DIpil Das

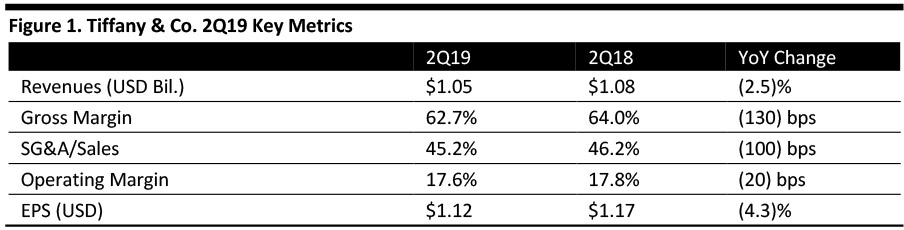

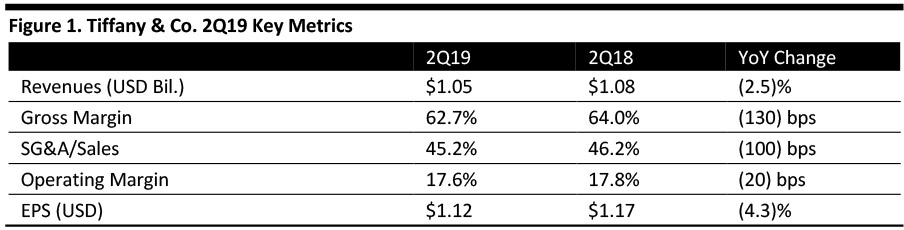

[caption id="attachment_95365" align="aligncenter" width="700"] Source: Company reports/Coresight Research.[/caption]

2Q19 Results

Tiffany reported EPS of $1.12, down 4.3% but beating the consensus estimate of $1.04.

Total revenue for the quarter declined 2.5% to $1.05 billion, missing the consensus estimate of $1.06 billion, reflecting softness across regions and product categories.

By category, sales from jewelry collections were unchanged (down 1% on a currency neutral basis), engagement jewelry was down 3% (2% currency neutral), and designer jewelry declined 10% (flat currency neutral).

By region, revenue decreased 4% as reported to $455 million in the Americas. Comps decreased 4%, due to lower spending by foreign tourists, and, to a lesser extent, local customers.

In Asia Pacific, sales were down 1% to $298 million, including a 3% decline in comps and reflecting the opening of new stores and increased wholesales revenue. Management believes the effect of foreign currency translation led to the sales decrease. By sub-market, mainland China saw double-digit growth and the company enabled e-commerce for the first time there. Sales in Hong Kong slowed, while other markets showed mixed performance.

In Japan, sales were $155 million, flat compared to the year-ago quarter. Comps declined 1%. In Europe, sales declined 4% to $116 million.

Gross margin contracted 130 basis points (bps) year over year to 62.7%. The decline in gross margin was driven by changes in the sales mix toward higher price-point jewelry and sales growth in wholesale diamonds, offsetting the positive impact from lower product-related costs.

SG&A represented 45.2% of revenue, down 100 bps year over year, and declining 5% due to lower marketing costs, partially offset by increased store occupancy and depreciation costs.

Net earnings were $136 million, down from $145 million a year ago, despite a lower effective income tax rate.

The company opened three self-operated stores and closed two in the first half. At the end of July 2019, Tiffany operated 322 stores, with 124 in the Americas, 90 in Asia Pacific, 56 in Japan, 47 in Europe and 5 in the United Arab Emirates.

In mainland China, the company is planning to enter third-tier cities, where it currently has no physical footprint. The company also plans enhanced digital marketing capabilities to better tap into Chinese holidays in 2019, as the company did for Chinese Valentine's Day in August. The company is also expanding its airport duty-free store network and plans to open the first Tiffany store in a duty-free zone at the Beijing airport in Q3.

Outlook

The company reiterated its FY19 guidance for sales and earnings and modestly lowered comp guidance as follows:

Source: Company reports/Coresight Research.[/caption]

2Q19 Results

Tiffany reported EPS of $1.12, down 4.3% but beating the consensus estimate of $1.04.

Total revenue for the quarter declined 2.5% to $1.05 billion, missing the consensus estimate of $1.06 billion, reflecting softness across regions and product categories.

By category, sales from jewelry collections were unchanged (down 1% on a currency neutral basis), engagement jewelry was down 3% (2% currency neutral), and designer jewelry declined 10% (flat currency neutral).

By region, revenue decreased 4% as reported to $455 million in the Americas. Comps decreased 4%, due to lower spending by foreign tourists, and, to a lesser extent, local customers.

In Asia Pacific, sales were down 1% to $298 million, including a 3% decline in comps and reflecting the opening of new stores and increased wholesales revenue. Management believes the effect of foreign currency translation led to the sales decrease. By sub-market, mainland China saw double-digit growth and the company enabled e-commerce for the first time there. Sales in Hong Kong slowed, while other markets showed mixed performance.

In Japan, sales were $155 million, flat compared to the year-ago quarter. Comps declined 1%. In Europe, sales declined 4% to $116 million.

Gross margin contracted 130 basis points (bps) year over year to 62.7%. The decline in gross margin was driven by changes in the sales mix toward higher price-point jewelry and sales growth in wholesale diamonds, offsetting the positive impact from lower product-related costs.

SG&A represented 45.2% of revenue, down 100 bps year over year, and declining 5% due to lower marketing costs, partially offset by increased store occupancy and depreciation costs.

Net earnings were $136 million, down from $145 million a year ago, despite a lower effective income tax rate.

The company opened three self-operated stores and closed two in the first half. At the end of July 2019, Tiffany operated 322 stores, with 124 in the Americas, 90 in Asia Pacific, 56 in Japan, 47 in Europe and 5 in the United Arab Emirates.

In mainland China, the company is planning to enter third-tier cities, where it currently has no physical footprint. The company also plans enhanced digital marketing capabilities to better tap into Chinese holidays in 2019, as the company did for Chinese Valentine's Day in August. The company is also expanding its airport duty-free store network and plans to open the first Tiffany store in a duty-free zone at the Beijing airport in Q3.

Outlook

The company reiterated its FY19 guidance for sales and earnings and modestly lowered comp guidance as follows:

Source: Company reports/Coresight Research.[/caption]

2Q19 Results

Tiffany reported EPS of $1.12, down 4.3% but beating the consensus estimate of $1.04.

Total revenue for the quarter declined 2.5% to $1.05 billion, missing the consensus estimate of $1.06 billion, reflecting softness across regions and product categories.

By category, sales from jewelry collections were unchanged (down 1% on a currency neutral basis), engagement jewelry was down 3% (2% currency neutral), and designer jewelry declined 10% (flat currency neutral).

By region, revenue decreased 4% as reported to $455 million in the Americas. Comps decreased 4%, due to lower spending by foreign tourists, and, to a lesser extent, local customers.

In Asia Pacific, sales were down 1% to $298 million, including a 3% decline in comps and reflecting the opening of new stores and increased wholesales revenue. Management believes the effect of foreign currency translation led to the sales decrease. By sub-market, mainland China saw double-digit growth and the company enabled e-commerce for the first time there. Sales in Hong Kong slowed, while other markets showed mixed performance.

In Japan, sales were $155 million, flat compared to the year-ago quarter. Comps declined 1%. In Europe, sales declined 4% to $116 million.

Gross margin contracted 130 basis points (bps) year over year to 62.7%. The decline in gross margin was driven by changes in the sales mix toward higher price-point jewelry and sales growth in wholesale diamonds, offsetting the positive impact from lower product-related costs.

SG&A represented 45.2% of revenue, down 100 bps year over year, and declining 5% due to lower marketing costs, partially offset by increased store occupancy and depreciation costs.

Net earnings were $136 million, down from $145 million a year ago, despite a lower effective income tax rate.

The company opened three self-operated stores and closed two in the first half. At the end of July 2019, Tiffany operated 322 stores, with 124 in the Americas, 90 in Asia Pacific, 56 in Japan, 47 in Europe and 5 in the United Arab Emirates.

In mainland China, the company is planning to enter third-tier cities, where it currently has no physical footprint. The company also plans enhanced digital marketing capabilities to better tap into Chinese holidays in 2019, as the company did for Chinese Valentine's Day in August. The company is also expanding its airport duty-free store network and plans to open the first Tiffany store in a duty-free zone at the Beijing airport in Q3.

Outlook

The company reiterated its FY19 guidance for sales and earnings and modestly lowered comp guidance as follows:

Source: Company reports/Coresight Research.[/caption]

2Q19 Results

Tiffany reported EPS of $1.12, down 4.3% but beating the consensus estimate of $1.04.

Total revenue for the quarter declined 2.5% to $1.05 billion, missing the consensus estimate of $1.06 billion, reflecting softness across regions and product categories.

By category, sales from jewelry collections were unchanged (down 1% on a currency neutral basis), engagement jewelry was down 3% (2% currency neutral), and designer jewelry declined 10% (flat currency neutral).

By region, revenue decreased 4% as reported to $455 million in the Americas. Comps decreased 4%, due to lower spending by foreign tourists, and, to a lesser extent, local customers.

In Asia Pacific, sales were down 1% to $298 million, including a 3% decline in comps and reflecting the opening of new stores and increased wholesales revenue. Management believes the effect of foreign currency translation led to the sales decrease. By sub-market, mainland China saw double-digit growth and the company enabled e-commerce for the first time there. Sales in Hong Kong slowed, while other markets showed mixed performance.

In Japan, sales were $155 million, flat compared to the year-ago quarter. Comps declined 1%. In Europe, sales declined 4% to $116 million.

Gross margin contracted 130 basis points (bps) year over year to 62.7%. The decline in gross margin was driven by changes in the sales mix toward higher price-point jewelry and sales growth in wholesale diamonds, offsetting the positive impact from lower product-related costs.

SG&A represented 45.2% of revenue, down 100 bps year over year, and declining 5% due to lower marketing costs, partially offset by increased store occupancy and depreciation costs.

Net earnings were $136 million, down from $145 million a year ago, despite a lower effective income tax rate.

The company opened three self-operated stores and closed two in the first half. At the end of July 2019, Tiffany operated 322 stores, with 124 in the Americas, 90 in Asia Pacific, 56 in Japan, 47 in Europe and 5 in the United Arab Emirates.

In mainland China, the company is planning to enter third-tier cities, where it currently has no physical footprint. The company also plans enhanced digital marketing capabilities to better tap into Chinese holidays in 2019, as the company did for Chinese Valentine's Day in August. The company is also expanding its airport duty-free store network and plans to open the first Tiffany store in a duty-free zone at the Beijing airport in Q3.

Outlook

The company reiterated its FY19 guidance for sales and earnings and modestly lowered comp guidance as follows:

- Worldwide net sales growth in the low single digits.

- Comps flat compared to the prior year, versus previous guidance for a low-single-digit comp.

- EPS growth in the low to mid single digits.

- Operating margin equal to the prior year.

- Minimal growth in new inventories.

- Capital expenditure of $350 million.