albert Chan

What’s the Story?

We provide our insight into three apps that are poised for success in China in 2021 and the opportunities these platforms provide for brands and retailers to increase traffic and drive sales.

Why It Matters

The demand for social and lifestyle apps skyrocketed amid the pandemic in 2020 as consumers spent more time confined at home. By the end of 2020, the number of Internet users in China jumped to almost 1 billion, from 802 million in 2019, according to the Cyberspace Administration of China.

Major apps, such as Douyin (the Chinese version of TikTok) and Bilibili (an online streaming site known as China’s YouTube), hit record numbers of active users—in its fourth quarter of 2020 the average monthly number of active Bilibili users reached 202 million, a year-over-year increase of 55%.

The Chinese e-commerce market is huge and diversified, with opportunities for emerging apps beyond already established apps and traditional e-commerce platforms, such as Alibaba’s Tmall and Taobao, to drive traffic to brands and retailers and boost sales.

We discuss three apps that we expect to see success in China in 2021 by integrating social and lifestyle trends in beauty, luxury and sneakers with e-commerce.

Three Chinese Apps Set To Gain Traction in 2021: In Detail

1. BevolBevol is a cosmetic ingredient query platform that provides researcher-verified articles and videos on product features and efficacy. Since its launch in 2015, Bevol has built a database of 2.5 million beauty products and answered more than 2.2 billion queries on cosmetic safety, ingredient functionality and skin type suitability for more than 20 million users.

How Bevol Works

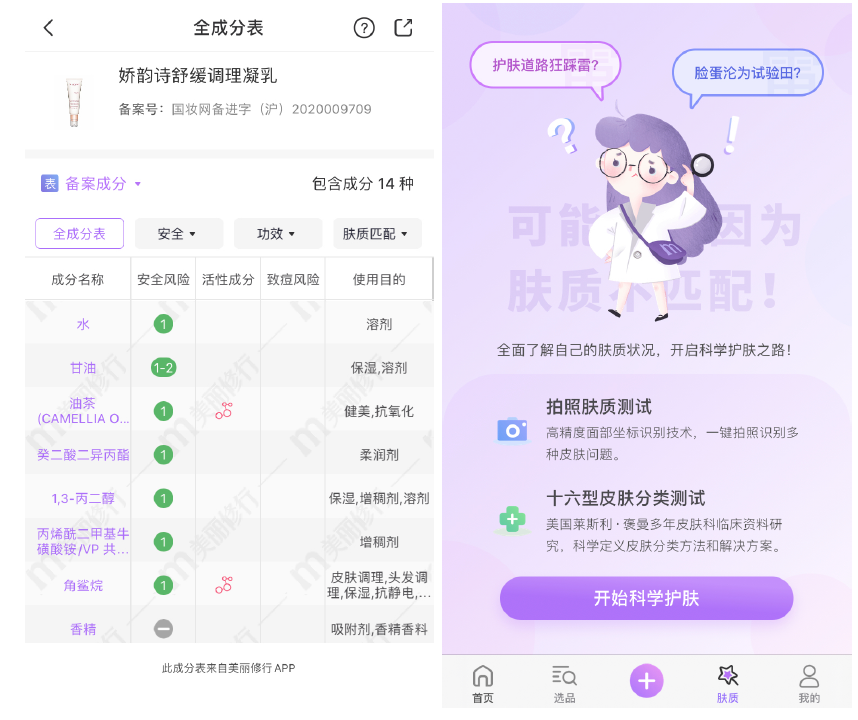

Users enter the name or upload a photo of a beauty product to view Bevol’s information about ingredients as well as comments from other users. The app also offers a skin type suitability test, based on the skin type classification designed by American dermatologist Dr. Leslie Baumann. Along with the test results, Bevol provides skincare guidelines and product recommendations.

