albert Chan

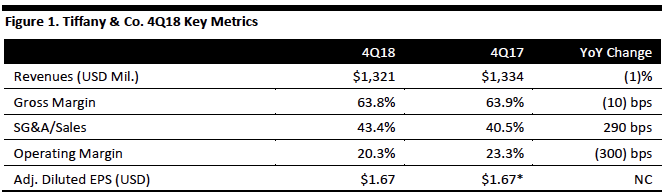

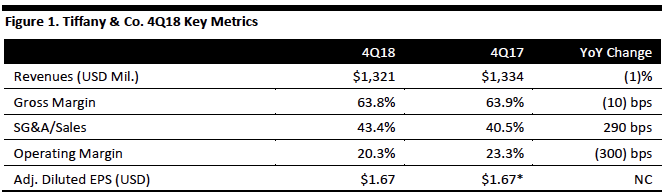

[caption id="attachment_81694" align="aligncenter" width="662"] *The US Tax Cuts and Jobs Act reduced GAAP 4Q17 EPS by $1.17

*The US Tax Cuts and Jobs Act reduced GAAP 4Q17 EPS by $1.17

Source: Company reports/Coresight Research[/caption] 4Q18 Results Tiffany reported adjusted EPS of $1.67 for 4Q18, beating the consensus estimate of $1.60. Total revenue for the quarter was down 1% (up 1% on a currency-neutral basis) to $1.32 billion, missing the consensus estimate of $1.33 billion, due to softer demand from both local and foreign tourists across most regions. In the Americas, revenue was flat both as reported and at constant foreign exchange rates at $618 million. In Asia Pacific, sales were down 1% (up 2% at constant exchange rates) to $316 million but in Japan, sales increased 3% both as reported and at constant exchange rates to $196 million. In Europe, sales declined 3% (flat on a currency-neutral basis) to $162 million. Globally, comparable sales declined 1%, and were flat at constant exchange rates. In the Americas, comparable sales were flat (up 1% at constant exchange rates), with spending by local customers and foreign tourists softening in the fourth quarter. The company saw growth in Mainland China but mixed results elsewhere in Asia Pacific ex Japan, resulting in a 3% decline in comps (flat currency neutral) in the region. In Japan, higher spending by local customers and foreign tourists contributed to a 3% increase in comps, both as reported and at constant exchange rates. In Europe, comps declined 5% as reported and were flat at constant exchange rates. The gross margin contracted 10 bps year over year to 63.8% and missed the consensus estimate of 64.5%. SG&A represented 43.4% of revenue (up 290 bps year over year) and rose 6% due to increased investment in technology, visual merchandising, digital and store presentations. The operating margin contracted 300 bps to 20.3%. Net inventories were up 8% year over year at 2.43 billion, mainly caused by higher levels of finished goods inventories. In 2019, Tiffany plans to open new stores in Greater China and other key markets. Its first store in Washington DC will open this month. The company will continue to renovate its New York Flagship. Tiffany is upgrading its websites around the world and plans to operate its own e-commerce website in China independently later this year. Meanwhile, the company will continue working with third parties. Its US website provides customers with consultations with diamond experts as well as the option to buy select diamond rings online. Outlook The company provided the following guidance for FY19:

*The US Tax Cuts and Jobs Act reduced GAAP 4Q17 EPS by $1.17

*The US Tax Cuts and Jobs Act reduced GAAP 4Q17 EPS by $1.17Source: Company reports/Coresight Research[/caption] 4Q18 Results Tiffany reported adjusted EPS of $1.67 for 4Q18, beating the consensus estimate of $1.60. Total revenue for the quarter was down 1% (up 1% on a currency-neutral basis) to $1.32 billion, missing the consensus estimate of $1.33 billion, due to softer demand from both local and foreign tourists across most regions. In the Americas, revenue was flat both as reported and at constant foreign exchange rates at $618 million. In Asia Pacific, sales were down 1% (up 2% at constant exchange rates) to $316 million but in Japan, sales increased 3% both as reported and at constant exchange rates to $196 million. In Europe, sales declined 3% (flat on a currency-neutral basis) to $162 million. Globally, comparable sales declined 1%, and were flat at constant exchange rates. In the Americas, comparable sales were flat (up 1% at constant exchange rates), with spending by local customers and foreign tourists softening in the fourth quarter. The company saw growth in Mainland China but mixed results elsewhere in Asia Pacific ex Japan, resulting in a 3% decline in comps (flat currency neutral) in the region. In Japan, higher spending by local customers and foreign tourists contributed to a 3% increase in comps, both as reported and at constant exchange rates. In Europe, comps declined 5% as reported and were flat at constant exchange rates. The gross margin contracted 10 bps year over year to 63.8% and missed the consensus estimate of 64.5%. SG&A represented 43.4% of revenue (up 290 bps year over year) and rose 6% due to increased investment in technology, visual merchandising, digital and store presentations. The operating margin contracted 300 bps to 20.3%. Net inventories were up 8% year over year at 2.43 billion, mainly caused by higher levels of finished goods inventories. In 2019, Tiffany plans to open new stores in Greater China and other key markets. Its first store in Washington DC will open this month. The company will continue to renovate its New York Flagship. Tiffany is upgrading its websites around the world and plans to operate its own e-commerce website in China independently later this year. Meanwhile, the company will continue working with third parties. Its US website provides customers with consultations with diamond experts as well as the option to buy select diamond rings online. Outlook The company provided the following guidance for FY19:

- Worldwide net sales will see low-single-digit growth (slightly higher at constant exchange rates).

- Comp growth in the low single digits.

- Low-single-digit percentage growth in EPS which includes an estimated $0.10-0.15 per share incremental SG&A expense related to the New York flagship project, versus $0.08 per share in FY18.

- An operating margin above 17.8%.

- Minimal growth in new inventories.

- Capital expenditure of $350 million.