[caption id="attachment_68896" align="aligncenter" width="600"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

4Q18 Results

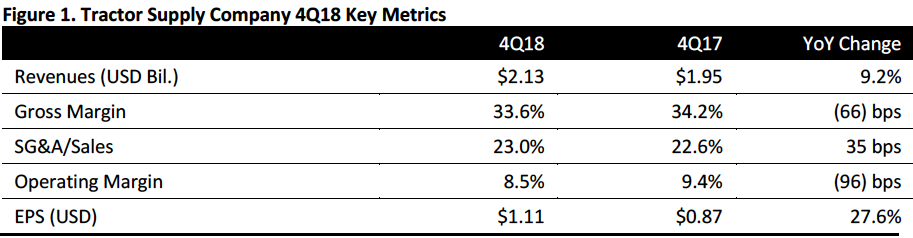

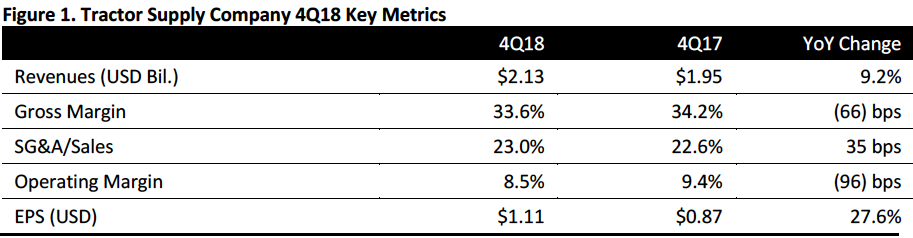

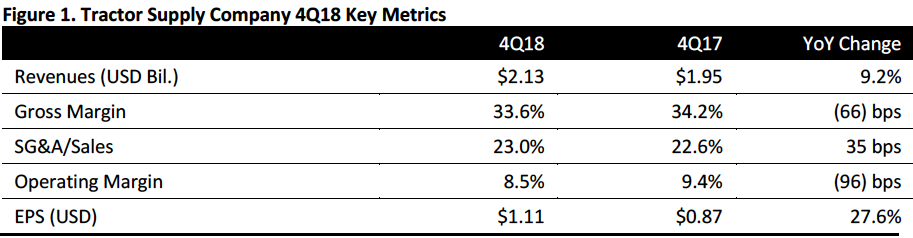

Tractor Supply reported Q4 revenues of $2.13 billion, up 9.2% year over year and above the $2.10 billion consensus estimate.

Comps were 5.7%, beating the 3.7% consensus estimate and comprising a 3.0% increase in average ticket and a 2.6% increase in transaction count.

All geographic regions and all major product categories had positive comps. Continued strength in everyday merchandise in the consumable, usable and edible categories helped drive comps, in addition to strong sales of winter and other seasonal products.

The decrease in gross margins was due to an increase in freight expense as well as an unfavorable change in product mix shift of products sold. Margins were also hurt by increased clearance of Petsense inventory from store closures and inventory rationalization, partially offset by the company’s price management program.

The increase in SG&A expense was mainly due to higher incentive compensation, in addition to planned investments in infrastructure, labor wages and technology, and also includes costs associated with the opening and ramp-up of operations of the new distribution center in Frankfort, NY, partially offset by leverage in occupancy and other costs from a one-time benefit.

EPS was $1.11, up 27.6% beating the $1.09 consensus estimate.

FY18 Results

FY18 revenues were $7.91 billion, up 9.0%.

Comps increased 5.1%, versus a 2.7% increase in 2017.

During the year, gross margin decreased 18 basis points to 34.2% from 34.3%, and SG&A expense increased to 25.3% of sales compared to 24.9% in 2017.

EPS was $4.31, up 30.8% from the prior year.

During the year, the company opened 80 new Tractor Supply stores and 18 new Petsense stores and closed 11 Petsense stores.

Details from the Quarter

Management characterized the year as successful, characterized by balance and broad-based sales growth while making strategic investments.

Other details:

- Transaction count and average ticket increased in the quarter and full year. Q4 represented the best annual comp store sales growth in six years. The quarterly results represented the sixth consecutive quarter of comp store sales above 3%, as well as 42 out of 43 quarters of positive customer traffic.

