Details from the Survey

The NRF and Prosper Insights and Analytics surveyed 7,320 consumers about both back-to-school and back-to-college plans during June 29–July 8 and calculated the following high-level results:

- Total spending for back-to-school and back-to-college is forecast to reach $82.8 billion, slightly below last year’s $83.6 billion.

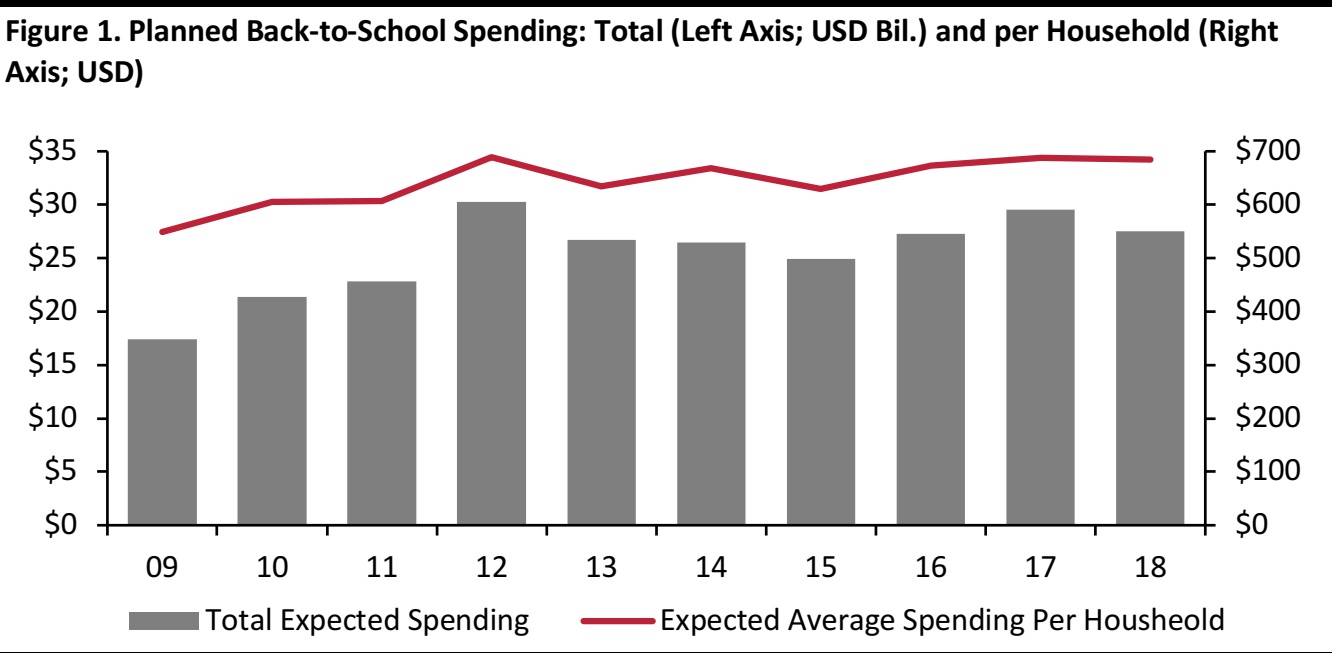

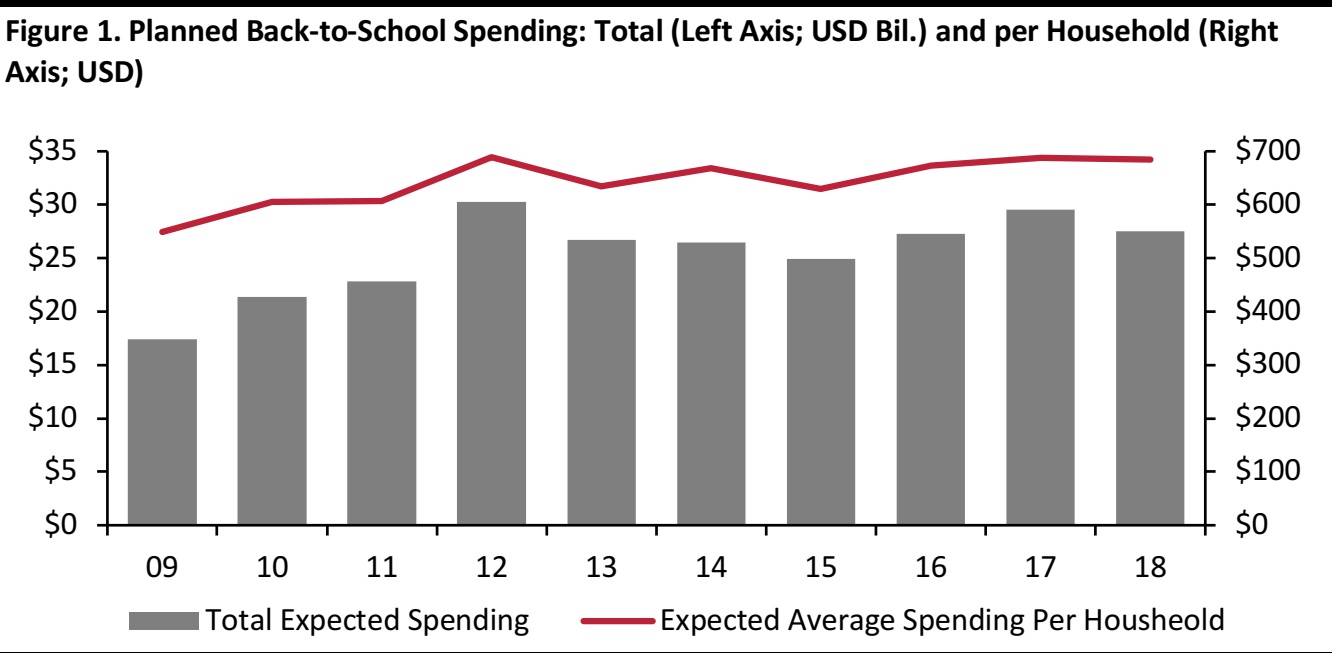

- Families plan to spend an average of $684.79 each on back-to-school purchases, slightly below last year’s $687.72, for a total of $27.5 billion. This is the third-highest figure in the history of the survey, following a peak of $30.3 billion in 2012.