[caption id="attachment_126438" align="aligncenter" width="350"] Bevol ingredient description (left) and skin type test (right)

Bevol ingredient description (left) and skin type test (right)Source: Bevol[/caption]

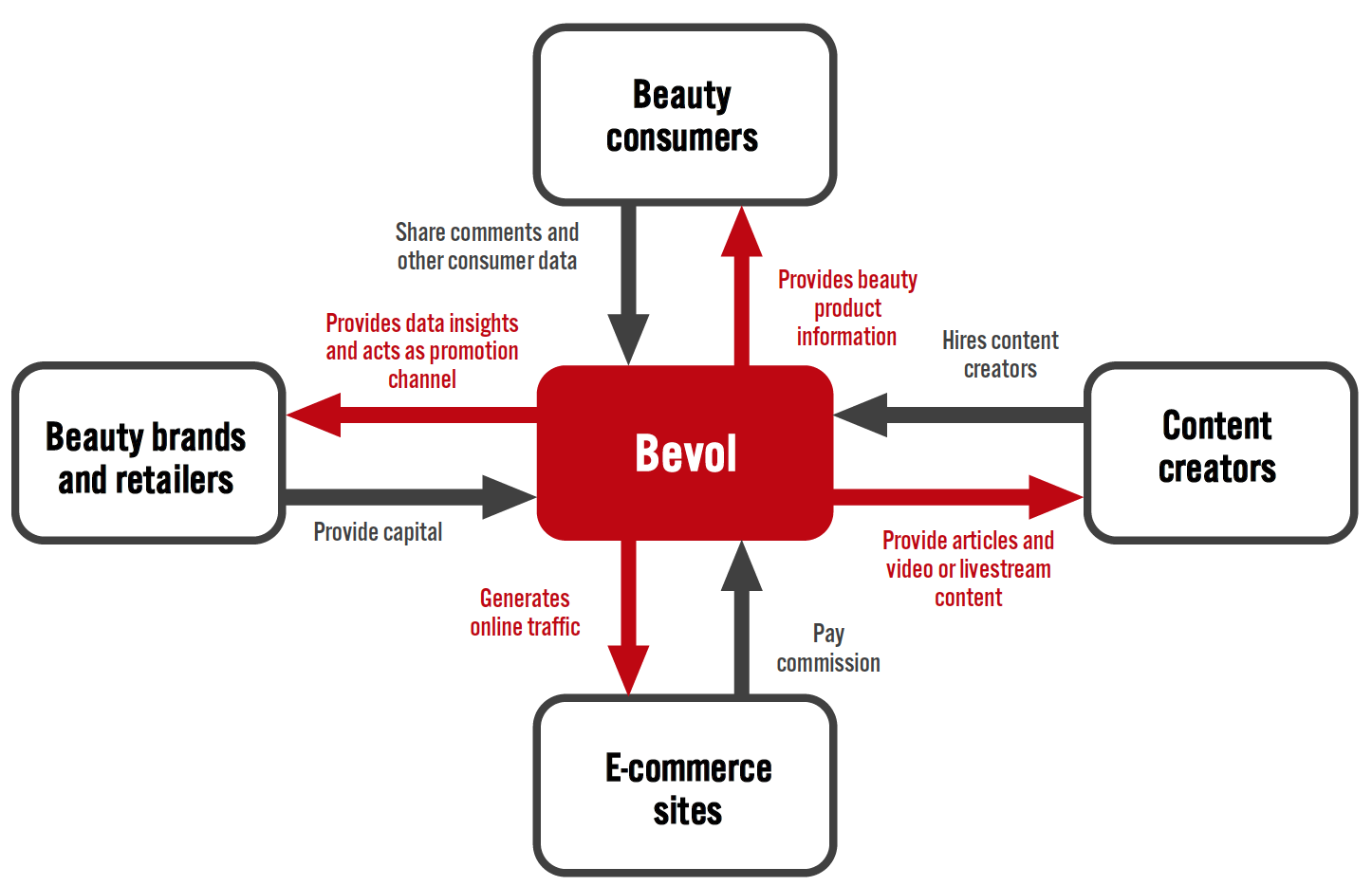

The app provides shopping links to beauty products that users browse and earns a commission if users purchase through the affiliated links. Bevol also offers consumer data to beauty companies and acts as a promotion channel for new products in collaboration with content creators.