- Store openings during the year increased selling square footage by 5%, and the company saw solid progress in its ONETractor initiatives.

- The company also exceeded its internal loyalty program membership growth goals.

- Investments in digital capabilities resulted in higher traffic and conversion rates.

- The ONETractor strategy initiatives are aligned around four key objectives:

- Drive profitable growth.

- Build customer-centric engagement.

- Offer relevant products and services.

- Enhance the company’s core and foundational infrastructure capabilities.

- Online sales grew in the solid double digits for the quarter and year.

- During the year the company significantly expanded its buy online, pickup in store (BOPIS) capabilities and expanded the deployment of its Stockyard in-store kiosks to nearly 600 stores and mobile POS technologies across nearly 400 stores.

- Tractor Supply completed construction of its new distribution center in Frankfort, NY, to support store expansion in the northeast corridor. The new facility will start shipping in 2019.

- In 2019, capital spending will be allocated towards new stores, store-level initiatives, IT projects and the supply chain. Tractor Supply plans to open approximately 80 Tractor Supply stores, and company market analysis supports the potential for more than 2,500 store locations over time. In 2019, the company anticipates opening 10 to 15 new Petsense stores, which target a different customer with a preference for products and services not available today in the company’s stores.

Outlook

Going into 2019, management aims to build on its ONETractor strategy and give customers a seamless shopping experience anytime, anywhere and in any way they choose.

The company offered the following guidance for 2019:

| Item |

Values |

| Net Sales |

$8.31–$8.46 billion |

| Comps |

+2.0%–4.0% |

| Operating Margin |

8.9%–9.0% |

| EPS |

$4.60–$4.75 |

| Capital Expenditures |

$225–$250 million |

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Tractor Supply reported Q4 revenues of $2.13 billion, up 9.2% year over year and above the $2.10 billion consensus estimate.

Comps were 5.7%, beating the 3.7% consensus estimate and comprising a 3.0% increase in average ticket and a 2.6% increase in transaction count.

All geographic regions and all major product categories had positive comps. Continued strength in everyday merchandise in the consumable, usable and edible categories helped drive comps, in addition to strong sales of winter and other seasonal products.

The decrease in gross margins was due to an increase in freight expense as well as an unfavorable change in product mix shift of products sold. Margins were also hurt by increased clearance of Petsense inventory from store closures and inventory rationalization, partially offset by the company’s price management program.

The increase in SG&A expense was mainly due to higher incentive compensation, in addition to planned investments in infrastructure, labor wages and technology, and also includes costs associated with the opening and ramp-up of operations of the new distribution center in Frankfort, NY, partially offset by leverage in occupancy and other costs from a one-time benefit.

EPS was $1.11, up 27.6% beating the $1.09 consensus estimate.

FY18 Results

FY18 revenues were $7.91 billion, up 9.0%.

Comps increased 5.1%, versus a 2.7% increase in 2017.

During the year, gross margin decreased 18 basis points to 34.2% from 34.3%, and SG&A expense increased to 25.3% of sales compared to 24.9% in 2017.

EPS was $4.31, up 30.8% from the prior year.

During the year, the company opened 80 new Tractor Supply stores and 18 new Petsense stores and closed 11 Petsense stores.

Details from the Quarter

Management characterized the year as successful, characterized by balance and broad-based sales growth while making strategic investments.

Other details:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Tractor Supply reported Q4 revenues of $2.13 billion, up 9.2% year over year and above the $2.10 billion consensus estimate.

Comps were 5.7%, beating the 3.7% consensus estimate and comprising a 3.0% increase in average ticket and a 2.6% increase in transaction count.

All geographic regions and all major product categories had positive comps. Continued strength in everyday merchandise in the consumable, usable and edible categories helped drive comps, in addition to strong sales of winter and other seasonal products.

The decrease in gross margins was due to an increase in freight expense as well as an unfavorable change in product mix shift of products sold. Margins were also hurt by increased clearance of Petsense inventory from store closures and inventory rationalization, partially offset by the company’s price management program.

