Source: Company reports/FGRT

Fiscal 2Q18 Results

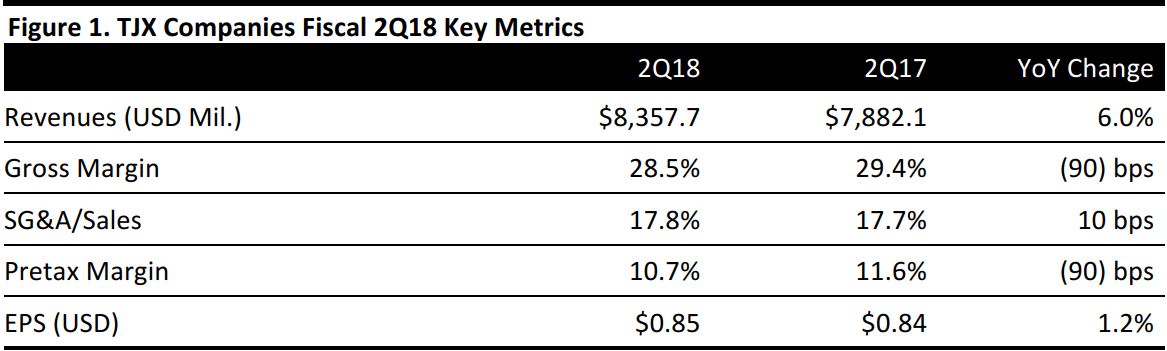

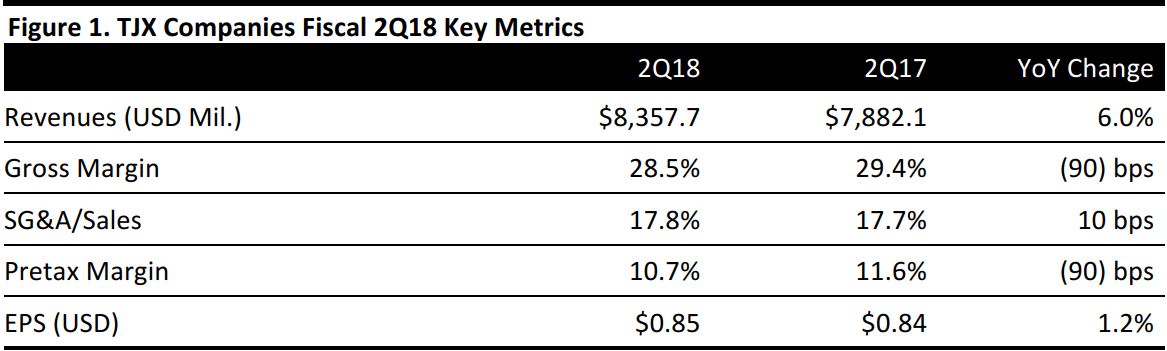

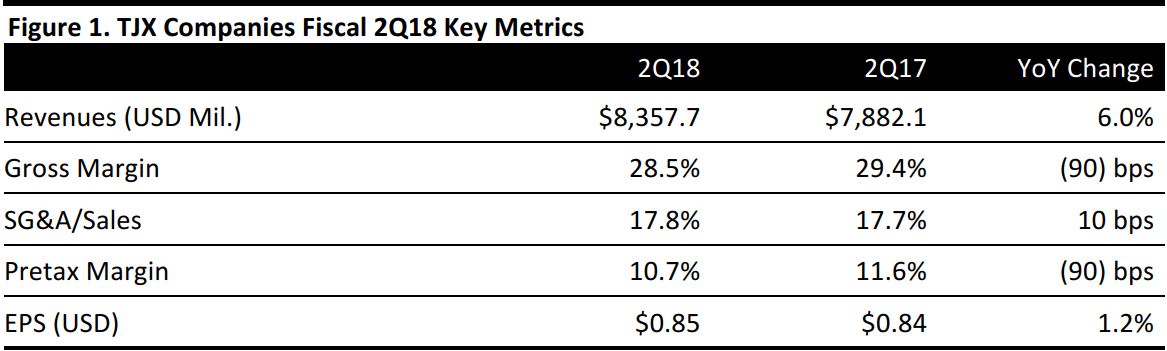

TJX Companies reported fiscal 2Q18 EPS of $0.85, above both the consensus estimate of $0.84 and management’s expectations.

Total revenues increased by 6.0% year over year, to $8.4 billion. Comps increased by 3.0%, versus expectations for a 2.2% increase. Marmaxx comps were up 2.0%, above expectations of 1.0%, while HomeGoods comps were up 7.0%, above expectations of 2.4%. TJX Canada comps were up 7.0% and TJX Europe comps were up 1% in the quarter.

Comps continued to be driven by strong traffic trends, and the overall merchandise margin was up.

During the quarter, TJX Companies increased its store count by 51, to a total of 3,913. Square footage was up 5% year over year.

Outlook

For the third quarter, the company expects EPS of $0.98–$1.00, versus consensus of $1.00. That increase would represent growth of 18%–20% over the prior year period’s EPS result of $0.83. The guidance assumes that wage increases will negatively impact EPS growth by 1%. For the fourth quarter, the company also expects EPS of $0.98–$1.00, versus consensus of $1.00. The guidance assumes that wage increases will negatively impact EPS growth by 1%, that changes in foreign currency will positively impact EPS growth by 3% and that a change in accounting rules for share-based compensation will positively impact EPS growth by an additional 2%. The outlook is based on expected comp growth of 1%–2%, which is below the consensus of 2.5%.

For the full year, management raised its EPS projections to $3.89–$3.93 from $3.71–$3.78 previously; consensus calls for full-year EPS of $3.89. This full-year guidance includes an expected benefit of approximately $0.11 per share from the 53rd week in fiscal year 2018. Full-year guidance assumes that wage increases will negatively impact EPS growth by 2%. The change in accounting rules for share-based compensation is expected to positively impact EPS growth by 2%. The guidance is based on an expected comp increase of 1%–2% for the full year.