Web Developers

From Amazon’s purchase of Whole Foods Market last year to Southeastern Grocers’ bankruptcy filing in March, we have seen a flurry of activity in the US grocery market in recent months. In this report, we discuss these corporate developments and note three trends driving mergers and acquisitions (M&As) in grocery. The sector is shifting:

By number of transactions, 2017 was relatively light, as S&P Capital IQ recorded only nine M&A deals with food retailers as the target last year. That was fewer than the 18 recorded in 2016 and the 31 recorded in 2015: in both of those years, grocery retailers sold several batches of stores.

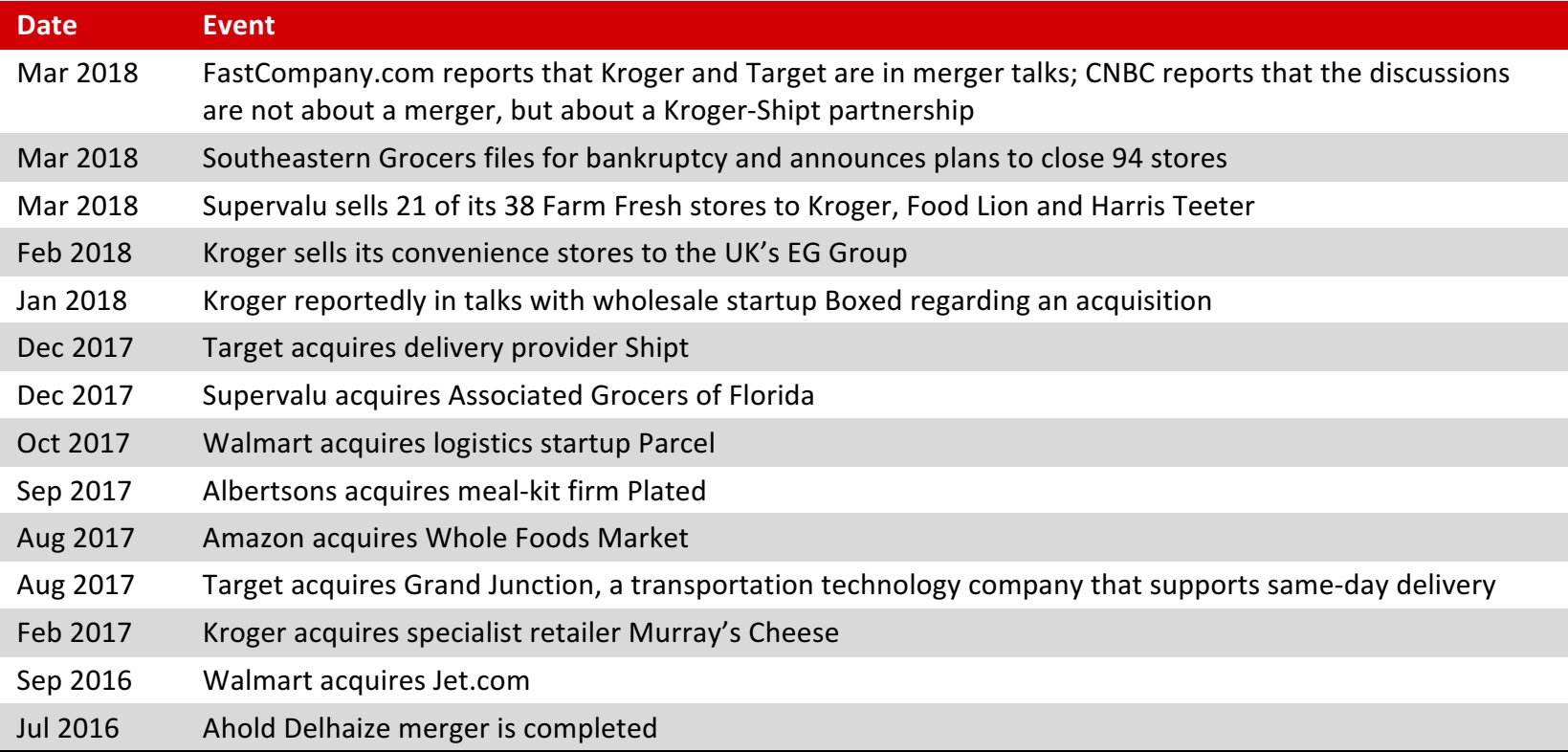

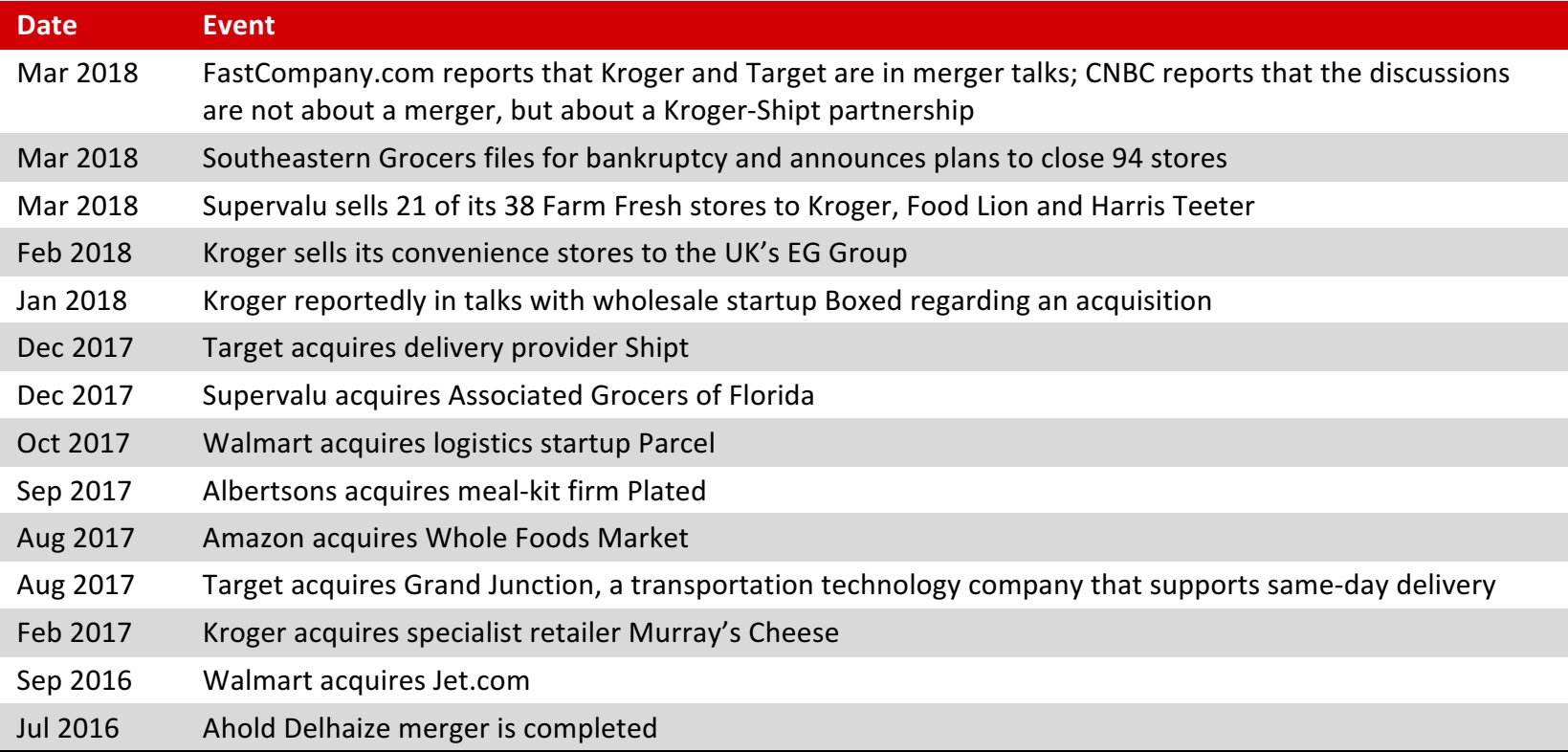

The table below highlights some of the recent corporate developments at major grocery retailers, ranging from M&A transactions to bankruptcy filings.

A Flurry of Activity in US Grocery

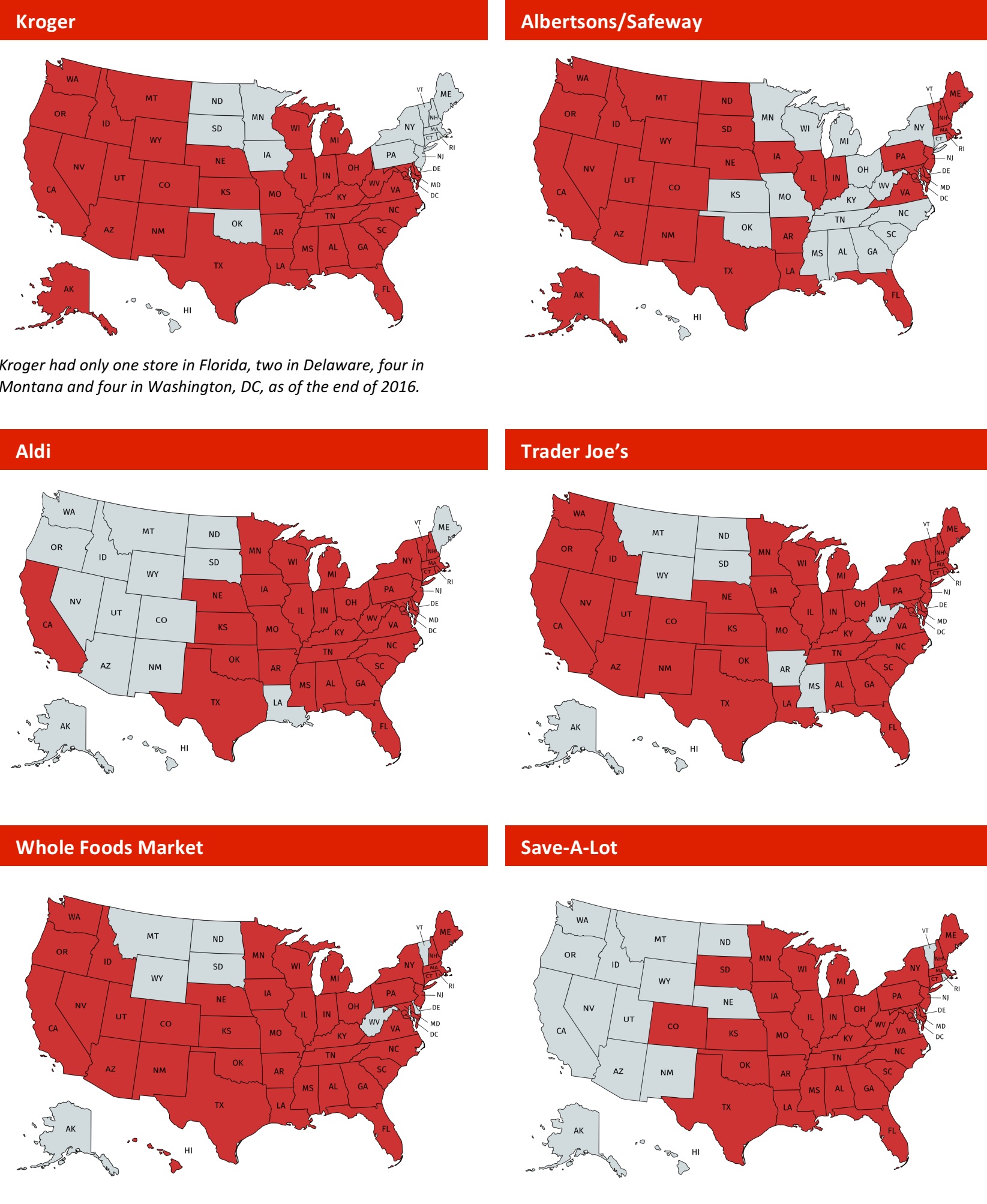

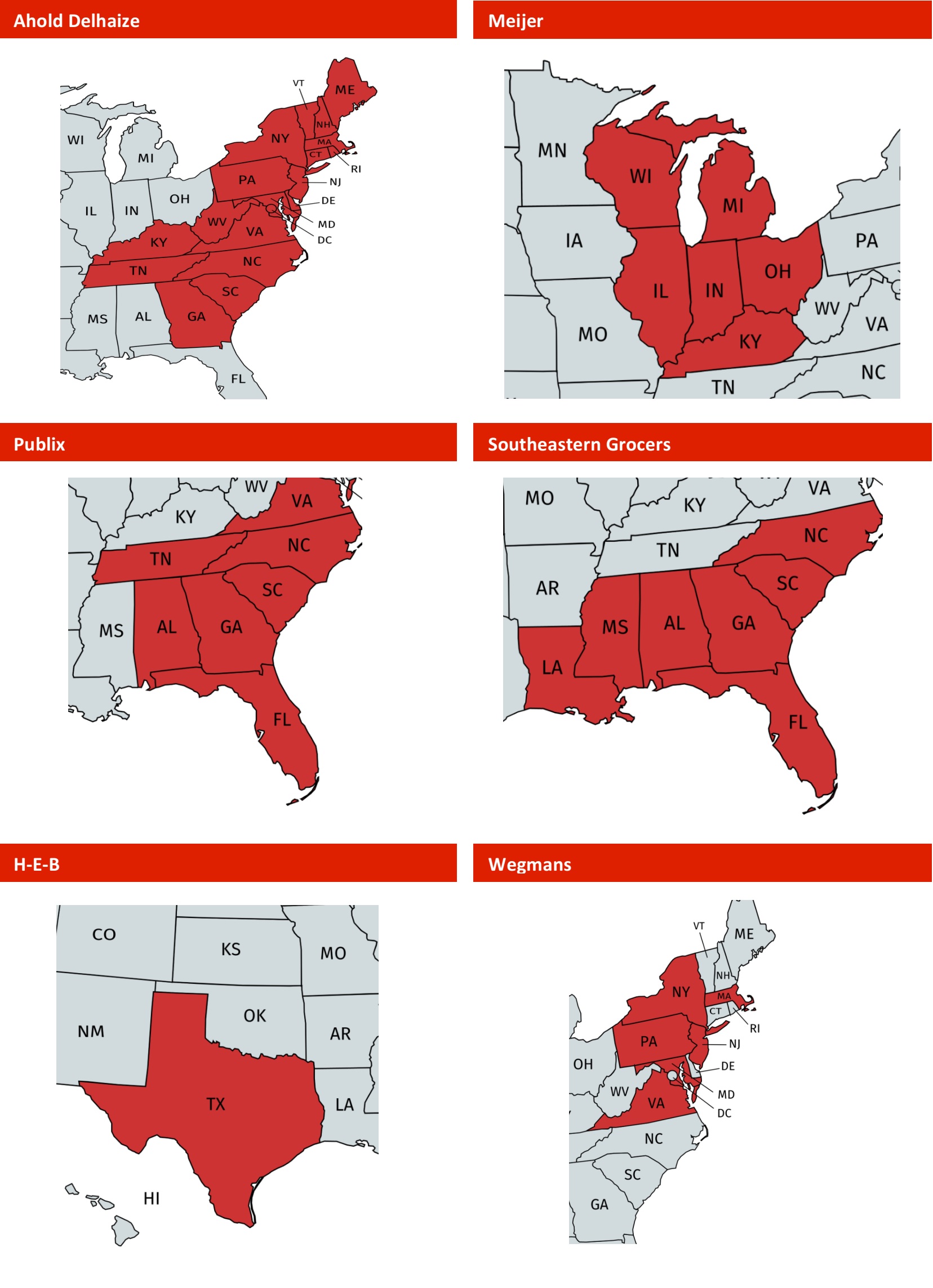

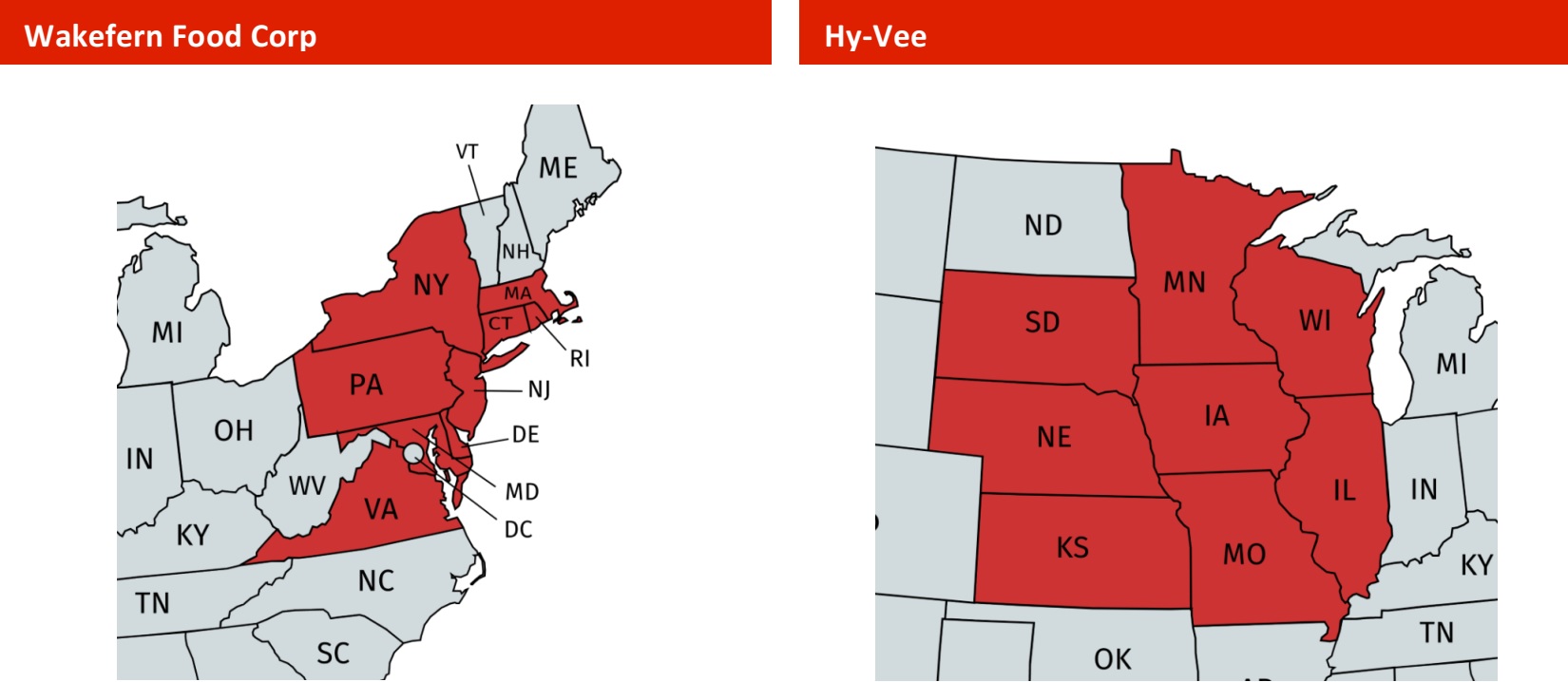

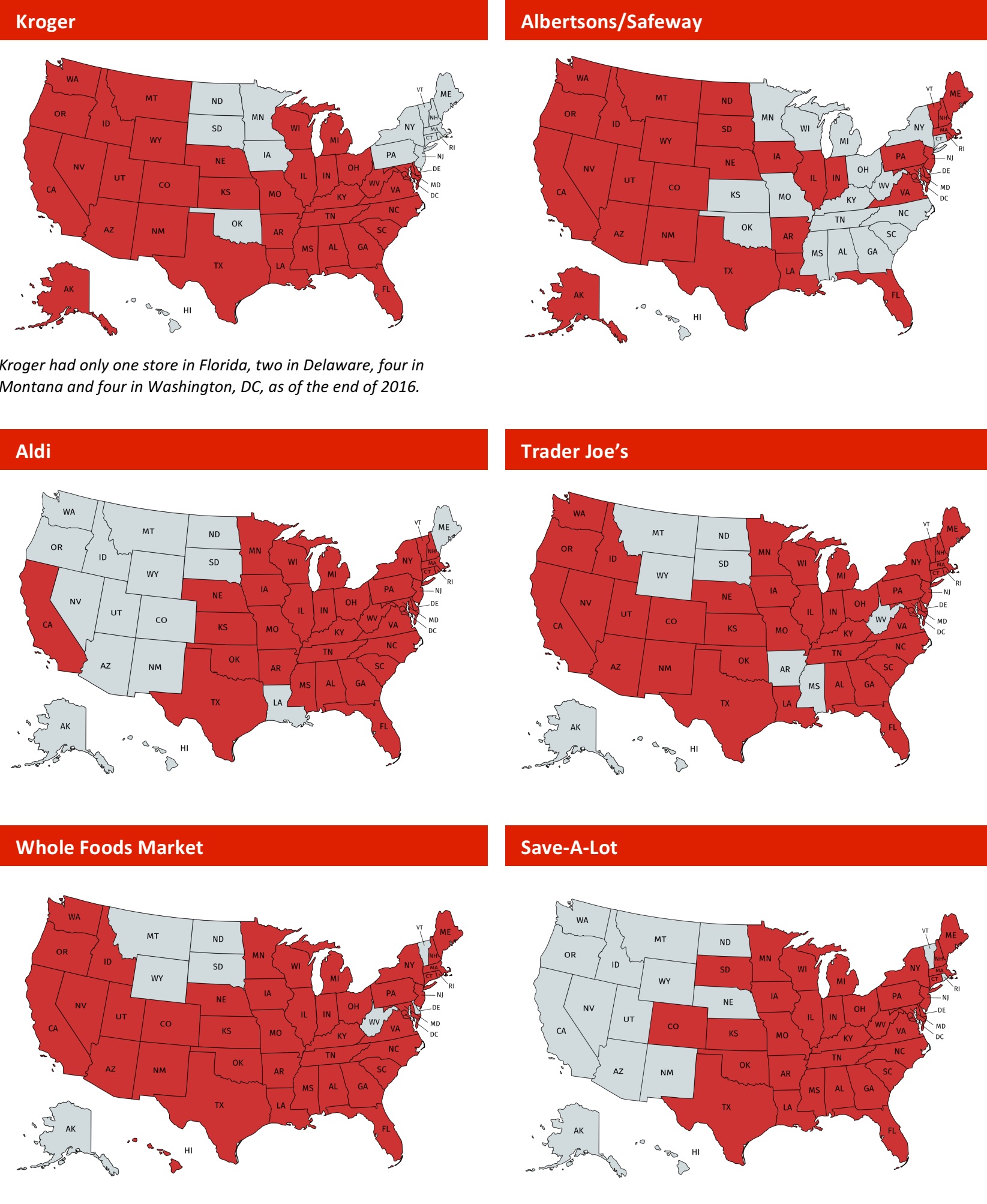

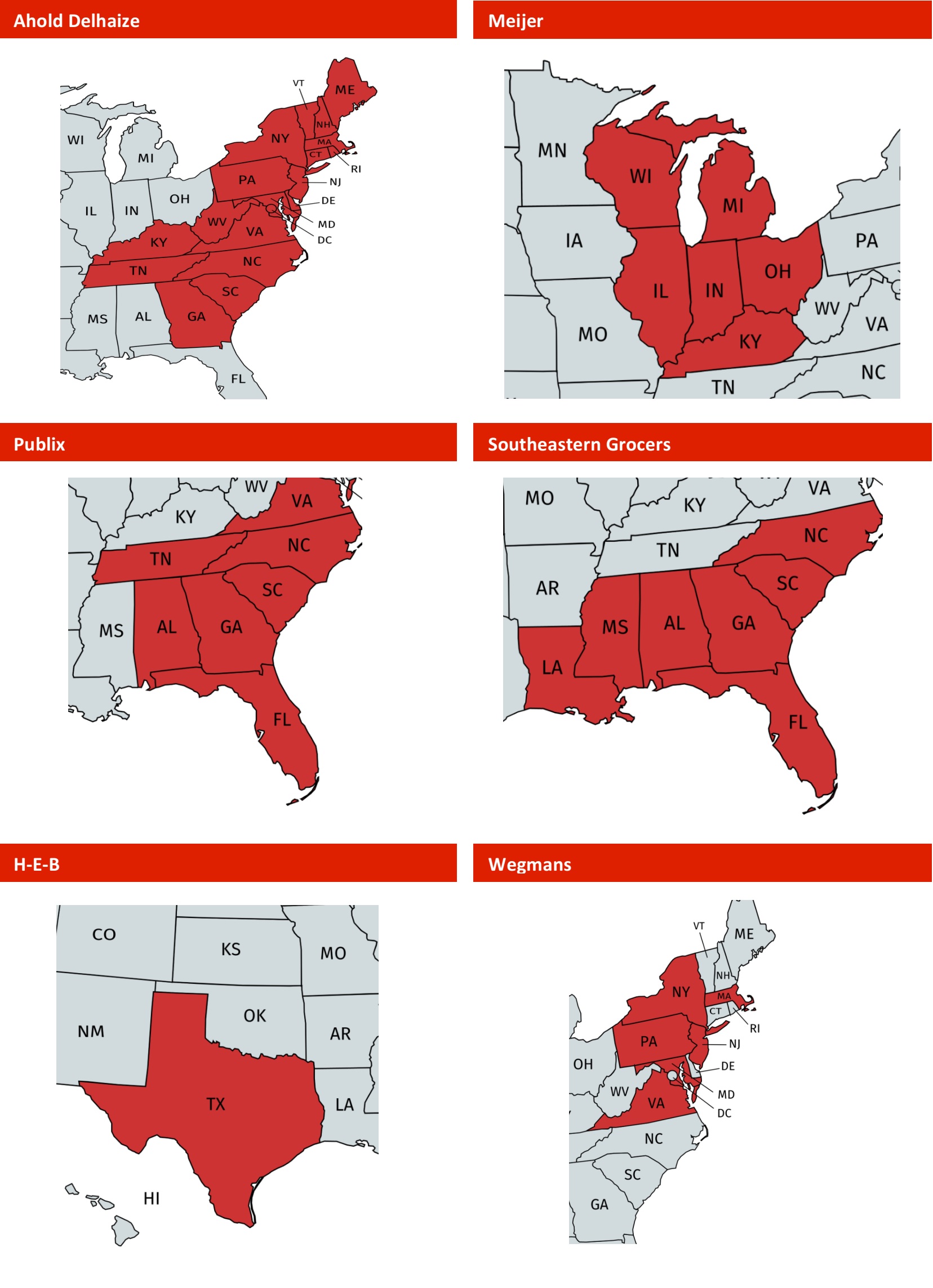

So far this year, the US grocery market has generated many unexpected headlines, from the quickly scotched rumors of a Target-Kroger merger to the bankruptcy filing by Southeastern Grocers. These reports followed last year’s news