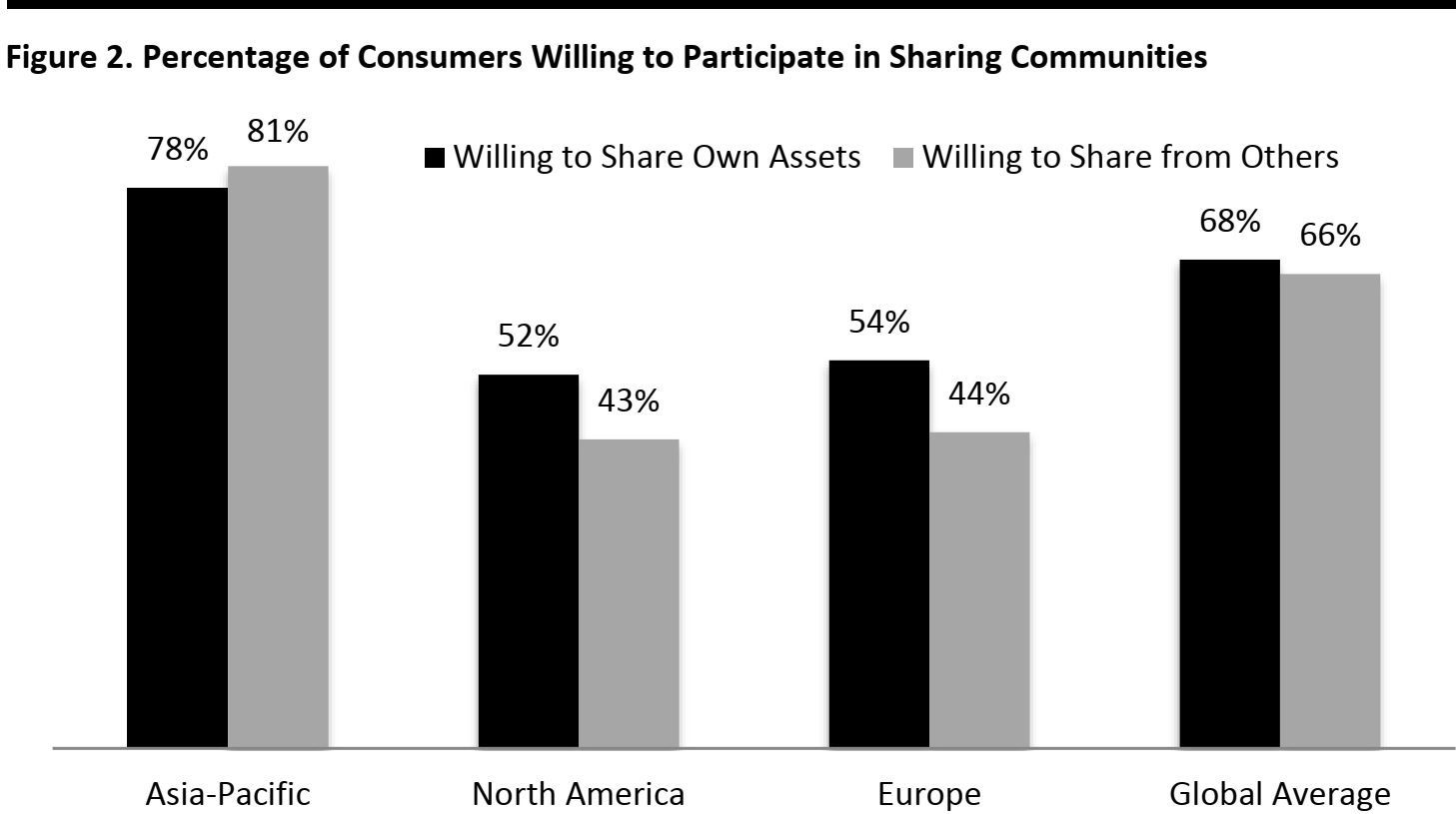

Uber’s success is often attributed to the “sharing economy,” which has spawned a type of business model built upon the sharing of resources – allowing customers to access goods without ownership. It is also referred to as the peer-to-peer economy, mesh, collaborative economy and collaborative consumption. In the sharing economy, owners rent out an asset they are not using, such as a car, house or bicycle to a stranger using these peer-to-peer services. Figure 2 shows that a large number of people are now willing to share assets with and from others.

