Nitheesh NH

Topsports International Holdings

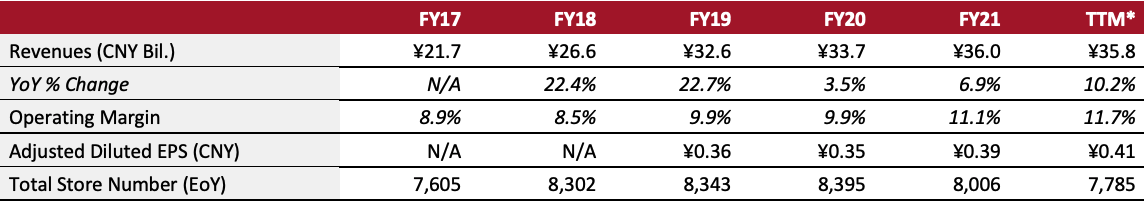

Sector: Apparel specialty retail Countries of operation: China Key product categories: Sports and outdoor accessories, apparel and footwear Annual Metrics [caption id="attachment_143332" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

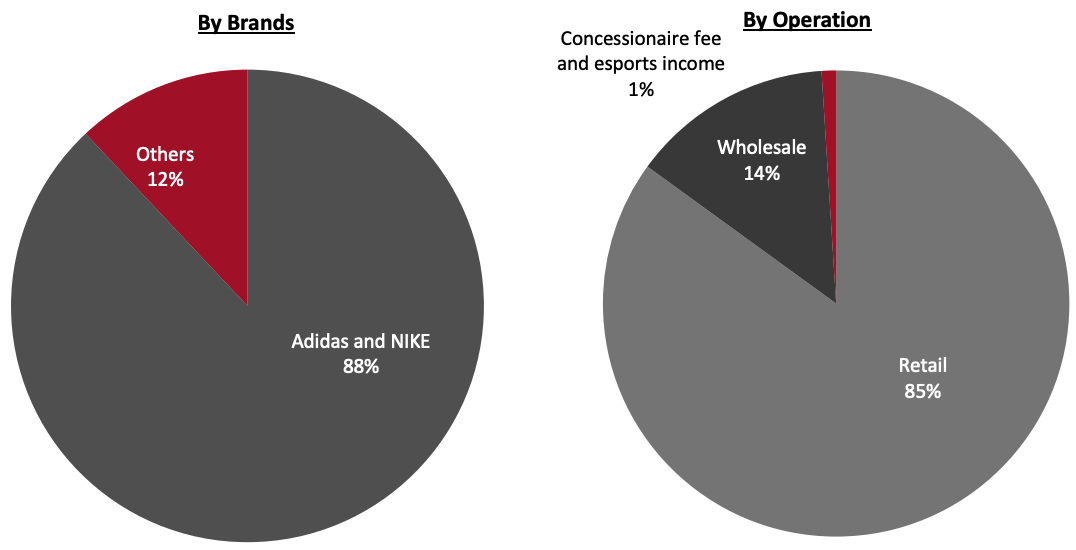

Fiscal year ends on January 30 of the following calendar year*Trailing 12 months ended August 31, 2021[/caption] Summary Founded in 1999 and headquartered in Shanghai, China, Topsports International Holdings is an investment holding company that sells sports apparel and footwear, and leases commercial premises for joint sales to other retailers through its subsidiaries. The company generates over 85% of its revenues through sales of two global brands: Adidas and NIKE. Topsports’ other brand partners include Asics, Converse, The North Face, Onitsuka Tiger, Puma, Reebok, Skechers, Timberland and Vans. As of August 31, 2021, the company operates 7,785 stores across Tier 1–7 cities in China. Topsports has over 47 million registered members as of January 2022. Company Analysis Coresight Research insight: Topsports capitalizes on its procurement scale, distribution footprint and strong relationships with key vendor partners—including leading brand owners such as Adidas, NIKE, The North Face, Puma and Reebok. The company has witnessed strong sales growth over the past five years; however, in the first half of fiscal 2022 (ended August 31, 2021), the company’s total sales were slightly impacted by the supply chain shortage and the resurgence of the pandemic in China—with sales decreasing by 1.2% year over year. Nevertheless, the company’s management expects positive sales growth for the full year fiscal 2022, driven by Adidas and NIKE (which comprise a large majority of the company’s revenues), increased marketing investment in China, ongoing supply chain recovery and the easing pandemic situation. We expect demand for Topsports’ products to remain solid in 2022 and beyond, as we believe consumer perspectives on active lifestyles will remain unchanged even after the pandemic. New work-from-home setups will also likely continue to support athleisure and outdoor apparel market growth in China. Additionally, Beijing’s Winter Olympics in February 2022 will help drive demand for athletic and outdoor products, combined with recent governmental measures to increase health awareness. Topsports is looking to diversify its brand portfolio to reduce its reliance on its main brands. In January 2022, Topsports stated that it has expanded its collaboration with Skechers, as the latter consolidates its distributors in China during fiscal 2022. We believe that the company should also collaborate with reputable domestic brands as it expands its store network across China, capitalizing on its retail management and digital capabilities. We believe a well-diversified brand portfolio could enhance Topsports’ resilience.

| Tailwinds | Headwinds |

|

|

- Upgrade its store management system, by providing its frontline workers with mobile digital toolkits, featuring an algorithm-backed app, offering a real-time view of consumer demand and inventory

- Launch store-based online community groups and sales conversion tools

- Install a digitalized inventory procurement and replenishment system to generate base orders for each store and to adjust the product portfolio to meet local demand

- Connect customer touchpoints and manage consumer traffic across channels by integrating virtual and physical venues

- Facilitate steady omnichannel retail growth by unifying price offerings

- Incorporate social fission marketing and use social relations to amplify products’ impact and energize sales growth

- Ensure thorough analysis of consumer shopping behavior and implement marketplace analysis models to rationalize decision-making

- Enhance member loyalty by launching diversified membership events, introducing an award-points redemption system and prioritizing limited-edition products

- Standardize its mobile toolkit for frontline staff to ensure precise traffic management within stores

- Enrich product offerings across brands and categories

- Deepen collaborations with its principal brand partners, Adidas and NIKE

- Create a diversified brand portfolio by enhancing cooperation with non-principal brand partners, such as Skechers

- Open larger stores, referred to as “big boxes,” which provide an extensive array of products, aiming compete with e-commerce players with unlimited shelf space

- Prioritize store opening in high foot traffic areas, such as Beijing’s prime commercial district

- Close smaller, loss-making or less productive stores

- Enhance existing stores’ interior design and display

Company Developments

Company Developments

| Date | Development |

| January 24, 2022 | Collaborates with NIKE to open a new retail store, NIKE Beijing—NIKE’s first Rise concept store developed in collaboration with a strategic partner in China. |

| October 29, 2021 | Announces an increase in semi-annual dividends for the period ended August 31, 2021. |

| October 27, 2020 | Appoints Kam Leung as Executive Director. Leung joined the company in June 2006 and served as the Company Secretary and Chief Financial Director of Belle International, the parent company of Topsports. |

| June 26, 2020 | Announces a change to its principal place of business in Hong Kong. |

| September 23, 2019 | Launches a $1.2 billion Hong Kong initial public offering. |

- Wu Yu—Executive Director and CEO

- Qiang Zhang—Vice President

- Xiaoji Chai—Vice President

- Zhong Tian—Vice President

- Kam Leung—Executive Director, Secretary and Chief Financial Director (Belle International)

Source: Company reports/S&P Capital IQ