DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

1Q19 Results

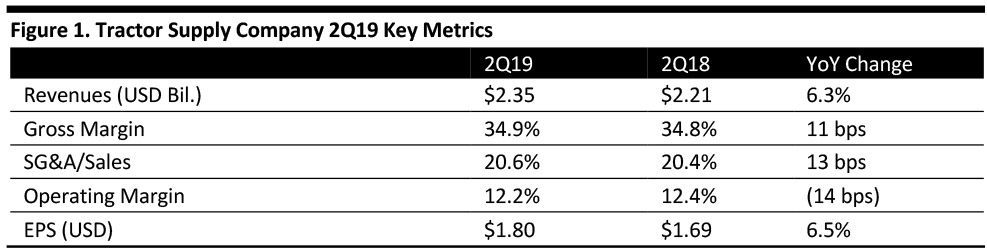

Tractor Supply reported 2Q revenues of $2.35 billion, up 6.3% year over year and in line with the consensus estimate.

Comparable store sales were 3.2%, marginally beating the 3.1% consensus estimate, including a 2.2% increase in average ticket and a 1.0% increase in transaction count.

All major product categories across all geographic regions registered positive comps. The company’s strength in everyday merchandise in the consumable, usable and edible categories drove the increase in comps, in addition to strong sales of spring and summer seasonal categories.

The company’s product mix and strong price management program boosted gross margin for the quarter.

SG&A expenses grew, mainly due to costs incurred on the new distribution center in Frankfort, New York, higher incentive compensation and, to a lesser degree, an investment in wages of store team members. Leverage in occupancy and other costs arising from the increase in comparable store sales partially offset expense growth.

EPS was $1.80, up 6.5% but marginally missing the $1.81 consensus estimate.

Details from the Quarter

Management proclaimed its performance in the second quarter as “solid,” characterized by sales growth across all geographies as well as improvement in comparable average ticket and traffic.

Other details:- Transaction count and average ticket size increased in the second quarter, with the strong growth in average ticket attributed to the positive impact of various factors including the company’s product mix and overall retail price management. Theese quarterly results represent the eighth consecutive quarter of comparable store sales growth above 3%.

- During the quarter, the company opened 15 new Tractor Supply stores and one new Petsense store, compared with the 25 new Tractor Supply stores and three new Petsense stores opened in the second quarter of 2018.

- The company continued to execute its ONETractor strategy initiatives, which are aligned around four key objectives:

- Drive profitable growth.

- Build customer-centric engagement.

- Offer relevant products and services.

- Enhance the company’s core and foundational infrastructure capabilities.

- Online sales in the quarter experienced solid double-digit comps and represented the 28th consecutive quarter of strong growth.

- During the quarter, the company continued to reap rewards from its buy online pickup in store (BOPIS) capabilities with over 70% of its e-commerce orders fulfilled at its stores.

Outlook

Management stated its ONETractor strategy initiatives along with its merchandising and marketing initiatives position it well for the second half of the year.

The company updated guidance for 2019:

- Revenue to grow to $8.40-8.46 billion.

- Comps growth in the range of 3.0-4.0%.

- EPS in the range of $4.65-4.75.

- Capital expenditure in the range of $225-250 million.

In FY19, the consensus estimates recorded by StreetAccount call for Tractor Supply to report revenues of $8.45 billion, up 6.8%, and EPS of $4.76, up 10.4%.