Introduction: $7 Billion Up for Grabs as Toys“R”Us Closes Its Doors

Whether or not Amazon killed Toys“R”Us, the e-commerce giant is likely to be one of the retailers that gains from the chain’s closure as toy shoppers look for alternatives. However, Amazon will see very strong competition for those toy dollars, according to findings from our exclusive consumer survey, which we conducted in the wake of the Toys“R”Us bankruptcy. Our research suggests that Walmart and Target are set to enjoy disproportionate gains from the closure of Toys“R”Us stores in the US and that Amazon’s dependence on Prime members may limit its ability to acquire former Toys“R”Us customers.

Toys“R”Us generated more than $7 billion in sales in the US in the year ended January 2017 (latest reported), which means rivals stand to reap major gains once the retailer closes its doors. To find out where those shopper dollars might go, we surveyed US consumers about where they browse and buy children’s toys and games.

Our research enables us to look at those who shopped at Toys“R”Us in the past year and determine which other retailers they also browsed and/or bought children’s toys and games from. This gives us an indication of which retailers are most likely to win the toy dollars that Toys“R”Us will no longer be taking.In this report, we also offer a full rundown of where US consumers browse and buy toys and games and assess how Prime membership factors into Amazon’s toy shopper numbers.

Other Retailers that Toys“R”Us Shoppers Also Browsed and Bought Toys and Games from in the Past Year

Toys“R”Us is (or was) the fourth-most-popular toy retailer in the US, as measured by number of shoppers. Its closure leaves three giants fighting over the lion’s share of the market: Walmart, Amazon and Target.

