albert Chan

Introduction

What’s the Story?

The Coresight Research Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail. We provide a definitive overview of each topic and its impact on retail. Coresight Research has identified retail-adjacent opportunities as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the appendix of this report for more details).

Loyalty programs are a retail-adjacent opportunity that recognize and reward customers who frequently engage with a brand or retailer. This type of marketing approach typically rewards customers with free merchandise, discounts, early access to products, coupons and other special incentives.

In this Think Tank, we explore US retail loyalty programs, presenting insights into the competitive landscape, market drivers and themes we are watching in the space. We analyze findings from a Coresight Research survey of US consumers conducted in March 2022 to inform our insights into the benefits that make loyalty programs attractive to shoppers and the elements that they dislike. Our survey data cover traditional loyalty programs as well as paid retail membership programs such as Amazon Prime and Costco membership.

Why It Matters

Loyalty programs help differentiate brands and retailers, encouraging customers to shop with them frequently. They play a vital role in driving customer engagement, increasing customer retention and enhancing the customer experience, which ultimately increase sales and profits.

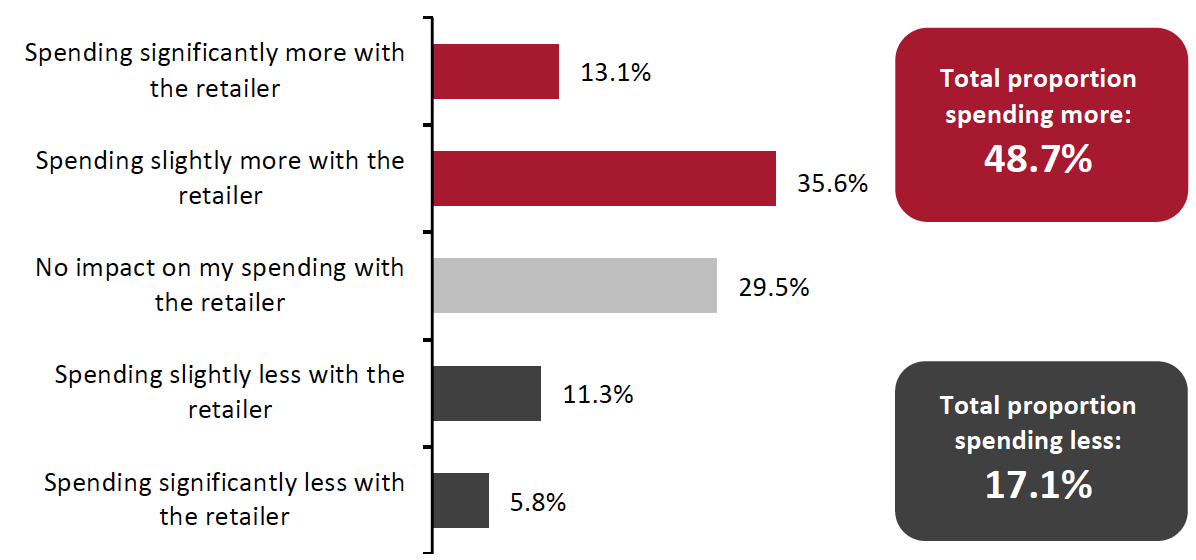

Retained customers are more likely to spend more on each transaction: according to Coresight Research’s survey of US consumers on March 7, 2022, almost half of respondents with a loyalty program membership reported that they now spend more with that retailer than before they joined its loyalty program.

Figure 1. Respondents with a Loyalty Program Membership: Changes in Spending Levels Since Joining a Loyalty Program (% of Respondents)

[caption id="attachment_147660" align="aligncenter" width="550"] Base: 329 US respondents aged 18+ who are members of a retail loyalty program

Base: 329 US respondents aged 18+ who are members of a retail loyalty programSource: Coresight Research[/caption]

Loyalty programs are exposed to inflation and supply chain disruption challenges—with many consumers being driven to try out cheaper and easily available alternatives. As such, it is more important than ever for retailers to pay close attention to developing and fine-tuning loyalty-program strategies to suit the needs of customers in the current climate.

US Retail Loyalty Programs: A Think Tank

Consumer Positions on Loyalty Programs: Our Survey Data

A well-designed loyalty scheme can help businesses target and attract valuable customer segments. Our March 2022 survey found that just over two-thirds (68.0%) of US consumers are currently enrolled in a retail loyalty program, including paid retail membership programs.

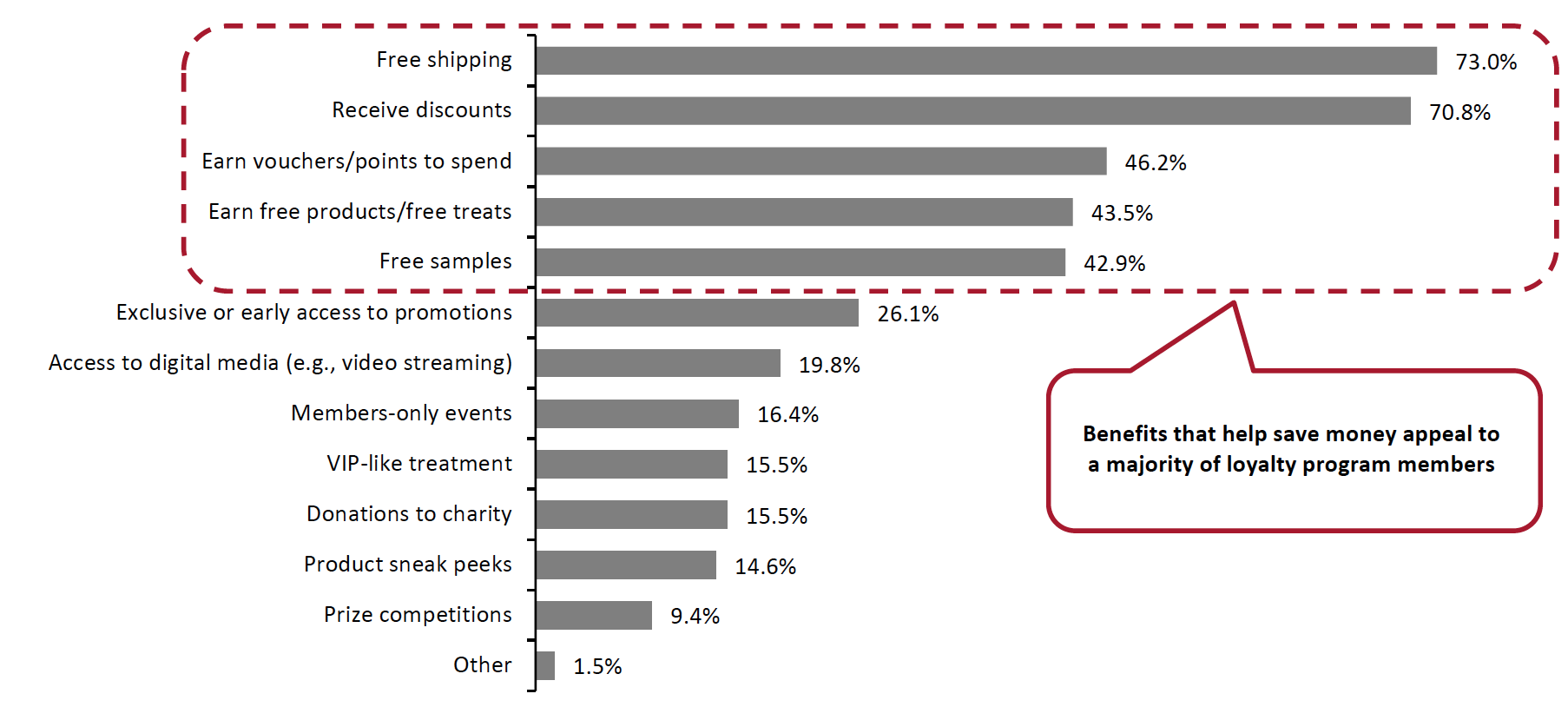

We found that transactional benefits top the list of what shoppers like in a loyalty program. Respondents ranked free shipping, discounts and the ability to earn points to redeem rewards as favorite program features (see Figure 2). Retailers should ensure that these core benefits are embedded thoroughly in their loyalty programs to gain favor among shoppers and increase purchase frequency.

Figure 2. Respondents with a Loyalty Program Membership: Type of Benefits They Like in a Loyalty Program (% of Respondents) [caption id="attachment_147661" align="aligncenter" width="700"]

Base: 329 US respondents aged 18+ who are members of a retail loyalty program

Base: 329 US respondents aged 18+ who are members of a retail loyalty programSource: Coresight Research[/caption]

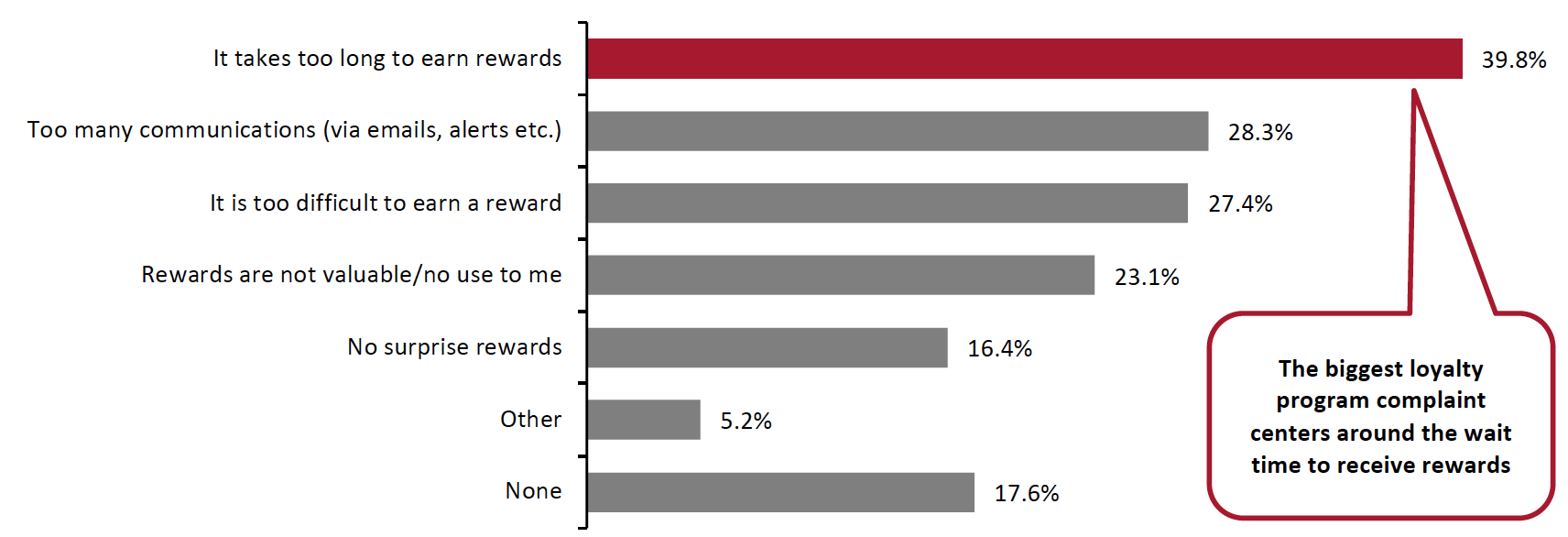

As shown in Figure 3, the most disliked aspect of loyalty programs is the time it takes to earn rewards, cited by around 40% of respondents, implying that today’s shoppers crave immediate or quickly accrued benefits. Retailers should look to incorporate an instant-gratification component in their loyalty programs to reduce wait time and keep consumers engaged.

Other negatives highlighted include receiving too much communication and the redemption process being too difficult. Retailers should ensure that program rewards are easily attainable and communications are never too disruptive to their members.

Figure 3. Respondents with Loyalty Program Memberships: What They Don’t Like About the Loyalty Program They Belong to (% of Respondents) [caption id="attachment_147662" align="aligncenter" width="700"]

Base: 329 US respondents aged 18+ who are members of a retail loyalty program

Base: 329 US respondents aged 18+ who are members of a retail loyalty programSource: Coresight Research[/caption]

Competitive Landscape

While customer loyalty programs take varied forms, points-based programs have been, and still are, the most popular among US retailers. These are the most recognizable loyalty format for shoppers, and the free sign-up proposition helps retailers drive new customer acquisition.

Nevertheless, with consumers having shifted to online channels amid the Covid-19 pandemic, we are seeing loyalty programs evolve from generic points-based programs to offer more engaging digital experiences. Retailers are extending their offerings to create a balanced portfolio of monetary and non-monetary benefits to differentiate their programs and deliver a compelling value proposition.

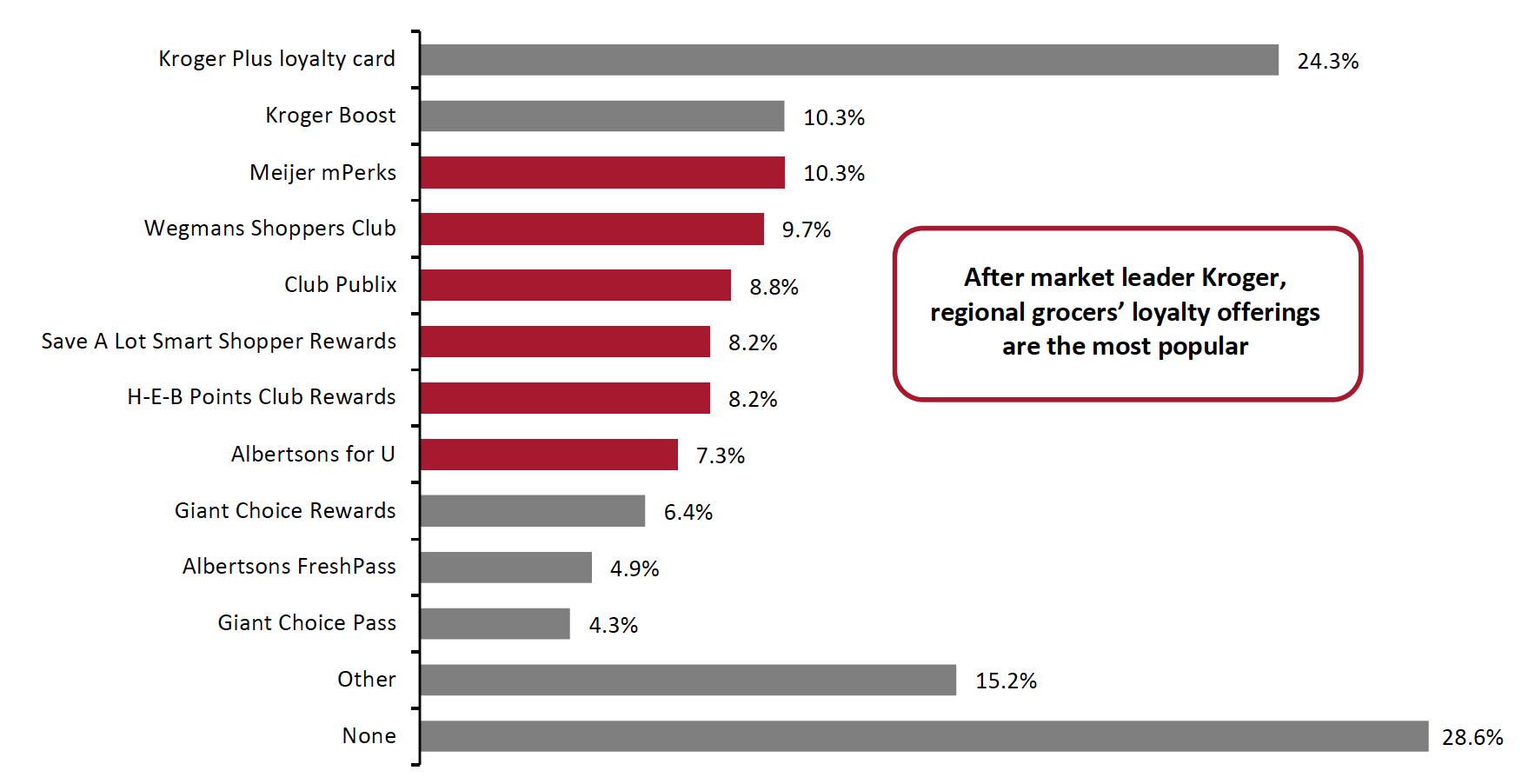

Among retail sectors, grocery retailers and supermarkets are leading the way with loyalty programs, proving to be the most popular among shoppers. Our March 2022 survey of US consumers found that Kroger Plus, a free-to-join points-based loyalty program, is most popular among respondents with a loyalty membership, as shown in Figure 4. Kroger Boost, a premium loyalty program launched by Kroger in November 2021, came in second place. In its Business Update event held on March 4, 2022, Kroger stated that it is seeing a significant portion of consumers not enrolled in either its fuel or delivery program that are enrolling in its premium offering.

Regional supermarket chains also have strong customer loyalty programs. Meijer, Wegmans and Publix’s programs are most popular after Kroger.

The grocers covered in the survey are not evenly spread across all US states, partly explaining the lower respondent percentages scored by their loyalty programs.

Figure 4. Respondents with Loyalty Program Memberships: Supermarket Retailers’ Programs They Are Currently a Member of (% of Respondents) [caption id="attachment_147663" align="aligncenter" width="700"]

Base: 329 US respondents aged 18+ who are members of a retail loyalty program

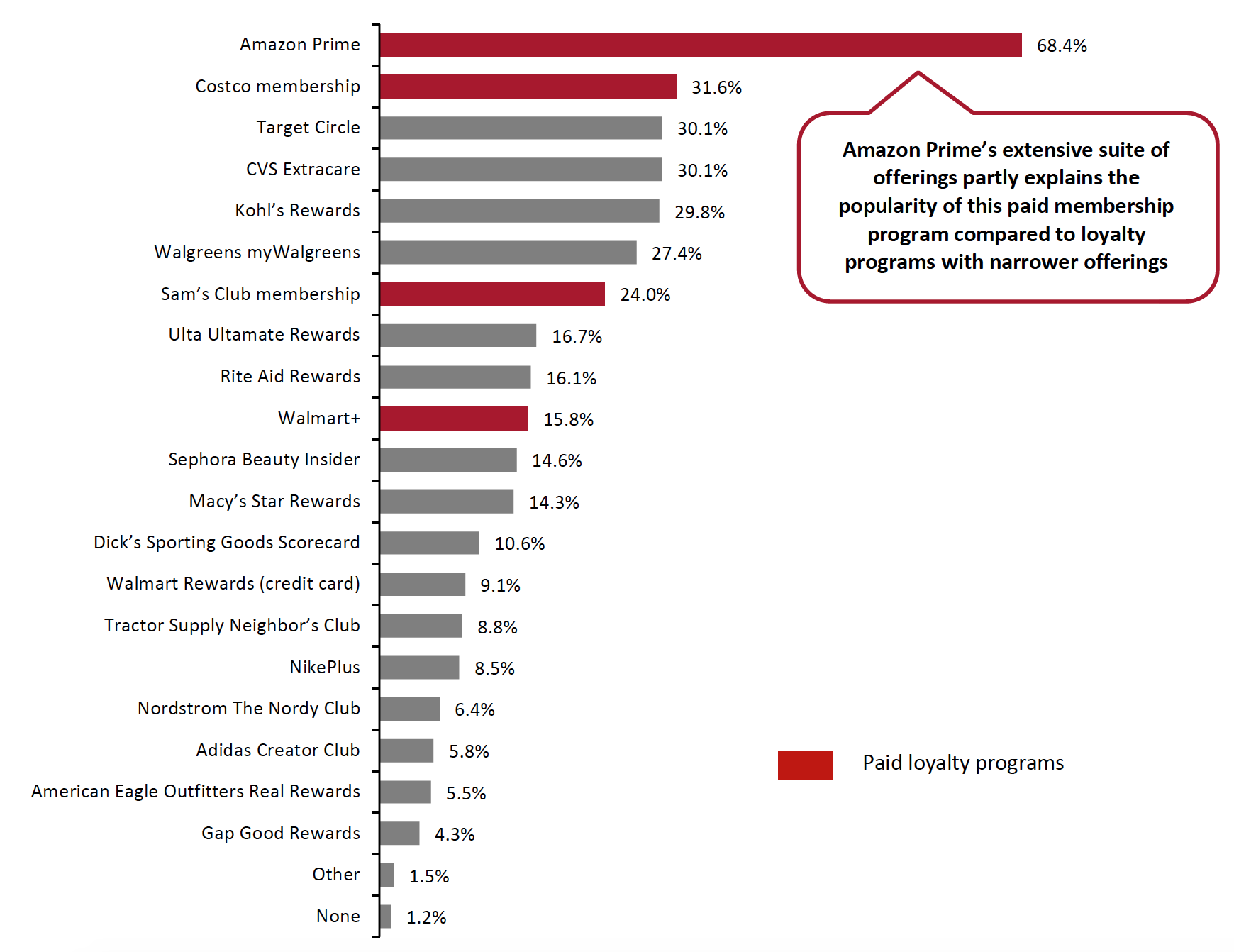

Base: 329 US respondents aged 18+ who are members of a retail loyalty programSource: Coresight Research[/caption] When asked about other retailers’ loyalty programs that customers are members of, Amazon’s premium loyalty/membership program Prime loomed large over the results, with almost seven in 10 loyalty program members indicating that they are Prime members. In addition to transactional benefits, such as free and fast shipping, Amazon Prime includes a suite of offerings ranging from music and movies to online photo storage and ebooks, which partly explains the popularity of Amazon Prime compared to other loyalty programs with narrower offerings. After Amazon, Costco’s membership is the most popular among US loyalty program members, which follows a loyalty structure similar to a premium loyalty program, wherein customers must become paid members to shop in Costco stores. The membership model allows Costco to undersell its rivals by offering products in bulk at lower prices to ensure customer loyalty.

Figure 5. Respondents with Loyalty Program Memberships: Retailers’* Programs They Are Currently a Member of (% of Respondents) [caption id="attachment_147666" align="aligncenter" width="700"]

*Excluxing supermarkets

*Excluxing supermarketsBase: 329 US respondents aged 18+ who are members of a retail loyalty program

Source: Coresight Research[/caption]

Market Drivers

Unlocking First-Party Data

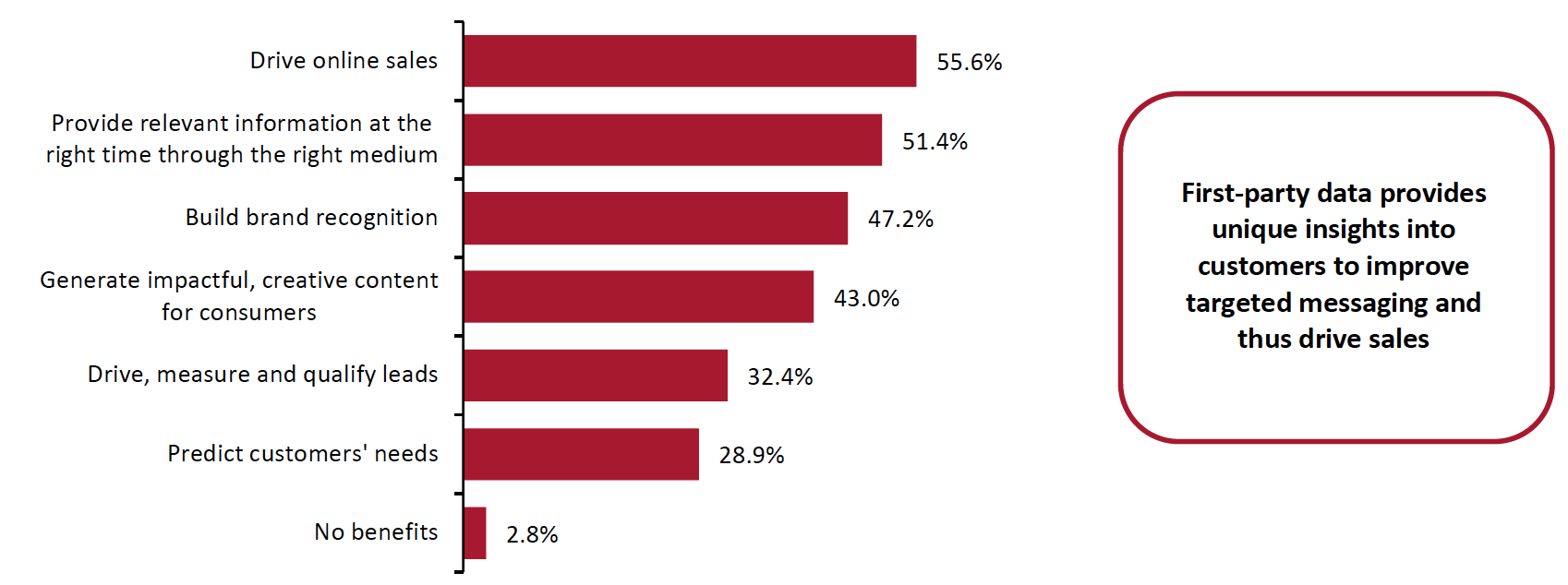

Loyalty programs allow retailers to source first-party data while adhering to general data privacy compliance rules. Data harvested provide retailers with unique insights into their customers to better understand their behavior and thus improve the accuracy and relevance of targeted messaging. This elevates customer satisfaction and drives greater brand recognition, leading to improvements in the top line. The majority of US-based executives believe that efficient use of first-party data helped their company to drive online sales, according to a November 2021 Coresight Research survey (see Figure 6).

Figure 6. Benefits of Using First-Party Data (% of Respondents)

[caption id="attachment_147664" align="aligncenter" width="700"] Base: 142 US-based executives whose organizations use first-party data for marketing purposes

Base: 142 US-based executives whose organizations use first-party data for marketing purposesSource: Coresight Research[/caption]

Monetizing first-party data collected through loyalty programs can also unlock a new revenue stream for retailers through retail media. With tightening consumer privacy standards and phasing out of third-party cookies, marketers and advertisers are looking for effective ways to target consumers. First-party data are more accurate than data collected through other means and have minimal privacy concerns involved. With the abundance of first-party data collected from loyalty programs, retailers can offer marketers and advertisers personalized and targeted marketing opportunities as well as provide syndicated customer data to their brand partners.

Broadening the Engagement Horizon with NFTs

The popularity of NFTs—non-fungible tokens, a unique digital asset with ownership tracked on blockchain— has skyrocketed in recent years, alongside pandemic-fueled interest in virtual metaverse worlds and cryptocurrencies. The technologies allow for authenticity guarantees, security, verification and protection of digital assets.

Brands and retailers are looking to establish their own spaces within metaverse worlds—and to participate in in-game economies, they are beginning to mint and sell NFTs for individual items and collections. We expect to see retailers tying up their loyalty programs with NFTs to gamify engagement and provide experiential rewards.

Benefits of integrating NFTs into a loyalty program include the following:

- Exclusivity—NFTs are inherently distinct and limited, driving an air of exclusivity because of their rarity, especially when there are limited releases or additional perks granted by token ownership.

- Ease of creation—NFTs are fairly easy to create while leveraging brand value. For example, technology startup Niftmint enables brands and retailers to mint and sell NFTs directly on their websites, assisting them in building brand awareness and expanding their customers’ digital cart size at checkout.

- Early adoption—While NFTs are still an emerging market, they have created significant excitement among consumers. While the initial hype cycle may recede, brands that invest and execute early can apply their learnings to succeed in the space in the long run.

- Novelty—NFTs offer a new way to access and reward customers, collaborate with other brands, support a social purpose and build a community—these elements can encourage customers to follow and maintain engagement with a brand over the long term.

US-based loyalty, rewards and referral tech provider Yotpo told Coresight Research that brands and retailers are blending “real-life” products with NFTs, or doing collaborations with artists and complementary brands, and the application for using the tokens for loyalty are endless.

- In October 2021, Estée Lauder-owned beauty brand Clinique held a competition for its Smart Rewards loyalty members, requiring them to share their stories of hope and optimism for the future on Instagram, Tik Tok and Twitter. Judges selected three winners who were each awarded an NFT named “MetaOptimist”—a digital representation of Clinique’s flagship products, Moisture Surge and Almost Lipstick in Black Honey.

Opportunities for Retailers: Making Loyalty Programs More Attractive

Premium Loyalty Programs

As more shoppers moved their shopping online during the pandemic, their habits and expectations shifted accordingly. Online shopping gives consumers a much wider choice of retailers, making loyalty difficult to secure. Therefore, many retailers are seeking to foster the loyalty of a more digitally engaged consumer base with new premium loyalty programs (also called subscription loyalty programs).

Premium loyalty programs differ from traditional loyalty programs offered by retailers—in exchange for a recurring membership fee, premium offer enhanced, immediate benefits, including instant discounts, free shipping and VIP experiences that can be used at any time. Paid programs enable the retailer to offer benefits like free shipping, which they may not be otherwise able to afford to offer in a free program. Attila Kecsmar, CEO and Co-Founder of UK-based loyalty technology provider Antavo, told Coresight Research that the most important characteristic of a subscription loyalty program is that it amps up the reward experience significantly in order to make up for the entry cost. As long as the benefits are valuable, most consumers are willing to join a paid loyalty program at their favorite retailer.

The landscape of premium loyalty programs is still small but is expanding rapidly, following the launch of Amazon Prime in 2005. The program delivers many benefits to members who pay upfront for inclusion. Amazon gets a recurring revenue stream, higher ordering frequency, and customer data that can further tailor future benefits and programs.

Major retailers that have launched premium programs recently include Walmart (Walmart+ in September 2020), Ahold Delhaize (Giant Choice Pass in January 2021), Albertsons (FreshPass in July 2021) and Kroger (Boost in November 2021). Premium programs are most popular in the grocery sector because the products sold are highly commoditized and undifferentiated, meaning the paid feature makes it unfavorable for consumers to switch brands.

Below, we offer a comparison of major premium loyalty programs in the US.

