DIpil Das

What’s the Story?

In our monthly countdown to Singles’ Day, also known as the 11.11 Global Shopping Festival, we will help brands and retailers to prepare for the event and make the most of the huge opportunities it represents. Earlier in the series, we discussed the popular Chinese social media apps and marketing tools that can enable brands and retailers to increase brand awareness and ultimately drive sales during the festival—covering livestreaming and content marketing platforms. In this report, we delve deeper into livestreaming, with learnings from last year’s Singles’ Day, insights into the growth of the market and our expectations on the role of this customer engagement channel for the 2021 shopping festival. We also discuss how livestreaming can benefit international retailers during Singles’ Day 2021.Why It Matters

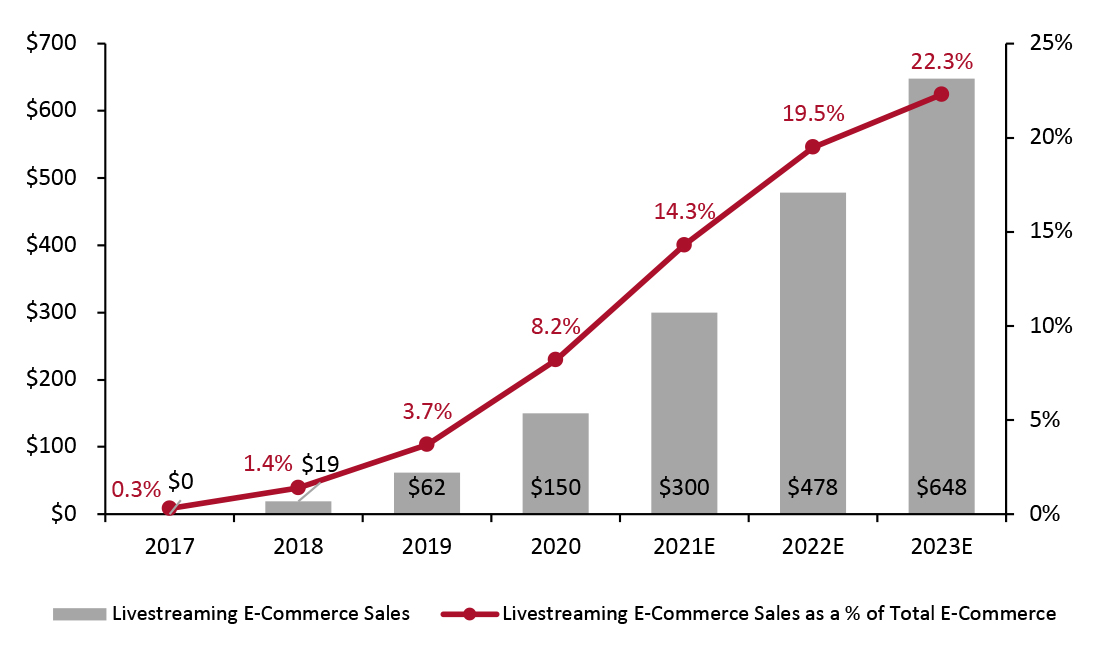

Although livestreaming is not new in China, it is revolutionizing digital retail: Coresight Research estimates that China’s livestreaming e-commerce market will see huge growth this year, totaling $300 billion—doubling in size from 2020. Furthermore, we estimate that livestreaming e-commerce accounted for 8.6% of total e-commerce revenue in China in 2020, and we expect the market to see strong growth in the coming years (see Figure 1). As Singles’ Day and social commerce are both high-growth segments within China’s retail ecosystem, we expect the combination to drive significant sales growth for brands and retailers. Livestreaming will therefore be a key tool for any brand seeking to capitalize on this massive sales event.Figure 1. China: Livestreaming E-Commerce Sector Size (USD Bil, left axis), and Penetration (% of Total E-Commerce, right axis) [caption id="attachment_131185" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Three Months to Singles’ Day: In Detail

Singles’ Day 2020: Livestreaming Success During Singles’ Day last year, many companies used livestreaming to attract shoppers and drive sales, including e-commerce giants Alibaba and JD.com, social commerce platform Pinduoduo and super app WeChat. Taobao Live, the dedicated livestreaming channel owned by Alibaba Group, attracted nearly 300 million viewers through its 33 livestreaming channels during last year’s shopping festival, with each generating more than ¥100 million ($15 million) in GMV. In total, shoppable livestreams on Taobao Live accounted for $2.9 billion in sales—twice as much as that generated in 2019. According to Alibaba Group’s news hub, Alizila, sales generated by Taobao Live have grown by triple-digit percentages from 2017 to 2020. JD.com hosted a “Super Livestream Night” on November 10, 2020, that featured over 30 celebrities. During the festival, the company held over 500 livestream shows on its own platform and via WeChat and short-video app Kuaishou (also known as Kwai). The events featured celebrities and management team representatives from brand partners. The success of the livestreaming channel during Singles’ Day 2020 can be partly attributed to pent-up consumer demand and increased e-commerce penetration due to Covid-19 pandemic-led lockdowns and travel restrictions. In addition to accelerated structural shifts to e-commerce, the pandemic also redirected shopping that would have taken place on overseas trips by Chinese travelers to domestic purchases, especially in highly popular categories for overseas shopping—such as alcohol, beauty, clothing, footwear and accessories, electronics, fragrances, health supplements and vitamins, and jewelry and watches. Furthermore, store closures during lockdowns forced brick-and-mortar businesses to innovate, with many deciding to digitalize parts of their businesses and turn to livestreaming to market their goods. Livestreaming provided another touchpoint for brands and retailers to engage with shoppers online in an immediate and personal way—something that was attractive to consumers who were spending increased time at home. Singles’ Day 2021: Livestreaming Strategies In order to take advantage of online demand and tap livestreaming sales opportunities, we are seeing e-commerce platforms in China focus their efforts on two key strategies:1. Develop livestreaming talent, particularly in rural areas