Worldwide, two-thirds of consumers are willing to share

Source: Nielsen

The sharing economy model was first brought to people’s attention by Airbnb, a website that facilitates renting out a part—or all—of one’s home, primarily to travellers. Valued at $13 billion in October (ahead of an employee stock sale), Airbnb is worth more than the market value of many large hotel chains, such as Wyndham ($10.2 billion) and Hyatt ($8.8 billion), and may soon overtake Hilton ($25.7 billion). (Market values as of December 10, 2014.) This serves as a perfect example of how today’s networked platforms can disrupt traditional industries and their participants.

Uber allows non-professional drivers to enter the market and offer quasi-taxi services, as well as enabling professional drivers’ to make use of their “off”-time (as well as their vehicles) to provide a service to others and earn money at the same time.

On-demand Services Provide New Level of Convenience and Comfort

People feel positively about Uber because it provides an on-demand service at an affordable price. Taxi rides can be unpleasant, especially when the passenger has to wait outside in inclement weather. While the passenger can call for a taxi over the phone, he or she might face a longer wait time before the car arrives.

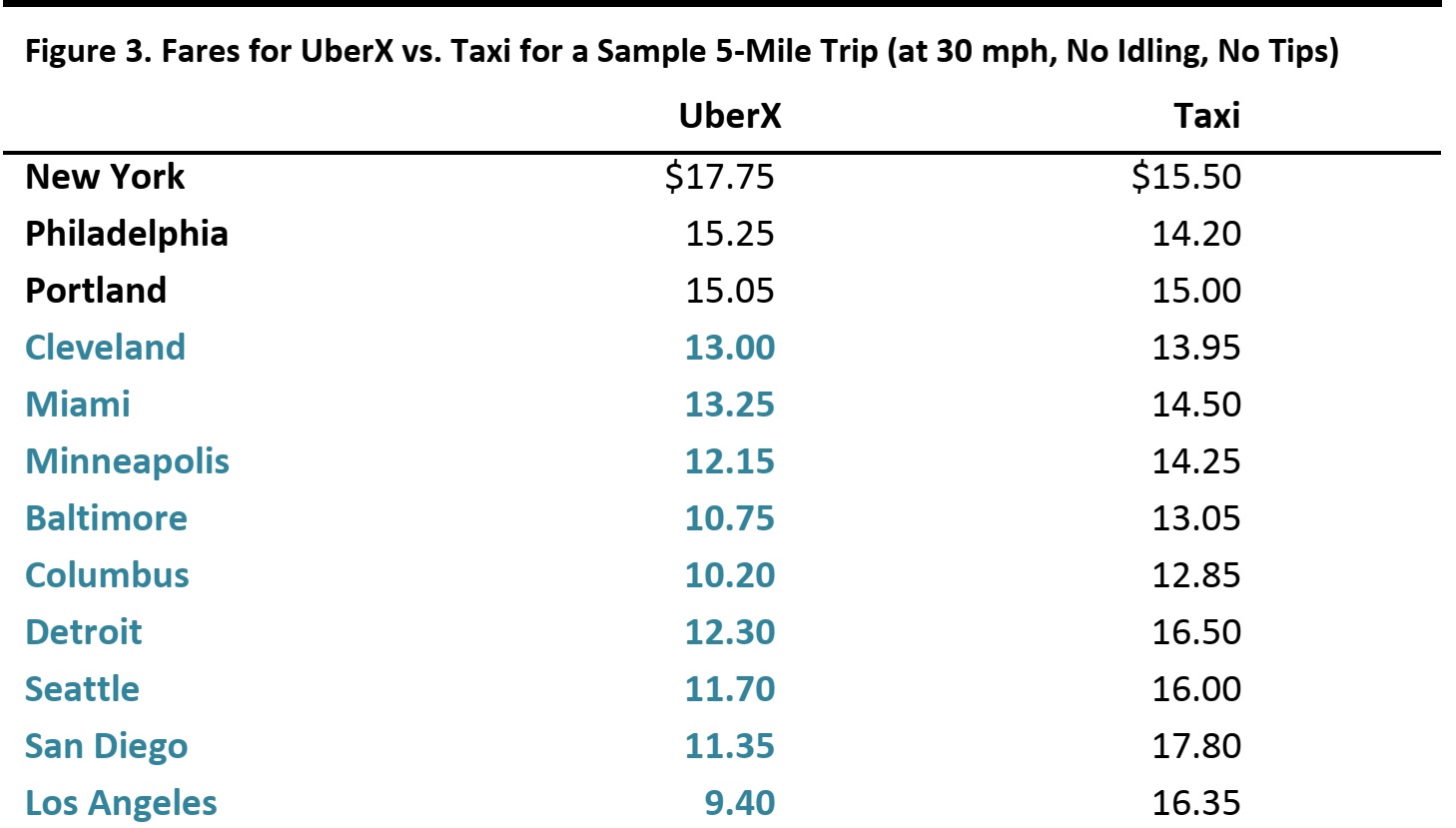

Uber democratizes the car service industry by breaking up the silos between different companies that provide taxi and limo services. By aggregating and matching driver supply and passenger demand on a massive scale, Uber is able to allocate resources efficiently, and therefore maximize convenience and choice for users. Unburdened of the high overhead of taxi companies, Uber offers its services at highly competitive prices. UberX, Uber’s cheapest service in the U.S., charges much less than a taxi in most cities (see Figure 3).

UberX offers cheaper rides than many taxi services

Source: Business Insider

As mobile devices become more popular and powerful, more and more services are becoming available to us with a push of a button. According to BRE Venture’s Steve Schlafman, these “on-demand mobile services” (ODMS) deliver a “closed loop” experience by collapsing the value chain including discovery, order, payment, fulfilment (offline but within an owned network) and confirmation. This definition emphasizes that the service is fulfilled offline with direct interactions between providers and recipients, and that the loop is closed because payment is made on the same platform (as opposed to a referral model where payment is made outside of the platform).

From Uber to Uberification: Startups Match Demand with Supply

Inspired by Uber’s business model and the concept of sharing and an on-demand economy, start-ups are increasingly seeking to “uberfy” the world with convenient services that match demand with supply digitally.

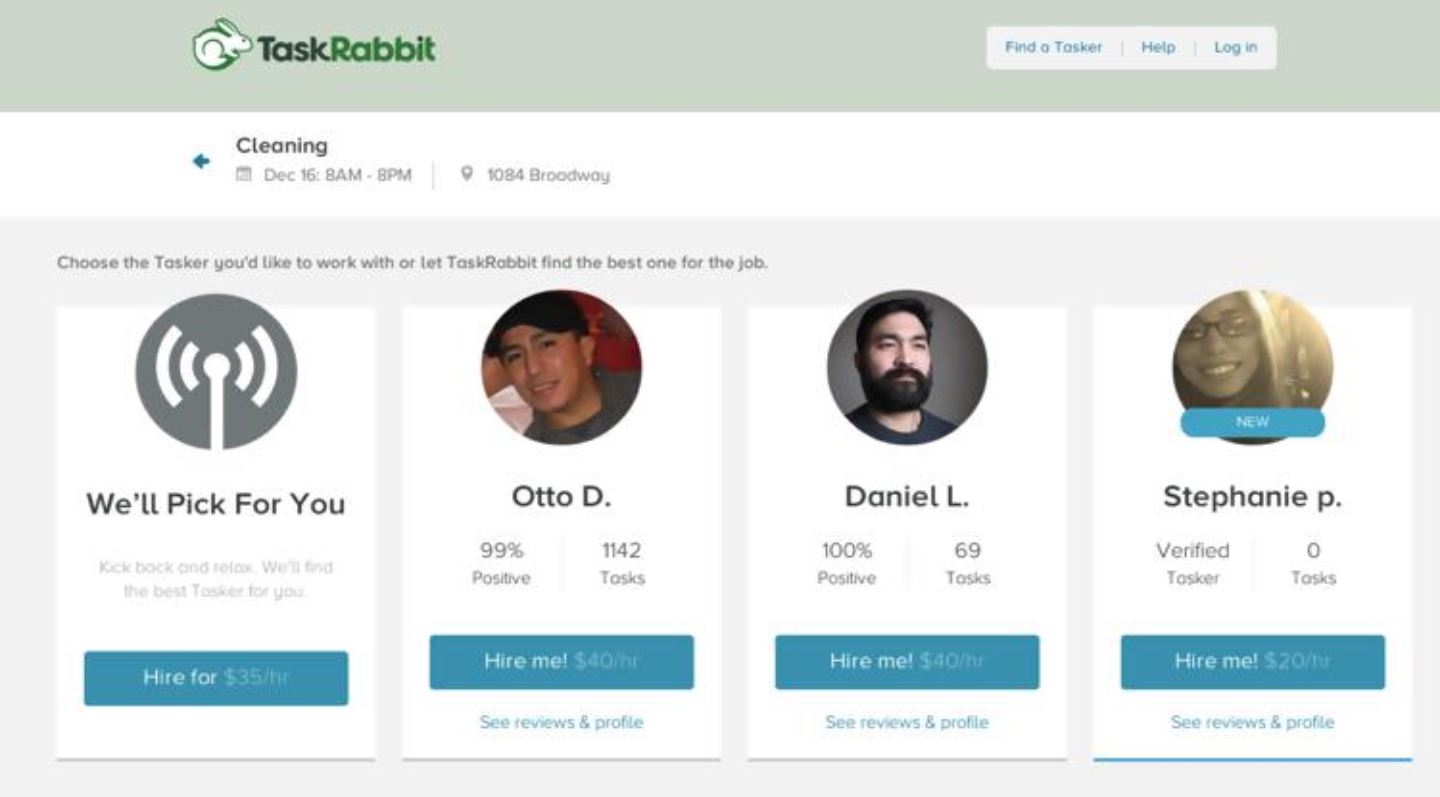

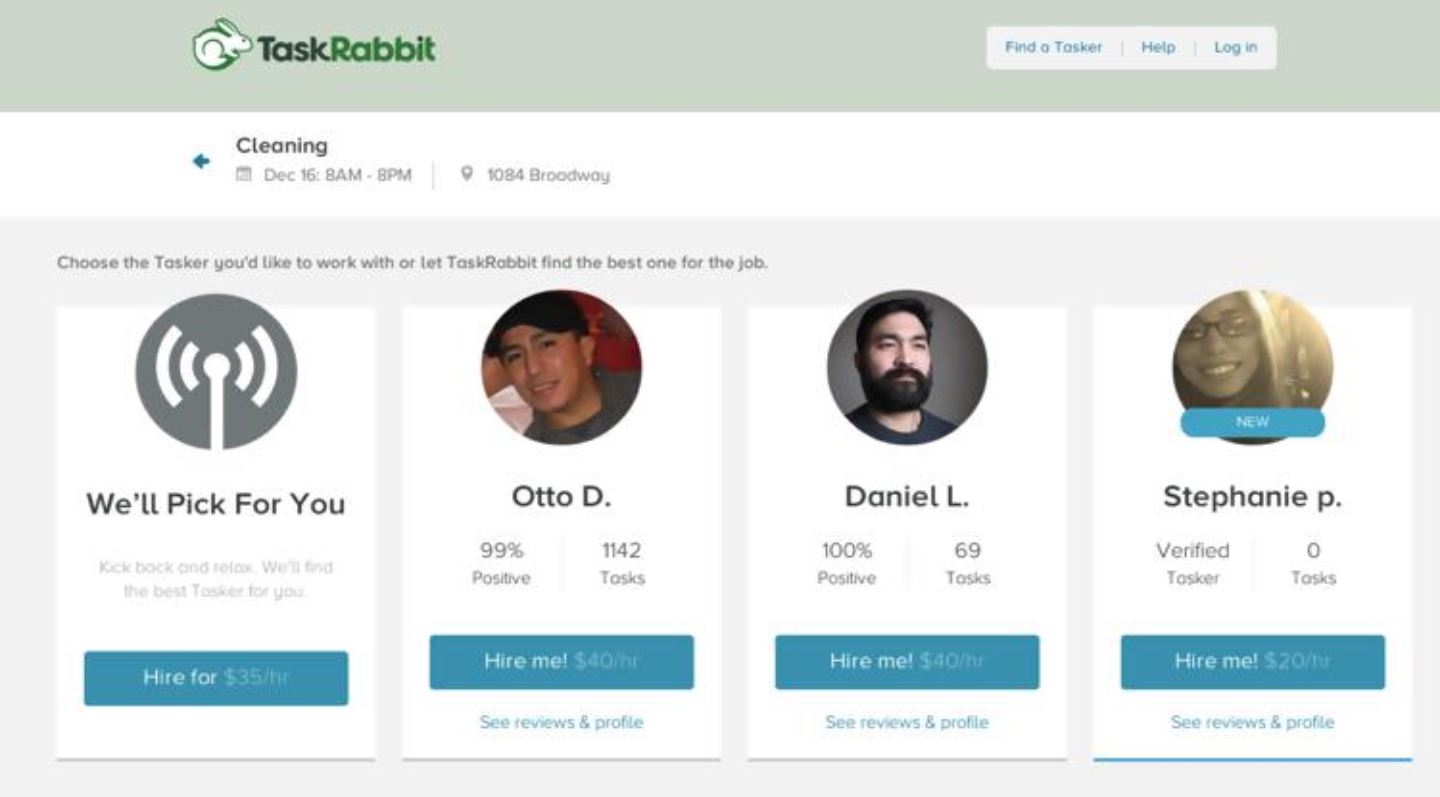

For example, TaskRabbit allows users to outsource small jobs and tasks to others in their neighborhood. Under the slogan of “neighbors helping neighbors,” TaskRabbit added 1.25 million users to its system in 2013 and doubled its force of contractors to 25,000.