Figure 7. Premium Loyalty Program Features of Selected Major US Retailers [wpdatatable id=1977] Source: Company reports

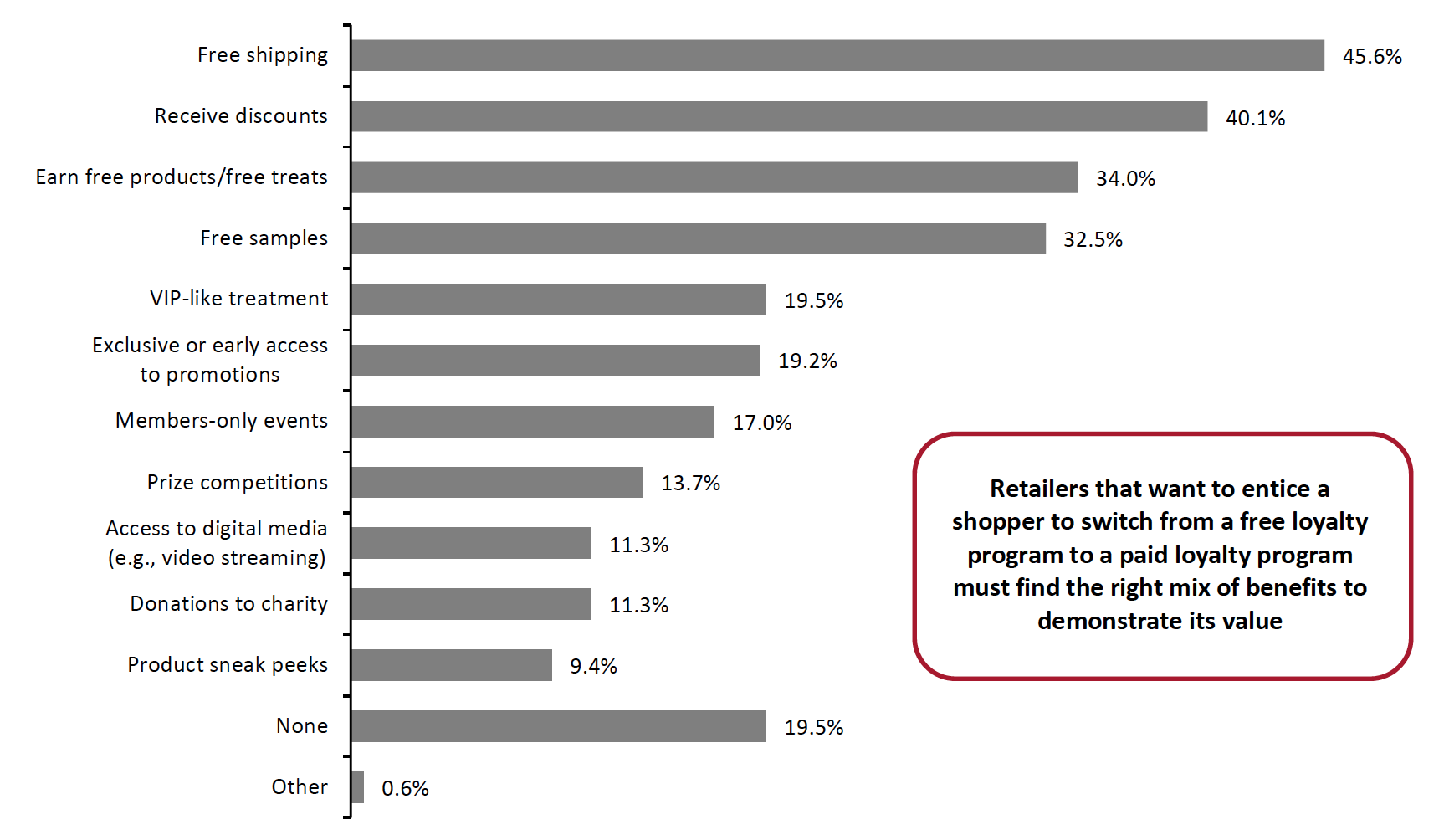

While premium programs typically offer enticing benefits, the sign-up fee can be a psychological barrier for customers. Retailers that want to entice a shopper to switch from a free loyalty program to a paid loyalty program must find the right mix of benefits to demonstrate its value.

We found that free shipping is the most sought-after benefit for a premium program (see Figure 8), meaning it could be the offering that convinces customers to upgrade to the paid tier.

Convenient discounts and free products/free treats are also likely to encourage consumers to shift over to a premium program. This indicates that brands can drive sign-ups by promoting the program’s tangible benefits—free products or services and discounts.

Figure 8. Respondents with Loyalty Program Memberships: Top Benefits That Will Motivate Them To Switch from a Free Loyalty Program to a Paid Loyalty/Membership Program (% of Respondents)

[caption id="attachment_147665" align="aligncenter" width="700"] Base: 329 US respondents aged 18+ who are members of a retail loyalty program

Base: 329 US respondents aged 18+ who are members of a retail loyalty programSource: Coresight Research[/caption]

Experiential Rewards

Transactional benefits such as cashback, discounts or free items offered by retailers may lure consumers into joining their loyalty programs but will not necessarily be sufficient to create enduring loyalty.