Alibaba is taking steps to ensure that its infrastructure and talent can best support a strong Singles’ Day 2021. This year, Taobao Live plans to build 300 physical livestreaming centers for its influencers and merchants, as well as 102 dedicated training facilities across China to train farmers and aspiring livestream hosts from rural regions, according to Alizila. Similarly, Pinduoduo has also committed to training farmers and agri merchants to harness the tools on its platform to increase their visibility. The company reported in its earnings report released May 26, 2021, that it has trained approximately 100,000 farmers to date and is committed to training another 100,000 over the next five years. With both Alibaba and Pinduoduo’s investments into rural China, it is likely that Singles’ Day 2021 will see a more diverse range of session hosts and products sold through the live shopping channel.2. Partner with alternative livestreaming platforms

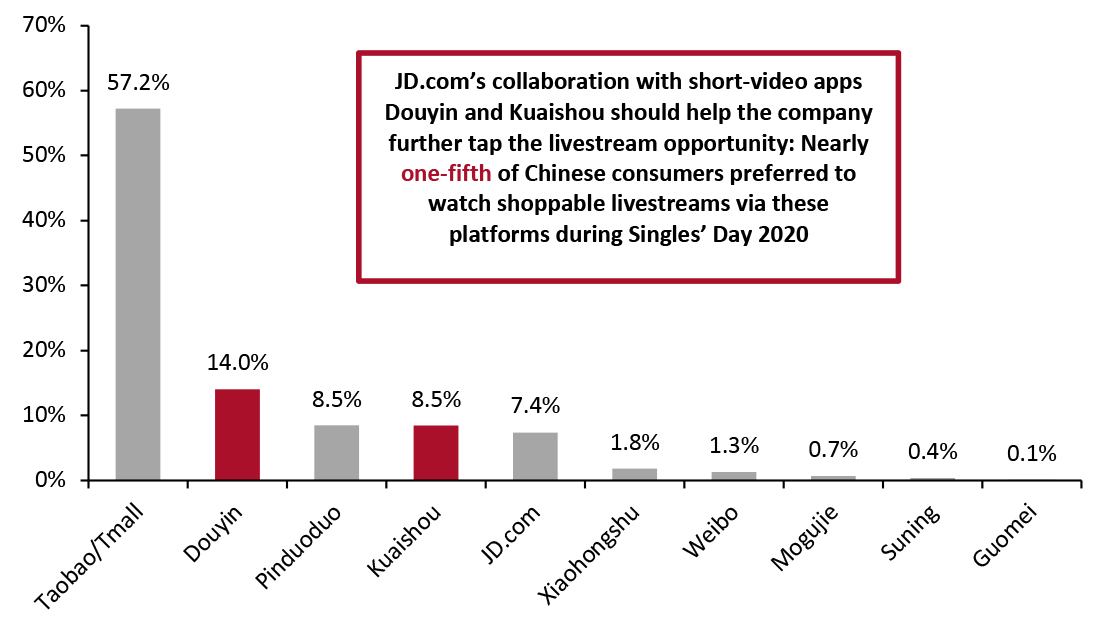

Against tough competition from Taobao Live, JD.com is investing in alternative platforms to diversify its e-commerce presence and extend its reach among livestream viewers this Singles’ Day. The company is collaborating with leading live-commerce websites such as Douyin and Kuaishou, according to its earnings call on May 19, 2021. Both platforms were among the top five most popular livestreaming sites among Chinese consumers during Singles’ Day 2020, according to KuRunData (see Figure 2). In the context of rapid growth in the livestream sector and the success of the channel during Singles’ Day 2020, we expect to see smaller companies, such as Suning, boost their livestream offerings this year.Figure 2. Chinese Consumers: First-Choice E-Commerce Platform for Watching Shoppable Livestreams During Singles' Day 2020 (% of Respondents) [caption id="attachment_131186" align="aligncenter" width="725"]

Percentages may not sum to 100 due to rounding

Percentages may not sum to 100 due to rounding Base: 1,005 Chinese consumers

Source: KuRunData/Statista [/caption] International Brands: How To Prepare for Livestreaming on Singles’ Day Against the backdrop of the Covid-19 pandemic, high demand in the China market attracted overseas brands: Alibaba reported that 31,755 overseas brands offered goods on its platforms last year. This year, the retail environment globally remains volatile, so Singles’ Day presents a lucrative opportunity for international brands to boost sales; they should look to penetrate the livestreaming market to appeal to Chinese consumers during the festival. Most international brands that participated in Singles’ Day 2020 relied on influencers to generate sales and brand awareness, but many are now seeking to develop their own livestreaming capabilities, according to Mark Yuan, Co-Founder and CEO of livestream shopping company Zhang. International brands should consider partnering with influencers and key opinion leaders (KOLs), which can help introduce new brands to consumers in an authentic and engaging way. Alibaba has seen great success with this strategy, as its top two livestreaming influencers, Austin Li and Viya, generated over ¥1 billion ($149.4 million) in non-refundable pre-sales deposits on October 21, 2020—the first day of the Singles’ Day pre-sales period—as reported by Forbes. Finally, livestreaming appeals to China’s Gen Z shoppers—a digitally native generation that accounts for 25% of spending on emerging brands, despite making up only 15% of China’s population, according to Alizila. This is a key demographic for international brands as Gen Z consumers are generally more open to trying new brands and products from overseas.