Introduction

What’s the Story?

The Coresight Research

Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail. We provide a definitive overview of each topic and its impact on retail. Coresight Research has identified corporate evolution as a

key trend to watch in retail and a component trend of Coresight Research’s

RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the end of this report for more details).

In this

Think Tank, we assess what the rapid expansion of venture capital (VC) funding means for US brands and retailers. We discuss key retail sectors for VC financing, the trajectory of funding in recent years and noteworthy retail-focused VC funding developments in the pipeline for 2022. We present our insights into why the future of VC investments in retail is solid for 2022 and beyond.

We present full lists of recently completed, announced and active retail-focused VC transactions in the US in the appendix of this report.

Why It Matters

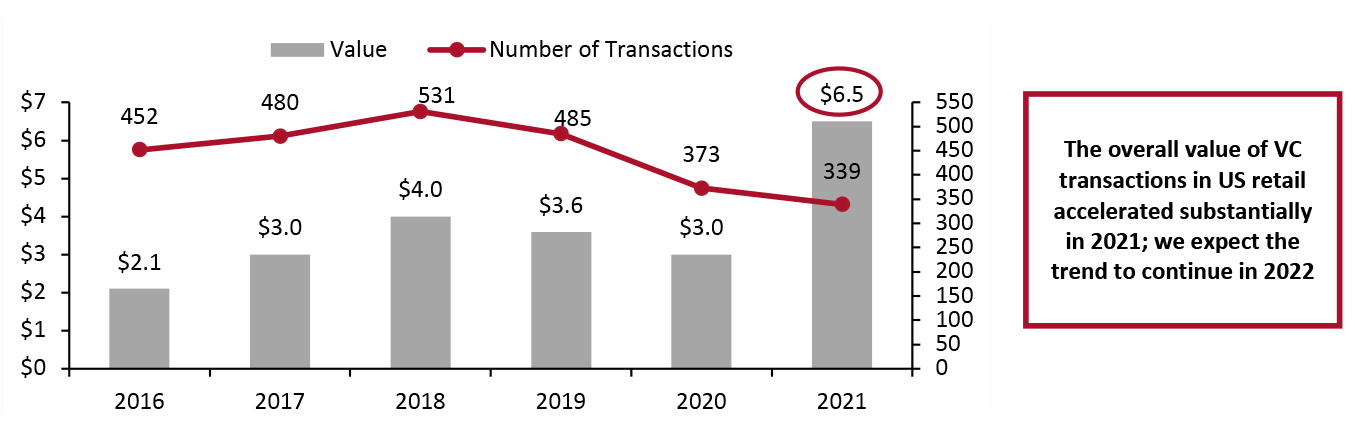

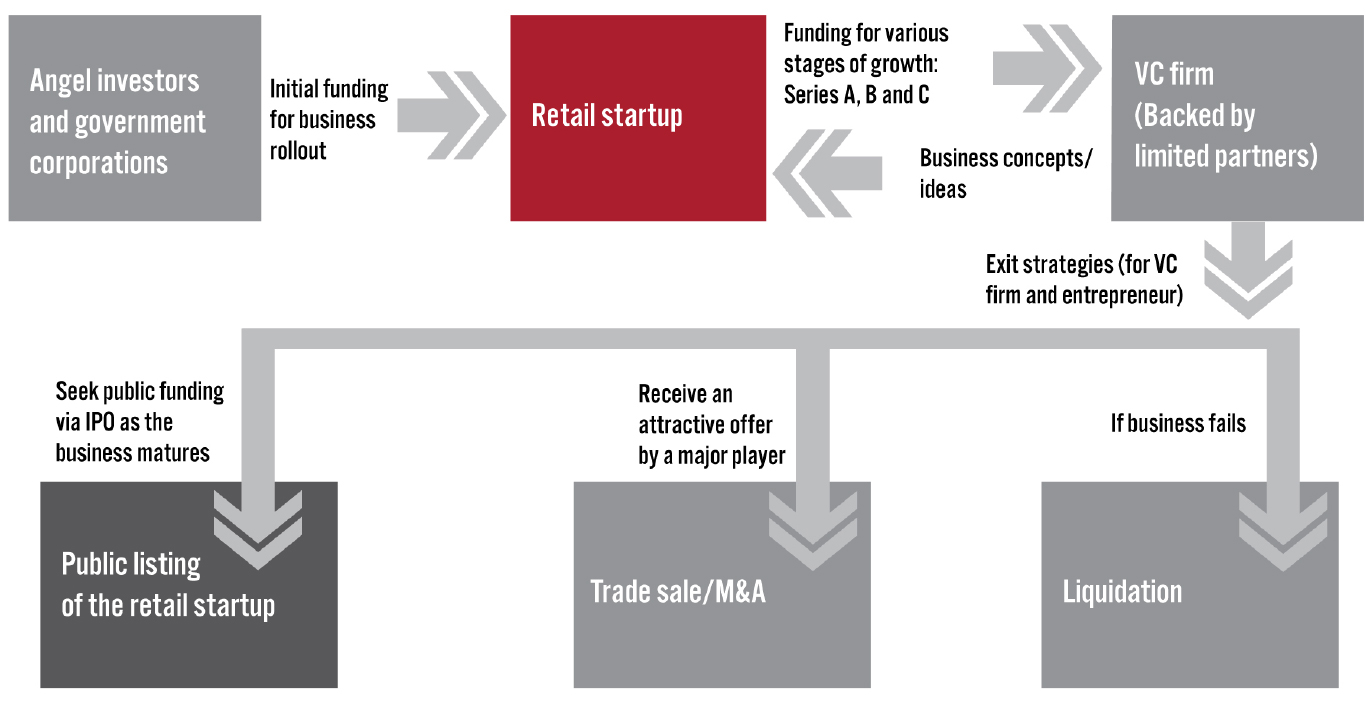

In 2021, the overall value of VC funding transactions in the US retail and consumer goods industry more than doubled from 2020, despite a slight reduction in the number of transactions: A total of 339 VC financing transactions were completed in the retail and consumer goods industry, valued at $6.5 billion, versus 373 in 2020, valued at $3.0 billion, according to Coresight Research analysis of S&P Capital IQ Pro data.

VC financing transactions included companies in the consumer discretionary and consumer staples sectors, such as apparel and footwear stores, automotive retailers, breweries, consumer electronics manufacturers, food retailers, furniture and home-furnishing retailers, Internet and direct marketing retailers, packaged foods manufacturers, personal care products manufacturers, restaurants, sporting goods retailers and software retailers, among others.

