Nitheesh NH

On November 1, 2020, two REITs—CBL and PREIT—filed for bankruptcy protection. Both filings were voluntary, triggering agreements that had been reached with creditors.

Company comments regarding the filings are as follows:

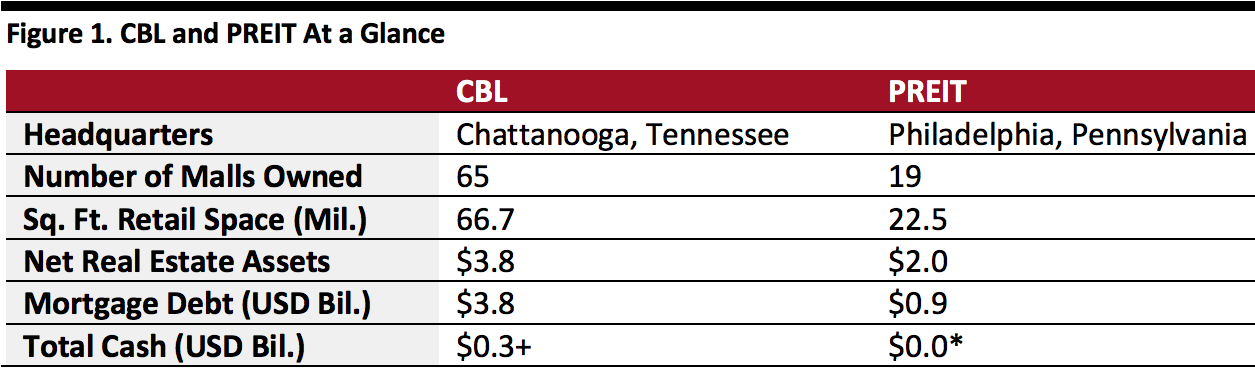

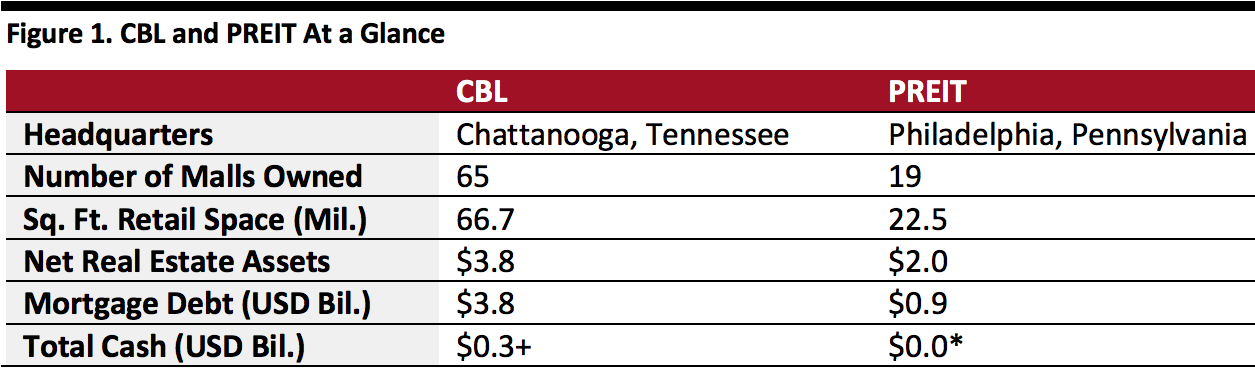

* $41 million, which rounds to $0.0 billion in total

* $41 million, which rounds to $0.0 billion in total

Financials as of June 30, 2020

+ As of September 30, 2020

Source: Company reports[/caption] Coresight Research’s Take: More Filings Are Likely To Come These two bankruptcy filings represent the first events in what is likely to be a long restructuring process among retailers, landlords and landlord creditors. The inability of many retailers to pay rent puts landlords in a difficult position with their creditors, leading to bankruptcy filings and debt restructurings. As of October 30, we tracked 29 major retailer bankruptcies in our weekly Store Tracker. There have been no major retailer filings in September and October, suggesting that retailers are seeking to push through the all-important holiday retail season. There are likely to be more filings after the season, once retailers add up the figures and make their projections for 2021. We expect a blockbuster holiday season that is up 5%, driven by an increase in e-commerce sales of 33.5%, as reported in our US Retail Outlook. However, it will likely be a tough holiday for brick-and-mortar stores: The latest Coresight Research US consumer survey, conducted on October 27, found that 55.4% of respondents are currently avoiding shopping centers and malls. Shippers including FedEx, UPS and the USPS expect to be at full capacity this holiday season, building on already record e-commerce sales, year to date. Holiday shipping surcharges and bottlenecks could cause consumers to reconsider entering stores or look to alternative gifts such as gift cards or homemade items.

- CBL commented that its negotiations with creditors had significantly strengthened its balance sheet, reducing total debt by $1.5 billion.

- PREIT commented that it will pay all vendors, suppliers and employees during the course of the bankruptcy process and that its creditor banks have committed to providing an additional $150 million to recapitalize its business and extend its debt maturity schedule.

* $41 million, which rounds to $0.0 billion in total

* $41 million, which rounds to $0.0 billion in totalFinancials as of June 30, 2020

+ As of September 30, 2020

Source: Company reports[/caption] Coresight Research’s Take: More Filings Are Likely To Come These two bankruptcy filings represent the first events in what is likely to be a long restructuring process among retailers, landlords and landlord creditors. The inability of many retailers to pay rent puts landlords in a difficult position with their creditors, leading to bankruptcy filings and debt restructurings. As of October 30, we tracked 29 major retailer bankruptcies in our weekly Store Tracker. There have been no major retailer filings in September and October, suggesting that retailers are seeking to push through the all-important holiday retail season. There are likely to be more filings after the season, once retailers add up the figures and make their projections for 2021. We expect a blockbuster holiday season that is up 5%, driven by an increase in e-commerce sales of 33.5%, as reported in our US Retail Outlook. However, it will likely be a tough holiday for brick-and-mortar stores: The latest Coresight Research US consumer survey, conducted on October 27, found that 55.4% of respondents are currently avoiding shopping centers and malls. Shippers including FedEx, UPS and the USPS expect to be at full capacity this holiday season, building on already record e-commerce sales, year to date. Holiday shipping surcharges and bottlenecks could cause consumers to reconsider entering stores or look to alternative gifts such as gift cards or homemade items.