Source: Company reports

4Q15 RESULTS

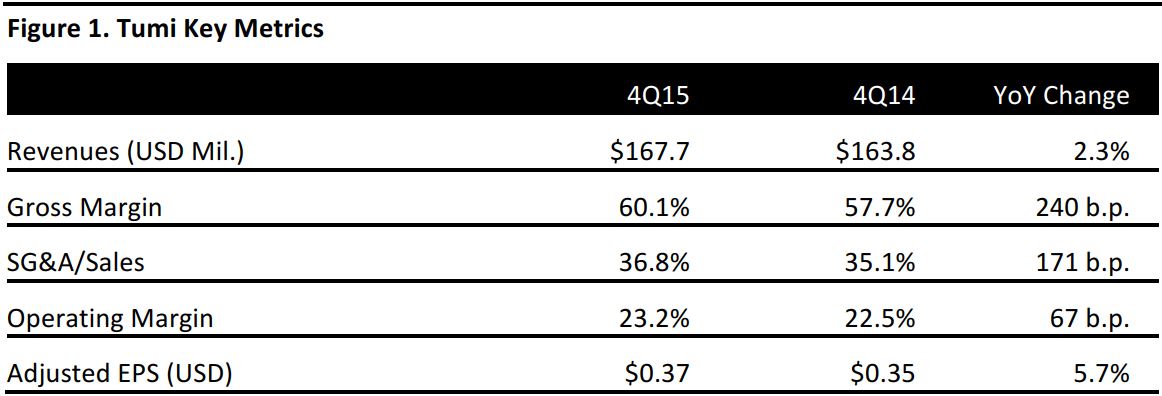

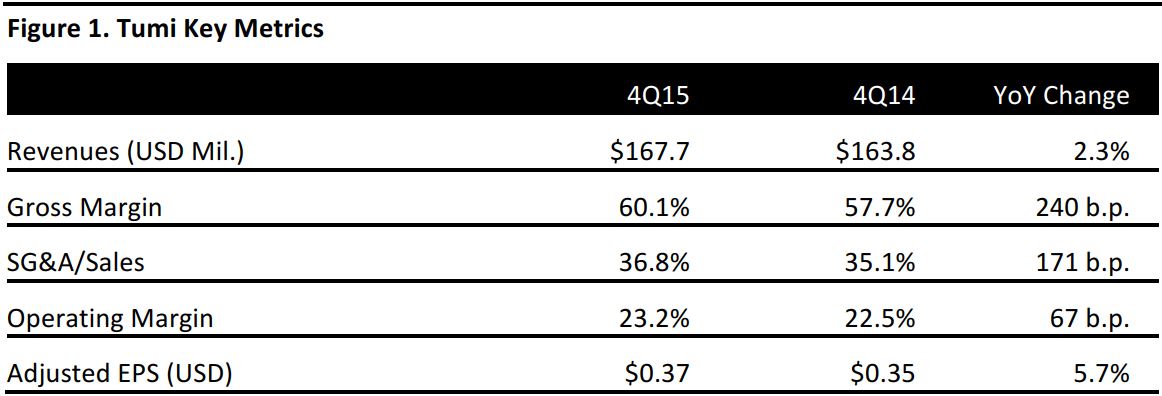

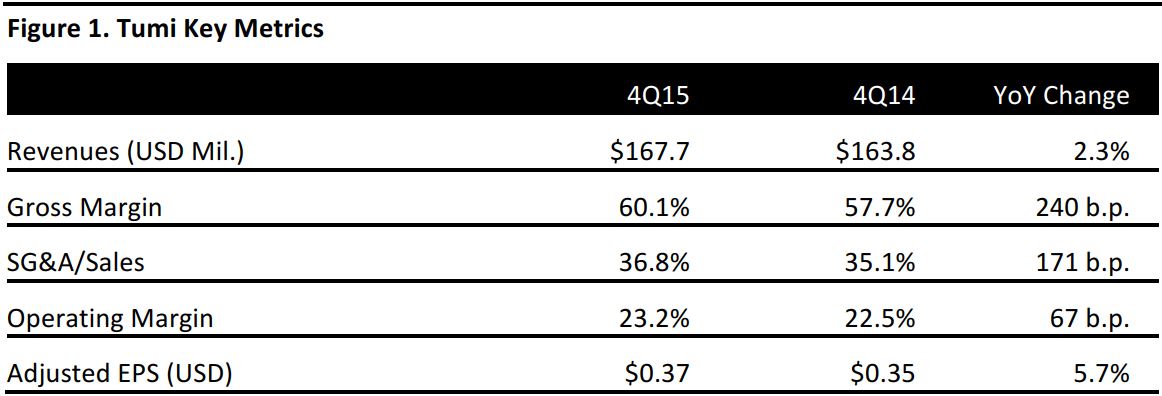

Tumi’s 4Q15 revenues increased by 2.3%, to $167.7 million, which were slightly higher than the consensus estimate of $164.1 million. Revenues increased by 4.4% on a constant-currency basis.

Comps for direct-to-consumer channels decreased by 4.6% and decreased by 3.4% on a constant-currency basis. Direct-to-consumer full-price comps in North America decreased by 5.6%, outlet comps increased by 6.0% and e-commerce comps decreased by 14.8%.

Gross margin increased by 240 basis points, to 60.1%. However, SG&A increased by 171 basis points, to 36.8% of sales, eroding much of the margin gain.

Adjusted EPS was $0.37, up 5.7% year over year and ahead of the consensus estimate of $0.32.

2015 RESULTS

Tumi’s revenues in 2015 were $547.7 million, up 3.9%. Revenues increased by 6.7% on a constant-currency basis. The gross margin was 59.7%, compared to 58.0% in 2014. The operating margin remained flat during the year at 17.7%.

Adjusted EPS was $0.97 per share, up 13.0% from $0.85 in 2014.

OUTLOOK

The company guided for a 4%–6% increase in revenue in 2016, to $569.6–$580.6 million, assuming that current exchange rates remain stable. Comp growth is expected to be flat for the year. EPS is expected to be $0.93–$0.97, which includes a $0.02 charge to be taken in 1Q16 for certain cost-reduction actions. The current consensus estimates are for revenue of $591.8 million and EPS of $1.00.

In 2016, the company expects to open 15–20 stores, with an increasing focus on international markets.

Capital expenditures for 2016 are expected to be $23.0–$28.0 million.