We expect the strong VC financing trends (in terms of value) to continue in 2022. In January 2022, 14 VC financing transactions were completed, raising $369.2 million versus 39 VC investments raising $305 million in January 2021.

Figure 1. Value of Completed VC Funding Transactions in the US Retail and Consumer Goods Industry (Left Axis; USD Bil.) and Total Count (Right Axis)

[caption id="attachment_143512" align="aligncenter" width="700"]

Source: S&P Capital IQ Pro/Coresight Research

Source: S&P Capital IQ Pro/Coresight Research[/caption]

Venture Capital Funding in Retail: A Think Tank

The US is witnessing bustling VC financing markets. In 2022, we expect continued growth in the value of retail-focused VC transactions, with institutional investors continuing to put cash to work despite a potential rise in interest rates.

Key Retail Sectors for VC Financing

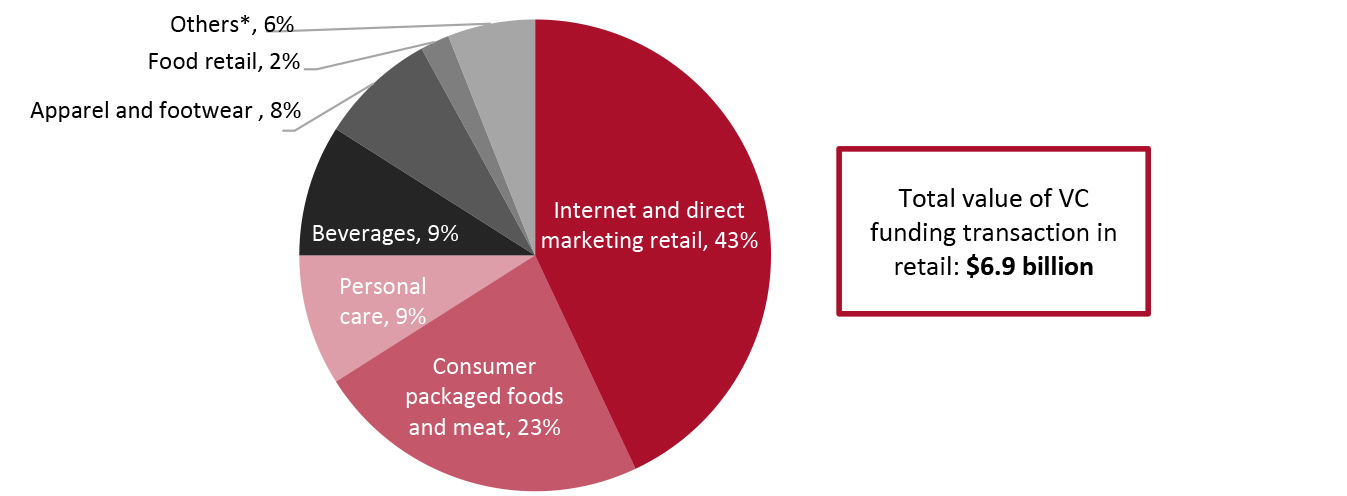

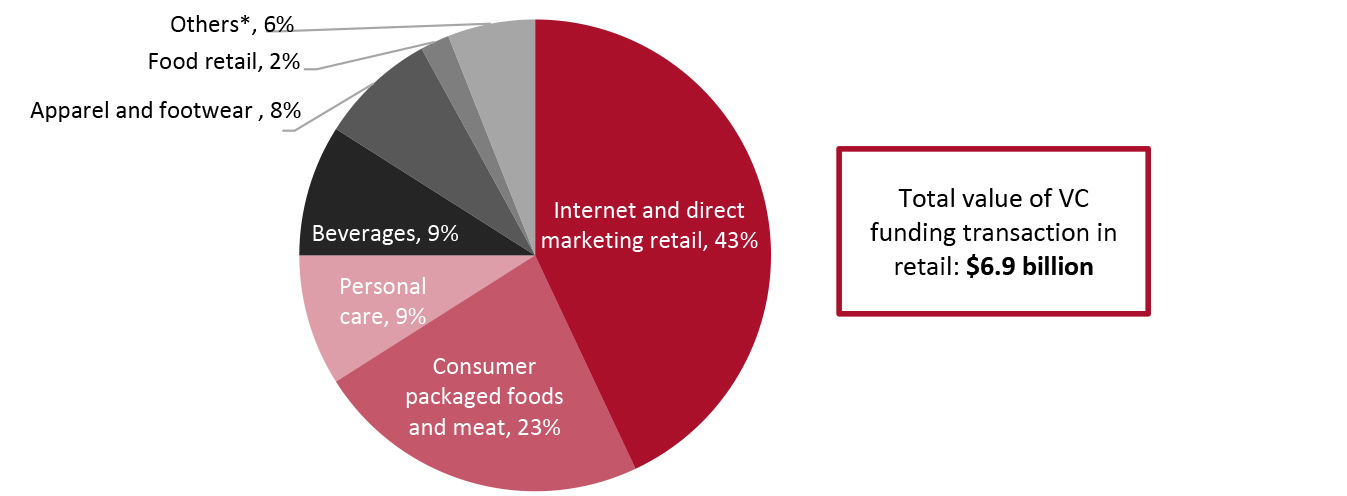

Between January 1, 2021, and January 31, 2022, Internet and direct marketing retailers raised the highest funding from VC firms among all retail sectors—accounting for 43% of the total $6.9 billion raised during the period. Consumer packaged foods and meat accounted for 26% of the total funding raised in retail. Apparel and footwear, beverages and personal care each accounted for between 8% and 10% of the overall value of completed VC funding transactions. Combined, these industries contributed about 90% of VC transactions (both in terms of valuation and count) in the retail sector during the period in question, according to Coresight Research analysis of S&P Capital IQ Pro data.

Figure 2. US: Value of Completed Retail-Focused VC Funding Transactions, Breakdown by Retail Sector, January 1, 2021–January 31, 2022, (% of Total Value)

[caption id="attachment_143513" align="aligncenter" width="700"]

Others” includes VC funding deals in automotive retail, jewelry retail, sporting goods retail, plant retail, gift-card retail and hotel-chain sectors

Others” includes VC funding deals in automotive retail, jewelry retail, sporting goods retail, plant retail, gift-card retail and hotel-chain sectors

Source: S&P Capital IQ Pro/Coresight Research [/caption]

Recent Noteworthy Completed VC Transactions

Below, we present eight completed retail-focused VC funding transactions from January 1, 2021, to January 31, 2022, organized via sector. Each company raised more than $100 million in VC funding during the period in question.

- Please see Appendix Figure 1 for a full list of the 353 completed retail-focused VC transactions in the US during the period.

Internet and Direct Marketing Retailers

Internet and direct marketing retailers, which include e-commerce companies and innovative startups catering to retailers, have benefitted from consumers’ continued structural shift toward online retail and have attracted a lot of capital in 2021. The real growth and penetration of direct-to-consumer (DTC) and e-commerce have accelerated. Below, we discuss three leading VC transactions in the Internet and direct marketing retail sector, all three of which are e-commerce aggregators of brands both on and off Amazon.

In June 2021, health and wellness e-commerce company Intrinsic closed $113 million in Series A funding led by Define Ventures. Intrinsic was formed in early 2021, and the latest round brings the company’s total valuation to $115 million.

The company plans to utilize the latest round of funding to accelerate M&A (merger and acquisition) activity and expand its platform. Intrinsic searches and acquires fast-growing health and wellness brands selling on Amazon and offers them healthcare marketing expertise, new capital, supply chain expertise and advanced analytics to maximize their potential.

In May 2021, Perch (also known as Whele), a technology-driven commerce company that acquires and operates top Amazon third-party and other DTC brands, raised $775 million in Series A funding led by SoftBank Vision Fund 2. Perch claims that this round of funding is “the largest ever Series A raised by a consumer goods company and the second-largest US-based Series A ever.” The latest funding brings the total valuation of the company to over $900 million. Perch plans to utilize the funds raised by expanding into additional channels and geographies, driving M&A activity and enhancing its core team and platform.

Perch’s key cash infusion follows a robust e-commerce trend of acquiring and consolidating multiple smaller, third-party merchants that sell their products via Amazon’s marketplace. In July 2021, Perch acquired Web Deals, one of the leading sellers on Amazon with more than $80 million in revenue. Perch owns more than 70 brands as of July 2021.

Unybrands, another e-commerce aggregator of brands both on and off Amazon, raised $300 million in Series A funding from Crayhill Capital Management in July 2021, following a $25 million seed round in February 2021. Unybrands claims that it capitalizes its integrated platform to maximize the potential of each brand it purchases. The company handles consolidating sourcing and logistics for brands to optimize their performance and profitability. Unybrands specializes in eight key categories: arts, home and culinary; garden and outdoor; home care; juvenile and baby; personal care; pet care; sports and fitness; and supplements and lifestyle.

Unybrands plans to use the $300 million funding to accelerate acquisitions of brands and further expand them across Amazon, Shopify and other DTC platforms, develop in-house technology and enhance the company’s core team. In its press release, Unybrands noted that the company has already begun building out its technology platform to offer new functionalities, such as automation of supply chain management and optimization of e-commerce growth investments.

CPG Companies

Consumer packaged goods (CPG) companies, which sell consumer packaged foods and meat as well as beverages, raised the second-highest funding from VC firms in the retail sector.

In August 2021, vertical farming company 80 Acres Farms secured $160 million in Series B funding led by General Atlantic and Siemens Financial Services. 80 Acres Farms grows a wide variety of food produce commercially sold at scale. The company’s advanced data analytics capabilities and growing technologies have enabled 80 Acres Farms to achieve revenue growth of more than 450% between December 2020 and August 2021. As of August 2021, the company services more than 600 retail and foodservice locations in the US, including its recent expansion with food retailer Kroger in March 2021 to 316 stores and to the online channel powered by the Kroger–Ocado Solutions partnership.

80 Acres Farms planned to utilize the second round of funding for product development and continued farms expansion—from its footprint of eight vertical farms as of August 2021.

Plant-based food technology company Motif FoodWorks raised $226 million in Series B funding in June 2021, bringing its total value raised to date to $345 million. The company claims that it is on a mission to make plant-based food more nutritious and tastier. This second round of funding will help Motif accelerate its research and development (R&D) capabilities, expand and commercialize its food technologies, and scale its people and facilities footprint.

In its press release, Motif’s CEO Jonathan McIntyre said, “With support from our investors, we're advancing the understanding of food science and design to make plant-based foods better tasting, more nutritious and so desirable that people actually crave them.”

In December 2020, Motif opened a 10,600-square-foot office and lab space in Boston to expand its R&D capabilities to discover, analyze and design new methods to produce foods and food ingredients in the plant-based category.

Apparel and Footwear

The apparel and footwear sector, which saw a strong sales recovery in 2021, comprised a significant proportion of total VC funding raised (as charted in Figure 2 above).

In January 2022, Savage X Fenty, the lingerie and innerwear brand owned by singer-turned-entrepreneur Rihanna, announced that it secured $125 million in Series C funding, led by investment firm Neuberger Berman. This brings Savage x Fenty’s total funding to $310 million to date. The Series C funding completion announcement came just three days after the opening of Savage X Fenty’s first brick-and-mortar store in Las Vegas. Furthermore, the company plans to open a total of 10 stores by the end of 2022. Savage X Fenty expects the latest round of funding to help the company expand into physical retail, launch new product lines and grow internationally.

In January 2022, lingerie and innerwear brand Skims Body (a key competitor of Savage x Fenty), owned by American media personality and entrepreneur Kim Kardashian, secured $240 million in a Series B funding round led by Lone Pine Capital, bringing the brand’s total valuation to $3.2 billion. Skims Body plans to use the raised funds to expand its retail locations (including opening international locations) and accelerate product innovation and brand partnerships.

Skims remains optimistic about its future business growth and expects its revenues to increase by 46%, year over year, to $400 million in fiscal 2022.

Personal Care

Like the apparel and footwear sector, personal care also saw strong sales growth in 2021 and comprises a notable proportion of total VC funding raised in the US retail sector.

In August 2021, Quip, an oral healthcare company with nearly 8 million users, raised $100 million in Series B funding, led by Cowen Sustainability Investments (CSI). Quip has recently expanded its retail presence across the US through strategic partnerships with mass retailers. For instance, in October 2020, Quip launched a comprehensive oral care product range across retail giant Walmart’s 3,100 stores across the US and on Walmart.com. The launch with Walmart follows a successful initial rollout into mass retail via retail giant Target’s stores in October 2018.

Quip plans to utilize the latest round of funding to grow its multi-million subscriber base, accelerate product innovation, improve its professional virtual dental care services, drive global expansion and invest in sustainable initiatives. In its press release, CSI’s Co-Head Ewa Kozicz said:

Quip is well on its way to becoming the iconic oral care brand in the way we’ve seen companies revolutionize other industries like fitness, pet care and eyewear. No other oral care company can match Quip’s engaged customer base, data expertise, professional network and digital platform that helps people take control of every aspect of their oral health.

Recently Announced and Active VC Funding Transactions by Retail Industry

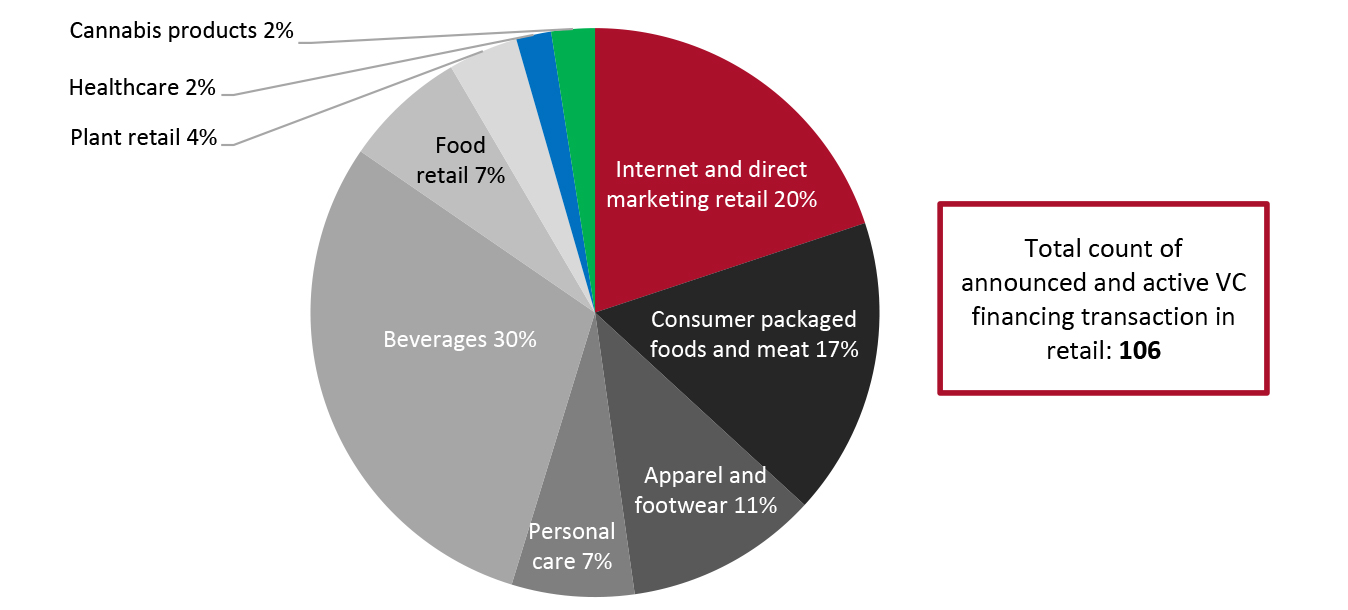

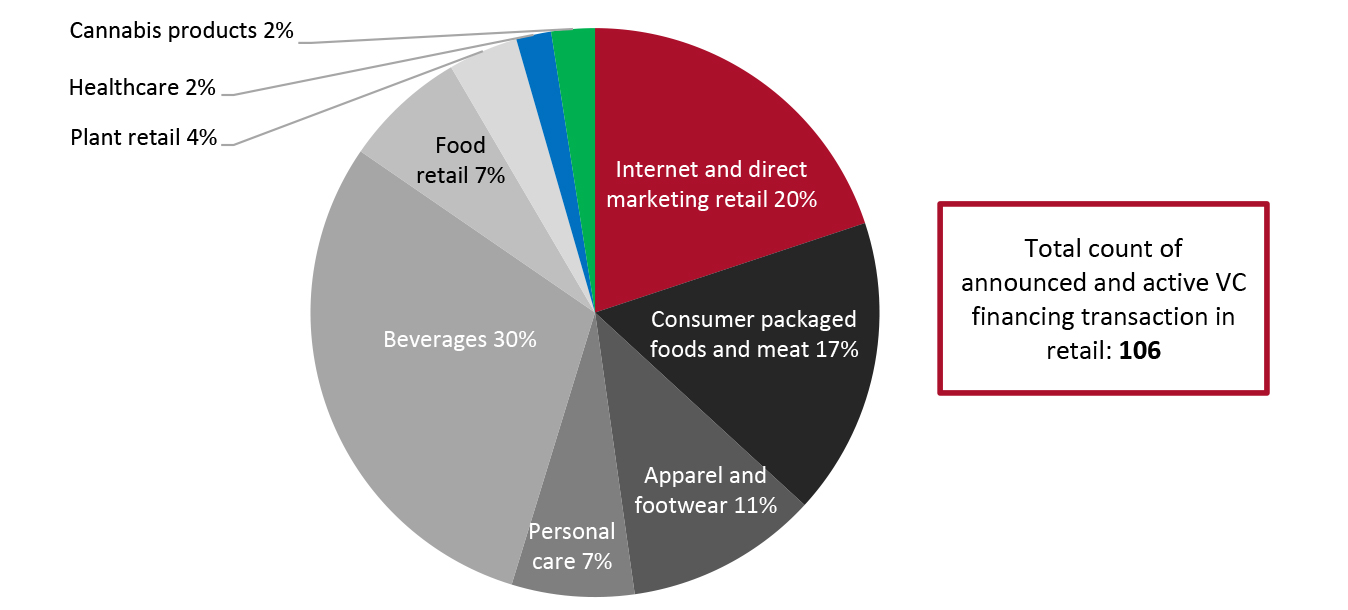

The attractiveness of retail companies among VC firms remains strong. Between January 1, 2021, and January 31, 2022, 106 VC funding transactions in retail-focused sectors were announced that remained active (transactions are still in process) as of January 31, 2022, according to Coresight Research analysis of S&P Capital IQ Pro data.

Nearly 30% of all the active VC financing announcements were in the beverage industry, while 20% were in the Internet and direct marketing retail industry. Other major target retail industries include consumer packaged foods and meat, apparel and footwear, and personal care products.

- Please see Appendix Figure 2 for a full list of the 106 recently announced and active VC transactions focused on retail and consumer goods.

Figure 3. US: Retail-Focused Announced and Active VC Funding Transactions, Breakdown by Retail Sector, January 1, 2021–January 31, 2022, (% of Total Count)

[caption id="attachment_143514" align="aligncenter" width="700"]

Source: S&P Capital IQ Pro/Coresight Research

Source: S&P Capital IQ Pro/Coresight Research[/caption]

Our Insights: Retail-Focused VC Funding Growth and Future Prospects

In 2022, we expect to see continued strong VC financing activity in the US retail sector.

Five Driving Forces

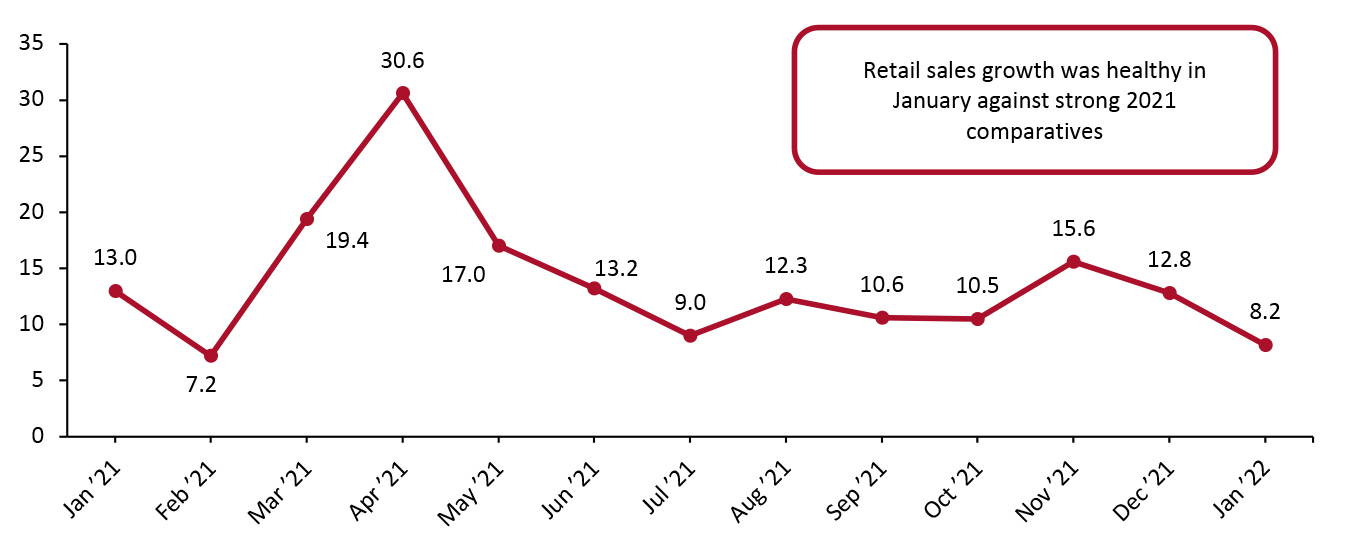

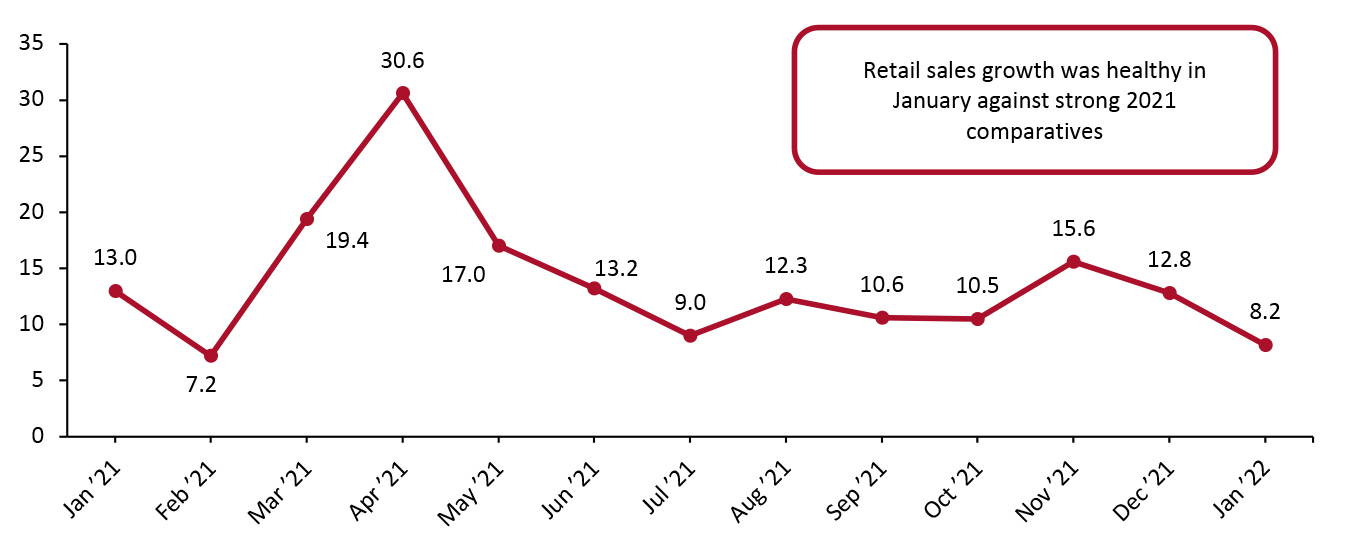

1. Ongoing Robust Recovery in the US Retail Sector

The robust ongoing recovery seen in sales across industries in the US retail sector will drive the retail-focused VC financing growth in 2022 with an inflow of funds from both domestic and international investors. The optimism linked to Covid-19 vaccinations is one key factor that will drive further retail recovery in 2022. In the US, 76% of the population have received at least one shot and 65% are fully vaccinated as of March 1, 2022, according to the US Centers for Disease Control and Prevention.

Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change

[caption id="attachment_143515" align="aligncenter" width="700"]

Data are not seasonally adjusted

Data are not seasonally adjusted

Source: US Census Bureau/Coresight Research [/caption]

2. Private Equity Firms Seeking Value-Creation Opportunities in Carve-Outs

Between January 1, 2021, and November 23, 2021, private equity firms across the globe raised over $714 billion in “dry powder” (the amount of committed but unallocated capital firms have on hand), and this unspent capital is expected to rise further in 2022, according to UK-based data provider Preqin. Due to this increase in reserves, we expect 2022 to involve a high level of VC financing activity. We see brands and retailers as likely points of interest for these private equity buyers.