The increase in SG&A expense was mainly due to higher incentive compensation, in addition to planned investments in infrastructure, labor wages and technology, and also includes costs associated with the opening and ramp-up of operations of the new distribution center in Frankfort, NY, partially offset by leverage in occupancy and other costs from a one-time benefit.

EPS was $1.11, up 27.6% beating the $1.09 consensus estimate.

FY18 Results

FY18 revenues were $7.91 billion, up 9.0%.

Comps increased 5.1%, versus a 2.7% increase in 2017.

During the year, gross margin decreased 18 basis points to 34.2% from 34.3%, and SG&A expense increased to 25.3% of sales compared to 24.9% in 2017.

EPS was $4.31, up 30.8% from the prior year.

During the year, the company opened 80 new Tractor Supply stores and 18 new Petsense stores and closed 11 Petsense stores.

Details from the Quarter

Management characterized the year as successful, characterized by balance and broad-based sales growth while making strategic investments.

Other details:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Tractor Supply reported Q4 revenues of $2.13 billion, up 9.2% year over year and above the $2.10 billion consensus estimate.

Comps were 5.7%, beating the 3.7% consensus estimate and comprising a 3.0% increase in average ticket and a 2.6% increase in transaction count.

All geographic regions and all major product categories had positive comps. Continued strength in everyday merchandise in the consumable, usable and edible categories helped drive comps, in addition to strong sales of winter and other seasonal products.

The decrease in gross margins was due to an increase in freight expense as well as an unfavorable change in product mix shift of products sold. Margins were also hurt by increased clearance of Petsense inventory from store closures and inventory rationalization, partially offset by the company’s price management program.

The increase in SG&A expense was mainly due to higher incentive compensation, in addition to planned investments in infrastructure, labor wages and technology, and also includes costs associated with the opening and ramp-up of operations of the new distribution center in Frankfort, NY, partially offset by leverage in occupancy and other costs from a one-time benefit.

EPS was $1.11, up 27.6% beating the $1.09 consensus estimate.

FY18 Results

FY18 revenues were $7.91 billion, up 9.0%.

Comps increased 5.1%, versus a 2.7% increase in 2017.

During the year, gross margin decreased 18 basis points to 34.2% from 34.3%, and SG&A expense increased to 25.3% of sales compared to 24.9% in 2017.

EPS was $4.31, up 30.8% from the prior year.

During the year, the company opened 80 new Tractor Supply stores and 18 new Petsense stores and closed 11 Petsense stores.

Details from the Quarter

Management characterized the year as successful, characterized by balance and broad-based sales growth while making strategic investments.

Other details:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Tractor Supply reported Q4 revenues of $2.13 billion, up 9.2% year over year and above the $2.10 billion consensus estimate.

Comps were 5.7%, beating the 3.7% consensus estimate and comprising a 3.0% increase in average ticket and a 2.6% increase in transaction count.

All geographic regions and all major product categories had positive comps. Continued strength in everyday merchandise in the consumable, usable and edible categories helped drive comps, in addition to strong sales of winter and other seasonal products.

The decrease in gross margins was due to an increase in freight expense as well as an unfavorable change in product mix shift of products sold. Margins were also hurt by increased clearance of Petsense inventory from store closures and inventory rationalization, partially offset by the company’s price management program.

The increase in SG&A expense was mainly due to higher incentive compensation, in addition to planned investments in infrastructure, labor wages and technology, and also includes costs associated with the opening and ramp-up of operations of the new distribution center in Frankfort, NY, partially offset by leverage in occupancy and other costs from a one-time benefit.

EPS was $1.11, up 27.6% beating the $1.09 consensus estimate.

FY18 Results

FY18 revenues were $7.91 billion, up 9.0%.

Comps increased 5.1%, versus a 2.7% increase in 2017.

During the year, gross margin decreased 18 basis points to 34.2% from 34.3%, and SG&A expense increased to 25.3% of sales compared to 24.9% in 2017.

EPS was $4.31, up 30.8% from the prior year.

During the year, the company opened 80 new Tractor Supply stores and 18 new Petsense stores and closed 11 Petsense stores.

Details from the Quarter

Management characterized the year as successful, characterized by balance and broad-based sales growth while making strategic investments.

Other details: