Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

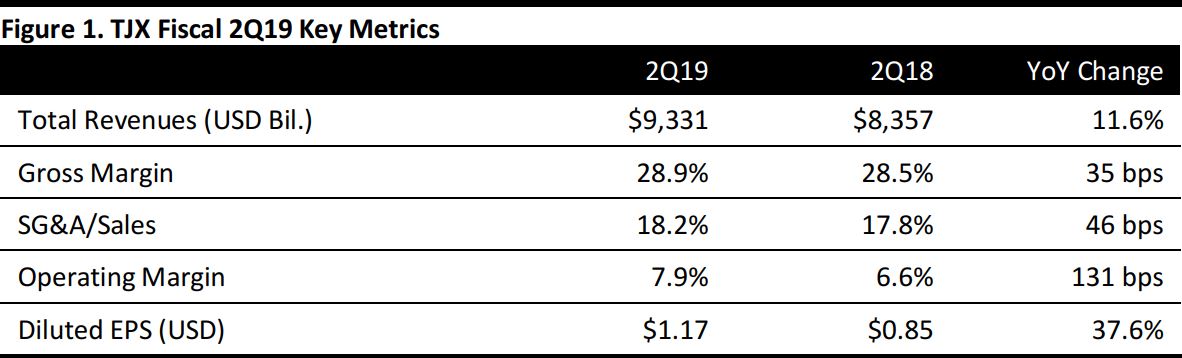

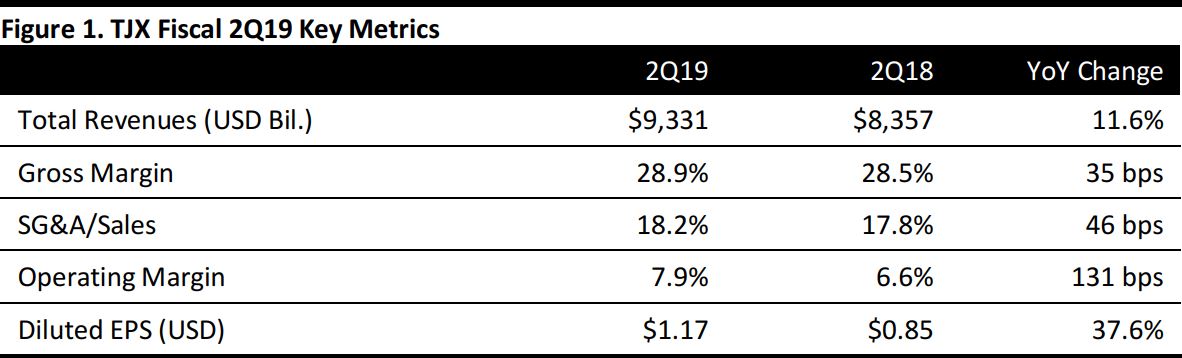

Fiscal 2Q19 Results

TJX reported fiscal 2Q19 for the quarter ended August 4, 2018, with net sales of $9.3 billion, up 11.6% year over year and above the consensus estimate of $9.0 billion. Diluted EPS was $1.17, above the consensus estimate of $1.05 and up 37.6% from the year-ago quarter.

TJX reported comparable sales increases of 6% compared to a 3% increase for the period last year ending August 5, 2017 and above the consensus estimate of 2.1%. Marmaxx, the company’s largest division, delivered a 7% comparable-store sales increase compared to a 2% increase last year. TJX Canada comparable-store sales increased by 6% compared to 7% last year, TJX International increased by 4% compared to 1% last year, and HomeGoods increased by 3% compared to 7% last year.

The company attributed customer traffic as the primary driver of its comp store sales increases. TJX reported that this was the 16th consecutive quarter of customer traffic increases for TJX and Marmaxx. The company reported that average ticket order values were also up this quarter.

TJX reported that it is attracting new, younger customers at all divisions, and that the apparel division has seen robust performance. In particular, the company reported that its Marmaxx customers are younger, Gen-Z and millennial customers. TJX reported that it has more than 20,000 vendors sourcing merchandise from around the globe. It is focusing on innovation and is constantly testing new ideas within its stores and online channels.

During the second quarter, TJX increased its store count by 534 stores to a total of 4,194 stores from 4,141, and increased its square footage by 5% over the same period.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research