Toys“R”Us Files for Chapter 11 Bankruptcy Protection in the US and Canada

On Monday, Toys“R”Us joined the growing list of US retailers that have filed for bankruptcy this year. The retailer is seeking to restructure its debt obligations, which have proved unsustainable following the company’s leveraged buyout in 2005.

The company’s operations outside of the US and Canada, including its approximately 255 licensed stores and JV partnership in Asia with Fung Retailing, are separate entities and are not part of the Chapter 11 filing.

A Heavy Debt Load and an Increasingly Competitive Landscape Are to Blame

As of April 29, 2017, Toys“R”Us had long-term debt on its balance sheet totaling over $5.2 billion, $444 million of which is due next year. Much of the debt is the legacy of the $6.6 billion leveraged buyout, led by Bain Capital, KKR Group and Vornado Realty Trust, back in 2005. Since then, the company has struggled to emerge from the financial constraints of its debt burden, as the annual interest expense alone was as much as half a billion dollars in some years. The retailer has now opted to seek court protection during a restructuring process that it hopes will seek a brighter future for the business.

To facilitate the Chapter 11 proceedings, Toys“R”Us has secured a $3 billion debtor-in-possession loan that will enable it to continue its business operations during the restructuring.

The company emphasized that its roughly 1,600 locations worldwide, which also include stores under the Babies“R”Us banner, will continue to operate as usual ahead of the holiday season.

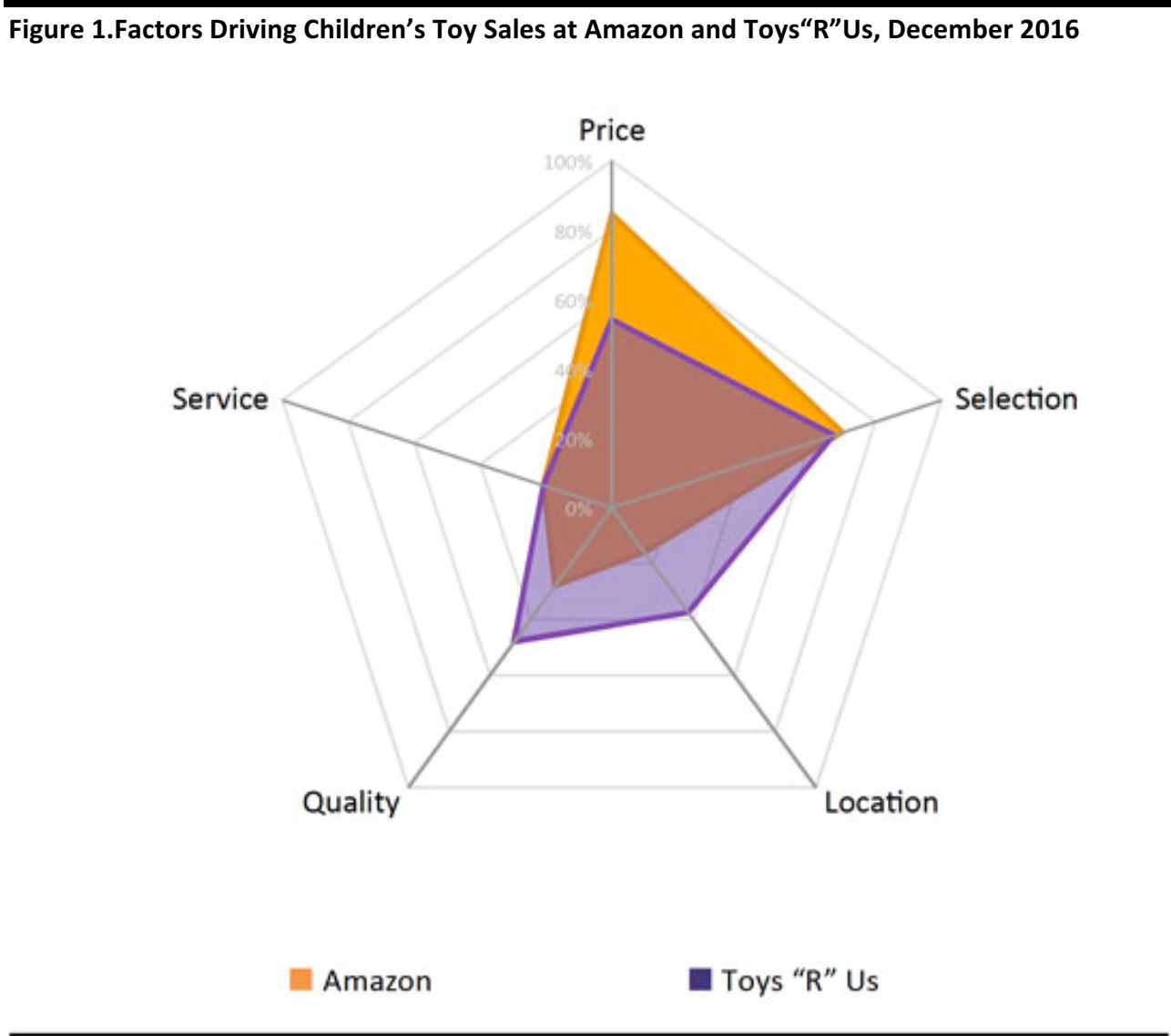

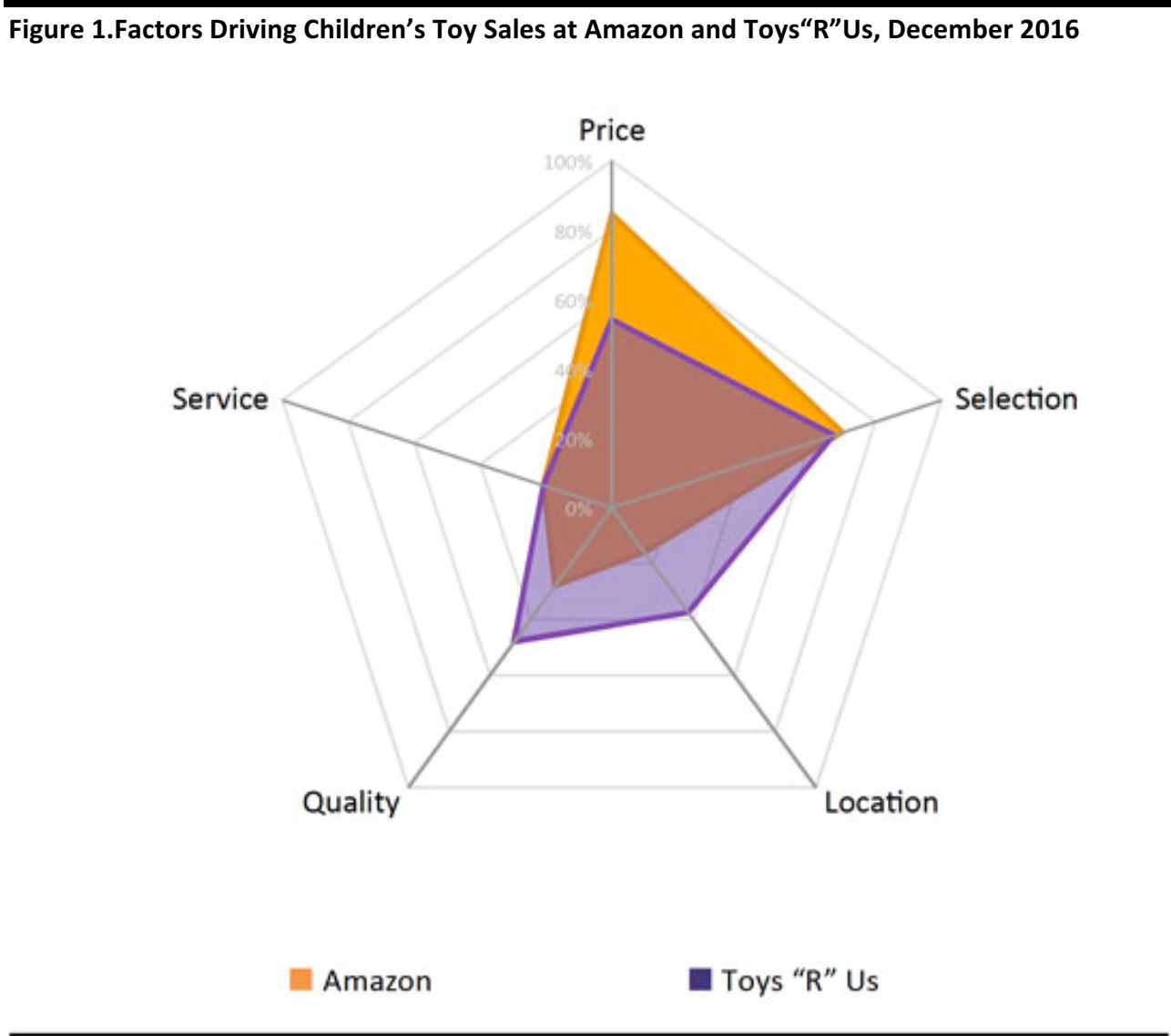

In its prime, Toys“R”Us was one of the leading toy retailers in the US, and our

research showed that the company has remained differentiated in the eyes of consumers. Yet, intensified competition, particularly online, has hurt the company significantly, and our data indicated that it lagged behind Amazon in both price and selection.

Note: Target Universe = Parents with children aged 9 or below who shopped for children's toys most often at Amazon and Walmart, respectively.

Sample size: N=182 (Amazon); N=279 (Toys "R" Us)

Source: Prosper Insights & Analytics, Monthly Consumer Surveys

In addition, similar to other brick-and-mortar retailers, Toys“R”Us has suffered from declining mall traffic and sluggish same-store sales.

For more on the retail landscape in the US, follow our

weekly tracker of US and UK store openings and closings.