Figure 1. The Bevol Business Model [caption id="attachment_126439" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

How Brands and Retailers Can Work with Bevol

While beauty product prices are easily accessible online, it can be more of a challenge for consumers to find information about ingredients and product efficacy. According to a 2018 study by the Fashion Institute of Technology, more than 40% of global beauty shoppers do not think that brands provide sufficient information about ingredient safety in the beauty products they buy. Moreover, nearly three-quarters of beauty consumers think that should do more to explain the effects of product ingredients, reflecting a demand for greater transparency in the beauty market.

Concerns related to cosmetic ingredients and “clean” beauty accelerated amid the health pandemic in 2020. According to a report jointly published by CBNData and L’Oréal in June 2020, product safety, efficacy and ingredients are the top considerations for Chinese consumers when choosing beauty products, while cost, performance and brand awareness have become secondary factors.

Bevol’s database provides transparent beauty product information that many consumers are seeking, bolstering consumer confidence in brands that have satisfactory listings on the platform.

Brands can partner directly with Bevol in the following ways:

- Leveraging the platform as a promotion channel. For example, Nivea partners with Bevol to offer sample trials of its cosmetic products on the platform.

- For support in content creation and raising brand awareness. Spanish beauty brand ISDIN teamed up with Bevol to launch a sunscreen manual in 2020, with information on sun protection and the scientific research behind the brand’s products.

Hongbulin is an e-commerce marketplace that focuses on secondhand luxury items and provides full consignment services, including marketing, sales and customer service. Around 90% of the goods on the platform are sold through consignment by individual sellers, with the company earning a service commission rate of 20%. In addition to personal consignment, Hongbulin also cooperates with Japanese luxury goods suppliers to sell products. The company states that its target consumer group is urban white-collar workers.