Similarly, Washio enables consumers to have their laundry and dry cleaning picked up and dropped off at their home or office. Customers schedule the place and time, and a driver comes to pick up the customer’s laundry. A day later, the driver returns with clean clothes. Washio performs the service by organizing a network of piece-rate freelance drivers (whom they call “ninjas”) for delivery and a network of local laundry outlets for the actual cleaning.

Zeel offers an “in-home” massage-on-demand service. Founders of Zeel noticed that most massages are an impulse buy. “If massages were booked two or more days out, there would be cancellation rates of 28%,” commented Zeel’s CEO, Samer Hamadeh. Zeel found that 55% of requests are for within four hours, but “the industry isn’t set up to offer massages within four hours.” With one click on the Zeel mobile app, a massage therapist will show up at the door with a massage table.

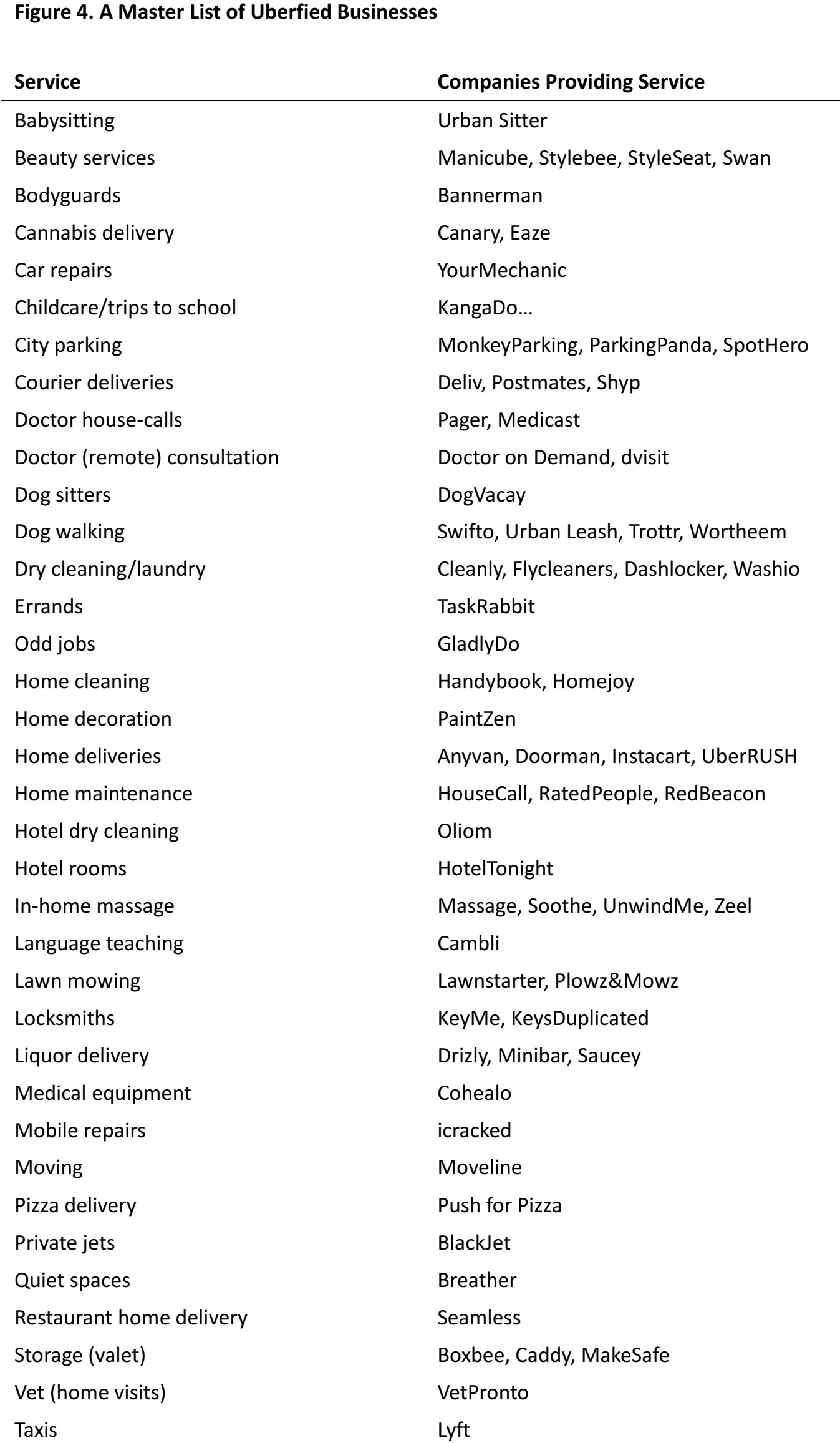

As shown in Figure 4 below, it seems that practically all kinds of services can be “uberfied”. This trend of further disintermediation is often referred to as the “Uberification of the economy.”