of Target and Walmart acquiring delivery and logistics firms, Albertsons purchasing meal-kit provider Plated and, famously, Amazon acquiring Whole Foods Market. In this report, we summarize recent corporate developments in US grocery and discuss three drivers of M&A activity in the sector. We include an appendix that maps major supermarket retailers’ presence by state to illustrate how fragmented the US grocery market still is, despite the recent M&As.Reviewing Corporate Developments

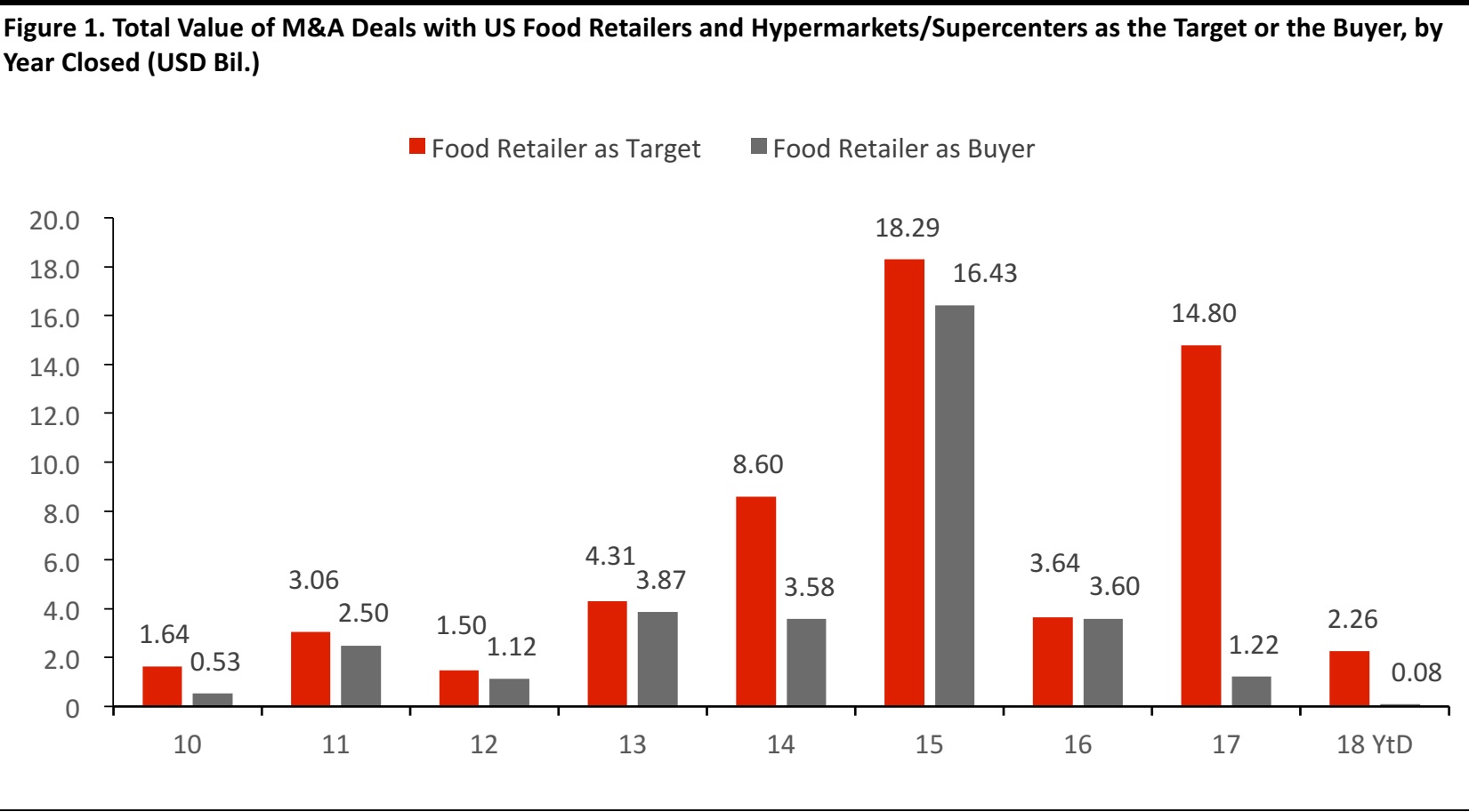

2017 was a major year for grocery M&A activity, as measured by total deal value. Below, we chart the value of M&A deals per year, with food retailers as the target and as the buyer. Transactions with food retailers as the target amounted to almost $15 billion last year, but Amazon’s purchase of Whole Foods accounted for the vast majority of that. 2015 was actually a bigger year, due to Albertsons’ completion of its Safeway acquisition that year. 18 YtD is through April 12, 2018

Source: S&P Capital IQ/Coresight Research

18 YtD is through April 12, 2018

Source: S&P Capital IQ/Coresight Research

By number of transactions, 2017 was relatively light, as S&P Capital IQ recorded only nine M&A deals with food retailers as the target last year. That was fewer than the 18 recorded in 2016 and the 31 recorded in 2015: in both of those years, grocery retailers sold several batches of stores.

The table below highlights some of the recent corporate developments at major grocery retailers, ranging from M&A transactions to bankruptcy filings.

Source: Company reports

Three Shifts Underpinning Grocery M&A Activity

Three shifts in the US grocery market have underpinned recent corporate developments and are likely to continue to fuel M&A activity: the market is moving from fragmented to more consolidated, from offline to digitalized and from pure play to multichannel.2. From Fragmented to More Consolidated

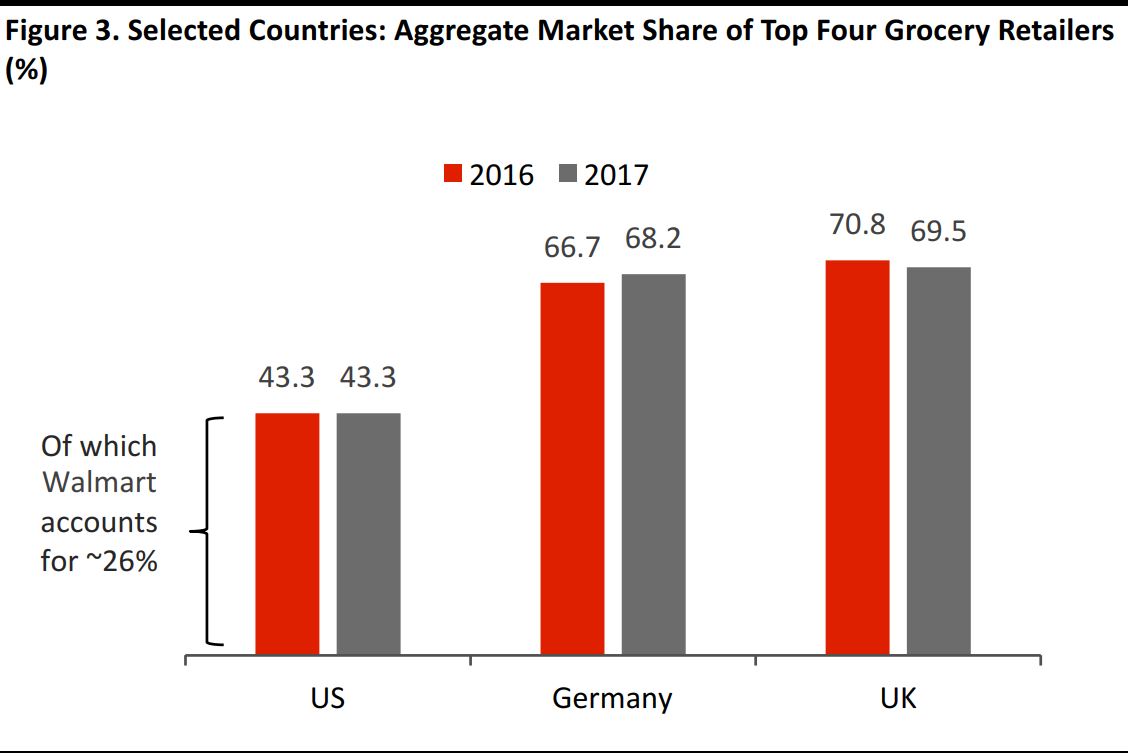

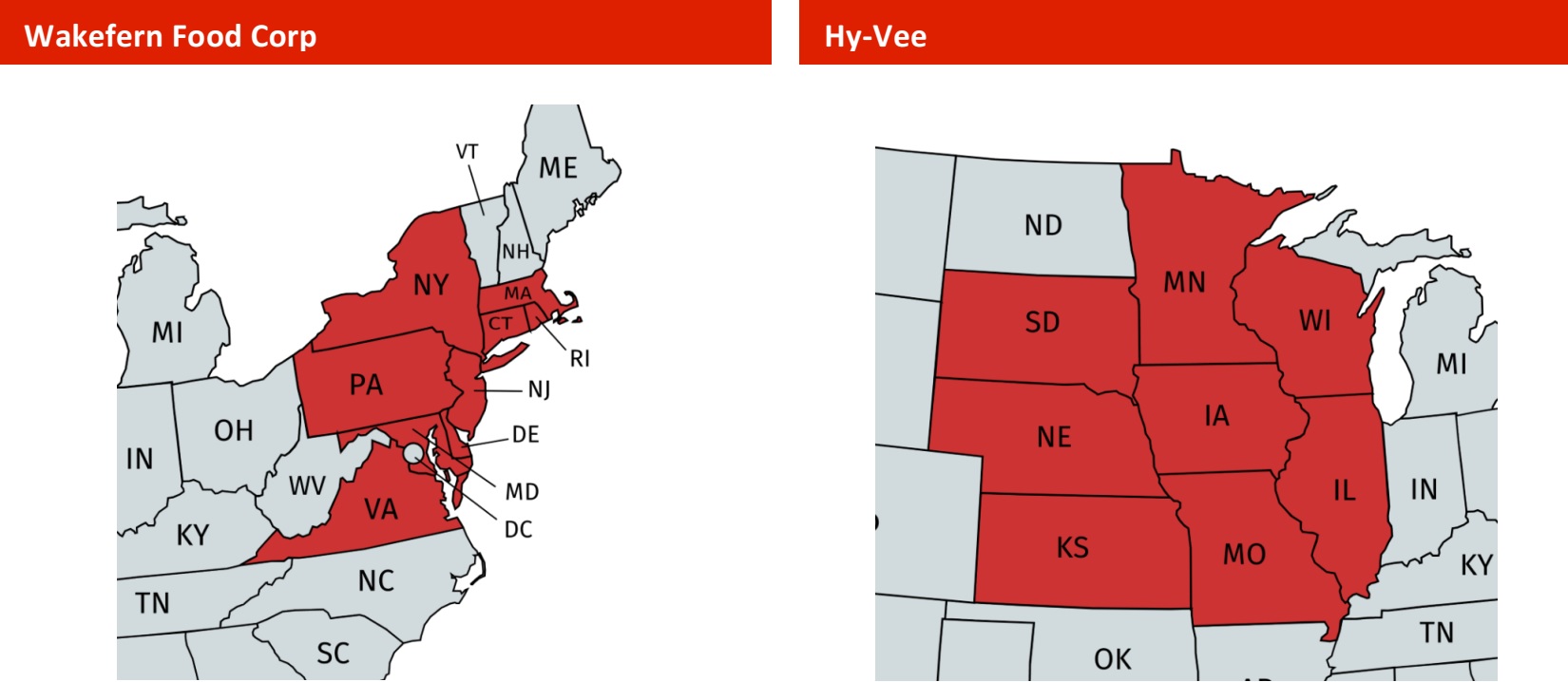

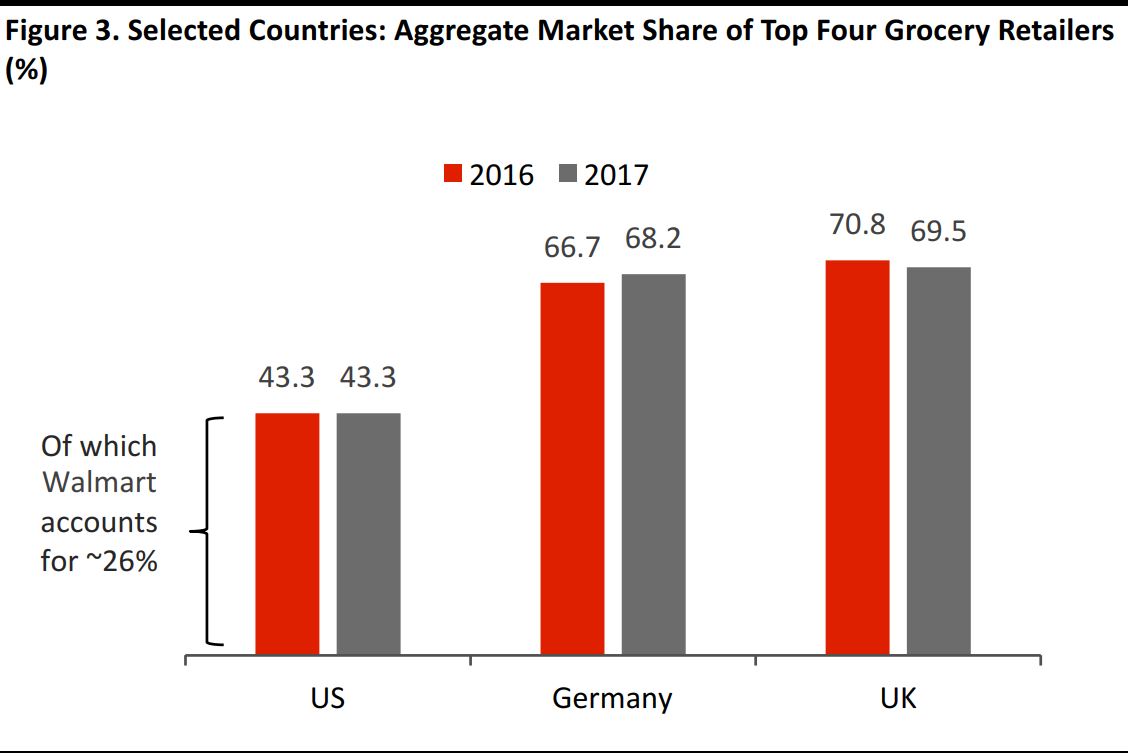

The US grocery market remains highly fragmented. A large number of supermarket chains are regional operators, and even Kroger, the leading US supermarket retailer, does not have national coverage. We provide maps showing major supermarket retailers’ presence by state in an appendix to this report, and those maps clearly illustrate the regionalized nature of many supermarket chains. This fragmentation is an underlying driver of incremental consolidation, and it means there is still plenty of room for further consolidation in the sector.

Source: Euromonitor International/Coresight Research

Consolidation should better position grocery retailers to compete in key areas such as private label and e-commerce:- As we have noted before, the US lags a number of other Western markets in terms of private-label products’ share of grocery sales. However, the expansion of Aldi and Lidl and the distribution of Whole Foods brands on Amazon are likely to fuel competition in private-label grocery, and that will require other grocery companies to invest in sophisticated, tiered ranges.

- US grocery retail is undergoing rapid digitalization, as we note in the following section, and greater scale should support the investments that grocery chains will need to make in order to keep pace with major rivals.