3. Ongoing Strong IPO and M&A Trends in Retail

The ongoing strong

IPO and

M&A trends in US retail sector will drive VC investments. IPO and M&A are the key exit strategies for VC firms, which we discuss in detail in the next section.

4. Expanding Investment Activities in Growing Industry Verticals

Investors are taking an active interest in companies that have benefitted from pandemic-related consumer shifts to e-commerce. For example, private Internet and digital marketing retailers are gaining traction among investors.

5. ESG Considerations

Environmental, social and governance (ESG) considerations may generate significant deal activity in 2022 and beyond as retail companies and VC firms look at their environmental footprint and consider acquiring, rationalizing or divesting assets. Furthermore, investors are likely to see ESG as a key element to build a more sustainable business, which can adapt well to potential market shifts.

Potential Headwinds

We believe there are two key factors that could hinder VC funding activity in the retail sector in 2022, as we discuss below.

- Rising Inflation and Increase in Interest Rates

To counter inflation, on December 18, 2021, the US Central Bank announced that the government could wind up the stimulus by the end of March 2022, after which the bank would raise the key interest rates. The Federal Reserve System expects three interest-rate increases in 2022, followed by three more in 2023.

An increase in interest rates could cool down VC funding activity, since higher interest rates will increase the opportunity cost for investment in growing private companies. In 2021, a part of the VC financing market’s runaway success was due to investors seeking higher returns than they might get in fixed-income markets. A higher interest rate could make those fixed-income investments start to look a little more appealing. This could hinder retail-focused VC funding activity to some extent.

- Proposed Increase in US Corporate Tax

In 2021, US President Joe Biden proposed an increase in various taxes in the US, including raising the corporate tax from 21% to 25%, to help finance the government’s infrastructure proposal. We believe that the proposed increase in the US corporate tax rate could decrease the attractiveness of investment into US companies while leading to more investment overseas.

Nevertheless, the proposed tax changes are still under discussion and are heavily opposed by the US opposition party and business lobbies.

Key Considerations for Private Retailers Raising Funds Through VC Financing

As retail startups grow, VC funding becomes one of the most effective ways to raise capital. VC firms are usually backed by limited partners, which include wealthy individuals, pension funds and insurance companies, among others. With the VC financing market momentum growing strongly, many brands and retailers are assessing their readiness to raise funds via VC financing. However, navigating the VC investments pathway is an immense undertaking, and many retailers should evaluate the resource and time commitment required.

