Source: Company reports/Fung Global Retail & Technology

1Q18 Results

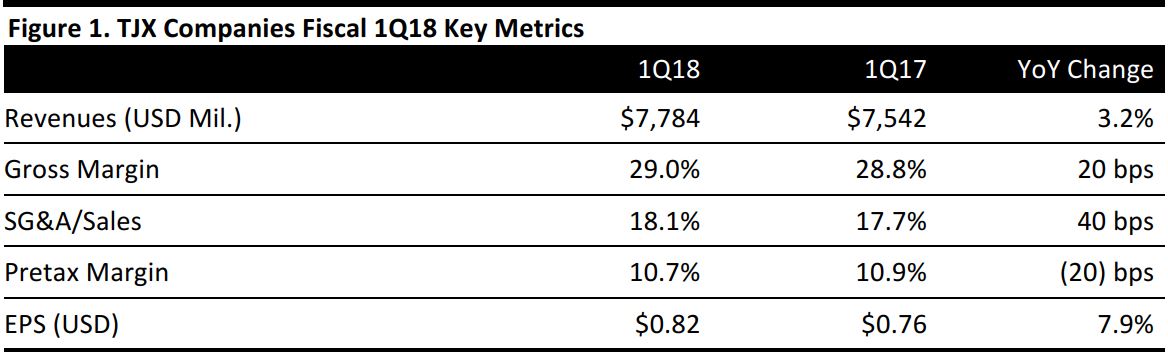

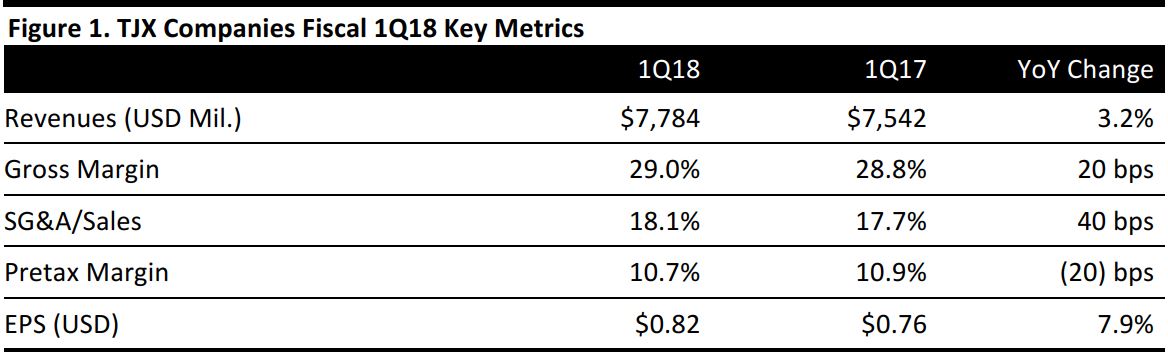

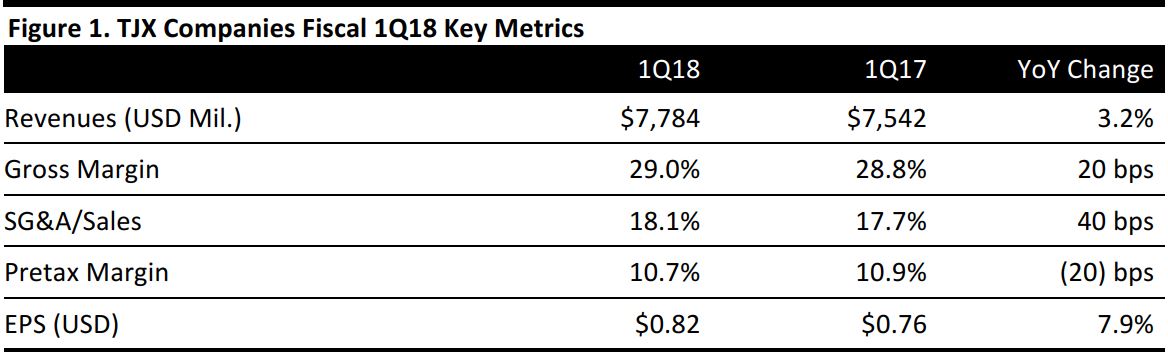

TJX Companies reported fiscal 1Q18 EPS of $0.82 versus the consensus estimate of $0.79.

Total revenues increased by 3%, to $7.8 billion. Comps increased by 1.0% versus expectations for a 1.6% increase. Marmaxx comps were flat, below expectations of 1.5%, while

HomeGoods comps were up 3.0%, above expectations of 2.4%. TJX Canada comps were up 3.0% and TJX Europe comps were flat in the quarter.

Comps continued to be driven by traffic despite unfavorable weather compared with the same quarter last year. Sales trends accelerated as the quarter progressed.

During the first quarter, TJX Companies increased its store count by 50, to a total of 3,862. Square footage was up 4% year over year.

FY18 Outlook

Management commented that the second quarter is off to a solid start. For the second quarter, the company expects EPS of $0.81–$0.83 versus consensus of $0.92 and compared with $0.84 in the year-ago period. The guidance assumes that foreign exchange will negatively impact EPS growth by 4% and that wage increases will negatively impact EPS growth by another 2%. The company expects a change in accounting rules for share-based compensation to positively impact EPS growth by 1%. Guidance also assumes a comp increase of 1%–2%.

For the full year, management maintained its projections for EPS of $3.71–$3.78 versus consensus of $3.90. Full-year guidance assumes that wage increases will negatively impact EPS growth by 2% and that foreign exchange will negatively impact EPS growth by an incremental 1%. The change in accounting rules for share-based compensation is expected to positively impact EPS growth by 1%. The guidance is based on an expected comp increase of 1%–2% for the full year.