DIpil Das

What’s the Story?

Singles’ Day, also known by Alibaba as the 11.11 Global Shopping Festival, has become China’s most important online shopping festival, with consumers flocking to major Chinese e-commerce platforms such as Tmall and JD.com, to take advantage of promotions. Now that the coronavirus lockdown has lifted, many brands and retailers are looking for the event to help them hit revenue targets. From now until the event in November, merchants, including brands, retailers and other sellers can actively prepare for Singles’ Day by driving online traffic to their Taobao or Tmall stores. In this report, we discuss the new event timeline for Singles’ Day 2020 and highlight five marketing and advertising tools that brands and retailers can use to raise brand awareness and acquire traffic during the accumulation and warmup period.Timeline Changes: Two Explosion Periods for Singles’ Day 2020

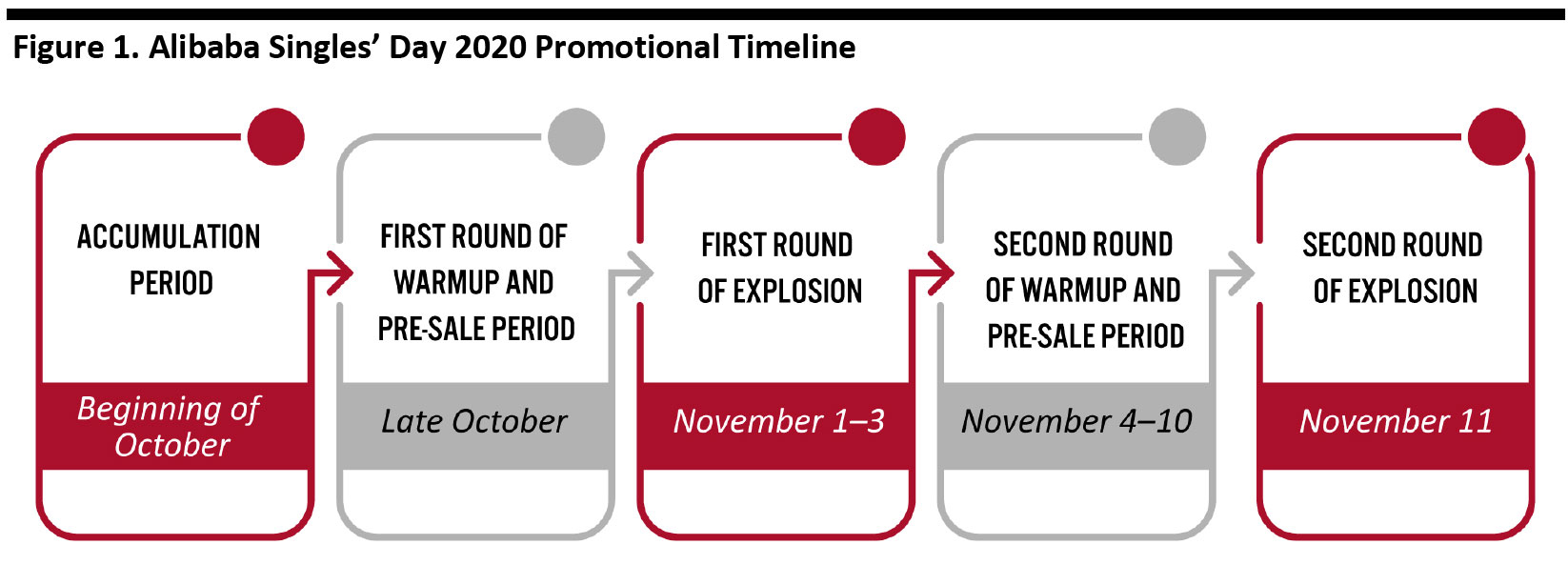

As the negative impacts of the coronavirus pandemic continue, many consumers are keeping a tighter grip on their spending, particularly in discretionary categories. Participating in Singles’ Day could help international brands and retailers to boost sales and clear inventories in non-Western markets. Alibaba plans to unveil its Go Global 11.11 Pitch Fest on September 15, which will allow a group of US small and medium-sized businesses that do not have a Tmall or Taobao storefronts to participate in Singles’ Day 2020. Alibaba expects at least 250,000 brands to join Singles’ Day 2020, including 2,600 international brands on Tmall Global—compared to a total of approximately 200,000 brands for last year’s event. The timeline for Alibaba’s 2020 event is different to that of previous years. Alibaba announced on August 12 that it will have two “explosion” periods for the official sale, extending the length of the annual shopping extravaganza from a 24-hour online sale event to a shopping season of just under a month. In 2019, rival e-commerce giants JD.com and Suning extended their sale periods and launched