DIpil Das

1Q19 Results

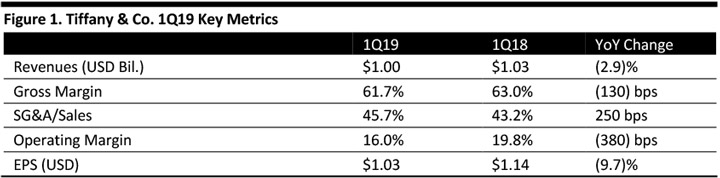

Tiffany reported EPS of $1.03, down 9.7% but beating the consensus estimate of $1.01.

Total revenue for the quarter declined 2.9%, and were flat on a constant-currency basis, to $1.00 billion, missing the consensus estimate of $1.01 billion, reflecting mixed results across regions and product categories.

By category, sales from jewelry collections grew 1% (4% currency neutral), engagement jewelry declined 6% (2% currency neutral), and designer jewelry declined 14% (11% currency neutral).

A strong US dollar impacted 1Q retail sales to foreign tourists visiting the US. Tiffany estimates sales to tourists visiting the US represent a low-double-digit percentage of its total US retail sales, but those sales to tourists fell about 25% compared to 1Q18, with sharper declines among Chinese tourists – more pronounced than declines in 2H18. Falling sales to tourists in the US were offset by sales to local customers in global markets, which were up approximately 3%, with strong growth in mainland China particularly noteworthy.

In the Americas, revenue decreased 4% both as reported and at constant currency to $406 million. In Asia Pacific, sales were down 1% (up 3% currency neutral) to $324 million, reflecting strong growth in Mainland China and mixed results in other regions. Sales in Japan declined 4% (flat currency neutral) to $145 million due to lower spending from foreign tourists. In Europe, sales declined 4% (up 4% currency neutral) to $102 million, reflecting mixed results across the region.

Globally, comparable sales declined 5%, or 2% at constant foreign exchange rates. In the Americas, comparable sales were down 5% (4% currency neutral), driven by continued soft foreign tourist spending from the second half of last year. The company saw growth in mainland China but mixed results elsewhere, resulting in a 5% (flat currency neutral) decline in comps in Asia Pacific, due to the strong dollar. In Japan, lower spending by foreign tourists pushed down comps 4% (flat currency neutral). In Europe, comps were down 7% (up 1% currency neutral).

Gross margin contracted to 61.7%, down 130 bps year over year, missing the consensus estimate of 63.2%. The decline in gross margin was driven by lower sales leverage on fixed costs, changes in the sales mix toward higher price point jewelry and sales growth in diamonds wholesale, offsetting the positive impact from lower product-related costs.

SG&A represented 45.7% of revenue, up 250 bps year over year, and rose 3% due to higher store occupancy and depreciation expenses. The impact from exchange rates cut SG&A expenses 2%.

Net inventories as of January 31, 2019, were up 6% over the same period last year, mainly due to higher inventory as a result of slowing sales.

Net earnings were $125 million, down from $142 million a year ago, despite the lower effective income tax rate.

The company opened two self-operated stores, closed two and relocated two stores during the quarter. At the end of April 2019, Tiffany operated 321 stores, up from 314 stores a year ago.

Outlook

The company provided the following outlook for fiscal 2019 and expects the tariffs will grow to a new level of 25% on average on jewelry exported from the US to China:

- Worldwide net sales growth in low single digits.

- Comps growth in low single digits.

- EPS growth in the low to mid-single digits.

- Operating margin equal to or slightly above the prior year.

- Minimal growth in new inventories.

- Capital expenditure of $350 million.

- Worldwide net sales growth in low single digits.

- Comp growth in low single digits.

- EPS growth in the low to mid-single digits.

- Operating margin equal to or slightly above the prior year.

- Minimal growth in new inventories.

- Capital expenditure of $350 million.