Source: Company reports/Coresight Research

Fiscal 3Q18 Results

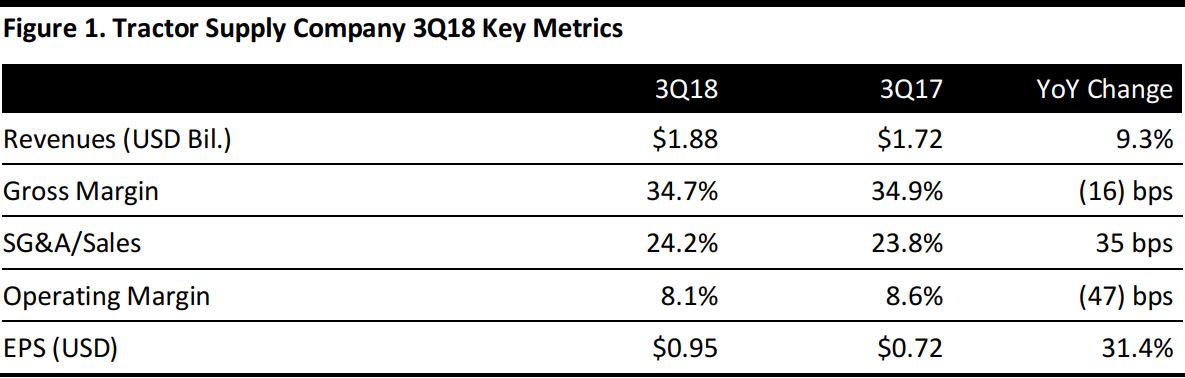

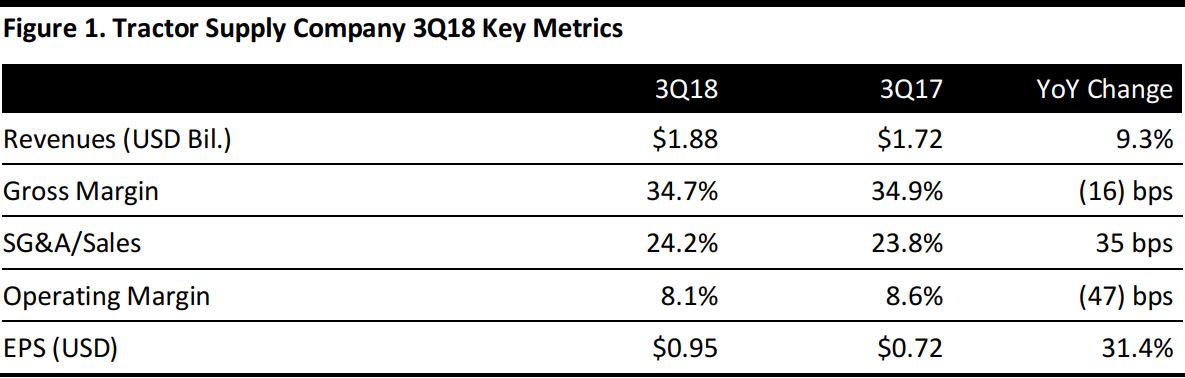

Tractor Supply reported 3Q18 revenues of $1.88 billion, up 9.3% year over year and above the $1.83 billion consensus estimate.

Comps increased 5.1%, beating the 1.9% consensus estimate.

EPS was $0.95, up 31.4% from a year ago and beating the consensus of $0.87.

Details from the Quarter

Management commented that the increase in comps was driven by continued execution of the ONETractor strategy, which drove increases in both average ticket and transaction count. In addition, management of the product assortment, marketing events and the store experience built up to a comp increase of 6.6% in the year-ago quarter. Management’s raising guidance reflects the strength of the business and positive macroeconomic factors.

Other details:

- Strong sales across all geographic regions and merchandising divisions helped achieve the comp increase in the quarter. The results represent the fifth consecutive quarter of comparable store sales above 3% despite a difficult year-over-year comparison.

- The quarter marks 41 out of 42 quarters with increases in customer traffic.Like in 2Q18, the average-ticket increase of 3.6% continued to be among the best in the last six years.

- The company continues to stock everyday basic assortments for its customers’“Out Here” lifestyle.

- The macroeconomic backdrop for the company’s consumers is relatively healthy given recent trends in unemployment and consumer confidence, and the macroeconomic headwinds experienced over the last several years have abated. The company continues to see some benefit from energy-related markets along with inflationary trends, both of which are positively contributing to topline performance.

- Overall customer satisfaction scores continued to be at record levels. In a recently completed team-member engagement survey, scores continued to be strong. The company continues to see growth in the Neighbor's Club loyalty program, now with over 9.7 million members and well on track to exceed the goal of 10 million members by the end of this year.

- The quarter marks the 25th consecutive quarter of strong double-digit sales growth in the e-commerce business, with“Buy Online, Pick Up In Store”again showing growth that exceeded expectations. The loyalty program encourages customers to come into the store to pick up online orders, which is resulting in 20% of customers making incremental purchases. Between the combination of “Buy Online, Pick Up In Store” and “direct delivery to the stores,” more than 70% of e-commerce orders continued to be fulfilled at the store level, which represents a cost-effective way to serve customers with greater speed, convenience and efficiency.

- The ONETractor strategy focuses on the following four objectives:

- Driving profitable growth;

- Building customer-centric engagement;

- Offering relevant products and services; and

- Enhancing the core and foundational infrastructure capabilities.

- The ONETractor strategy is to serve customers anytime, anywhere and in anyway they choose, and management believes the strategy positions the company to meet the unique preferences customers have for demand-driven, immediate-need products in an easy and seamless shopping experience.

- The company opened 23 new Tractor Supply stores and seven new Petsense stores in the quarter. The company remains on track to open 80 new Tractor stores and 20 new Petsense store locations in 2018 and continues to be pleased with the new stores’ productivity and returns.

Outlook

The company raised 2018 guidance across the board, as follows:

- Net sales of $7.84–$7.87 billion, up from $7.77–$7.80 billion previously

- Comps of 4.0%–4.5%, up from 3.0%–3.5% previously

- EPS of $4.23–4.27, up from $4.10–$4.20 previously. The prior consensus estimate was $4.20.