Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

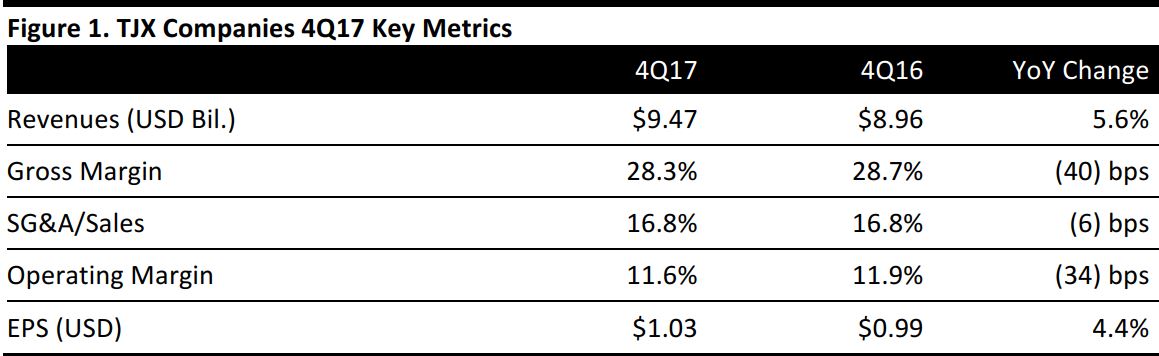

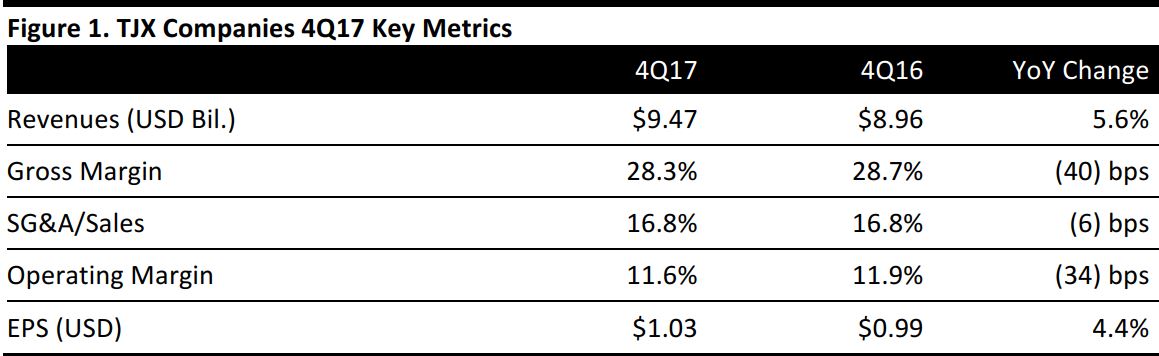

4Q17 Results

TJX Companies reported fiscal 4Q17 revenues of $9.47 billion, up 5.6% year over year and slightly ahead of consensus estimates. Total comps increased by 3%, ahead of the 2.7% consensus estimate and compared with a 6% increase in the year-ago quarter.

Management was pleased with the company’s 50-year history and sales surpassing $33 billion and that customer traffic was the primary driver of comp increases at every major division during the quarter. The 2016 calendar year also marked the company’s 21st consecutive year of comp sales increases.

EPS was $1.03, versus $0.99 in the year-ago quarter and beating the consensus estimate by two cents.

Performance by Segment

- Marmaxx: Revenues (US only) were $6.0 billion, up 5.4% year over year. Comps were up 3%, compared with a 6% increase in the year-ago quarter.

- HomeGoods: Revenues (US only) were $1.3 billion, up 12.6% year over year. Comps were up 5%, compared with a 7% increase in the year-ago quarter.

- TJX Canada: Revenues were $873 million, up 11.8% year over year. Comps were up 4%, compared with a 14% increase in the year-ago quarter.

- TJX International: Revenues (Europe and Australia) were $1.2 billion, down 3.4% year over year. Comps were up 1%, compared with a 1% increase in the year-ago quarter.

FY17 Results

Fiscal-year 2017 revenues were $33.18 billion, up 7.2% from the prior year.

Total comps increased by 5%, compared with a 5% increase the prior year. By segment, Marmaxx posted comps of 5% (compared with 4% the prior year), HomeGoods posted comps of 6% (compared with 8% the prior year), TJX Canada posted comps of 8% (compared with 12% the prior year) and TJX International posted comps of 2% (compared with 4% the prior year).

Full-year adjusted EPS was $3.53, compared with $3.33 the prior year. GAAP EPS was $3.46, which includes a debt extinguishment charge and pension settlement charge that reduced earnings by $0.07 per share.

Outlook

FY18

For FY18, the company expects EPS of $3.80–$3.89, representing a 10%–12% increase and in line with or above the $3.80 consensus estimate. The guidance includes the following assumptions:

- Includes a 53rd week in the calendar, which adds $0.11 to EPS.

- Excludes the $0.07 per share debt extinguishment charge mentioned above.

- Wage increases are expected to hurt EPS growth by 2%.

- Comps are expected to increase by 1%–2%.

1Q18

For fiscal 1Q18, the company expects EPS of $0.76–$0.78, compared with $0.76 in the year-ago quarter and below the $0.81 consensus estimate. The guidance includes the following assumptions:

- Wage increases are expected to hurt EPS growth by 3%.

- Foreign currency changes and transaction costs are expected to hurt EPS growth by 6%.

- Accounting changes are expected to help EPS by 1%.

- Comps are expected to grow by 0%–1%, compared with 7% in the year-ago quarter.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology