Source: Company reports/FGRT

Fiscal 3Q18 Results

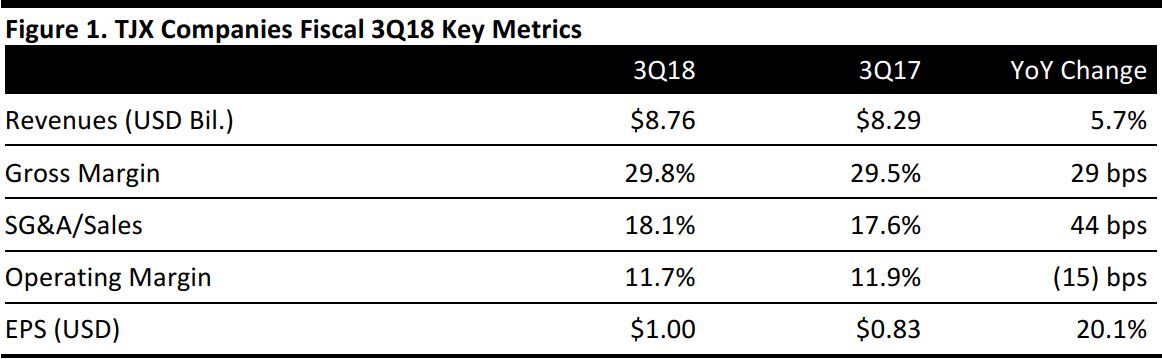

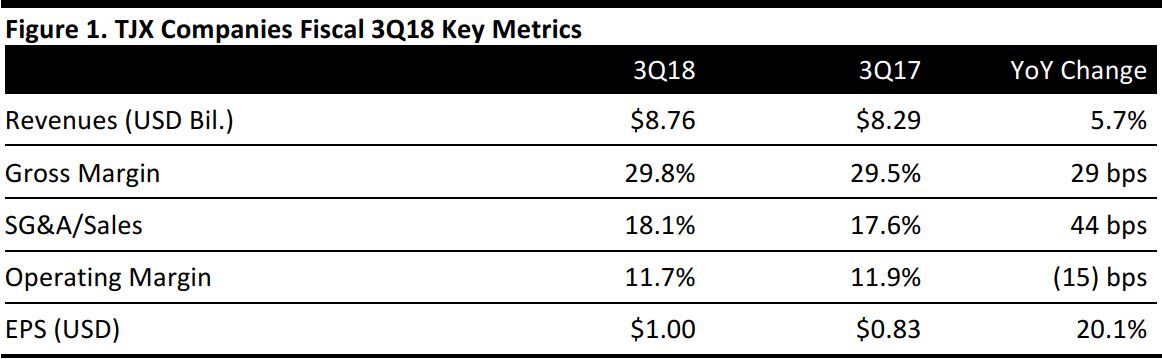

TJX Companies reported fiscal 3Q18 revenues of $8.76 billion, up 5.7% year over year and slightly below the consensus estimate of $8.86 billion. Comps were flat, below the 2.4% consensus estimate and compared with 5% in the year-ago quarter.

Management noted that, although the hurricanes in the US affected business, sales trends at Marmaxx improved with the weather and that customer traffic was up at every major division. Management further commented that the fourth quarter was off to a strong start, adding that the company faces numerous opportunities for the holiday selling season across its retail banners.

EPS was at the high end of the company’s planned range and in line with the consensus estimate at $1.00, versus $0.83 in the year-ago quarter.

Performance by Segment

- Marmaxx: Revenues were $5.3 billion, up 0.9% year over year. Comps were (1)%, compared with 5% in the year-ago quarter.

- HomeGoods: Revenues were $1.2 billion, up 14.0% year over year. Comps were 3%, compared with 6% in the year-ago quarter.

- TJX Canada: Revenues were $983 million, up 15.0% year over year. Comps were 4%, compared with 8% in the year-ago quarter.

- TJX International: Revenues were $1.3 billion, down 13.3% year over year. Comps were 1%, compared with flat in the year-ago quarter.

Details from the Quarter

- TJX Companies’ merchandise margin was better than expected and the company held the line on expenses despite a flat comp thanks to the flexibility of its off-price model.

- Consolidated inventories on a per-store basis, including inventories held in warehouses but excluding in-transit and e-commerce inventories, were down 4% in constant currency terms. Management is comfortable with its liquidity and inventory position entering the fourth quarter and is well positioned to flow fresh merchandise into stores throughout the holiday season.

- Marmaxx’s profit margin decreased by 80 basis points, primarily due to expense deleverage on the lower-than-planned comp. However, the division’s merchandise margin was up significantly due to disciplined buying and inventory management.

- HomeGoods’ profit margin was down 60 basis points, primarily due to increased supply chain and freight costs that were largely a result of a new distribution center.

- TJX Canada’s adjusted profit margin, excluding foreign currency, was up 240 basis points due to a benefit from transactional foreign exchange and a strong increase in merchandise margin as well as lower supply chain costs versus last year. All three Canadian chains had great momentum and strong results in the quarter.

- TJX International’s adjusted profit margin, excluding foreign currency, was down 220 basis points due to costs related to opening a new distribution center in the UK, lower merchandise margin and expense deleverage on the 1% comp.

Outlook

FY18

For FY18, the company expects EPS at the high end of its $3.91–$3.93 guidance range, representing a 13%–14% increase over last year’s EPS of $3.46. The guidance includes the following assumptions:

- EPS is expected to benefit by $0.11 from an extra week in the quarter.

- Prior-year EPS includes a debt-extinguishment charge of $0.07 per share.

- Wage increases are expected to hurt EPS growth by 2%.

- A change in accounting rules is expected to help EPS by 1%.

- Comps are expected to be 1%–2%.

4Q18

For 4Q18, the company expects EPS of $1.25–$1.27, compared with $1.03 in the year-ago quarter and the $1.27 consensus estimate. The guidance includes the following assumptions:

- EPS is expected to benefit by $0.11 from an extra week in the quarter.

- Wage increases are expected to hurt EPS growth by 1%.

- Foreign currency changes and transaction costs are expected to boost EPS growth by 1%.

- Comps are expected to be 1%–2%.