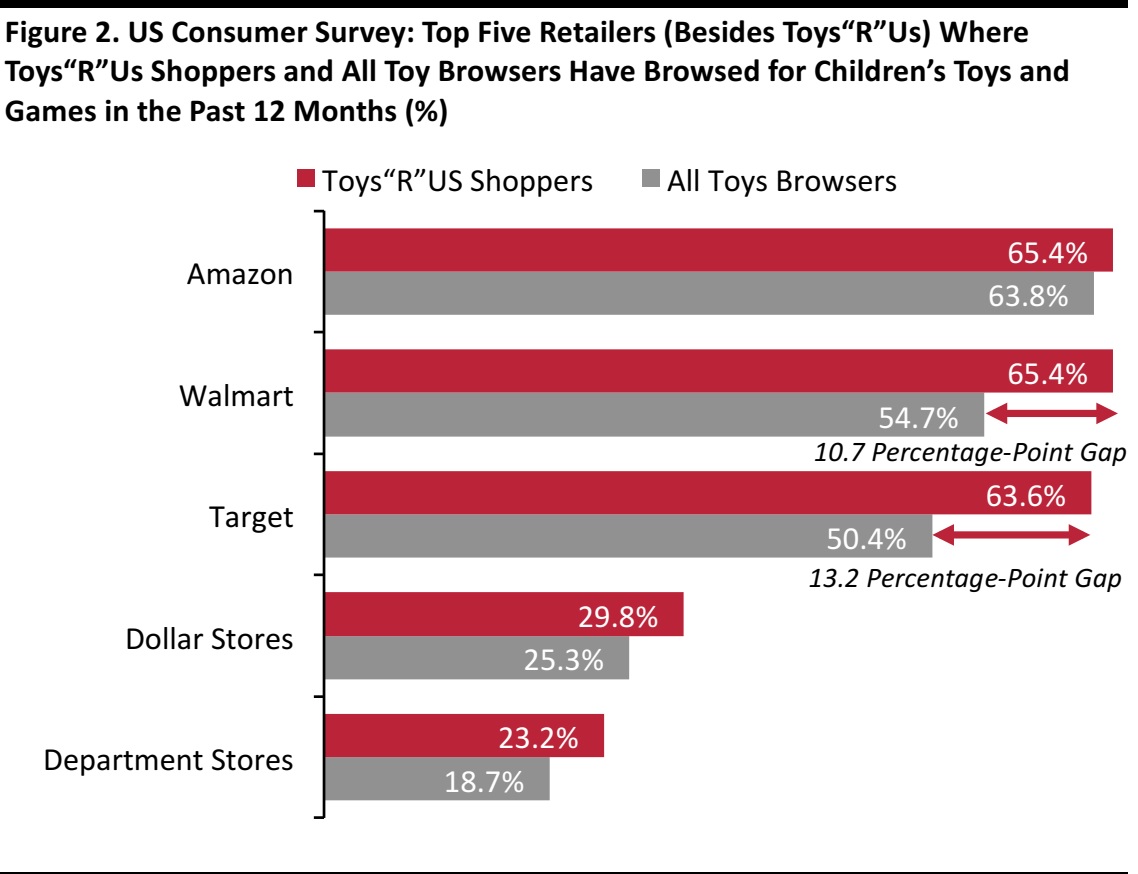

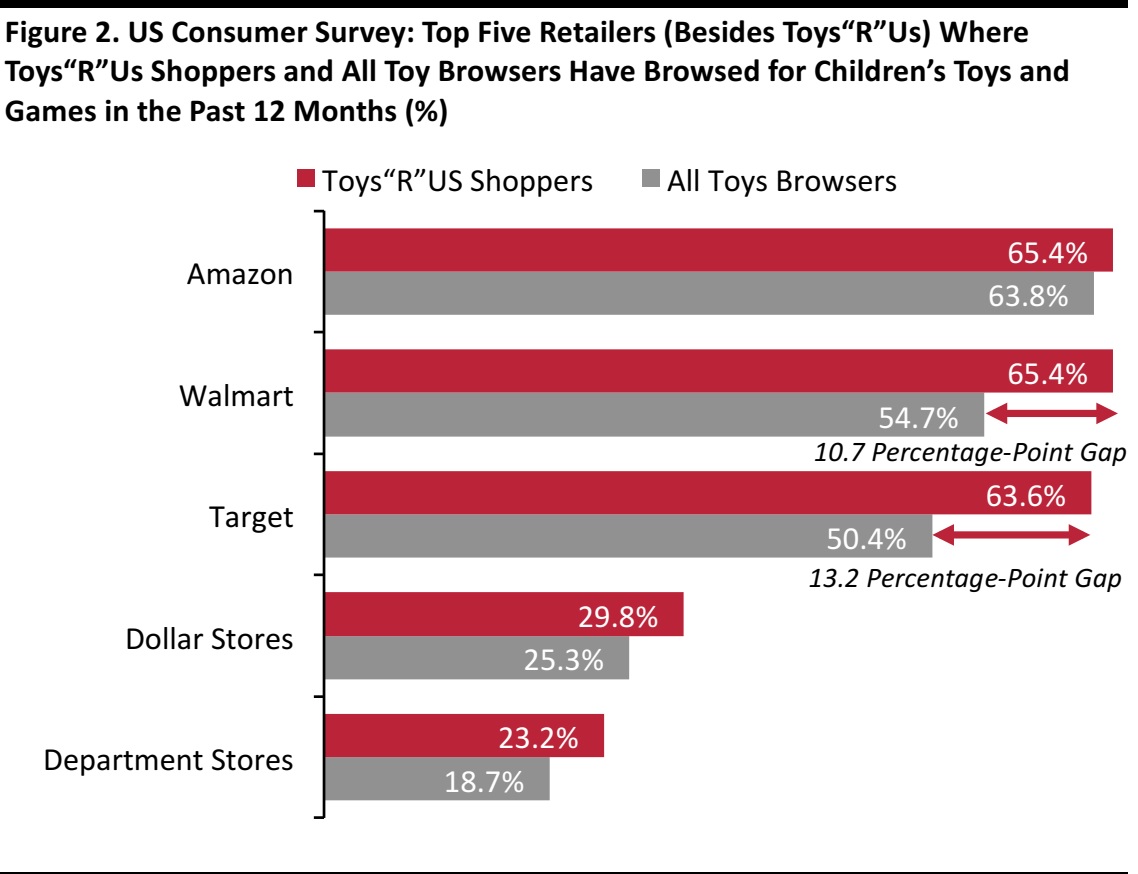

In our survey, we asked Toys“R”Us shoppers at which additional retailers they had browsed for toys and games in the past year. As we chart below, the results showed that Walmart and Amazon were neck and neck, with Target just behind—suggesting that all three will capture a substantial share of purchases that previously went to Toys“R”Us.

Consolidation among the top tier of retailers is not necessarily the only result we will see from these store closures, however.Lower-ranking retailers are likely to see gains, too, as toy dollars flow down as well as up. The data suggest that dollar stores, department stores, eBay and Costco could also chalk up gains as a result of the Toys“R”Us closures.

Base: 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

*Defined in the survey as Dollar General/Dollar Tree/Family Dollar/99 Cents Only

Source: Coresight Research

Base: 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

*Defined in the survey as Dollar General/Dollar Tree/Family Dollar/99 Cents Only

Source: Coresight Research

While Amazon will almost certainly grow its toy sales on the back of the Toys“R”Us closures, Walmart and Target look set enjoy disproportionate gains.We compared the list of additional retailers at which Toys“R”Us shoppers also browsed with the retailers where all toy and game shoppers browsed and found that:

- Toys“R”Us shoppers were much more likely than average toy shoppers to have browsed toys at Walmart or Target. Likelihood to have browsed at Walmart or Target was higher by double digits among Toys“R”Us shoppers than among all shoppers who browsed for toys.

- Among all toy shoppers, Amazon was the most popular retailer for browsing toys. However, among Toys“R”Us shoppers, Walmart was tied with Amazon in first place.

- The relative strength of Walmart and Target was probably due to the fact that many Toys“R”Us shoppers, by definition, had a preference for shopping at multi channel retailers instead of Internet pure plays such as Amazon.

Base: 1,181 US Internet users ages 18+ who have browsed children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research

Base: 1,181 US Internet users ages 18+ who have browsed children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research

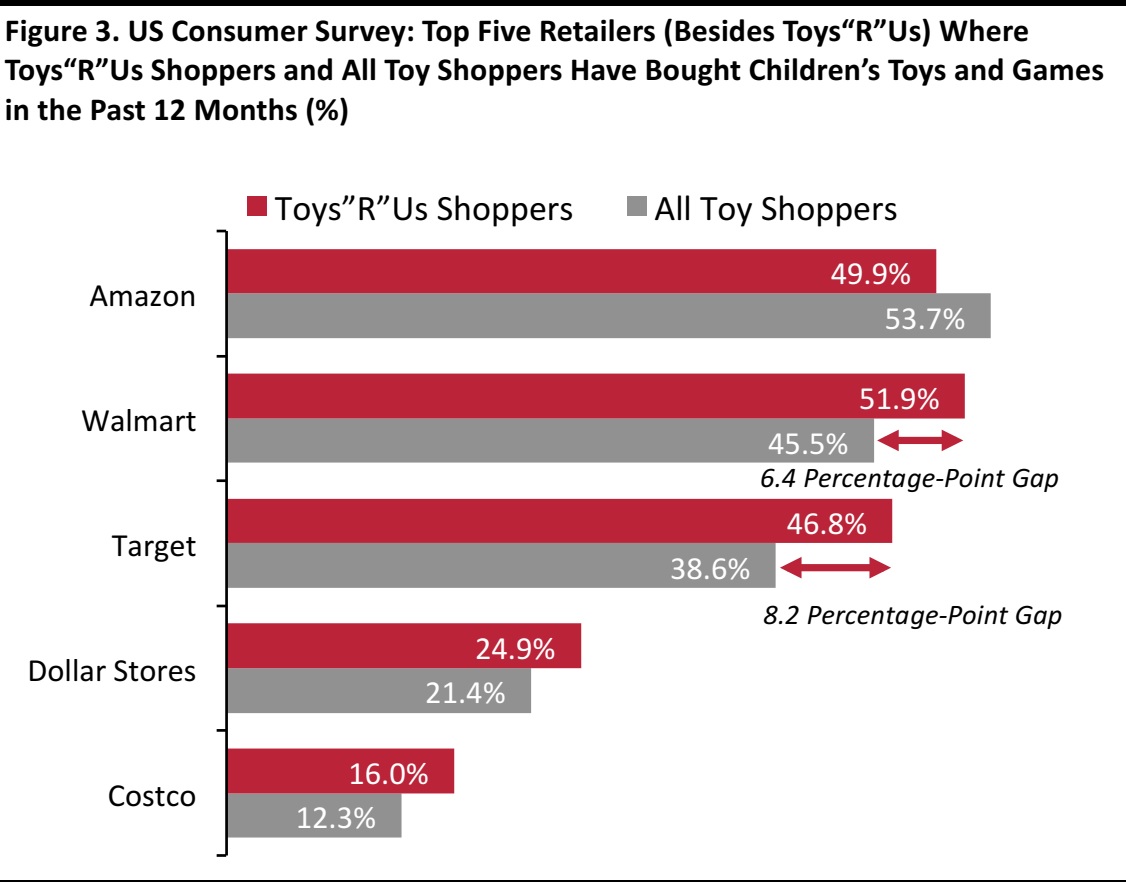

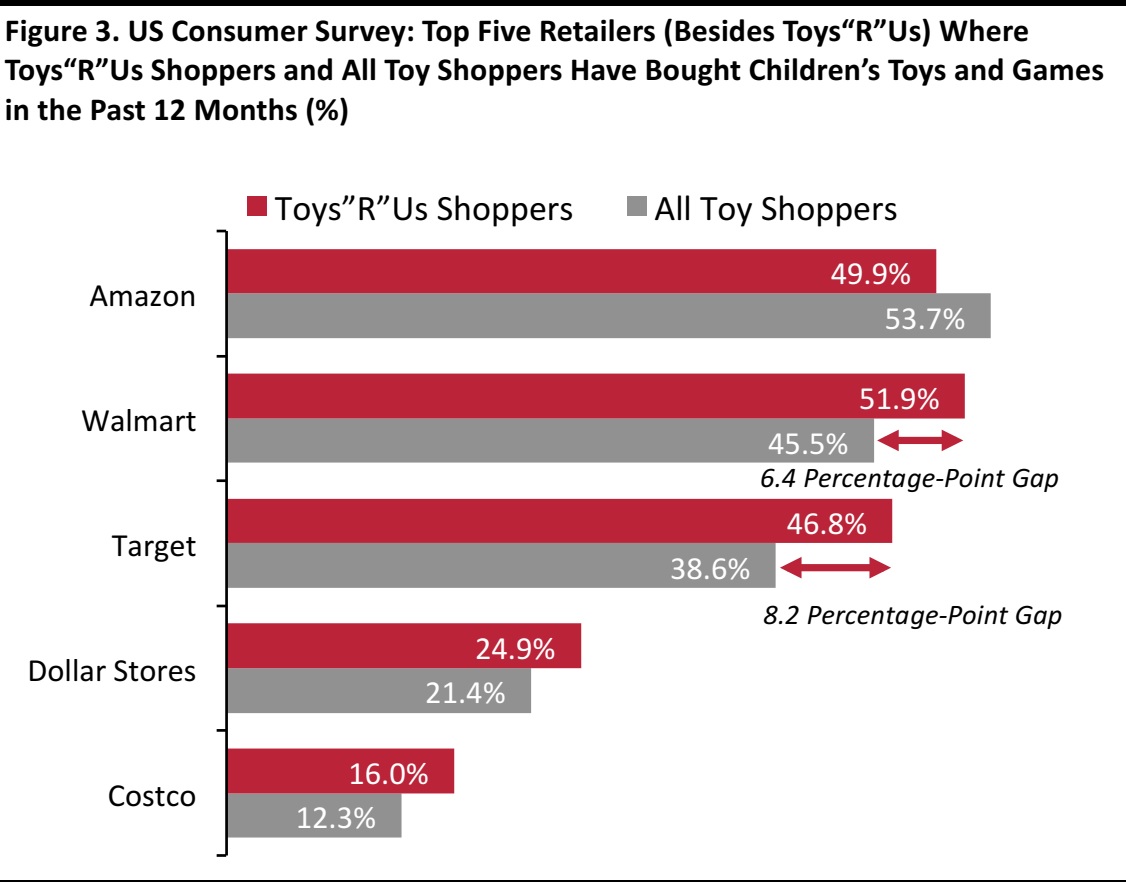

Similarly, we see a large gap when we compare where Toys“R”Us shoppers and all toy shoppers bought toys in the past 12 months. Toys“R”Us shoppers were considerably more likely than all toy shoppers to have bought toys from Walmart or Target in the past year.

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research

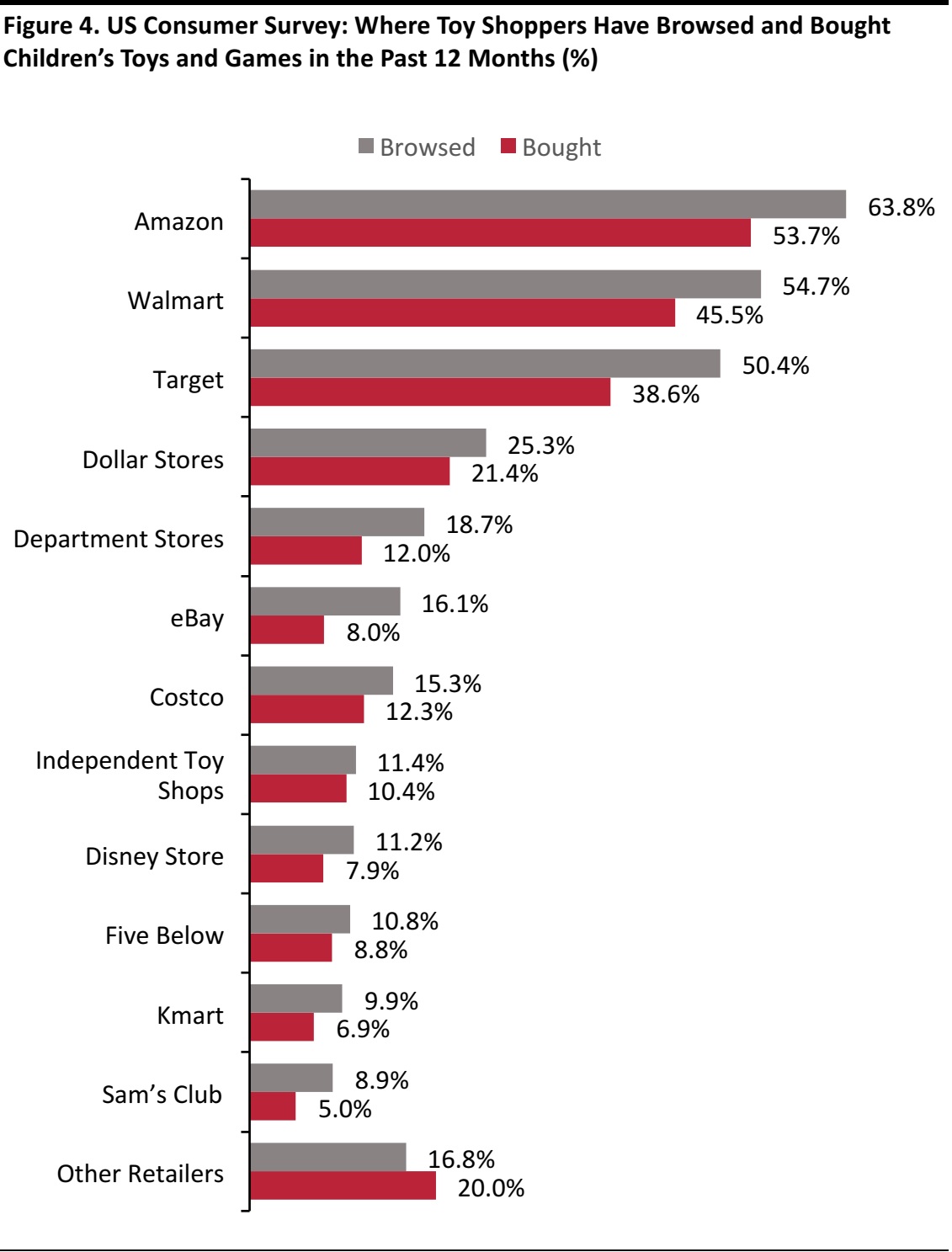

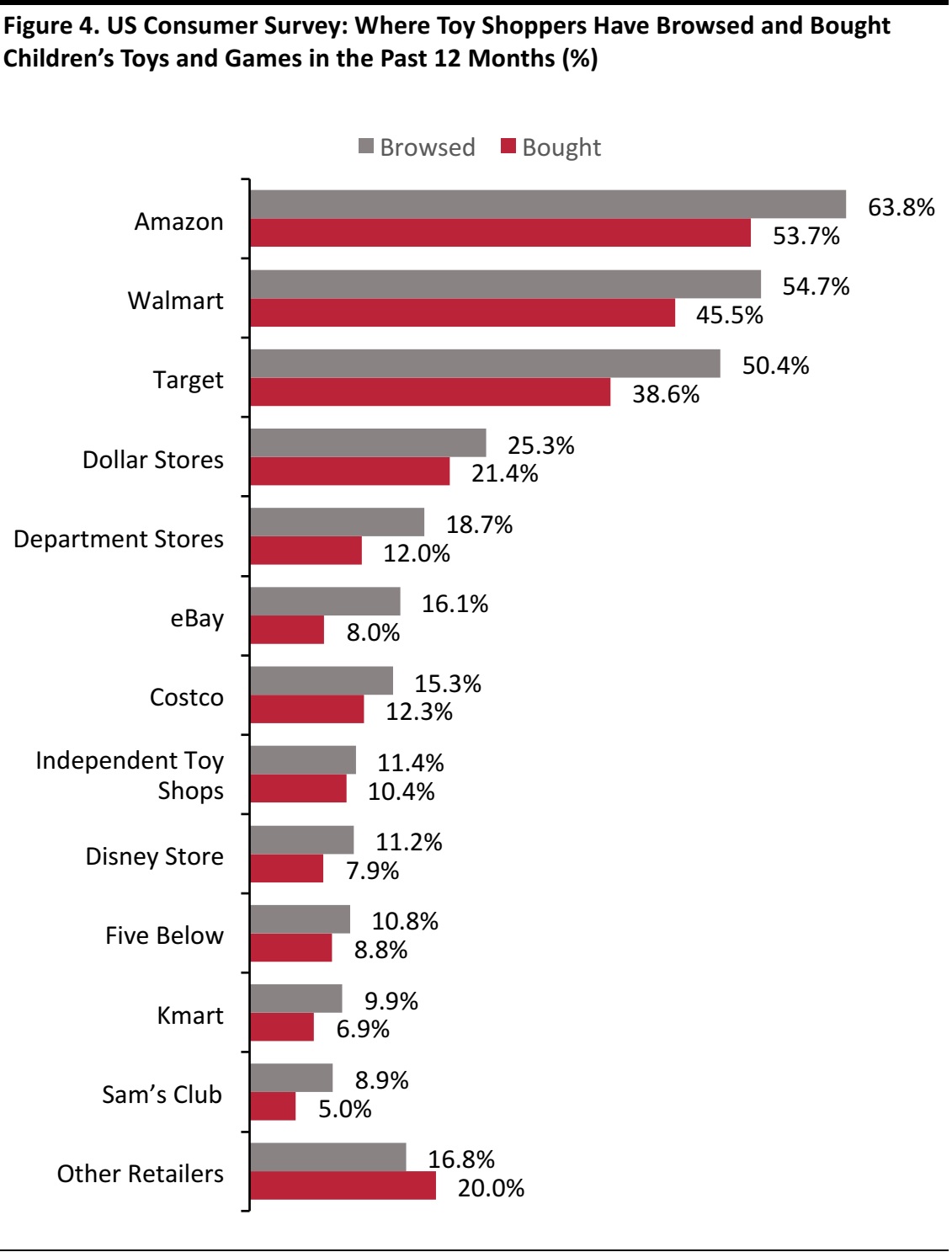

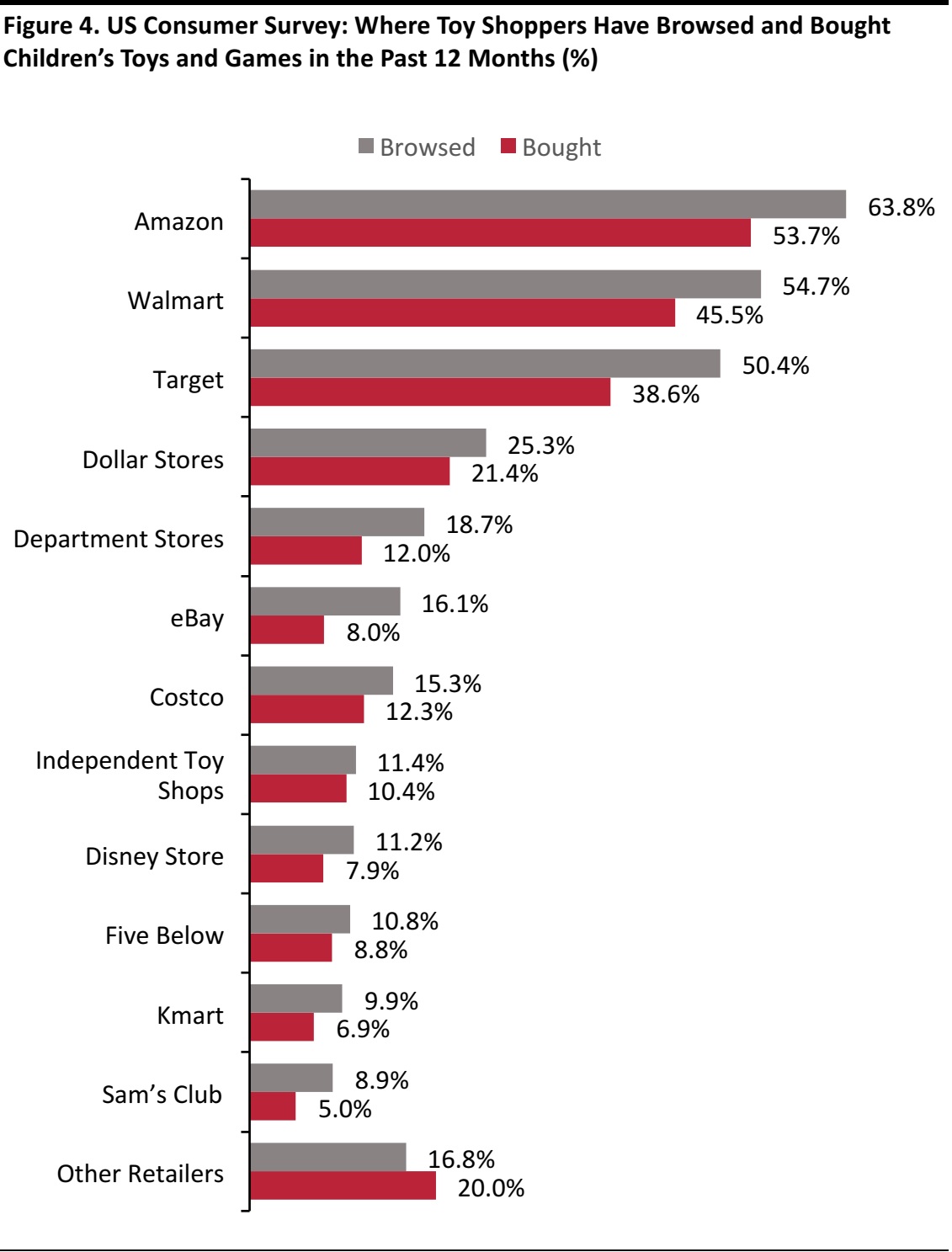

Ranking America’s Toy Retailers: Amazon, Walmart and Target Dominate