their sales as early as November 1. The first round of Alibaba’s warmup and pre-sale period will take place in late October, when consumers can preview promotions that will be offered, then put down deposits before completing orders and finalizing payments during the explosion period. The first round will kick off on November 1 and will last three days, focusing on trendy categories, new products and smaller brands. November 4–10 will see the second round of Alibaba’s warmup and pre-sale period, followed by the traditional 24-hour shopping explosion on November 11. We summarize this timeline in Figure 1. [caption id="attachment_116039" align="aligncenter" width="700"] Source: Alibaba/Coresight Research[/caption]

The change of timeline to include two pre-sale and two official sale periods this year will enable brands and retailers to better prepare for the event and provide consumers with an enhanced shopping experience. After the first round of explosion, Alibaba will offer data and feedback to brands and retailers so they can rapidly adjust and improve their sales and promotional strategy for the second round. The diversion of the peak shopping period on November 11 also helps to lighten the burden on logistics operations in terms of handling and fulfilling the spike in order volumes. Meanwhile, consumers could have their online orders delivered faster.

Source: Alibaba/Coresight Research[/caption]

The change of timeline to include two pre-sale and two official sale periods this year will enable brands and retailers to better prepare for the event and provide consumers with an enhanced shopping experience. After the first round of explosion, Alibaba will offer data and feedback to brands and retailers so they can rapidly adjust and improve their sales and promotional strategy for the second round. The diversion of the peak shopping period on November 11 also helps to lighten the burden on logistics operations in terms of handling and fulfilling the spike in order volumes. Meanwhile, consumers could have their online orders delivered faster.