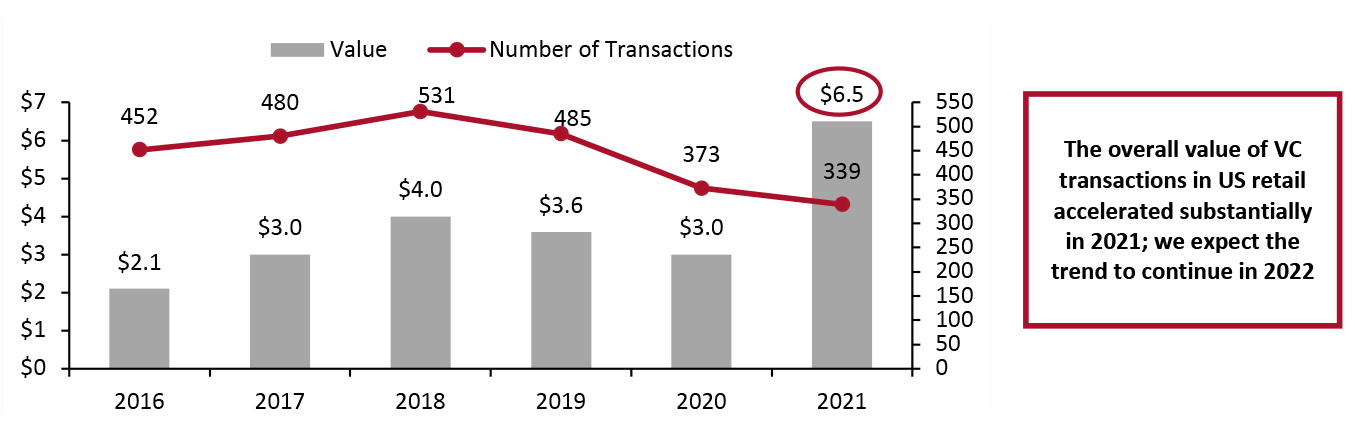

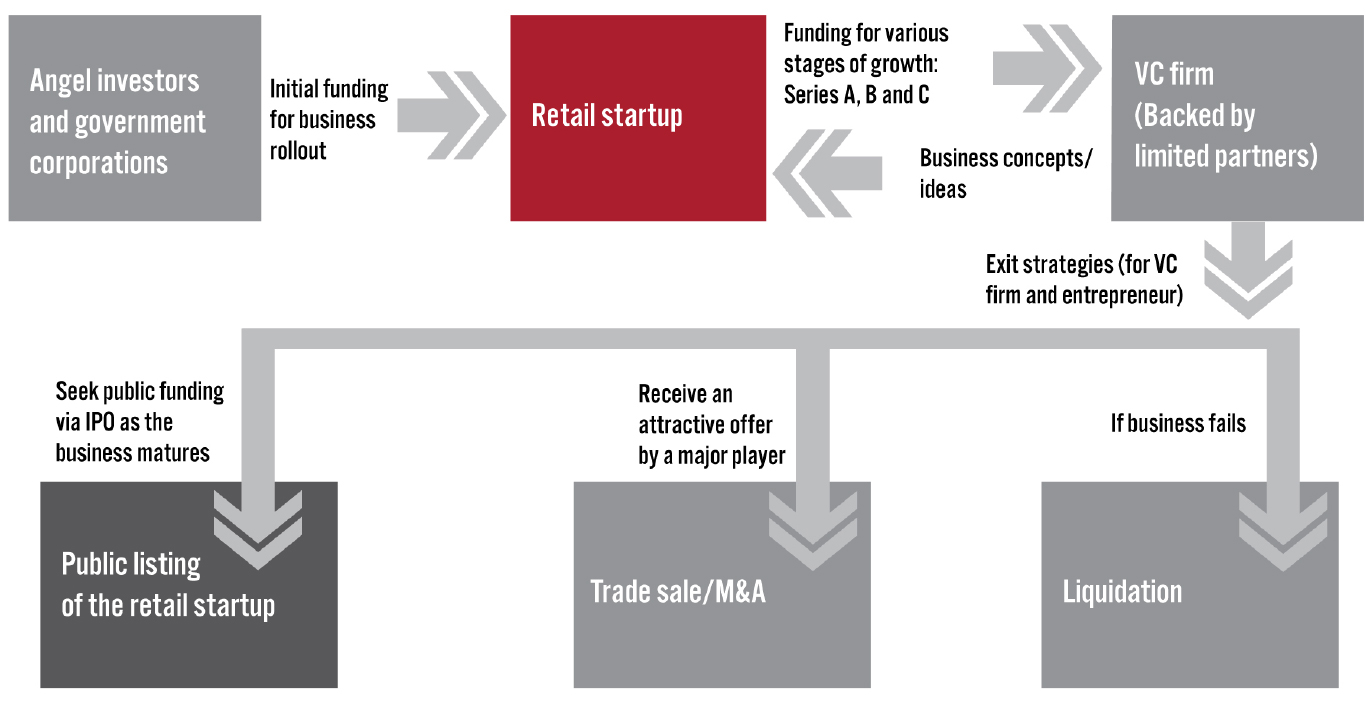

The Road to a VC Funding Transaction and Exit Strategies

Usually, VC funding takes place after an initial round of seed investment, which is typically funded by angel investors and government corporations. As the business grows, retail startups seek to raise VC financing by selling their business concepts and equity stories to VC firms. A retailer’s equity story typically includes the addressable market, company strategy, growth drivers, financial projections, management experience and more.

While it is most common for startups to raise their external equity funding with Series A, B and C rounds of VC financing, some companies can still go on to Series D and even Series E rounds if they have not achieved the stated goals during C funding or if they are looking for a final push before an IPO. Below, we discuss three key rounds of VC financing.

A retail startup typically opts for Series A funding once its business has developed a track record in terms of consistent revenue figures, an established user base and other key performance metrics. In this round of funding, VC firms are not just looking for great ideas but also a robust strategy to turn the idea into a money-making, successful business.

In 2021, the average Series A investment round was around $22 million (for all industries in the US, not specific to retail), according to fintech company Storm 2. As we discussed earlier, Internet and direct marketing retailers like Intrinsic, Perch and Unybrands massively outperformed the overall average, with more than $100 million raised in Series A rounds in 2021.

For the startup, Series B funding is all about taking the business to the next level, such as through investing in product development, advertising, tech support and talent acquisition. Series B is often led by the same key anchor investor as the Series A round, while the difference with Series B is the addition of a new wave of other VC firms that specialize in later-stage investing.

The average estimated capital raised in Series B funding is $33 million (for all industries in the US, not specific to retail), according to Storm 2. However, a few retailers and brands such as Motif FoodWorks (CPG), 80 Acres Farms (CPG), Skims Body (apparel brand) and Quip (personal care) raised $100 million and above in the Series B round of VC financing in 2021, as we discussed earlier.

A retail startup that makes it to Series C funding is already somewhat successful in terms of consumer base, revenue streams and proven histories of growth. These startups usually raise the additional funding to expand into new markets, develop new products and even acquire other companies.

As the business operation gets less risky and the startup proves its business model successful, more investors come to play in Serie C rounds, such as hedge funds, investment banks and larger secondary market groups. Many startups utilize Series C funding to help boost their valuation in anticipation of IPO (an exit strategy, which we discuss below).

In the Series C funding round, a retail startup often raises up to hundreds of millions of dollars. For instance, we saw Savage X Fenty secure $125 million in January 2022.

Exit Strategies

VC firms provide capital to a startup so that they can maximize their return through exit strategies, such as IPO and trade sale (acquisition by a major company). Below, we discuss three key exit strategies in VC funding transactions.

When the funded startup’s business is functioning well, many VC firms take up the IPO exit strategy to maximize their returns. To conduct an IPO listing, VC firms often approach investment banks and look for the most optimal time to ensure that they can make the best possible return while exiting their position in the company. However, there is usually a lockup period (typically ranging from 90 to 180 days) after IPO, during which VC firms cannot sell their stocks. This is to prevent a plunge in the stock price.

Another way to get money out of investments is a trade sale or M&A. When a VC firm receives an attractive offer from a major player to buy the integrated company, it sells off the investment, generating profits for each of the investors and the business founder.

In case the business fails, the startup liquidates all the assets at market value and then use the proceeds to pay off obligations and keep the residual.

Figure 5. The Typical VC Funding Process of a Retail Startup and Exit Strategies

[caption id="attachment_143516" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Benefits and Challenges of VC Funding for Brands and Retailers

In Figure 6, we present five benefits and three challenges that should be key considerations for private retailers raising funds via VC investments.

Figure 6. Key Benefits and Challenges of VC Funding for Retailers

|

- Access to capital: VCs provide companies access to capital for liquidity needs and delivering on their business plans, such as pursuing market expansion and launching new projects and products. VC funding is mainly beneficial for retail startups with high initial operating costs and limited operating histories.

- Business expertise and risk management: Apart from financial backing, VC financing offers valuable expertise and guidance for several business decisions, including financial and human resource management.

Furthermore, bringing on venture capital can help retail startup founders manage the risk inherent in most startups. The rate of failure for total private startups (not specific to retail) in the US between March 2020 and March 2021 was about 18%, according to data from the US Bureau of Labor Statistics. Having VCs to turn to for guidance when complex circumstances arise can increase the odds of making a good decision.

- No legal obligation for repayment in case of failure: Unlike bank loans, VC funding does not leave the startup with the burden of fund repayment. The startup owner has no obligation to repay the VC investors in case the business fails. The return on a VC investment depends entirely on the profitability of the funded business.

- Building networks: Venture capitalists are well-connected on several business fronts. Having access to this network can help the startup to enter alliances with businesses houses and institutional investors, build clients, hire key employees and build the team, and generate future rounds of funding.

- Increased publicity and goodwill: Many VC firms have media contacts and public relations (PR) groups, and associating with them can add a great deal of credibility to a startup.

|

|

- Dilution of ownership: The controlling shareholders’ equity interest and voting interest in the company are usually lowered post-VC funding, which could make the retailer vulnerable to a control transaction.

- Lengthy and tedious process: Approaching a VC firm, presenting a detailed business plan, organizing one-to-one meetings and conducting extensive due diligence are often lengthy and complex.