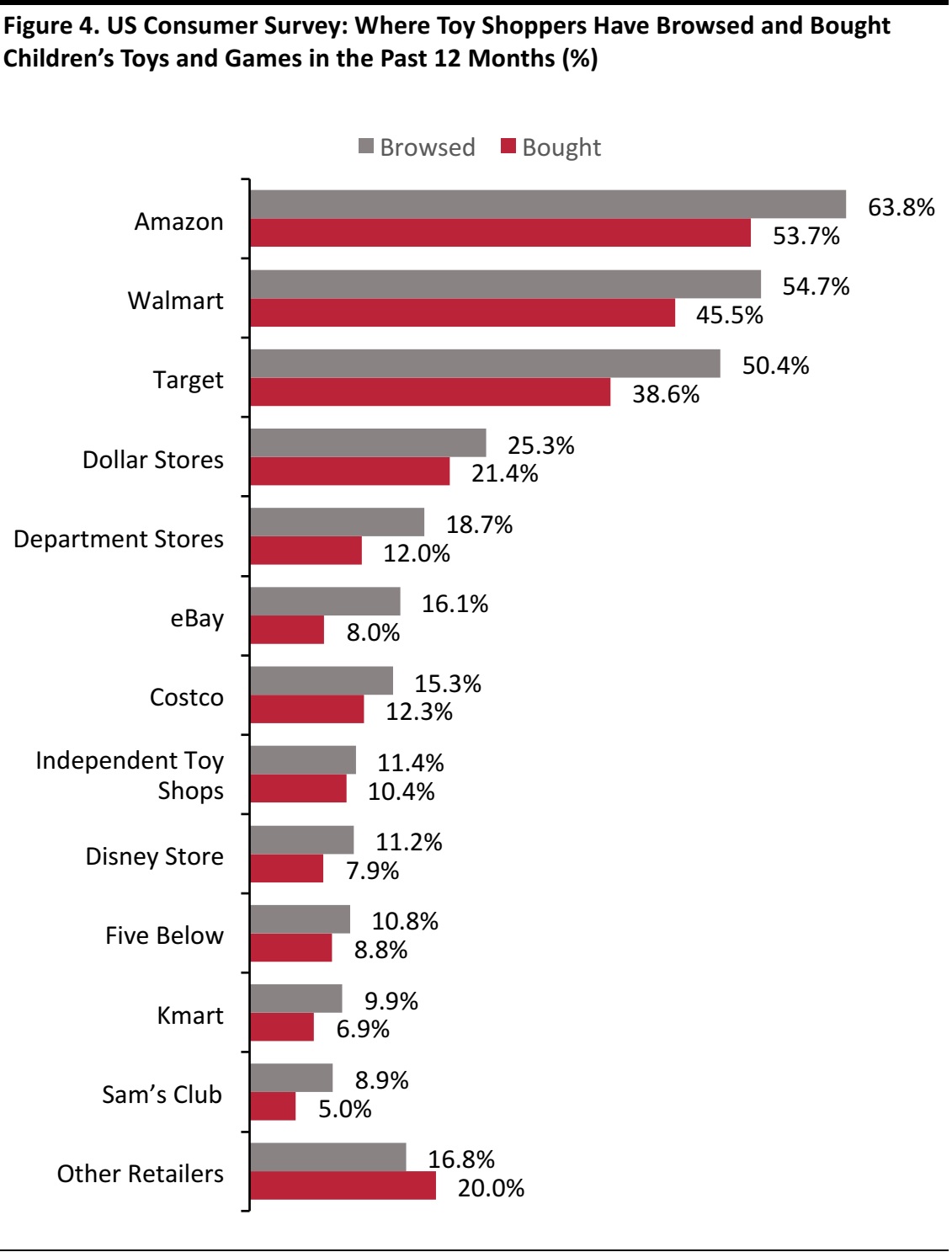

Our research confirms that the closure of Toys“R”Us will leave Amazon, Walmart and Target as the major retailers in the toys and games category. Below, we chart the overall rankings of retailers in terms of numbers of shoppers browsing and buying children’s toys and games. The graph excludes Toys“R”Us,which placed fourth in the rankings, with 36% of all toy shoppers having bought from the chain in the past 12 months.

Graph excludes Toys“R”Us. Figures are respective percentages of all those who have browsed and all those who have bought from each retailer/type of retailer shown.

Base: 1,181 US Internet users ages 18+ who have browsed for children’s toys or games in the past 12 months and 1,092 US Internet users ages 18+ who have boughtchildren’s toys or games in the past 12 months

Source: Coresight Research

Graph excludes Toys“R”Us. Figures are respective percentages of all those who have browsed and all those who have bought from each retailer/type of retailer shown.

Base: 1,181 US Internet users ages 18+ who have browsed for children’s toys or games in the past 12 months and 1,092 US Internet users ages 18+ who have boughtchildren’s toys or games in the past 12 months

Source: Coresight Research

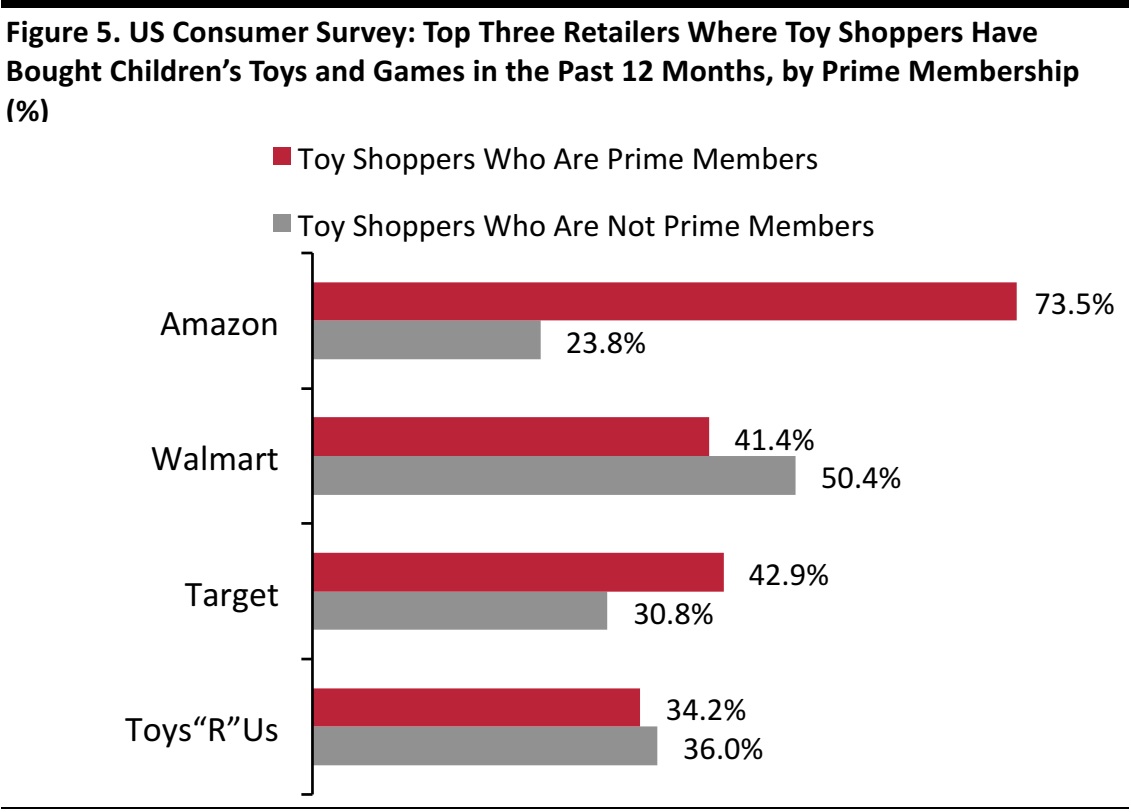

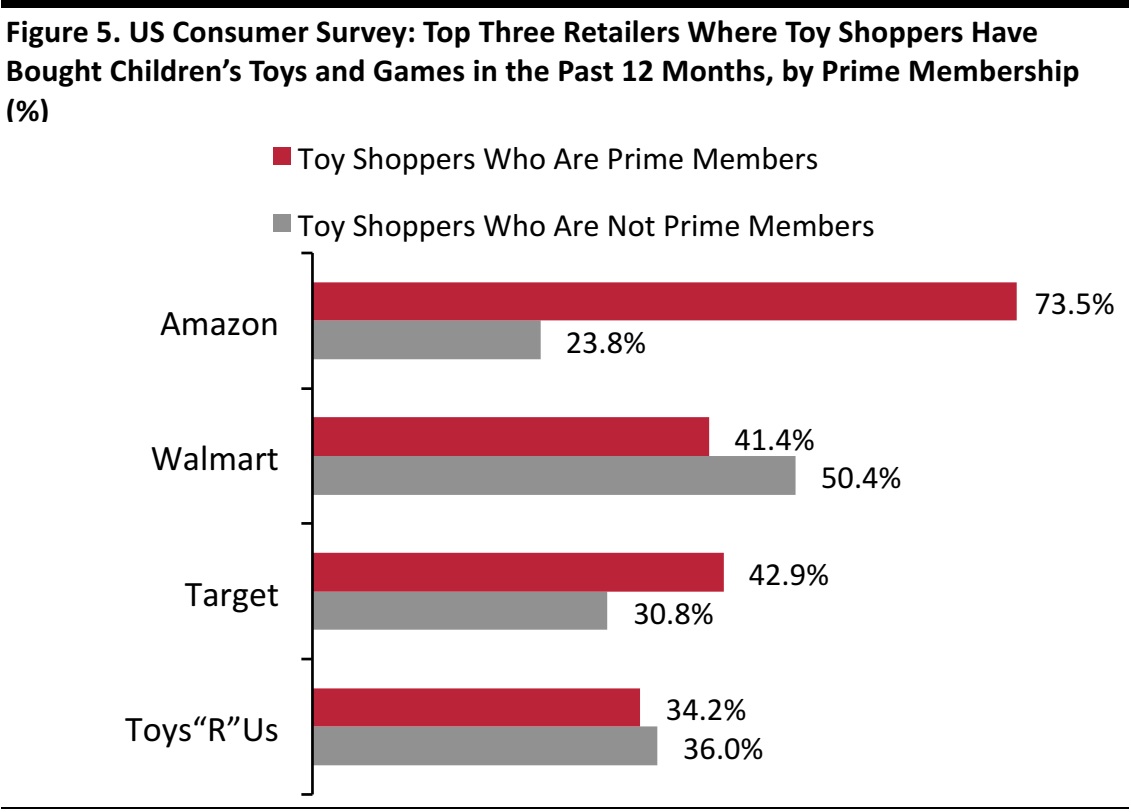

Amazon’s Leadership in Toys Is Driven by Prime Members

Amazon may be in first place by total number of toy and game shoppers, but its appeal is not universal, and its leading position in toys is almost entirely attributable to Prime members:

- Almost three-quarters of Prime members surveyed who bought toys or games in the past year did so on Amazon.

- Among those who bought toys in the past year but did not have a Prime membership, less than one-quarter bought on Amazon. That places Amazon firmly behind Walmart, Target and Toys“R”Us among toy shoppers who are not Prime members.

- Toys“R”Us sees relatively even representation among shoppers with Prime membership and those without.

Amazon is well placed to benefit as Prime members who had been shopping at Toys“R”Us turn to Amazon for toys instead. However, Amazon’s low shopper numbers among those without Prime suggest that it may face challenges in picking up large numbers of non-Prime Toys“R”Us shoppers.

“Prime Members” personally have a Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months, including 476 with Amazon Prime membership.

Source: Coresight Research

“Prime Members” personally have a Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months, including 476 with Amazon Prime membership.

Source: Coresight Research

Among all survey respondents, 41% had a personal Prime membership and a further 22% had access to Prime through someone else in their household. The remaining 36% of respondents had no access to Prime (figures do not sum to 100 due to rounding). Toys“R”Us shoppers recorded Prime membership rates that were broadly similar to the average.

Key Takeaways

- The closure of all stores by fourth-place toy retailer Toys“R”Us will leave Amazon, Walmart and Target fighting it out for dominance of the US toy retail market. All three are likely to pick up some of the $7 billion in spending that would otherwise have gone to Toys“R”Us.