How Hongbulin Works

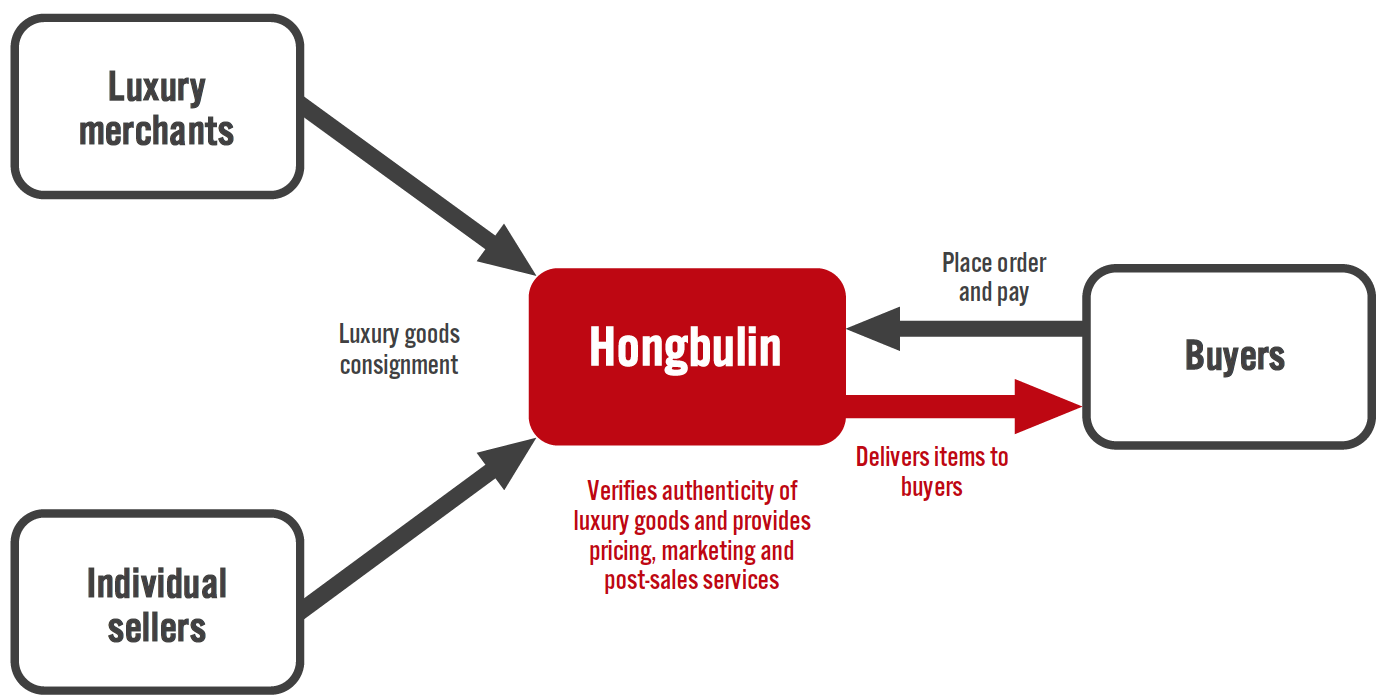

Like other luxury goods consignment platforms, after sellers fill in the consignment information, the platform collects and confirms the authenticity of the items. If the items are verified, the platform asks the seller to set the price. If there is no response from sellers within 24 hours, Hongbulin establishes set the price itself and will set the item up for sale on the platform within 48 hours. Any non-verified items are returned to sellers.

Figure 2. The Hongbulin Business Model [caption id="attachment_126441" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

To improve its authentication system, Hongbulin partnered with the China Certification and Inspection Group’s luxury identification center in July 2020, whose appraisal results have been accepted by customs, public security and other government departments.

Hongbulin also invested in its supply chain in 2020, building a commodity processing center that spans 107,639 square feet to bolster capacity for processing pre-owned goods from individuals and business sellers. According to the company, the new facility has enabled a reduction in processing times from five to seven days to less than two days.

Currently, Hongbulin reports a sell-out rate of nearly 60% within 30 days and a sell-out rate of nearly 90% within 90 days, with an average inventory turnover timeframe of approximately 45 days. The company reported that its monthly GMV reached “several hundred million yuan” as of March 2021 (100 million yuan is equivalent to $15.4 million).

How Brands and Retailers Can Leverage Hongbulin

Luxury brands and retailers should not overlook the significant potential in China’s secondhand luxury goods market. While there is growing demand for luxury resale items, sales of secondhand luxury products accounted for 5% of the overall luxury market in China in 2020, compared to 20–30% penetration in developed countries including Japan and the US, according to a 2020 report by luxury authentication and resale platform Isheyipai and Beijing’s University of International Business and Economics.

We see this as a strong opportunity for online secondhand luxury platforms to claim share of the market in China and drive sales as the market develops. We expect to see increased cooperation between luxury brands and Hongbulin and other Chinese platforms going forward, as we have already seen in luxury resale in other regions in relation to product authentication and refurbishment.

Brands and retailers looking for promotion opportunities, such as hotels and high-end restaurants and hotels, can cooperate with Hongbulin to host activities on the platform and tap into its existing user base of consumers interested in luxury. For instance, in October 2019, Japanese hotel group Izumigo partnered with Hongbulin, offering consumers the chance to win a luxury stay with Izumigo with each purchase on the platform. The promotional activities attracted tens of thousands of customers in less than three days, according to the two companies

We also see opportunities for Hongbulin to take on a similar function to The RealReal in promoting circularity for luxury fashion. In 2020, Gucci launched an online shop on the resale platform featuring pre-owned Gucci items verified by the luxury fashion house.