2. From Offline to Digitalized

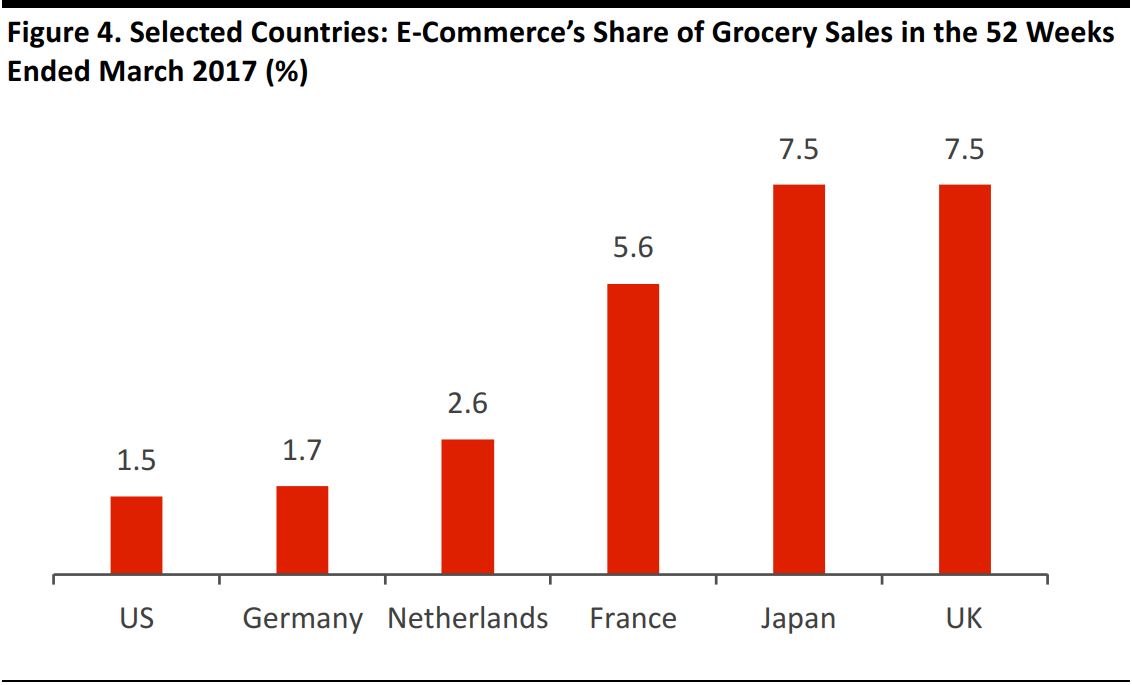

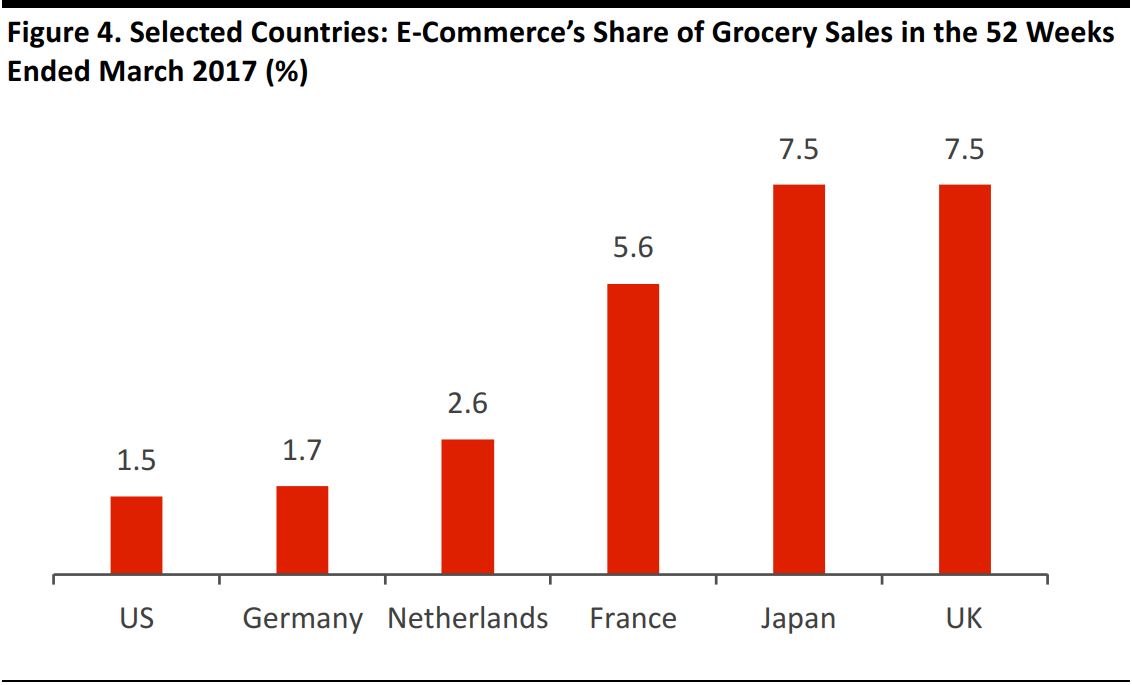

The US grocery market lags a number of other countries’ markets in e-commerce penetration, but online grocery appears to be in a phase of accelerated growth in the US. We estimate that e-commerce will jump from 1.8% of all US food and drink sales in calendar year 2017 to 2.4% this year. That is still a small share, but the 60-basis-point increase in penetration we foecast represents much faster growth than expected growth for e-commerce overall this year. The race to digitalize in grocery is fueling investments such as Target’s acquisition of Shipt, Albertsons’ purchase of Plated and Walmart’s acquisition of Parcel, and competition for online sales is likely to drive further acquisitions in the future. The graph below shows that the US grocery market is playing catch-up to a number of international peers in terms of e-commerce penetration.

Source: Kantar Worldpanel/Europanel/Intage

3. From Pure Play to Multichannel

At the same time that brick-and-mortar retailers are investing to build out their e-commerce offerings, former online-only retailers such as Amazon are investing in physical retail. We view Amazon’s acquisition of Whole Foods as an acknowledgement that it is much more difficult to make pure-play Internet retailing work in the grocery category than in nonfood categories. Amazon has ventured even further into brick-and-mortar retail by launching Amazon Go stores, and it has withdrawn AmazonFresh from some US regions and recently merged its Prime Now and AmazonFresh operations. Meanwhile, a number of major, established grocery retailers have been rapidly expanding their collection services, enabling more shoppers to pick up their grocery orders from stores. This expansion reflects the strength of cross-channel shopping in the grocery sector. We recently conducted an in-depth consumer survey on online grocery in the US. The study found that Amazon is the most-shopped retailer for online groceries but that shoppers tend not to turn to the site for their regular, large grocery shops. A number of other survey findings support this: Amazon grocery shoppers we surveyed were less likely than the average shopper to buy fresh food categories online and were more likely than average to do only a small part of their grocery shopping online. Our survey also suggested that online grocery shoppers tend to turn to the websites of established retailers such as Walmart and Kroger for regular, large-basket grocery shops. Further confirming the demand for cross-channel offerings, our research also found that collection, rather than delivery, is the majority fulfillment method in US online grocery. The mature online grocery markets of the UK and France, where multichannel retailers dominate, provide further evidence that pure plays are not the businesses that tend to lead in online grocery. This is the landscape that is emerging in the US, too, and it is prompting pure plays such as Amazon to move into brick-and-mortar, including through acquisitions.Appendix: Mapping Selected Supermarket Chains

The supermarket retailers whose locations by state are mapped below are among the biggest US grocery retailers by market share. We have not mapped prominent nonspecialist retailers such as Walmart, Target and Costco.