Leveraging Alibaba’s Digital Marketing Tools

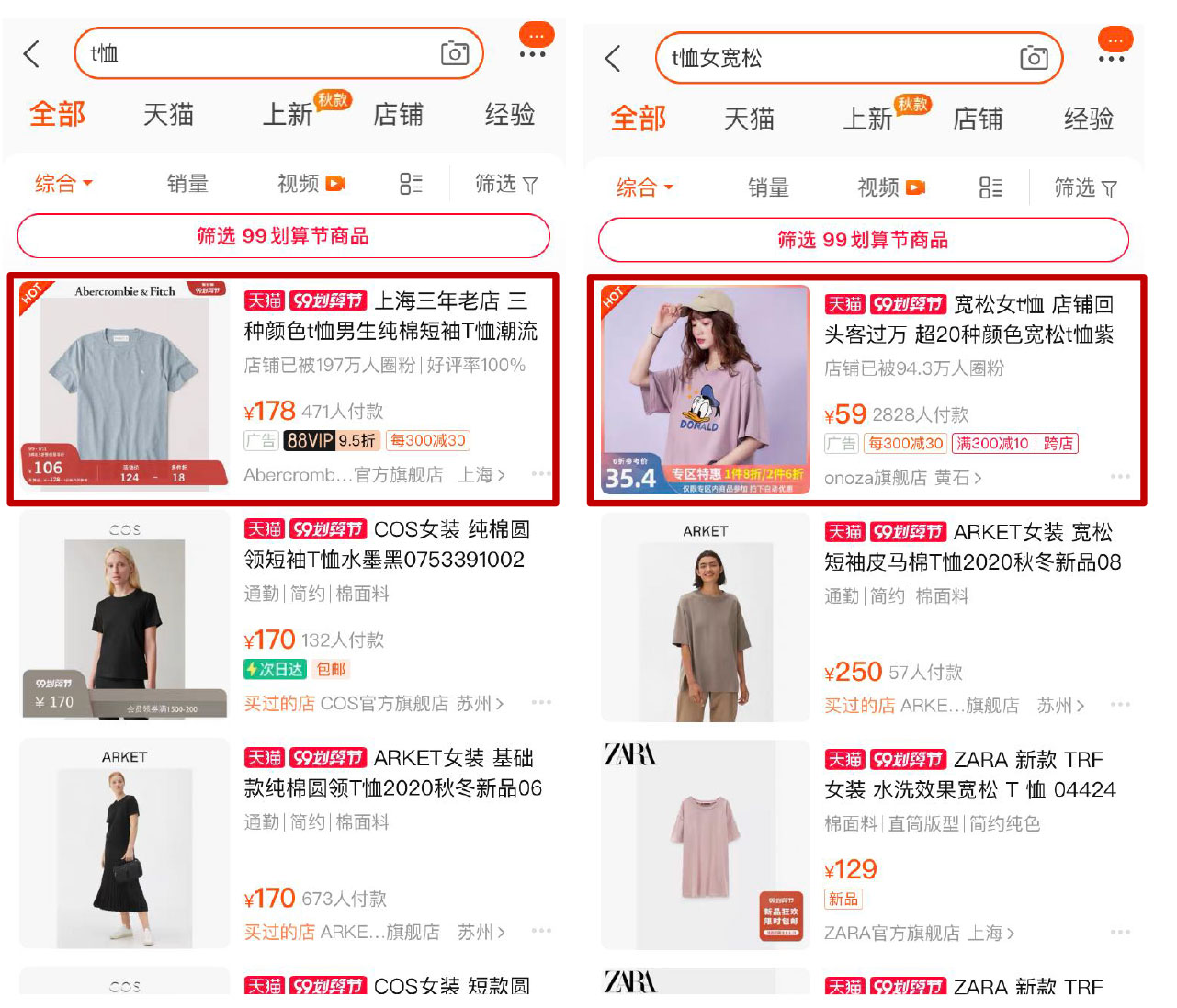

With increasing numbers of brands and retailers participating in the event, it is more important than ever for brands to develop a robust digital marketing strategy. Alibaba’s digital marketing platform Alimama provides a variety of advertising solutions powered by its big data capabilities to help brands and retailers to stand out on Singles’ Day. As of June 2020, Alibaba has 874 million active mobile users per month on Taobao and Tmall. This massive user base enables Alibaba to provide useful insights for sellers to leverage. Below, we highlight five types of advertising solutions that brands and retailers can adopt to increase their brand visibility and better engage with target consumers during the warmup and pre-sale periods—and ultimately boost sales. 1. Zhitongche Search Ads Zhitongche is a type of search engine marketing and is one of the most popular traffic driving advertising method offered by Alibaba. Brands and retailers can optimize their product listing in search rankings on Taobao or Tmall by using certain keywords to enable greater visibility. The keywords can be more general—for example, a product category such as “T-shirts” or apply to a specific product type, such as “women’s loose T-shirts.” Alibaba has made it possible for brands and retailers that pay for search ads to target specific types of users—such as female consumers in their twenties who have bought T-shirts from a rival brand in the past six months. Zhitongche will display products to shoppers that are likely to be most interested, based on these consumer insights. Zhitongche can be an effective tool for sales conversion, as consumers who use search bars to look for products typically have high buying intent. The payment model of Zhitongche is cost-per-click, so brands will only be charged when the ad is clicked. [caption id="attachment_116029" align="aligncenter" width="700"] Search ads prioritized at the top of the search lists Source: Taobao [/caption]

2. Super Diamond Booth Display Ads

Super Diamond Booth displays banner advertisements and prioritizes them according to real-time bids. The tool got upgraded in May and now has capacity to reach targeted customers across different platforms, including third-party platforms, increasing the precision of customer segmentation. It tracks and records customer behavior when customers search, browse, bookmark and order on Tmall and Taobao. Customers are then tagged in the system based on shopping and browsing behavior—information which is then used to direct advertising.