The Implications of Uberification: Retail on Demand?

While most of the uber-style start-ups listed above provide on-demand services, rather than on-demand delivery of physical merchandise, the line between the two is thin, as demonstrated by Uber’s lunch and corner-store item delivery trial programs.

The rising demand for convenience has fuelled the growth of Uber and uber-style start-ups. In turn, those who have experienced these services are likely to demand faster turnaround times on everything at the convenience levels they have become accustomed to. This new consumer mind-set challenges all retailers to be more responsive.

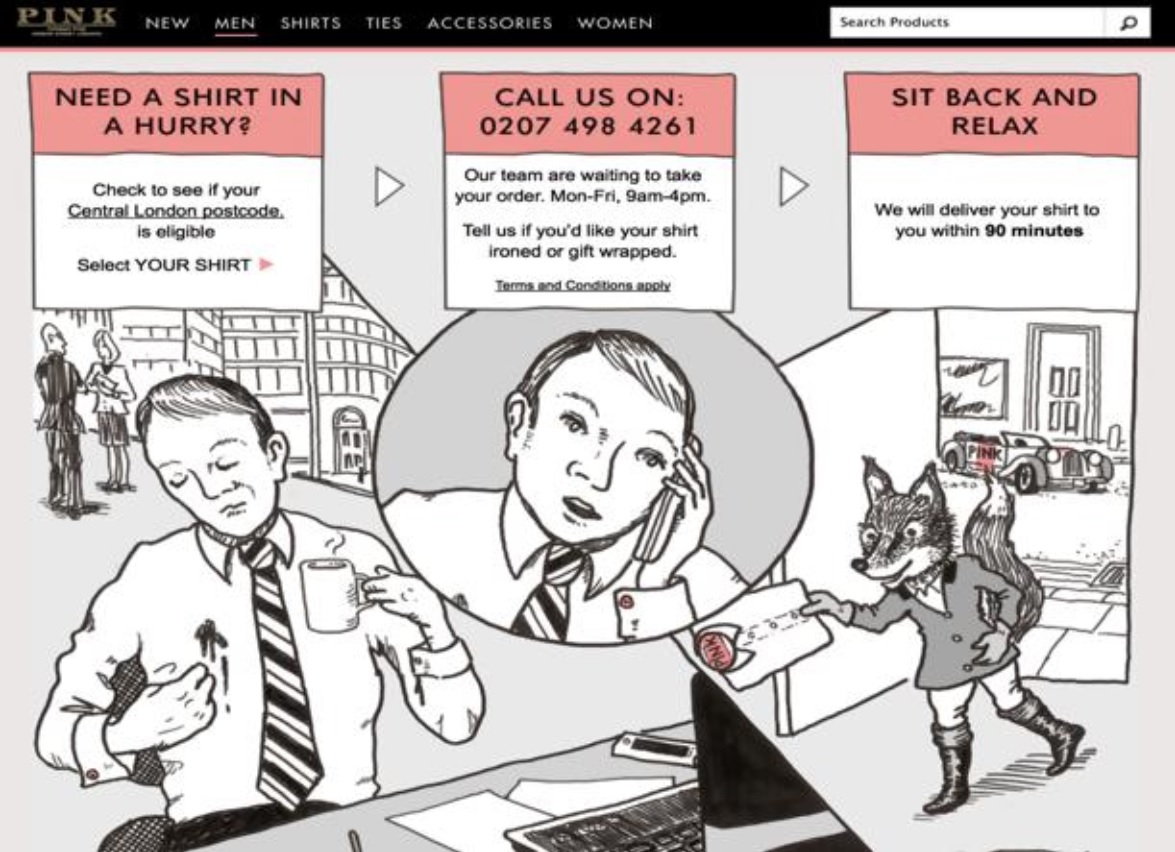

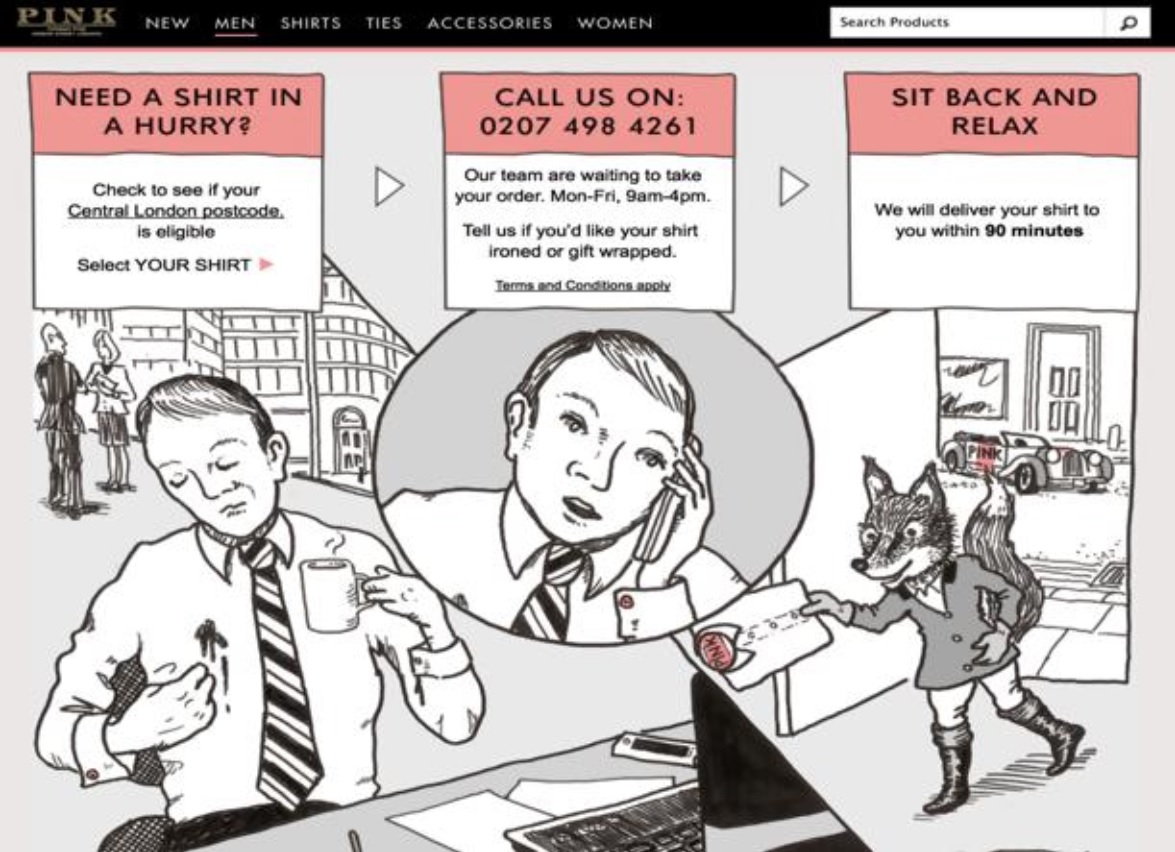

Retailers are taking up the challenge. London shirt tailor and retailer Thomas Pink has uberfied its e-commerce website into an on-demand mobile service that will deliver a shirt to your office—or wherever you and your mobile phone are located—within 90 minutes. This could really come in handy if you happen to spill coffee on your shirt.

An Uber ride is not always cheaper than a cab ride, which means that consumers are willing to pay a premium for on-demand services. Equipped with this insight, retailers can identify other areas where customers are willing to pay more for convenience.

There Is an Uber for Everything

Source: Digital Intelligence Today

Uber is essentially an app that connects drivers directly with passengers, rather than through a centralized booking service or just by hailing a taxi on the street. The app—which is available on both Android and iOS—pitches itself as a safe and reliable way to get on-demand rides in most of the world’s major cities.

The Uber app allows users to request a ride and track when it will arrive along with its progress in real time. Both the rider and driver can see each other’s picture and profile on the app, which requires both parties to accept one another before a ride is arranged. The app then provides navigation information to the driver using the Global Positioning System (GPS), to both the customer’s location and destination.

The Uber app also facilitates direct payment. It calculates the estimated fare ahead of time and transfers the money electronically, so no money need change hands, and Uber takes its cut from the fare.

Uber is essentially an app that connects drivers directly with passengers, rather than through a centralized booking service or just by hailing a taxi on the street. The app—which is available on both Android and iOS—pitches itself as a safe and reliable way to get on-demand rides in most of the world’s major cities.

The Uber app allows users to request a ride and track when it will arrive along with its progress in real time. Both the rider and driver can see each other’s picture and profile on the app, which requires both parties to accept one another before a ride is arranged. The app then provides navigation information to the driver using the Global Positioning System (GPS), to both the customer’s location and destination.

The Uber app also facilitates direct payment. It calculates the estimated fare ahead of time and transfers the money electronically, so no money need change hands, and Uber takes its cut from the fare.

Other similar experiments include the Uber Corner Store in the Washington, DC area, which offers on-demand delivery of corner-store staple items.

Other similar experiments include the Uber Corner Store in the Washington, DC area, which offers on-demand delivery of corner-store staple items.

People feel positively about Uber because it provides an on-demand service at an affordable price. Taxi rides can be unpleasant, especially when the passenger has to wait outside in inclement weather. While the passenger can call for a taxi over the phone, he or she might face a longer wait time before the car arrives.

Uber democratizes the car service industry by breaking up the silos between different companies that provide taxi and limo services. By aggregating and matching driver supply and passenger demand on a massive scale, Uber is able to allocate resources efficiently, and therefore maximize convenience and choice for users. Unburdened of the high overhead of taxi companies, Uber offers its services at highly competitive prices. UberX, Uber’s cheapest service in the U.S., charges much less than a taxi in most cities (see Figure 3).

UberX offers cheaper rides than many taxi services

People feel positively about Uber because it provides an on-demand service at an affordable price. Taxi rides can be unpleasant, especially when the passenger has to wait outside in inclement weather. While the passenger can call for a taxi over the phone, he or she might face a longer wait time before the car arrives.

Uber democratizes the car service industry by breaking up the silos between different companies that provide taxi and limo services. By aggregating and matching driver supply and passenger demand on a massive scale, Uber is able to allocate resources efficiently, and therefore maximize convenience and choice for users. Unburdened of the high overhead of taxi companies, Uber offers its services at highly competitive prices. UberX, Uber’s cheapest service in the U.S., charges much less than a taxi in most cities (see Figure 3).

UberX offers cheaper rides than many taxi services

Similarly, Washio enables consumers to have their laundry and dry cleaning picked up and dropped off at their home or office. Customers schedule the place and time, and a driver comes to pick up the customer’s laundry. A day later, the driver returns with clean clothes. Washio performs the service by organizing a network of piece-rate freelance drivers (whom they call “ninjas”) for delivery and a network of local laundry outlets for the actual cleaning.

Zeel offers an “in-home” massage-on-demand service. Founders of Zeel noticed that most massages are an impulse buy. “If massages were booked two or more days out, there would be cancellation rates of 28%,” commented Zeel’s CEO, Samer Hamadeh. Zeel found that 55% of requests are for within four hours, but “the industry isn’t set up to offer massages within four hours.” With one click on the Zeel mobile app, a massage therapist will show up at the door with a massage table.

As shown in Figure 4 below, it seems that practically all kinds of services can be “uberfied”. This trend of further disintermediation is often referred to as the “Uberification of the economy.”

Similarly, Washio enables consumers to have their laundry and dry cleaning picked up and dropped off at their home or office. Customers schedule the place and time, and a driver comes to pick up the customer’s laundry. A day later, the driver returns with clean clothes. Washio performs the service by organizing a network of piece-rate freelance drivers (whom they call “ninjas”) for delivery and a network of local laundry outlets for the actual cleaning.

Zeel offers an “in-home” massage-on-demand service. Founders of Zeel noticed that most massages are an impulse buy. “If massages were booked two or more days out, there would be cancellation rates of 28%,” commented Zeel’s CEO, Samer Hamadeh. Zeel found that 55% of requests are for within four hours, but “the industry isn’t set up to offer massages within four hours.” With one click on the Zeel mobile app, a massage therapist will show up at the door with a massage table.

As shown in Figure 4 below, it seems that practically all kinds of services can be “uberfied”. This trend of further disintermediation is often referred to as the “Uberification of the economy.”

An Uber ride is not always cheaper than a cab ride, which means that consumers are willing to pay a premium for on-demand services. Equipped with this insight, retailers can identify other areas where customers are willing to pay more for convenience.

An Uber ride is not always cheaper than a cab ride, which means that consumers are willing to pay a premium for on-demand services. Equipped with this insight, retailers can identify other areas where customers are willing to pay more for convenience.