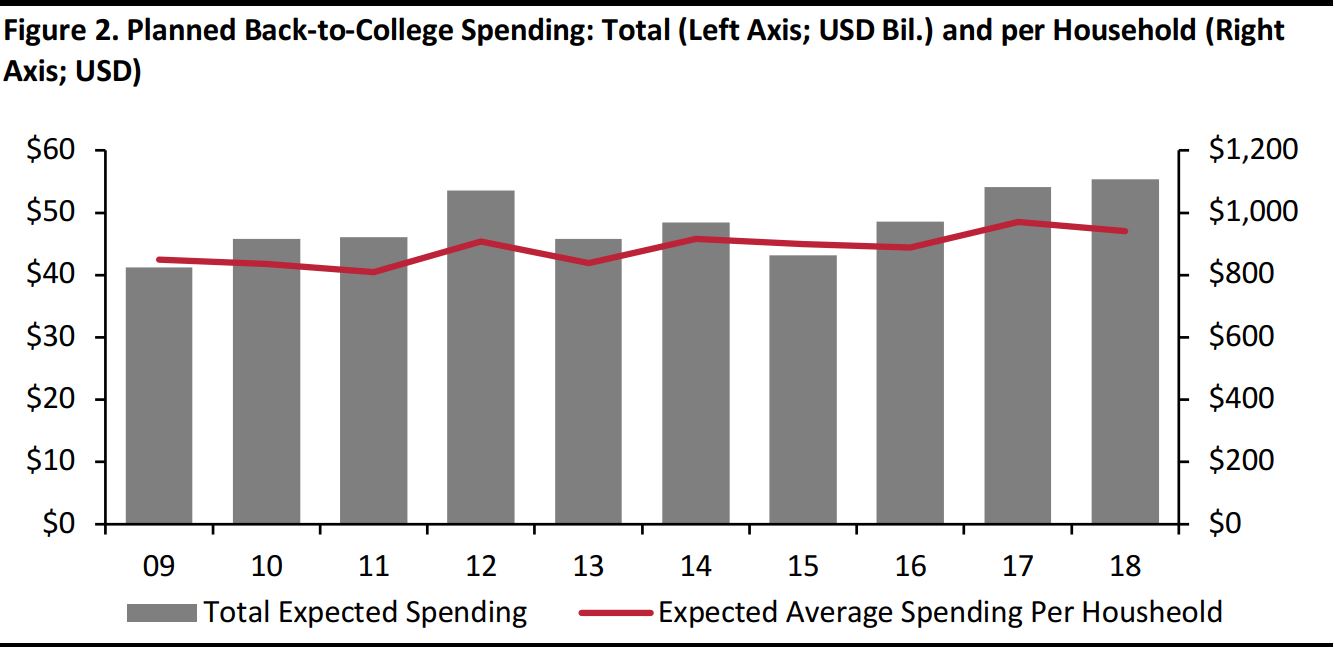

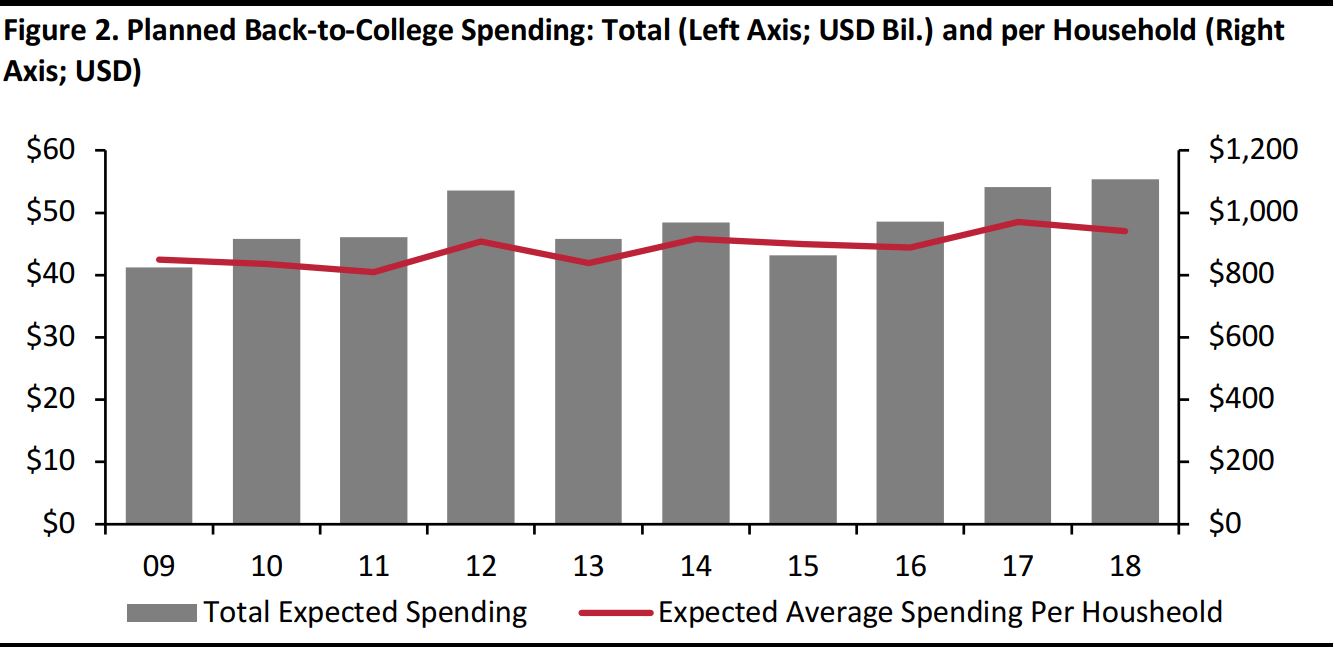

- Back-to-college families plan to spend an average of $942.17 each, below last year’s $969.88, for a total of $55.3 billion. This figure marks a new all-time high, up from last year’s record spending of $54.1 billion.

Back-to-School Spending

The figure below shows total and per-household back-to-school spending.

Source: 2018 NRF Back-to-School/College Spending Survey conducted by Prosper Insights & Analytics

The largest back-to-school spending categories are:

- Clothing—$236.90

- Electronics such as computers, calculators or phones—$187.10

- Shoes—$138.66

- Supplies such as notebooks, pencils, backpacks and lunchboxes—$122.13

The NRF commented that the biggest change in spending derives from electronics, as laptops, tablets and smartphones are now an everyday part of life and are therefore not purchased before the school year starts, which is driving a slight decrease in this category.

The top destinations for consumers shopping for back-to-school items are:

- Department stores—57%

- Online retailers—55%

- Discount stores—52%

- Clothing stores—51%

- Office supply stores—35%

The survey also found that more consumers are starting early this year. In the survey, 77% of back-to-school shoppers plan to start shopping at least three weeks before school begins, compared to last year’s 74% and 64% a decade ago. Moreover, 89% of back-to-school and college shoppers still have half or more of their purchases yet to acquire.

Moreover, the survey found that teenagers will spend $35.60 of their own money on average on back-to-school purchases, compared to $25.06 for preteens.

Back-to-College Spending

The figure below shows total and per-household back-to-college spending.

Source: 2018 NRF Back-to-School/College Spending Survey conducted by Prosper Insights & Analytics

The largest back-to-college spending categories are:

- Electronics—$229.21

- Clothing and accessories—$153.32

- Dorm or apartment furnishings—$109.29

- Food—$102.82

The most popular shopping destinations for back-to-college consumers are:

- Online retailers—49%

- Department stores—40%

- Discount stores—35%

- Office supply stores—31%

- College bookstores—30%

The survey found that 67% of college shoppers will start shopping early, flat with last year, but up from 51% in 2008.

The NRF commented further that back-to-college shoppers are increasing their spending budgets in categories such as clothing, furnishings and shoes, whereas spending in categories such as personal care items, gift cards and food declined this year, since consumers tend to make these types of purchases throughout the school year.