The banner ads can be displayed within the entire Alibaba ecosystem, including the main page of the Tmall and Taobao apps, payment app Alipay, video streaming app Youku, map app Amap, as well as on other platforms such as Weibo and Douyin—reaching almost all potential consumers. Brands and retailers can use this type of ad to attract new customers.

[caption id="attachment_116030" align="aligncenter" width="419"]

Search ads prioritized at the top of the search lists Source: Taobao [/caption]

2. Super Diamond Booth Display Ads

Super Diamond Booth displays banner advertisements and prioritizes them according to real-time bids. The tool got upgraded in May and now has capacity to reach targeted customers across different platforms, including third-party platforms, increasing the precision of customer segmentation. It tracks and records customer behavior when customers search, browse, bookmark and order on Tmall and Taobao. Customers are then tagged in the system based on shopping and browsing behavior—information which is then used to direct advertising.

The banner ads can be displayed within the entire Alibaba ecosystem, including the main page of the Tmall and Taobao apps, payment app Alipay, video streaming app Youku, map app Amap, as well as on other platforms such as Weibo and Douyin—reaching almost all potential consumers. Brands and retailers can use this type of ad to attract new customers.

[caption id="attachment_116030" align="aligncenter" width="419"] Banner ads on the main page of the Taobao app

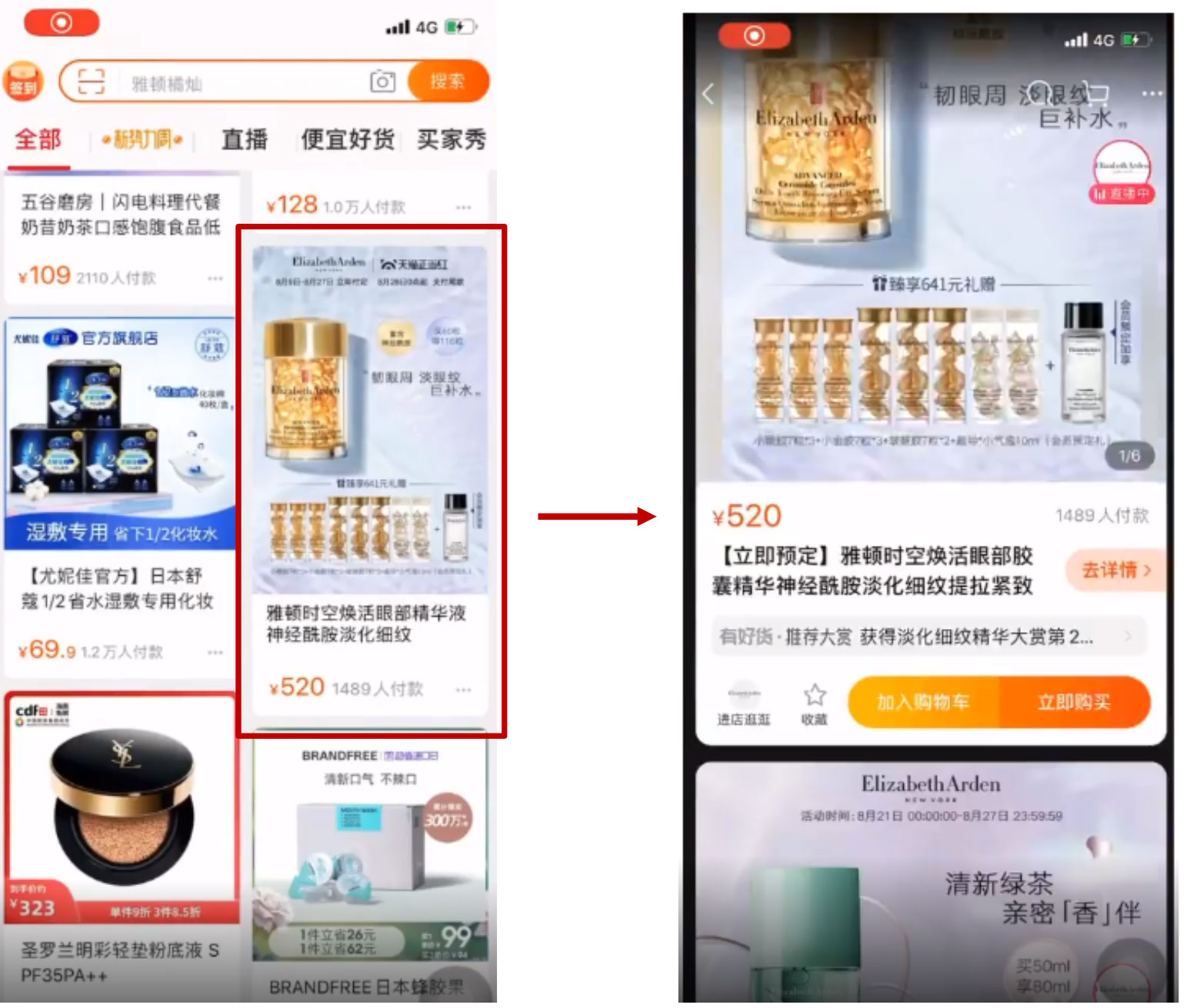

Banner ads on the main page of the Taobao app Source: Taobao [/caption] 3. Super Recommendation Ads Super Recommendation ads are part of Alibaba’s efforts to encourage users to browse products on the Taobao or Tmall app when they aren’t looking for specific items. The company deploys artificial intelligence that uses real-time online data to build models for predicting what consumers want, to provide them with better product recommendations. Personalization ads are placed on almost every page of the Taobao or Tmall app and each app user will see significantly different ads. The “guess you like it” section also displays products to most relevant customers on the shopping cart page, post-transaction page and Weitao. The feed of recommended products can be displayed in multiple formats—from simple product photos to live videos. Alibaba has recently been testing a new function called Minidetail, which can help increase exposure for more than a single product for brands and retailers. When users click on any of the products in the “guess you like it” section, they are directed to a page that displays other similar products in picture or video formats. The page is highly visual and customers can easily view different products by scrolling down. [caption id="attachment_116031" align="aligncenter" width="700"]