To retain customers in the long term, brands and retailers should look to provide experiential benefits—these elements create unique experiences that translate into a deeper relationship with customers, resulting in higher customer engagement and satisfaction. Yotpo executives told Coresight Research that if brands can perfect their experiential program experience, shoppers will drive repeat business through the roof, even during tough economic times.

Experiential rewards can take many forms, including:

- Exclusive access to events

- Members-only benefits reserved for the most dedicated customers

- Privileges that make the shopping journey smoother, such as personal concierge and dedicated customer support

- Early access to new products

- Input opportunity for product development

According to a survey of global executives carried out by loyalty technology provider Antavo in October 2021, 65.2% of companies that have a loyalty program, but do not yet offer experiential rewards, plan to start offering them in the next three years. As for companies who plan to provide a loyalty program in the next two years, 55.4% reported that their loyalty program will incorporate experiential rewards.

- Department store chain Neiman Marcus offers its Chairman’s Circle members (which is the highest tier of its InCircle loyalty program) privileges such as access to exclusive, customized travel experiences as well as complimentary valet parking, salon services and in-store dining.

Source: Neiman Marcus[/caption]

Source: Neiman Marcus[/caption]

- Activewear brand Lululemon’s premium loyalty program provides its members with access to curated in-person events and workout classes.

- Beauty brand Sephora offers its Beauty Insider loyalty members birthday gifts that are specially tailored to their preferences, based on purchase behavior and product preference data.

While we believe that monetary benefits are still important, with many retailers offering programs that provide similar benefits, it is easy for customers to switch brands based on price. Combining transactional rewards with experiential ones can help create differentiation and keep customers emotionally engaged.

Gamification

When paired with loyalty programs, gamification—the application of gamified elements in non-game contexts—can be much more effective than traditional loyalty programs. It encourages recurring behavior, incentivizes specific actions, spurs engagement beyond transactions and offers more fun and memorable customer experiences.

Brands that leverage gamification to drive customer engagement report a 22% rise in brand loyalty and a 47% spike in engagement, according to loyalty and promotions technology company Snipp. Moreover, web-based marketing content automation software provider TechValidate found that companies that added gamification elements within their loyalty programs increased registration conversion rates by 50%.

Retailers can add gamification features within their loyalty apps, such as quizzes, prize wheels, interactive videos and prize machines. Kecsmar advised that a prize wheel is ideal to incentivize enrollment, while using challenges and badges foster recurring activities and generate brand loyalty. In-store games, like a treasure hunt, also tend to increase time spent at the store locations and generate newer and returning customers.

To identify the gamification elements most suited to their customer base, retailers should first look to analyze the needs and of their different shoppers, such as through purchase history. By determining key customer information, companies can develop customized games to enhance their effectiveness.

Many retailers are using gamification elements in their loyalty programs to drive participation and boost customer engagement.

- In May 2021, grocery chain Southeastern Grocers enhanced its customer loyalty program with “rewards Boosters,” a new feature providing personalized savings offers in a game-style challenge. To participate, customers activate offers within the apps, complete the offer challenge and receive a reward.

- Home Depot introduced gamification features (including bonus rewards) to its loyalty program app in October 2020 to encourage repeat store visits and drive purchases as members track their advancement to the next reward level.

Loyalty tiers are also an effective way to bring gamification into loyalty programs. By creating exclusive VIP tiers that offer unique experiences, brands can build a real sense of community among customers. Ensuring that only VIPs have access to special perks will make customers feel truly valued and understand that their loyalty matters, resulting in a deeper relationship. It also incentivizes those on lower tiers to “level up” by making more purchases or earning points through non-purchase actions, like following on social media or leaving a review.

As gamification techniques continue to improve, we expect it will become easier for retailers to execute campaigns persuading members to engage in specific behaviors. With the trend gaining momentum, we believe more sophisticated white-label platforms will emerge, supporting the ability of loyalty programs to launch rich gaming experiences.

What We Think

To effectively compete in today’s loyalty landscape, retailers must offer easily accessible and user-friendly programs with a portfolio of benefits that are integrated into the broader brand and customer experience. Programs that lag on these features will face challenges in driving their desired business and loyalty impact.

Implications for Retailers

- Retailers should consider offering both a traditional points-based program and a premium loyalty program to create a loyalty ecosystem. A point-based program can help retailers acquire new customers, allowing them to experience the brand with a low barrier to entry. Using the behavioral data, retailers can then entice their most engaged customers to upgrade to a premium loyalty program through targeted communications.

- A loyalty program’s value proposition needs to include monetary benefits such as discounts or free products to drive ongoing participation, but experiential rewards should be used as differentiators to help emotionally connect with consumers.

- We expect brand-created NFTs to be a huge trend in the future. Retailers should look to incorporate them within the loyalty program experience, such as creating a collectible piece of brand history or programming exclusive perks and community access rights. Members who earn a branded NFT art piece will always have a reminder of the relationship, further strengthening the bond with the brand.

Implications for Technology Vendors

- Introducing new loyalty offers for consumers without appropriate personalization and segmentation of those offers runs the risk of the promotions being irrelevant to the consumer. Tech vendors should integrate AI into retailers’ loyalty programs to personalize incentives, predict future purchasing behaviors and create a better overall program experience.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

[caption id="attachment_143517" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]