Tractor Supply Company

Sector: Home and home improvement

Country of operation: US

Key product categories: Farm maintenance products, general maintenance, home and home-improvement products, lawn and garden, light truck equipment, and work clothing

Annual Metrics

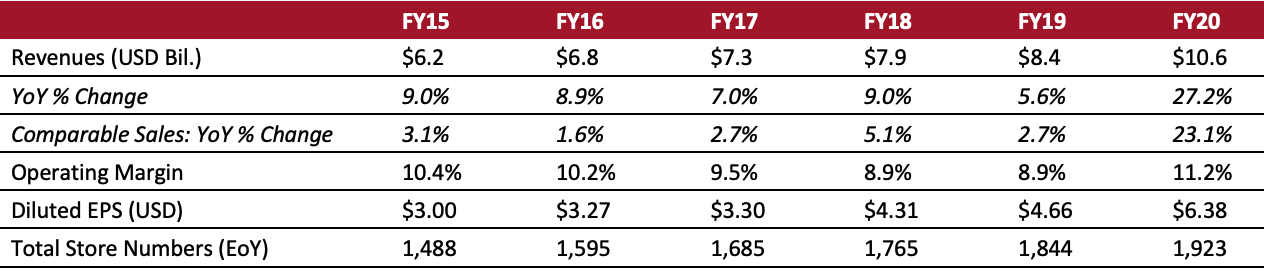

[caption id="attachment_126550" align="aligncenter" width="720"]

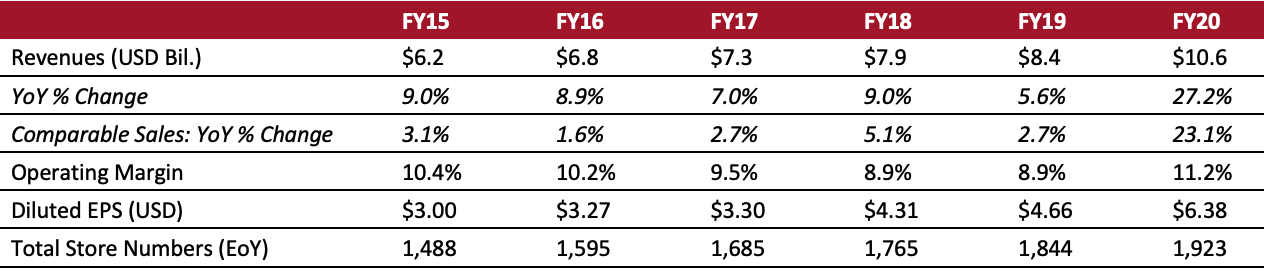

Fiscal year ends on December 26

Fiscal year ends on December 26[/caption]

Summary

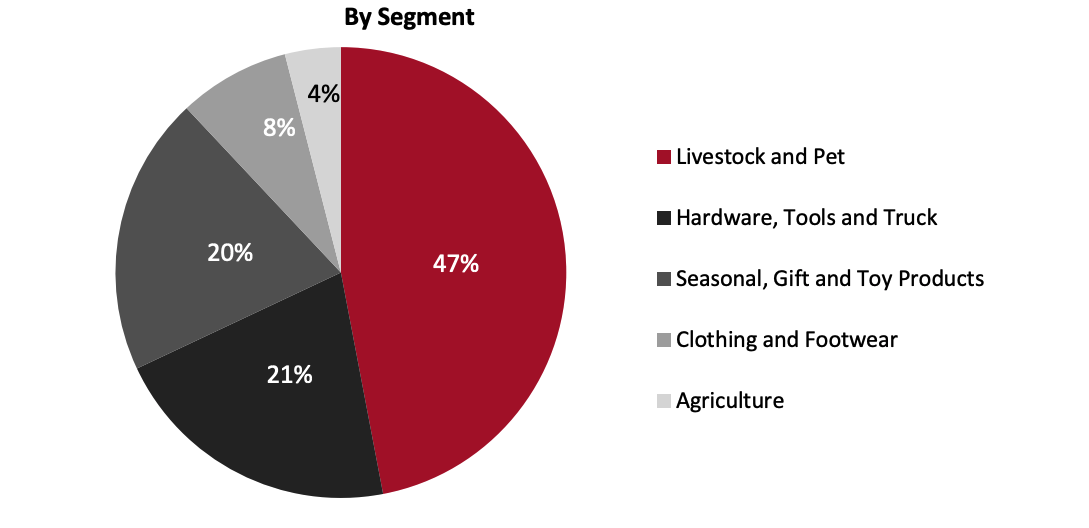

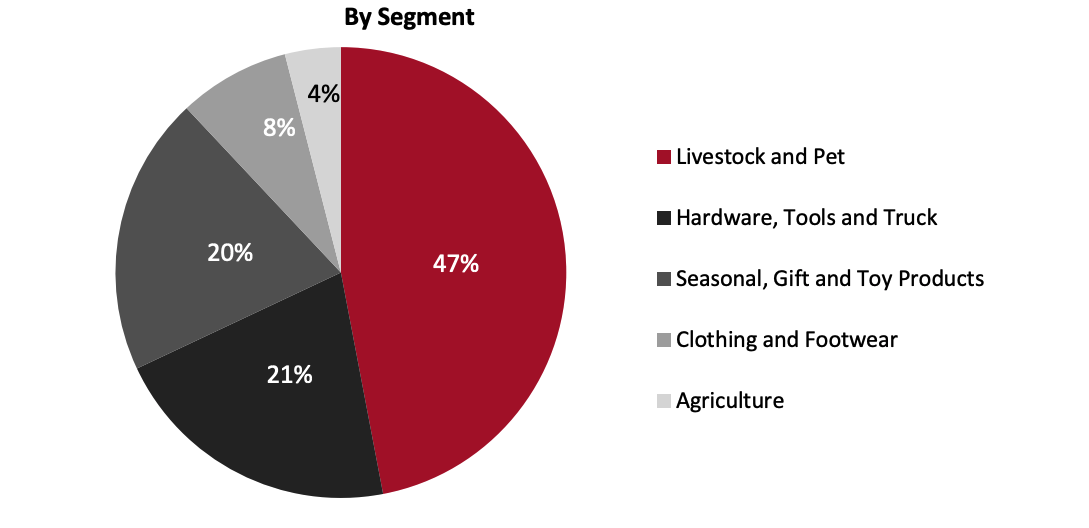

Tractor Supply Company was founded in 1938 and is headquartered in Brentwood, Tennessee. It is the largest rural lifestyle retailer in the US and operates primarily in towns outside major metropolitan areas. The company aims to serve professionals—including farmers and tradespeople—as well as rural families. Tractor Supply sells products covering all aspects of rural lifestyles, including clothing, garden maintenance, hardware and tools. Its product portfolio emphasizes goods for raising healthy livestock, a product category that accounted for 47% of the company’s total sales in 2019. Tractor Supply operates a total of 1,904 Tractor Supply stores across 49 US states and employs more than 42,000 staff, as of December 26, 2020. The company also operates 183 Petsense stores (its specialty pet supply retail subsidiary) in 26 states.

Company Analysis

Coresight Research insight: Tractor Supply has identified and carved out a successful niche, which stands up to competition from larger retailers. While mass merchandiser Walmart and home-improvement retailers such as Home Depot and Lowe’s have some overlap with Tractor Supply’s business, they do not compete directly, given the latter’s focus on rural lifestyles and its corresponding store presence. By focusing on the lifestyle needs of its core customers, which include countryside dwellers, ranchers, recreational farmers, small businesses and tradespeople, the company has differentiated itself from general merchandise and home specialty retailers.

The company reacted quickly to the Covid-19 pandemic and enhanced its e-commerce capabilities, offering same-day delivery from all of its stores (previously only available in 20% of stores). Consequently, Tractor Supply is now a well-positioned omnichannel operator.

| Tailwinds |

Headwinds |

- Strong momentum for categories such as home, lawn and garden, and pet products

- Consumer spending continuing to shift away from travel and experiences, leaving increased disposable income for home-improvement

- Newly augmented e-commerce and omnichannel capabilities amid growing online demand

|

- Uncertain economic environment with high unemployment levels and low consumer confidence

|

Strategy

Tractor Supply sets out is aim as reaching as many customers as possible in rural areas of the US. The company prides itself on its customer service and states that it attributes its success to understanding its customers better than any other retailer. The company describes its core strategies, ONETractor, as giving customers the opportunity to shop “any time, anywhere and in any way they choose.”

In October 2020, Tractor Supply outlined the following key pillars of its Life Out Here strategy:

1. Deliver exceptional customer experiences

- Expand the company’s customer base by offering personalized, localized and memorable customer engagements.

2. Advance the company’s ONETractor capabilities

- Develop the company’s “any time, anywhere, any way” customer experience by digitizing its business processes and enhancing omnichannel capabilities.

3. Operate the Tractor Way

- Drive operational excellence and productivity through continuous improvement, space utilization and advanced supply chain capabilities.

4. Go the country mile with its team

- Connect, empower and develop team members to enhance their lives and communities and provide exceptional customer service.

5. Generate healthy shareholder return

- Drive profitable growth and build total shareholder value through disciplined and efficient resource allocation.

To execute the Life Out Here strategy, the company expects annual capital expenditure in the range of $450–550 million. Moreover, the company plans to open around 75–80 new Tractor Supply stores, remodel 150–200 stores and transform side lots (underutilized outdoor spaces) into additional selling space in 150–200 locations in 2021.

Revenue Breakdown (FY19)

Company Developments

Company Developments

| Date |

Development |

| February 17, 2021 |

Tractor Supply acquires Orscheln Farm and Home. |

| January 25, 2021 |

Tractor Supply appoints Matthew Rubin as Senior Vice President and General Manager of Petsense. |

| January 14, 2021 |

Tractor Supply announces the appointment of Joy Brown to its Board of Directors. |

| September 16, 2020 |

Tractor Supply announces the opening of its 1,900th store. |

| August 24, 2020 |

Tractor Supply expands its pet products portfolio with the introduction of Victor Super Premium Pet Food into its dog food range. |

| May 26, 2020 |

Tractor Supply announces strategic investments in its human resources and in its consumer-shopping experience to position itself for long-term success. |

| April 14, 2020 |

Tractor Supply becomes the first general merchandise retailer in the US to offer same-day delivery from all of its stores. |

| February 6, 2020 |

Tractor Supply announces executive leadership promotions. |

| January 9, 2020 |

Tractor Supply announces its choice of Microsoft as its preferred cloud provider. Microsoft will support its technology architecture as well as the modernization of company’s e-commerce website and its enterprise analytics platform. |

| December 18, 2019 |

Tractor Supply announces the promotion of Letitia Webster to the position of Senior Vice President of E-commerce. |

| December 5, 2019 |

Tractor Supply names Hal Lawton as its President, CEO and member of its Board of Directors, effective January 13, 2020. Hal Lawton replaces Greg Sandfort, who previously announced his intention to retire. |

Management Team

- Hal Lawton—President and CEO

- Kurt D. Barton—EVP, CFO and Treasurer

- Robert D. Mills—EVP and Chief Technology, Digital Commerce and Strategy Officer

Source: Company reports/S&P Capital IQ/Coresight Research

Fiscal year ends on December 26[/caption]

Summary

Tractor Supply Company was founded in 1938 and is headquartered in Brentwood, Tennessee. It is the largest rural lifestyle retailer in the US and operates primarily in towns outside major metropolitan areas. The company aims to serve professionals—including farmers and tradespeople—as well as rural families. Tractor Supply sells products covering all aspects of rural lifestyles, including clothing, garden maintenance, hardware and tools. Its product portfolio emphasizes goods for raising healthy livestock, a product category that accounted for 47% of the company’s total sales in 2019. Tractor Supply operates a total of 1,904 Tractor Supply stores across 49 US states and employs more than 42,000 staff, as of December 26, 2020. The company also operates 183 Petsense stores (its specialty pet supply retail subsidiary) in 26 states.

Company Analysis

Coresight Research insight: Tractor Supply has identified and carved out a successful niche, which stands up to competition from larger retailers. While mass merchandiser Walmart and home-improvement retailers such as Home Depot and Lowe’s have some overlap with Tractor Supply’s business, they do not compete directly, given the latter’s focus on rural lifestyles and its corresponding store presence. By focusing on the lifestyle needs of its core customers, which include countryside dwellers, ranchers, recreational farmers, small businesses and tradespeople, the company has differentiated itself from general merchandise and home specialty retailers.

The company reacted quickly to the Covid-19 pandemic and enhanced its e-commerce capabilities, offering same-day delivery from all of its stores (previously only available in 20% of stores). Consequently, Tractor Supply is now a well-positioned omnichannel operator.

Fiscal year ends on December 26[/caption]

Summary

Tractor Supply Company was founded in 1938 and is headquartered in Brentwood, Tennessee. It is the largest rural lifestyle retailer in the US and operates primarily in towns outside major metropolitan areas. The company aims to serve professionals—including farmers and tradespeople—as well as rural families. Tractor Supply sells products covering all aspects of rural lifestyles, including clothing, garden maintenance, hardware and tools. Its product portfolio emphasizes goods for raising healthy livestock, a product category that accounted for 47% of the company’s total sales in 2019. Tractor Supply operates a total of 1,904 Tractor Supply stores across 49 US states and employs more than 42,000 staff, as of December 26, 2020. The company also operates 183 Petsense stores (its specialty pet supply retail subsidiary) in 26 states.

Company Analysis

Coresight Research insight: Tractor Supply has identified and carved out a successful niche, which stands up to competition from larger retailers. While mass merchandiser Walmart and home-improvement retailers such as Home Depot and Lowe’s have some overlap with Tractor Supply’s business, they do not compete directly, given the latter’s focus on rural lifestyles and its corresponding store presence. By focusing on the lifestyle needs of its core customers, which include countryside dwellers, ranchers, recreational farmers, small businesses and tradespeople, the company has differentiated itself from general merchandise and home specialty retailers.

The company reacted quickly to the Covid-19 pandemic and enhanced its e-commerce capabilities, offering same-day delivery from all of its stores (previously only available in 20% of stores). Consequently, Tractor Supply is now a well-positioned omnichannel operator.

Company Developments

Company Developments