New Minidetail function

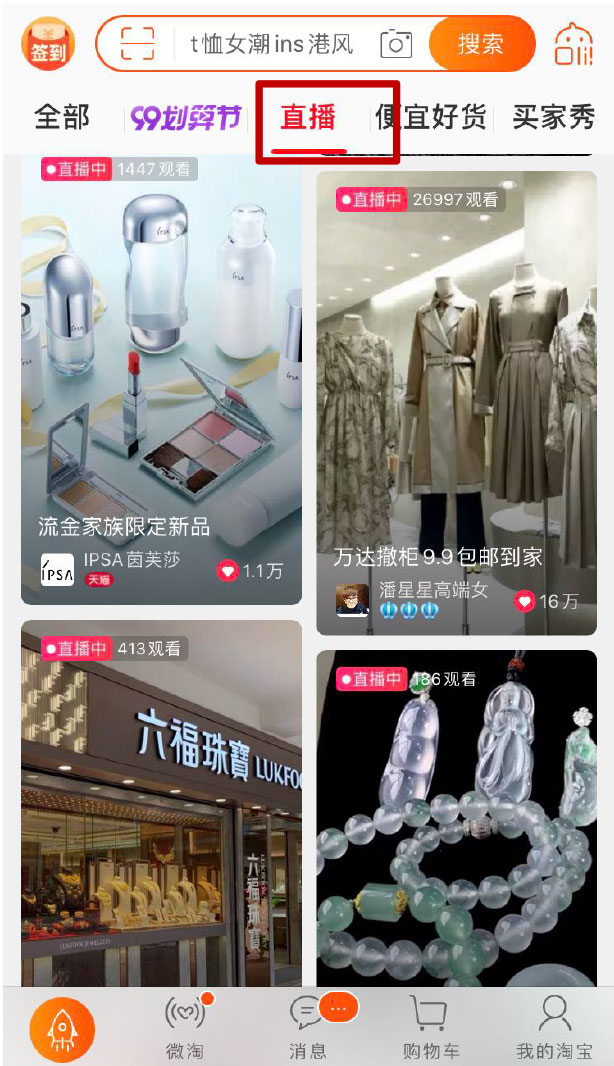

New Minidetail function Source: Alimama [/caption] 4. Super Livestreaming Super Livestreaming is a new marketing tool launched in June that aims to drive traffic before, during and after the livestreaming session. Livestreaming has become the norm in Chinese e-commerce and more brands are jumping on the bandwagon. According to Alibaba, the number of merchants utilizing Taobao Live for the first time increased by 719% month over month in February 2020. However, it is becoming more challenging for brands and retailers to drive a share of this traffic and viewers to their site as more merchants start livestreaming—and other e-commerce sites such as JD.com, short-video platforms Douyin and Kuaishou have also been focusing on livestreaming. Alibaba has added a new livestreaming tab on the main page of its Taobao app that displays recommended livestreaming sessions for each shopper. The livestreaming interface also includes a convenient “swipe” function to encourage viewers to watch other sessions and stay engaged with the livestreaming platform for longer. Similar to Douyin, Alibaba uses algorithms to suggest the next livestreaming session that is likely to appeal to a viewer. Brands can send notifications to customers that have browsed or purchased products from storefronts before a livestreaming session starts. Post livestreaming, brands can continue to send viewers targeted ads to increase sales conversion. [caption id="attachment_116032" align="aligncenter" width="403"]

New livestreaming tab on the main page of the Taobao app

New livestreaming tab on the main page of the Taobao app Source: Taobao [/caption] 5. Super Engagement Alibaba also launched marketing tool Super Engagement this year to leverage Alibaba’s iconic games hosted on the Taobao app to engage with consumers and drive sales. The function is integrated into three in-app games, including Taobao Life, Tmall Farm and Taobao Gold Coin—users can complete different tasks to receive virtual coins or rewards that can be converted into cash or coupons to put towards purchases. Brands and retailers can place ads in any of the tasks to increase impression. For example, consumers can receive coins by watching a 15-second video or livestream about a new product launch. In addition, brands and retailers can partner with games to launch marketing campaigns. For example, Japanese skincare brand Albion collaborated with Tmall Farm to promote its toning lotion. Tmall Farm created a virtual farmland of coix seeds, which is the key ingredient in the lotion, and users are encouraged to plant the seeds for a week to win red packets. The game not only educates consumers about its product ingredients but also attracts new members—Albion gained 253,000 new followers/members during the campaign period from July 22–29, 2020. [caption id="attachment_116033" align="aligncenter" width="700"]

Using Taobao’s in-app games to increase product impression

Using Taobao’s in-app games to increase product impression Source: Alimama [/caption]

What We Think

Implications for Brands and Retailers- As Singles’ Day approaches, brands and retailers across a range of categories, such as beauty, fashion and home should plan out their marketing plan for the event and leverage Aliababa marketing tools to increase brand exposure and drive traffic during the accumulation and warm-up period.

- Brands and retailers can use a combination of different advertising solutions to maximize the effect. Banners ads are most effective in targeting users who regularly use search bars to browse and purchase products, while banner ads can increase brand awareness among almost all potential customers.

- Brands and retailers can use text, pictures and short videos to market their products on Alibaba’s AI-powered product recommendation feed to boost sales.

- With more brands and retailers jumping on the livestreaming bandwagon, Alibaba’s Super Livestreaming tool can help drive traffic and gain viewers for livestreaming sessions.

- Brands and retailers can utilize Taobao in-app games to drive impressions and increase engagement. They can place ads within the game as tasks to complete in exchange for promotional incentives or adapt the game for specific product launch campaigns.