Source: Company reports/Fung Global Retail & Technology

Fiscal 4Q16 Results

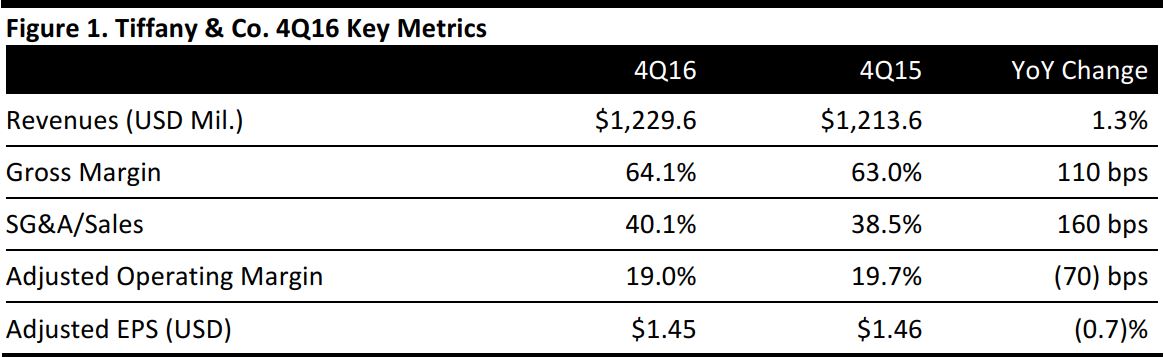

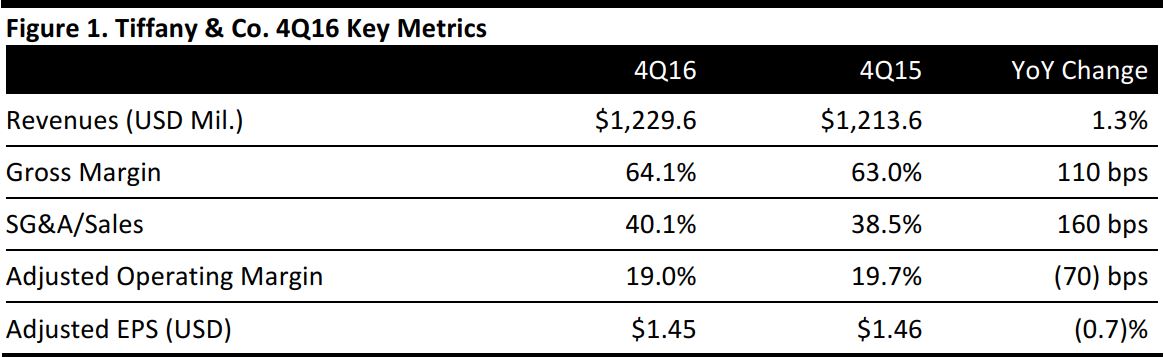

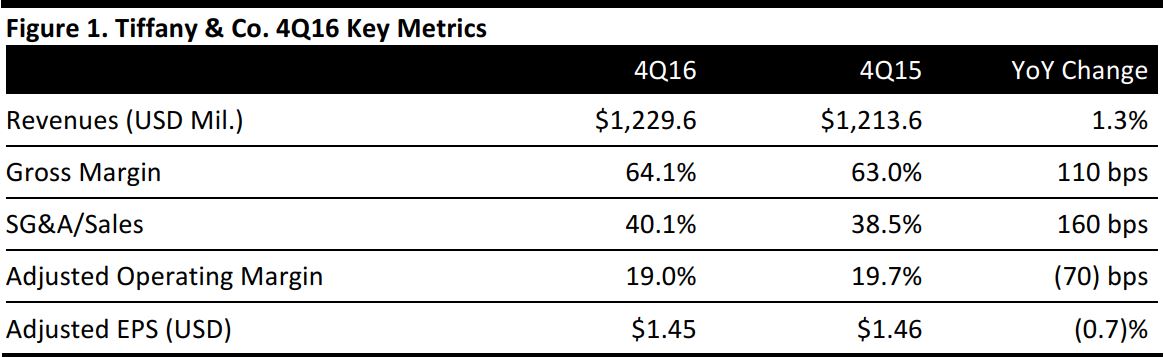

Tiffany & Co. reported 4Q16 revenues of $1.2 billion, which was a 1.3% increase from 4Q15 and in line with guidance.

In terms of geographic sales, the Americas represent 46% of worldwide sales, Asia-Pacific 25%, Japan 15% and Europe 11%. Comparable sales in the Americas declined 5% for the full year and 2% for the fourth quarter. Management attributed the results to lower spending by US customers and foreign tourists. Sales in the New York flagship store declined 11% in the full year and 7% in the fourth quarter versus a 14% decline in the November and December holiday period. The company estimates that spending by foreign tourists in the flagship store are at roughly 40% of its annual sales. Japan saw the highest increase in comparable-store sales, both for the year (up 16%) and for the quarter (up 19%). Management attributed sales growth in both periods to higher spending by local customers and the stronger yen. Additionally, the company reported that anecdotally Tiffany & Co. received brand exposure from a popular television show called, “For the Romantic,” which aired during the July-September time frame in Japan.

Tiffany & Co. opened 11 company-operated stores in the full year and closed five locations, resulting in a net increase of 3% gross retail square footage. As of January 31, 2017, the company operated 313 stores worldwide.

From the product side, the company reported softness across all jewelry categories, but highlighted that it had introduced new designs and refreshed some existing collections in 2016 and introduced new collections. The company reported a relative improvement in its fashion silver jewelry in 2016, led by the popularity of its Return to Tiffany Love collection. The company focused on product newness in silver jewelry in 2016 and grew the number of new items under $500 by more than 10%. The company also highlighted the success of its designer jewelry category, driven by Elsa Peretti’s Diamonds by the Yard, and designs of Paloma Picasso, highlighted by her Olive Leaf and her new Paloma’s Melody collection.

Outlook

The company’s guidance for fiscal 1Q17 includes an increase in worldwide net sales over the prior year by the low single-digit percentage and by a mid single-digit percentage on a constant exchange rate basis. Tiffany & Co. expects net earnings per share to increase by a high single-digit percentage over 2016’s EPS of $3.55 and by a mid single-digit percentage over $3.75.

The company expects worldwide gross retail square footage to increase 3%, which represents 11 store openings, 9 store relocations and 6 store closures.