Hongbulin is well positioned to work with luxury brands and retailers to tap into the growing secondhand luxury market and help brands strengthen their reputation in regards to sustainability—particularly among younger consumers, as many display an increasing interest in extending product life cycles to reduce their environmental impact.

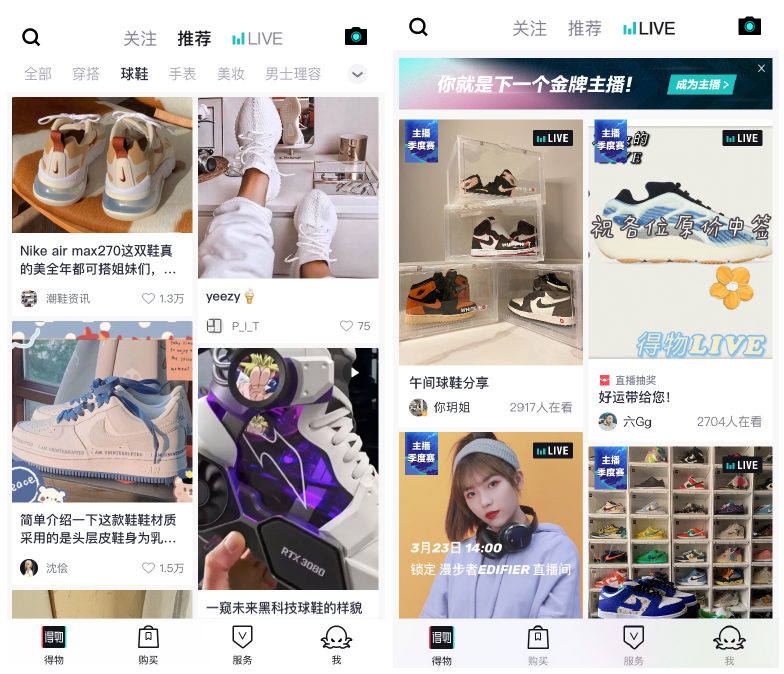

3. PoizonFirst launched as an online community for sneaker trends, Poizon is riding on the success of the country’s sneaker craze. The company has since moved into e-commerce, starting with sneakers and operating as a multi-category marketplace since 2019.

Whilst maintaining its focus on sneakers, Poizon now positions itself as a one-stop shop for streetwear and luxury accessories through direct sale or resale, as well as an interactive fashion community that provides fashion looks curated by experts to its style-conscious Gen-Z customers. The app is currently ranked in the top five free apps on China’s Apple App Store and is valued at $1 billion as of March 2021.

Tapping into local fashion trends, Poizon leverages interest in emerging national fashion brands among young Chinese consumers—a trend known as Guochao. In May 2020, Poizon held a Guochao design competition to build an incubation platform for Guochao brand owners and designers, helping Guochao enterprises to optimize original content design and production, design and innovate their business models.

[caption id="attachment_126442" align="aligncenter" width="300"] The community and marketplace on Poizon

The community and marketplace on PoizonSource: Poizon[/caption]

How Poizon Works

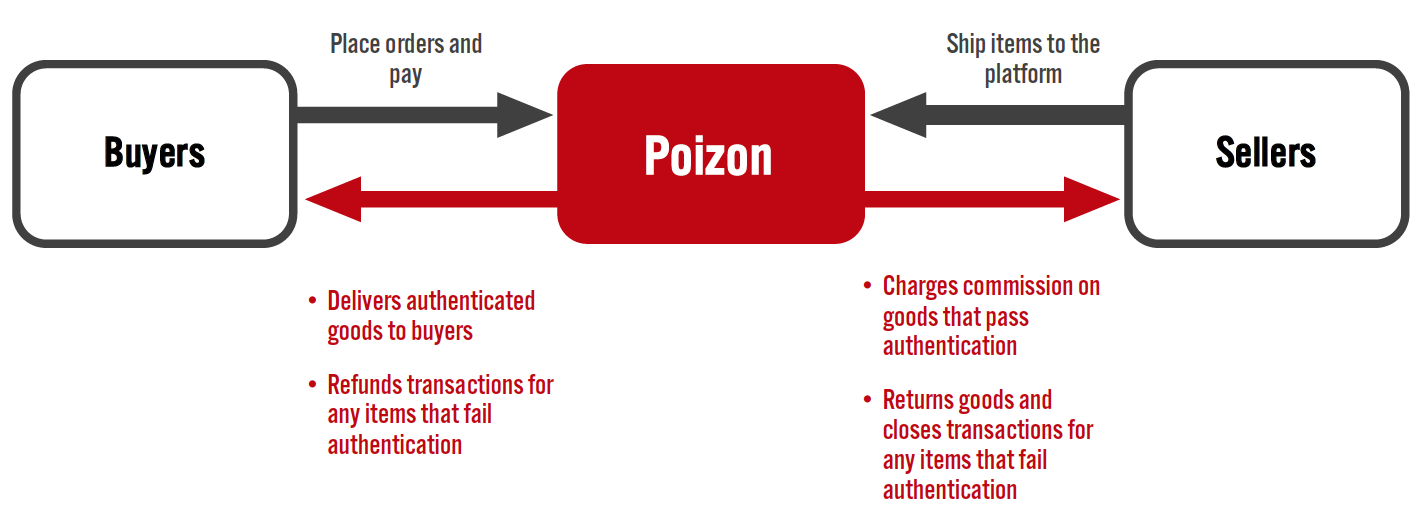

When a seller posts an item, interested buyers can bid or pay a fixed price to purchase it immediately. Once the customer pays, the seller sends the item to Poizon for authentication—if it passes, the company issues a certificate of authenticity before delivering the item to the buyer. In January 2020, the app launched an artificial reality (AR)-powered virtual try-on function for customers purchasing sneakers.

Figure 3. Poizon’s Personal Resale Model [caption id="attachment_126443" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

How Brands and Retailers Can Use Leverage Poizon

With 80% of Poizon’s 1.4 million monthly active user base aged under 21, the marketplace presents strong opportunities for brands and retailers looking to target a younger demographic. This has proved particularly popular among footwear brands given the appeal of the category among millennial and Gen Z consumers, with Poizon’s focus on sneakers setting it apart from resale competitors such as Isheyipai and Xianyu.

Brands and retailers can leverage Poizon in new product launches, with major sneaker brand NIKE debuting its Dior x Air Jordan 1 co-branded sneakers and its SB Dunk Ice Cream sneakers in China on the Poizon platform. Major streetwear brands including Casio, Champion and New Balance also chose the marketplace to debut new products in 2020.

We think that Poizon presents see strong opportunities to generate consumer excitement among sneaker and streetwear enthusiasts in this brand-driven category. There is strong growth potential in the category going forward, with the sports footwear market in China set to reach ¥341.4 billion ($52.3 billion) by 2025, representing a CAGR of 13.6% between 2020 and 2025, according to Euromonitor.

What We Think

We see strong opportunities for emerging apps to boost traffic to brands and retailers and drive sales. While Bevol, Hongbulin and Poizon may not be as broadly well-known as short-form video apps Bilibili and Douyin, or traditional e-commerce platforms such as Alibaba’s Tmall, they are capturing an increasing share of Chinese Internet users and impacting consumption within specific brand-driven discretionary retail categories in China.

Implications for Brands/Retailers

- Brands and retailers can look to launch new products exclusively on marketplaces with relevant user bases to leverage existing consumer communities that align with their offerings.

- Beauty brands and retailers should develop online communities for consumers to share and recommend products, as well as hire content creators, and key opinion leaders (KOLs) to lead consumption trends.

- Brands and retailers must address consumers that have accelerated amid Covid-19, such as sustainability and “clean” beauty. They can consider partnering with resale platforms to improve product circularity and with consumer information platforms to address consumer concerns on ingredient transparency.