- High ROI expectations and early redemptions: Some VC firms may decide to redeem their total investments within three to five years and require a high return on investment (ROI) in the medium term itself, which can often elevate the already high pressure that founders experience, particularly if the owner’s business plan will take a longer time to provide liquidity.

|

Source: Coresight Research

Major Factors to Consider When Selecting a VC Firm

Like any other major financing transaction, VC funding involves complex processes, and retailers should conduct ample due diligence when selecting a VC firm. Some of the key considerations include:

Brands and retailers should look to collaborate with a VC firm that has solid networks and can introduce them to future funding options. Looking deep into the VC firm’s operational structure, funding history and management experience can provide a fair idea of the VC firm’s network base.

- Vision Alignment/Cultural Fit

Retail startups should ensure that the VC firm’s vision is aligned with the company’s vision to generate robust values across key functions, including product development, promotions and sales.

There is an affinity for many VC firms to be more shortsighted than startup founders. A short-term focus on ROI could impact the survival of a promising startup. Therefore, retailers and VC firms should develop a clear understanding with regard to exit aspiration, whether it is IPO or trade sale.

Retail startups should search for VC firms that have a specialization in their respective retail industries. The startups will have a higher chance of success if they collaborate with VC firms that have relevant domains of expertise.

- Past Financial Track Record

Retailers must verify the past financial successes of VC-backed projects in terms of return and risk. The key metrics to evaluate a VC firm performance are total value to paid-in capital (TVPI) and internal rate of return (IRR).

TVPI is calculated as the total value of the VC fund’s holdings (realized and unrealized) divided by the amount of the money the limited partner has paid into the fund. The higher this ratio, the more startups find the VC fund attractive.

IRR is the approximate annual rate of growth an investment is expected to generate over a certain period. The IRR calculation involves trial and error using the net present value (NPV) method—which compares the present value of future cash flows with the initial investments.

- Flexibility in Deal Structuring

Retailers should seek out flexibility in VC funds according to the developmental phase of the company: seed, startup and expansion. For instance, during the expansion stage, the retail startup should raise a Series B round of funding through VC firms that specialize in the later stages of funding.

What We Think

In 2021, we saw a remarkable rise in the value of VC funding in the US retail sector, and we expect this trend to continue in 2022, driven by the ongoing solid recovery in the retail sector, high levels of available liquidity and strong IPO and M&A trends in retail. However, inflation and increase in interest rates remain key concerns.

In 2022 and beyond, we expect the retail and consumer goods VC financing pipeline to further broaden in terms of sector representation, including more of the sectors that witnessed a strong recovery from the pandemic in 2021—such as specialist stores and personal care—in addition to the bustling Internet and direct marketing retail and CPG sectors. An uptick in retail-focused VC financing activity could well intensify the competition for investment, placing greater focus on preparing early for VC funding.

VC financing provides robust opportunities for brand owners and retailers to access capital for liquidity and fund expansion. However, if a private retailer is considering raising funds through VC investment, it needs to be careful to weigh the pros and cons of VC financing and take into account the past track record and vision of VC funds.

Implications for Retailers and Brand Owners

- As the VC funding process is only the beginning of a retailer’s journey to the capital market, retailers should consider the long-term consequences. It is important that a retailer partner with VC firms that are backed by investors with relevant industry experience.

Retailers can maximize the valuation in the VC funding rounds by ensuring that their equity story provides investor confidence that their management is focused on the right growth channels in the marketplace to display the growth trajectory. Furthermore, retailers and brands should incorporate environmental, social and governance (ESG) considerations into their equity story as investors see ESG as a key element to build a more sustainable business that can adapt well to potential market shifts.

- Brands and retailers looking to raise VC funding should remain vigilant for proposed regulatory changes and a potential stock market correction arising from growth in pricing volatility and the pace at which the world recovers from the pandemic.

About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Figure 7. RESET Framework

[caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Appendix: Venture Capital Funding in Retail

Appendix Figure 1. US: Completed Retail-Focused VC Funding Transactions from January 1, 2021, to January 31, 2022

[wpdatatable id=1813 table_view=regular]

Source: S&P Capital IQ Pro/Coresight Research

Appendix Figure 2. US: Announced and Active Retail-focused Financing Transactions, from January 1, 2021 to January 31, 2022

[wpdatatable id=1814 table_view=regular]

Source: S&P Capital IQ Pro/Coresight Research

Source: S&P Capital IQ Pro/Coresight Research[/caption]

Source: S&P Capital IQ Pro/Coresight Research[/caption]

Others” includes VC funding deals in automotive retail, jewelry retail, sporting goods retail, plant retail, gift-card retail and hotel-chain sectors

Others” includes VC funding deals in automotive retail, jewelry retail, sporting goods retail, plant retail, gift-card retail and hotel-chain sectors  Source: S&P Capital IQ Pro/Coresight Research[/caption]

Our Insights: Retail-Focused VC Funding Growth and Future Prospects

In 2022, we expect to see continued strong VC financing activity in the US retail sector.

Five Driving Forces

1. Ongoing Robust Recovery in the US Retail Sector

The robust ongoing recovery seen in sales across industries in the US retail sector will drive the retail-focused VC financing growth in 2022 with an inflow of funds from both domestic and international investors. The optimism linked to Covid-19 vaccinations is one key factor that will drive further retail recovery in 2022. In the US, 76% of the population have received at least one shot and 65% are fully vaccinated as of March 1, 2022, according to the US Centers for Disease Control and Prevention.

Source: S&P Capital IQ Pro/Coresight Research[/caption]

Our Insights: Retail-Focused VC Funding Growth and Future Prospects

In 2022, we expect to see continued strong VC financing activity in the US retail sector.

Five Driving Forces

1. Ongoing Robust Recovery in the US Retail Sector

The robust ongoing recovery seen in sales across industries in the US retail sector will drive the retail-focused VC financing growth in 2022 with an inflow of funds from both domestic and international investors. The optimism linked to Covid-19 vaccinations is one key factor that will drive further retail recovery in 2022. In the US, 76% of the population have received at least one shot and 65% are fully vaccinated as of March 1, 2022, according to the US Centers for Disease Control and Prevention.

Data are not seasonally adjusted

Data are not seasonally adjusted  Source: Coresight Research[/caption]

Benefits and Challenges of VC Funding for Brands and Retailers

In Figure 6, we present five benefits and three challenges that should be key considerations for private retailers raising funds via VC investments.

Source: Coresight Research[/caption]

Benefits and Challenges of VC Funding for Brands and Retailers

In Figure 6, we present five benefits and three challenges that should be key considerations for private retailers raising funds via VC investments.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]