- Even though they are already in the top three, Walmart and Target look set to punch above their weight in terms of gaining shoppers from the Toys“R”Us store closures, as they over index for browsing and buying among Toys“R”Us shoppers relative to all toy shoppers.

- Moreover, Prime members account for a large proportion of those who shop for toys on Amazon. The site sees low toy shopper participation among those without Prime, which suggests that Amazon may struggle to pick up large numbers of Toys“R”Us shoppers who are not Prime members.

- Our survey data suggest that dollar stores, department stores, eBay and Costco could also benefit from the Toys“R”Us closures.

Base: 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

*Defined in the survey as Dollar General/Dollar Tree/Family Dollar/99 Cents Only

Source: Coresight Research

Base: 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

*Defined in the survey as Dollar General/Dollar Tree/Family Dollar/99 Cents Only

Source: Coresight Research Base: 1,181 US Internet users ages 18+ who have browsed children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research

Base: 1,181 US Internet users ages 18+ who have browsed children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months and 393 US Internet users ages 18+ who have bought children’s toys or games from Toys“R”Us in the past 12 months, surveyed March 15–21, 2018

Source: Coresight Research Graph excludes Toys“R”Us. Figures are respective percentages of all those who have browsed and all those who have bought from each retailer/type of retailer shown.

Base: 1,181 US Internet users ages 18+ who have browsed for children’s toys or games in the past 12 months and 1,092 US Internet users ages 18+ who have boughtchildren’s toys or games in the past 12 months

Source: Coresight Research

Graph excludes Toys“R”Us. Figures are respective percentages of all those who have browsed and all those who have bought from each retailer/type of retailer shown.

Base: 1,181 US Internet users ages 18+ who have browsed for children’s toys or games in the past 12 months and 1,092 US Internet users ages 18+ who have boughtchildren’s toys or games in the past 12 months

Source: Coresight Research “Prime Members” personally have a Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months, including 476 with Amazon Prime membership.

Source: Coresight Research

“Prime Members” personally have a Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Base: 1,092 US Internet users ages 18+ who have bought children’s toys or games in the past 12 months, including 476 with Amazon Prime membership.

Source: Coresight Research