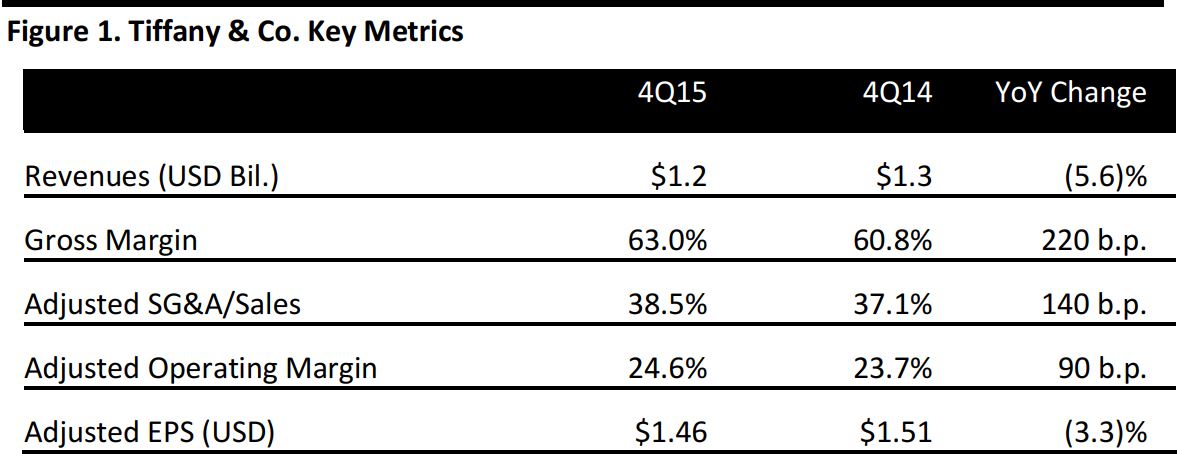

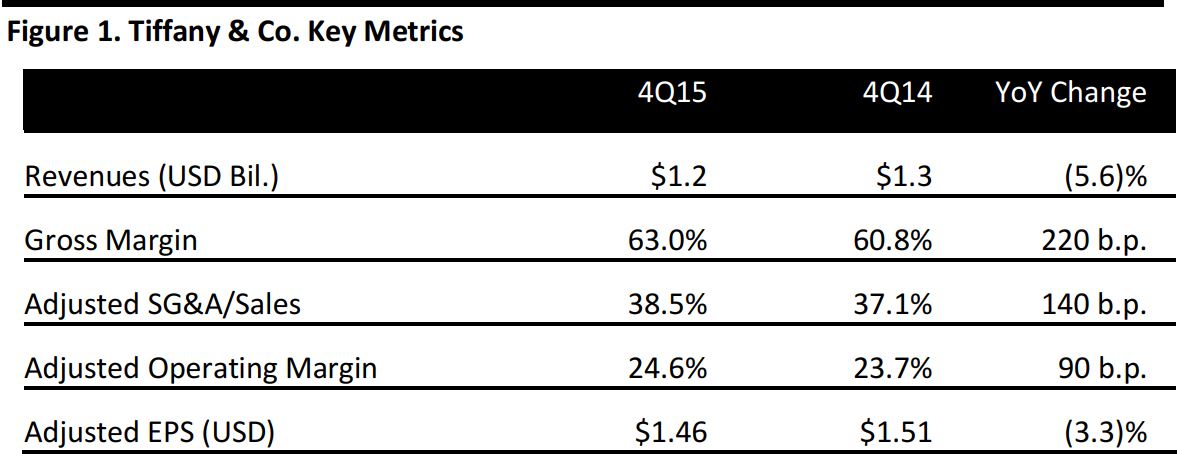

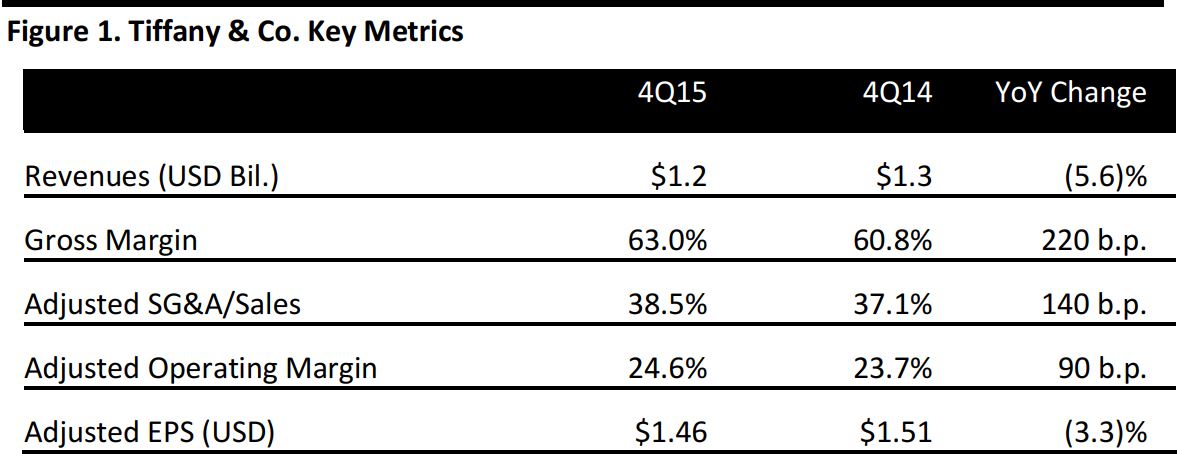

Source: Company reports

Tiffany & Co. reported 4Q15 EPS of $1.46 excluding onetime items versus consensus of $1.40.

Total revenue came in at $1.2 billion, in line with expectations. On a geographic basis, worldwide comps were (5)% versus consensus of (4.4)%; Americas comps were (8)%, in line with expectations; Asia-Pacific comps were (8)% versus consensus of (9)%; Japan comps were 10% versus consensus of 9.4%; and Europe comps were (3)% versus consensus of (3.4)%.

2016 guidance calls for a mid-single-digit decline in EPS, which is unchanged from prior guidance and versus consensus of $3.86; 2015 EPS was $3.83. On a constant-currency basis, sales are expected to increase at a low-single-digit rate, but to be flat year over year when translated into US dollars. Operating margin is expected to be down compared to last year’s 19.7%. Gross margin is expected to increase and SG&A growth is expected to exceed sales growth.

1Q16 EPS is expected to decline by 15%–20% while 2Q16 EPS is expected to decline by 5%–10%. EPS is expected to increase in the second half of the year.